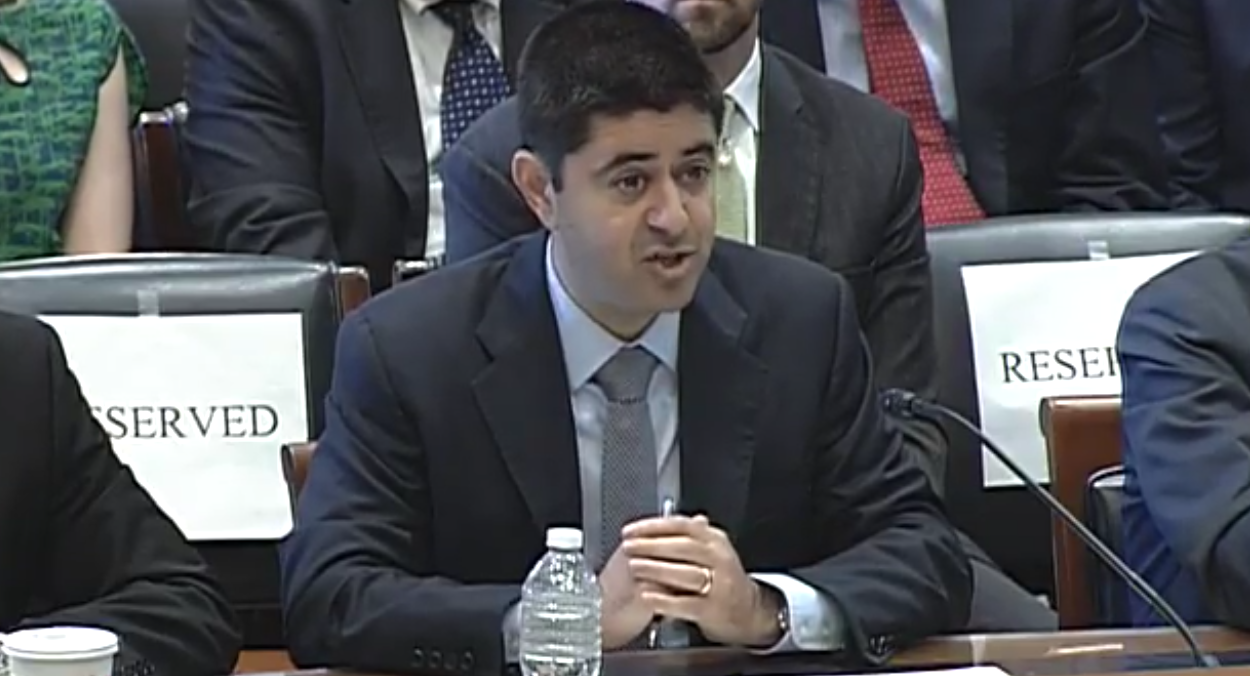

The director of the Commodity Futures Trading Commission (CFTC)’s fintech initiative cautioned against what he called “hasty regulatory pronouncements” during a Congressional hearing on Wednesday.

The remarks from Daniel Gorfine, director of LabCFTC, were directed toward members of the U.S. House Committee on Agriculture which, as reported by CoinDesk, on the issue of cryptocurrencies and digital assets. Alongside Gorfine were former JPMorgan blockchain lead Amber Baldet, former CFTC chair Gary Gensler and A16Z managing partner Scott Kupor.

Gorfine framed his remarks from the perspective that many different things can be considered “commodities” – but not all of them would warrant attention from U.S. regulators.

“It’s only when we start to see the rise of futures or swaps products built on those commodities that we have kind of direct oversight,” he remarked, going on to state:

“We all have the shared goal to bring clarity and certainty to the market but [we] also need to be sure that we are thoughtful in our approach and do not steer or impede the development of this area of innovation. Indeed, while some may seek the immediate establishment of bright lines, the reality is that hasty regulatory pronouncements are likely to miss the mark, have unintended consequences, or fail to capture important nuance regarding the structure of new products or models.”

Gorfine would return to that point several times during the hearing, which began at 10 a.m. local time.

“It’s important that we’re not hasty in figuring out what the contours are of applying securities law and then the commodities framework,” he remarked.

Congressional sentiment

notably provided a window into what some members of Congress think when it comes to the subject of cryptocurrencies – though it wasn’t positive in some cases.

For example, Rep. Collin Peterson that, in his view, much of the cryptocurrency ecosystem “seems like a Ponzi scheme” and asking “what’s behind this?”

It was Gensler who offered a response, stating that “there’s really nothing behind gold either … what’s behind it is a cultural norm, for thousands of years we liked gold.”

“We do it as a store of value, so bitcoin is a modern form of digital gold. It’s a social construct,” he continued.

In other cases, committee members simply wanted more information on how cryptocurrencies exactly work.

“We’re creating another money supply here as I see it. I just don’t know how that works. Our dollar sets the mark for the world. I can’t visualize how this would work,” Rep. Rick Allen commented.

But it was Michael Conaway, the chairman of the committee, who perhaps had one of the most notable – and telling – remarks about bitcoin, coming at the very end of the hearing and just days after the U.S. Justice Department claimed it conducted by 12 Russian intelligence officers accused of hacks during the 2016 presidential election.

“As long as the stupid criminals keep using bitcoin it’ll be great,” Conaway quipped.

Want to read CoinDesk’s full by-the-second coverage of the hearing? Follow our stream on Twitter .

image via House Agricultural Committee

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a . CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Published at Wed, 18 Jul 2018 17:26:52 +0000

Use Cases & Verticals[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]