President Donald Trump to keep the economy bloated with . He thinks that will boost exports. And he wants to keep U.S. stocks floating on the freakish levels of monetary liquidity created by the Fed when Ben Bernanke was chair.

Trump CPAC Saturday, intoning that a strong dollar hurts American businesses. He also criticized the for raising interest rates:

“America is now booming like never before. Other countries are doing very poorly. That makes it even harder for us to be successful. Plus, we have a gentleman that likes raising interest rates in the Fed.

He made a reference to Federal Reserve Chair :

“We have a gentleman that loves quantitative tightening in the Fed. We have a gentleman that likes a very strong dollar in the Fed. So with all of those things — we want a strong dollar but let’s be reasonable — with all of that we’re doing great.

Trump’s comments in the Dow’s 206 point plunge below 26,000 Monday, as well as fears that – an assessment that’s keeping Warren Buffett in liquid assets he’s ready to spend on an epic equities shopping binge for long-term stakes in U.S. companies when he can get a better price.

“Quantitative Tightening” Is Some Astonishingly Perverse Economic Terminology

President Donald Trump spoke out about the policies of the Federal Reserve chairman Jerome Powell at the Conservative Political Action Conference in Oxon Hill, Md., Saturday, March 2, 2019. Source: AP Photo / Jose Luis Magana

calls recent Fed policy “monetary tightening.” Let’s put that in context.

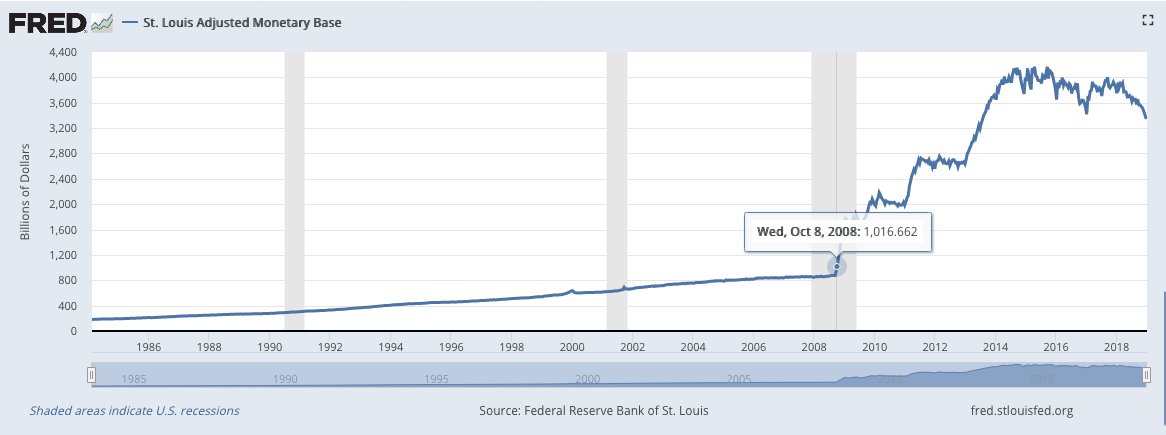

The sum of USD currency in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks–known as the Adjusted Monetary Base–is .

It’s the most radical experiment to have ever been undertaken with the Dollar.

These politicians and central bankers created 3 new dollars for every 1 dollar in existence and call that monetary madness “quantitative easing” as if there’s anything gentle about effectively stealing 75% of all the circulating money held as U.S. Dollars in ten years.

And then after the Fed blows the money supply up to 400% its previous amount in six years, Trump calls it “tightening” when they pare back just 10% of the new amount in two years.

These politicians are crazy.

You know you’re out of control when you on monetary policy and you’re making the we don’t want to print that much money.

Robbing Main Street Through Inflation to Enrich Wall Street With Low Rates, Easy Money

The Adjusted Monetary Base is calculated as the sum of currency, including coins, in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks. These data are adjusted for the effects of changes in statutory reserve requirements on the quantity of base money held by depository institutions. Source: Federal Reserve Bank of St. Louis

Trump administration officials a strong dollar makes Americans buy more from overseas, while foreigners buy less from Americans, and reasons this hurts American businesses.

This is a quite unsophisticated, mercantilist view of global commerce that dates back to the 16th century.

. There isn’t a deficit of anything. There is certainly a capital surplus, however.

But that sudden and massive increase of the Adjusted Monetary Base by the Federal Reserve since 2008 represents wealth redistribution on a historically unprecedented scale.

By the Federal Reserve Bank and its Wall Street hand puppets to themselves.

bitcoin: The People’s Bailout

Long bitcoin, short the banks | Photo: Max Pixel

That’s why you’re getting socialist workers revolutions in the form of immigrant hating, , and Bernie Sanders nearly toppling Hillary Clinton.

That’s why you’re getting Alexandria Ocasio-Cortez pulling out a ranking U.S. House Democrat’s chair from under him in his own party primary.

That’s why you got the anti-Wall Street Tea Party on the right in 2009, started by Rick Santelli on CNBC in response to Washington bailing out Wall St. banks.

That’s why you got Occupy Wall Street on the left in 2011.

But Donald Trump is playing all of his mesmerized 2016 fans for fools.

No immigrant has ever stolen as much money from American businesses and workers than the weak dollar – an inflationary monetary scheme designed by central bankers and influenced by politicians.

That’s why you got in 2013 and 2017.

bitcoin is the real Tea Party: People dumping fiat currency overboard into the harbor in favor of free-market Internet money. bitcoin is the real Occupy Wall Street: People holding Wall Street accountable through direct economic pressure. bitcoin is the people’s bailout.

Click for bitcoin’s real-time price chart.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

Published at Tue, 05 Mar 2019 20:32:53 +0000