Okay, time for another update. It has been like we have never been in a bear market . Bears are scared nowadays and not the bulls. The is what we need for a good rally.

Today’s rally got me by surprise a bit, did not think we would move up so quickly again. But that’s also because i would have rather seen a bigger consolidation, creating more foundation the next wave up. So i can’t say i am happy about today’s movement. But at the moment it is very strong, so maybe bulls think we are in 2017 again and simply just pumpy pump again. Some alts are very good, other are falling behind a bit. But in general, it’s all good. The past 7 hours we have seen a bull shake out AND a bear shake out with those Bart moves. I would like to say we are ready to move up again, but looking at the OI on , it’s too low. Should be more around 400 mil. So my best guess is, we will stay in the 3800/44200 for a few days maybe.

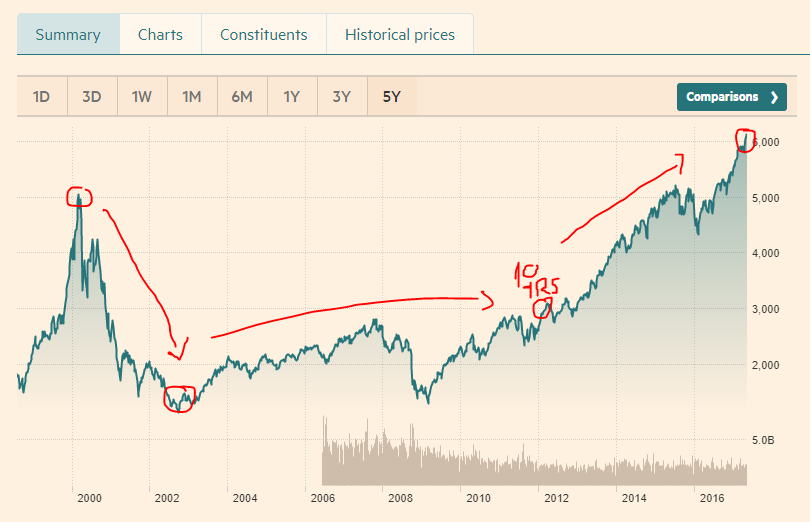

On the left we can see that big i have been talking about. Because of the strong rally we had this week, it has become very realistic! and speed is very good. I just rather see a touch of 4400 and see the neckline start there. So like the red line, up to 4400 coming days and then drop to make the right shoulder. That would be ideal. If that happens, we would have a target around 5500 even. Depending on the and strength on that wave, we can make a decent judgement if the bear market is over and the long term low is set or not. Thinking that now is crazy and wishful thinking, so don’t fool your self and start to hope.

Most alts also show a similar , so if these play out we can see we have had our panic lows and capitulation already. Same goes for of course.

My assumption at the lows was a big correctional wave up, making a big at least. I had 2 scenario’s, one was first rally below 3600, than 3300 and maybe 3800. That’s why i wanted to see a break of the 3600 so would could see a much bigger rally. That has happened, so there is no way we will continue the bear trend again, i am like 80% sure of that.Only a break of 3600 would put that in danger. We still need the second leg up before thinking of a again.

The rally from the lows, has been very good and strong. As you might know, i expected several short squeezes, which didn’t happen. At least not the big ones. I kept mentioning the stubborn bears who were probably shorting with anger, trying/hoping to push the market down again because they simply missed the entry at the lows :). Anyway, the lack of short squeezes is actually even better, because it was bulls buying and winning from the bears. Much better foundation than short squeeze rallies.

For me it was almost April all over again, which gave me confidence about the current rally to happen. The sentiment was becoming too obvious at the end. Bears were getting OVER confident. So we can set 2 or 3 stages from now on.

– First the smart money buying the lows, increasing during stable consolidations like the 3550 (like stepping their foot down on the bear and poking them with a stick ;). Now there has

been profit taking at these 3900/4100 levels (OI dropped) but the price has not even dropped. This indicates to me that bears have become very weak.

– Now bulls will probably just sit and wait for the price to come down a bit and load up in the 3800/3900 zone. So if we see low drops, that would be a decent confirmation for

that. Giving stubborn bears the feeling the rally is over already. Getting longs filled and use their shorts to fuel the breakout of the big resistance levels bringing us to the next stage.

– Normally, since this market is so emotional, we would like to see these bears turn in to bulls as well. Making bears even weaker and the FOMO can start to kick in. Like the

9000/10000 zone at the 10K high half year ago.

I get a lot of questions about if the long term low is set and the bull market has started, well let me make it very simple for you, i don’t know and i actually don’t even care. Why am i saying this, also very simple. This is the main reason why most of the retail traders have lost money this year, because of FOMO. Me and my members have a swing long from the lows and the strategy is very simple. If we do move up to 5K prices, based on the strength we will judge if we drop again or continue up. Thinking about that now and here, will make your life sooooo much more difficult and complicated. Just plan upfront and stick to it, unless you see real changes on high time frames. Not the noise on the lower time frame. This is really a/the virus that has been imprinted in the heads of everyone in the crypto sphere. I have been seeing it all year long. This is the reason why people can’t cut their losses when they bought at the high and the trend start to turn to the bear side again. Always the “what if’ question. They have all been hypnotized in 2018 with the HODL and all the other nice words. One of the worst ,is the fact that everyone thinks that as long as the amount of coins increase, your a king. Because even though the $ value drops 95%, you have twice the amount of coins. Because it’s a guarantee it will go up sooner or later. Yeah right, nice fairy tail. This only works if you pick a winner, if you pick one of the few that could/might really become something. I have been there and done that in the DotCom bubble, it was not near as sick as this market (no social media which made it much more difficult to spread the virus), where i also bought a stock which was the real future. Interactive Television, back in 2001. I even did my research. It dropped from the 300 to 50 and i kept buying up 3 times up until $20. After each buy we had a bounce and i felt proud i bought more, because the profit became even bigger. Every time i took my calculator and started to do the math; “what if we go back to 300 again, i will be even richer than the first time i bought. I felt even better the third time a bought and we went up again. Anyway, i kept looking at the 300 price and not knowing what the real potential was of this company. I knew what market cap meant, but i did not know that another company could simply pop up, copy their tech, do better marketing and destroy the company i had bought stocks off. Long story short, 2 years later the stock dropped to $0.50 and i never looked back again since. Lesson learned!!

Getting off topic a bit :). For now, i have drawn to right shoulders on the left. It could be we touched the neckline already today with that rejection and we are making the right shoulder the coming few days. That would mean it is much too early for a continuation of the rally, the right shoulder is much to small to have good/real value. It has to be much bigger (in time) than this. It could be the neckline has not been touched yet and we move towards the 4400ish and THEN start with the right shoulder. That would be super if the market is able to touch the 4400 with a day or so. But whatever happens, i don’t want to see a break of 4400. Need more consolidation before breaking the 4400.

The short term movement is difficult to judge now, today’s rally was not in my short term play book and because of that i still have to make a new one. Best guess i can make for now is, we will retest the 3900/3850 zone again before breaking the 4200.

Please don’t forget to like if you appreciate this 🙂

Previous analysis:

Published at Fri, 21 Dec 2018 01:17:34 +0000