Key Highlights

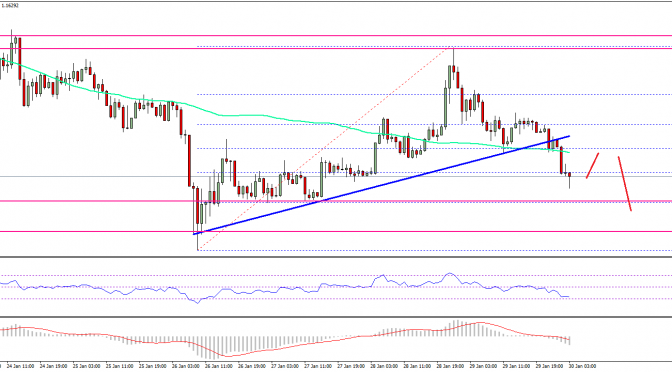

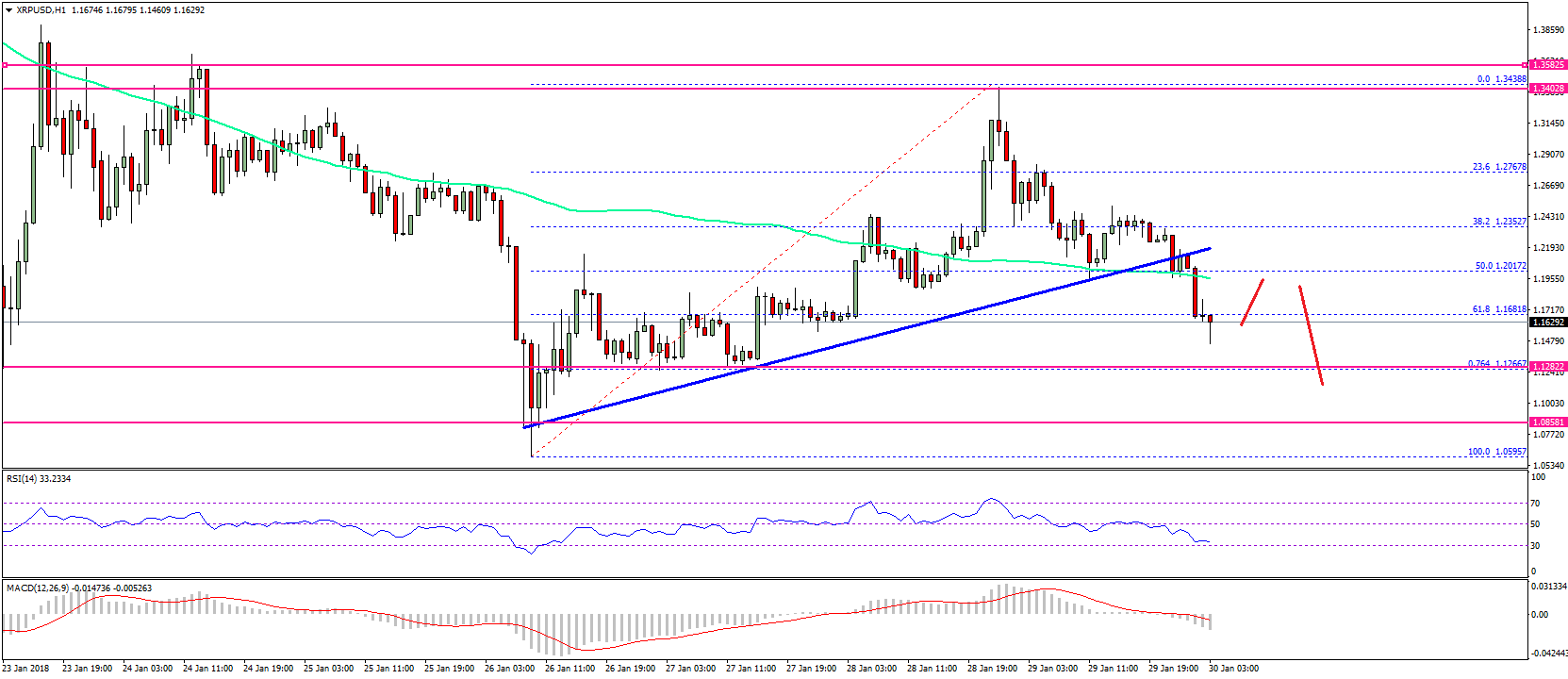

- Ripple price started a fresh downside wave from $1.3438 and moved below $1.2500 against the US dollar.

- There was a break below a key bullish trend line with support at $1.2150 on the hourly chart of the XRP/USD pair (data source from SimpleFx).

- The pair is currently heading lower and it may soon retest the $1.1250 support area.

Ripple price is currently back in the bearish zone against the US Dollar and bitcoin. XRP/USD could extend declines towards the $1.1250 and $0.8500 support levels.

Ripple Price Resistance

After a above $1.3000, Ripple price faced sellers on the upside against the US Dollar. The price traded as high as $1.3438 and it later started a downside wave. It traded lower and broke the 38.2% Fib retracement level of the last leg from the $1.0595 low to $1.3438 high. It opened the doors for more losses and the price traded below the $1.2500 support and the 100 hourly simple moving average.

During the downside move, there was a break below a key bullish trend line with support at $1.2150 on the hourly chart of the XRP/USD pair. This is a strong bearish sign since the price is now below the 50% Fib retracement level of the last leg from the $1.0595 low to $1.3438 high. It could continue to move down towards the next major support at $1.1250. The mentioned level is near the 76.4% Fib retracement level of the from the $1.0595 low to $1.3438 high.

Should there be a break and close below $1.1250, there can be a test of the $1.0000 handle. On the upside, the broken support near $1.2100 and the 100 hourly SMA are likely to prevent recoveries.

Looking at the technical indicators:

Hourly MACD – The MACD for XRP/USD is gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is moving lower towards the 30 level.

Major Support Level – $1.1250

Major Resistance Level – $1.2500

Charts courtesy –

Published at Tue, 30 Jan 2018 06:30:05 +0000

Analysis[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]