In the March 2019 edition of the , the SFOX research team has collected price, volume, and volatility data from eight major exchanges and liquidity providers to analyze the global performance of 6 leading cryptoassets — , ETH, BCH, LTC, BSV, and ETC — all of which are available for algorithmic on .

The following is a report and analysis of their volatility, price correlations, and further development in the last month. (For more information on data sources and methodology, please consult the appendix at the end of the report.)

Readers should note that, in the spirit of analyzing consistent time-frames and viewing data in the context of long-term trends, this report neither includes nor analyzes the sharp increase in crypto volatility that we have witnessed at the beginning of April. That volatility will be presented and analyzed in the April 2019 Volatility Report this coming month.

Current Crypto Market Outlook: Mildly Bullish

Based on our calculations and analyses, the SFOX Multi-Factor Market Index, which was set at mildly bullish at the end of February 2019, remains at mildly bullish at the end of March — although the index is now edging further in the bullish direction.

We determine the monthly value of this index by using proprietary, quantifiable indicators to analyze three market factors: price momentum, market sentiment, and continued advancement of the sector. It is calculated using a proprietary formula that combines quantified data on search traffic, transactions, and moving averages. The index ranges from highly bearish to highly bullish.

Even ahead of the bullish surge that the crypto market has witnessed in the first days of April, March showed mildly bullish sentiment towards the sector — sentiment which has been gradually increasing month-over-month since we launched the index late last year. While some outlets such as The Wall Street Journal expressed about the state of the market, several major coins showed significant growth in transaction volume, and companies such as Visa and Facebook expressed sustained interest in crypto and technologies. The data suggest that growth is still happening where it counts, as institutions continue to be interested in crypto and the sector’s infrastructure continues to mature.

Analysis of March 2019 Crypto Volatility

In March of 2019, individual saw a mixture of apparently motivated and unmotivated moves in volatility, set against the backdrop of an overall industry becoming less volatile and more mature.

LTC’s price increase and volatility seemed to level off after months of growth (March 10th-31st).

Last month, SFOX five factors that may have been contributing to LTC’s price nearly doubling since the beginning of 2019: increased , lower fees, faster transactions, an exploration of private transactions, and the upcoming halving event. From March 10th through the end of the month, however, LTC’s volatility decreased substantially as its price held between $54.93 USD and $60.46 USD. This may mean that the market is approaching the point at which it’s priced in the fundamentals we enumerated in our article.

BCH jumped in price and volatility in the middle of the month with no apparent cause (March 15–16th).

In the middle of the month, BCH’s price jumped 18% in two days. While this spike did roughly correspond with an under-the-radar of features coming in the chain’s hard fork later this year, there didn’t seem to be an obvious explanation for the sudden price hike. During this time, BCH’s volume was also led by LBank — an exchange that was recently highlighted in of exchanges that may potentially be faking a large portion of their alleged trade volume. It’s possible, therefore, that this March BCH rally may have been one of those spooky “rallies” that wasn’t grounded by anything fundamental.

ETC became gradually more volatile throughout the month.

Even as crypto volatility collectively decreased, ETC’s -relative 30-day historical volatility (defined below as a measure of a crypto-asset’s volatility relative to the broader crypto market) gradually increased throughout the month, starting at 146% and ending at 205%. This may be a function of increasing uncertainty about the future of this particular : on the one hand, ETCLabs’ renewed focus on Dapp development (especially Dapps focused on the Internet of Things) has some believing that ETC may be a currently undervalued platform for powering the next evolution of internet technologies; on the other hand, the still-recent , coupled with about figures such as Anthony Lusardi from prominent ETC roles, has some worried about the long-term prospects for the community.

Major companies continue to invest in the and crypto spaces in times of low volatility.

The major trend in crypto volatility was downward in March, with falling from 32.68% 30-day historical volatility at the start of the month to 17.94% volatility at the end of the month. At the same time that crypto volatility was decreasing, reports told of major companies like and investing in crypto technologies. This reinforces the narrative that the industry as a whole is continuing to mature, attracting the attention of more institutions as infrastructure improves.

What to Watch in April 2019

Look to these events as potentially moving the volatility indices of , ETH, BCH, LTC, BSV, and ETC in April:

Market uncertainty following the unexplained price jump of April 1st-2nd.

In the first few days of April, the price of has shot from $4089.54 USD to a peak of $5,089.99 USD on the 2nd — a jump of almost 25% in two days, without an immediately apparent fundamentals-based explanation. If the late-2017 rally is any indication, the sharp movement in ’s price without a clear cause could potentially lead to greater market uncertainty, which, in theory, could drive volatility upwards.

Multiple high-profile crypto conferences: (April 10th), (April 10th) (April 13th-19th) (April 25th-26th).

April features at least four high-profile conferences centered on institutional or professional interest in crypto and technologies. Because these conferences are opportunities to educate and generate new interest in the sector, they could potentially drive volatility — especially when targeted towards groups or individuals that control sizable pools of capital.

on April 26th.

