Key Highlights:

The Bears lose its pressure on the market;

the demand level of $0.28 was a turning point;

the Bulls take over the XRP market.

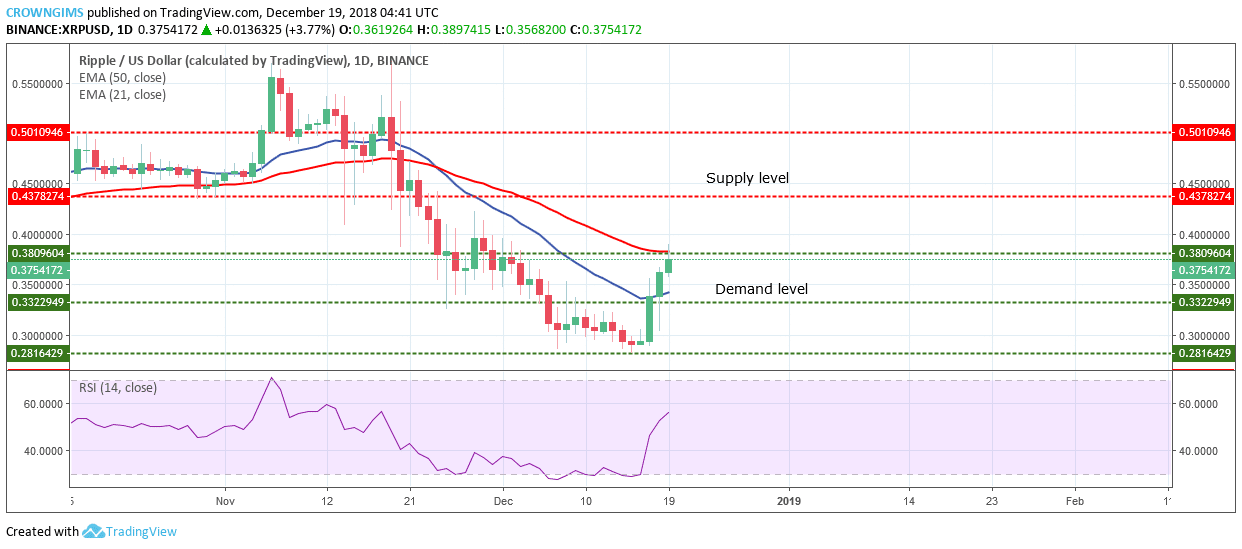

XRP/USD Price Long-term Trend: Bullish

Supply levels: $0.43, $0.50, $0.54

Demand levels: $0.38, $0.33, $0.28

XRP price has crossed the 21- day EMA upside while 50-day EMA is above the price which indicates that the bearish trend on the XRP market is changing to a bullish trend. It is likely for the uptrend movement to continue; as the Relative Strength Index period 14, is around 60 levels pointing up which indicate a buy signal. In case of the present daily bullish candle close above the supply level of $0.38 and 50-day EMA then, traders can place a long trading position as the coin may have its target at $0.43.

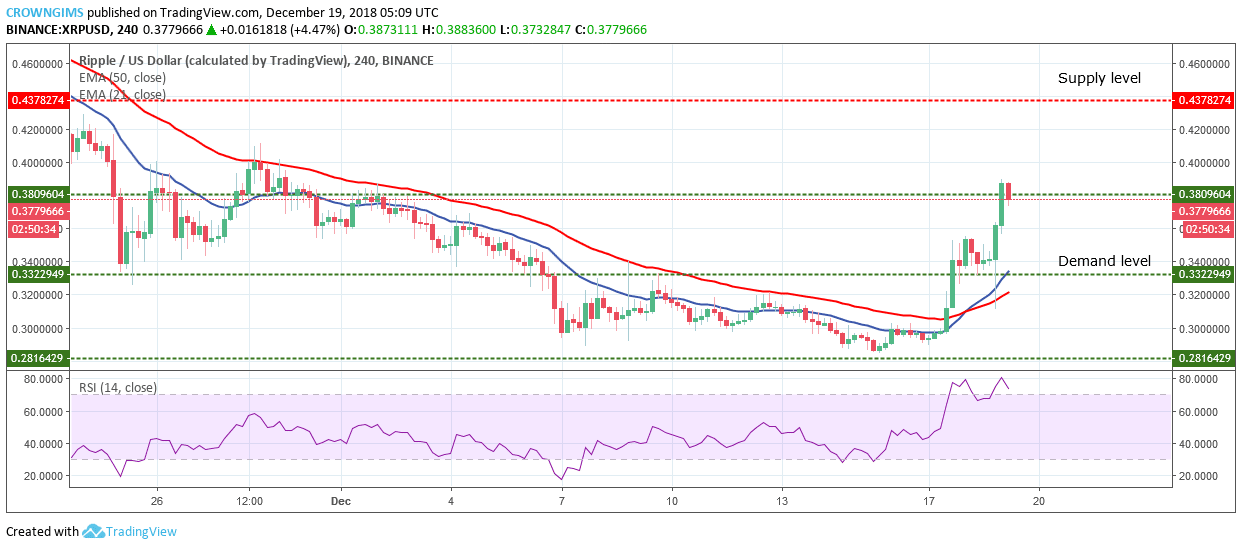

XRP/USD Price Medium-term Trend: Bullish

The 21-day EMA has crossed the 50-day EMA and the XRP price is trading above the two EMAs as a confirmation to the bullish trend. However, the Relative Strength Index period 14 is at oversold region pointing down which indicates sell signal which may be a pullback before uptrend continues.

To learn more about XRP coin, Ripple company and their innovative solutions, please check out our awesome.