Crypto volatility typically moves around the time of futures expirations. With CBOE backing off from futures, for the time being, the date of CME’s futures expiration may potentially impact volatility more than usual.

Get the SFOX edge in volatile times through our proprietary algorithms directly from

The Details: March 2019 Crypto Price, Volatility, and Correlation Data

Price Performance

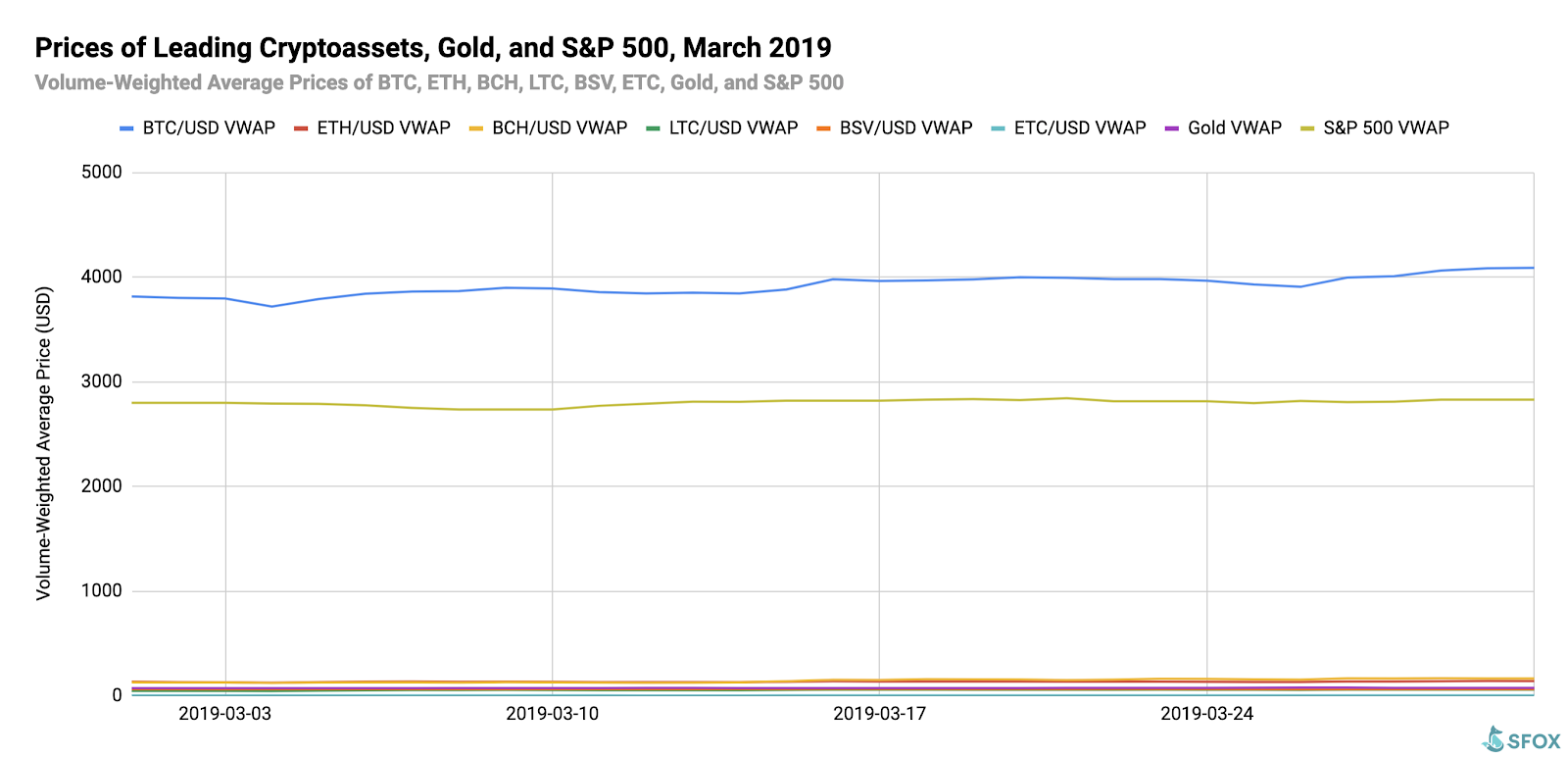

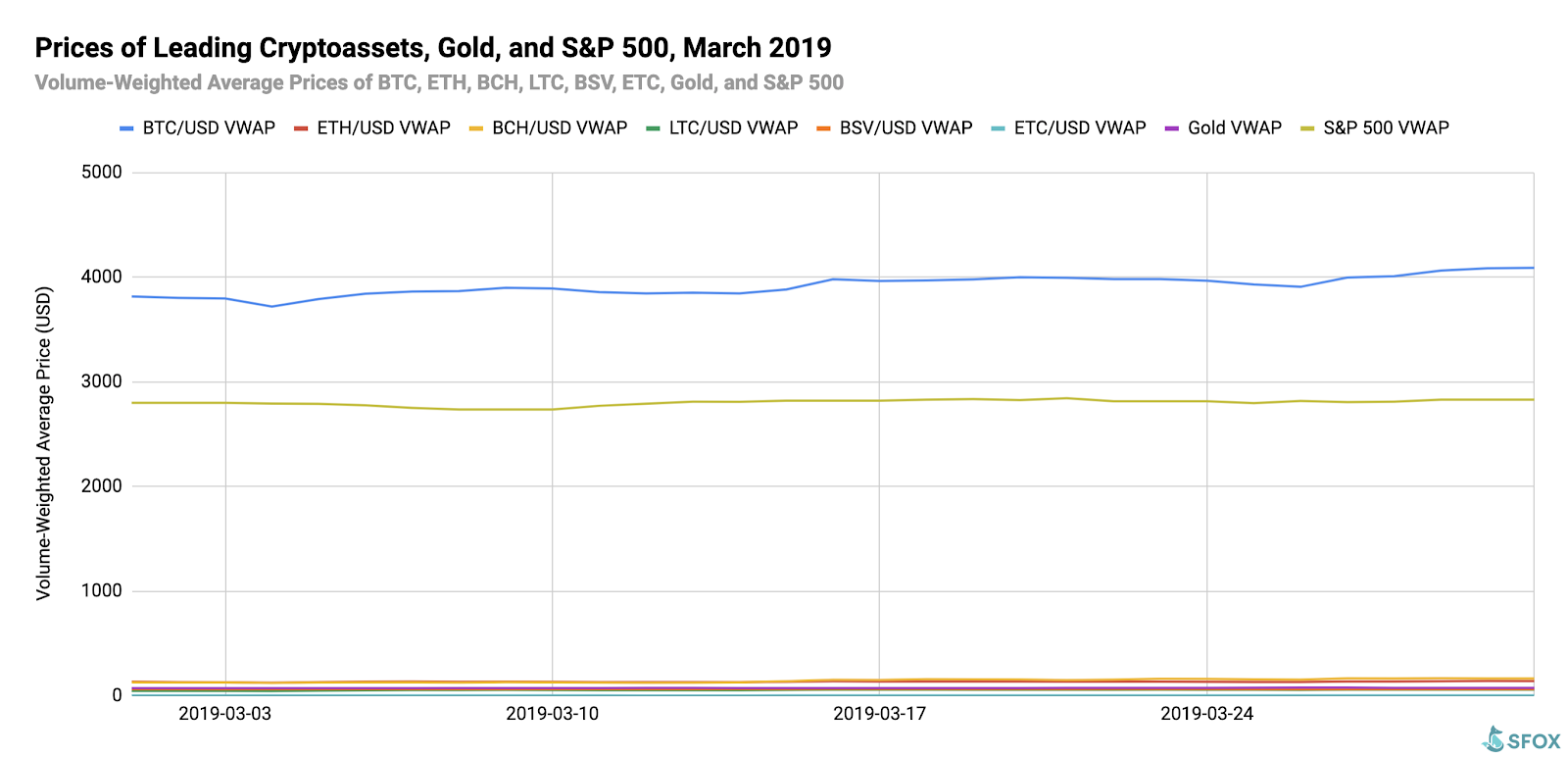

March saw relatively little movement in crypto prices. opened the month at $3816.29 USD before dipping to a low of $3719.67 USD on March 4th; after that, it gradually climbed to a price of $4089.54 USD at the end of the month.

For greater graphical clarity, see this additional chart omitting and the S&P 500 from the data set:

Volatility

By looking at the 30-day historical volatilities of , ETH, BCH, LTC, BSV, and ETC, we see that the crypto sector’s volatility gradually declined throughout the month, with the exception of LTC’s volatility increasing in early March and BCH’s volatility increasing in mid-March.

If we look at the 30-day historical volatilities of ETH, BCH, LTC, BSV, and ETC as a percentage of ’s 30-day historical volatility, we see that ETH, LTC, and BSV’s movements were, on average, roughly in line with ’s — though not as much as they were. BCH and ETC, on the other hand, saw their -relative volatilities increase over the course of the month.

Price Correlations

’s 30-day price correlations to ETH, BCH, LTC, and ETC all closed the month as highly positive (i.e. close to 1). The crypto asset least correlated to was ETC, with a correlation of 0.685; the least correlated crypto asset pair was LTC and ETC, with a correlation of 0.453.

For a full crypto correlations matrix, see the following chart:

Notably, the correlation level between and ETC steadily decreased from the beginning of March through March 20th, at which point the two were at a fairly low positive correlation of 0.21. This reinforces our earlier analysis that the uncertainty specifically surrounding ETC may be driving its volatility.

Published at Tue, 09 Apr 2019 06:10:16 +0000