bitcoin is a decentralized digital currency that operates on a peer‑to‑peer network, enabling transfers without a central authority and relying on cryptographic consensus for issuance and settlement . As its market value and liquidity have grown, consumers and businesses increasingly accept bitcoin as a medium of exchange for everyday goods and services, and it has also begun to appear in higher‑value transactions such as real estate purchases; these trends occur alongside notable price volatility and evolving market conditions that affect purchasing power and risk . This article examines how bitcoin is being used to buy goods, access services, and complete property transactions, and outlines the practical, legal, and financial considerations-payment infrastructure, price stability, custody, taxation and regulation-that buyers and sellers should weigh when transacting in bitcoin.

How bitcoin Payments Work for Everyday Goods and Digital Services

Payment flow begins in a wallet app: the buyer scans a merchant QR or pastes an address,chooses an amount and selects a fee to influence confirmation speed – many wallets let you set fee priorities on mobile devices for faster propagation and lower cost trade-offs . the wallet broadcasts the transaction to the network where miners include it in a block; for routine retail purchases merchants often accept a small number of confirmations or use payment processors that convert BTC to fiat instantly to remove volatility and settlement risk . For low-value everyday buys, the technical steps are the same as larger purchases – the difference is in the merchant’s confirmation policy and how they manage exchange and refund processes .

Delivery and risk differ between physical goods and digital services. Digital content or SaaS can be fulfilled nearly instantly on receipt or even on a zero-confirmation broadcast if the merchant accepts the small risk; physical goods generally wait for one or more confirmations before shipping to avoid fraud. Best-practice checklist for shoppers and merchants:

- Verify the exact address and payment amount before sending.

- Set an appropriate fee based on desired confirmation speed.

- Save transaction IDs and screenshots for receipts and disputes.

- Agree on confirmation requirements and refund policy in advance.

Confirmations and processor choices affect speed,cost and chargeback behavior .

Practical expectations are clear when you match transaction size to settlement rules. Below is a simple guide merchants and buyers use to balance speed and risk:

| Purchase type | Typical confirms | Notes |

|---|---|---|

| Micropayment / digital | 0-1 | Fast delivery,higher fraud tolerance |

| Retail / online store | 1-3 | Common compromise: speed and safety |

| High-value / property | 6+ | Full-chain settlement,legal records advised |

Fees, network congestion and merchant policy determine where a given purchase falls in this table – wallets and educational resources explain fee selection and step-by-step payment flows for both consumers and businesses .

Managing Price Volatility When Spending bitcoin: Practical Strategies

Price swings are an inherent feature of bitcoin markets, driven by liquidity, macro news and network effects rather than central policy-so merchants and buyers should treat BTC amounts as variable until settlement is complete. Real‑time feeds and historical charts can help quantify short‑term risk; use reputable price aggregators and exchange ticks to set thresholds for acceptable slippage and execution timing . The underlying peer‑to‑peer ledger and distributed validation model mean there is no single price setter, which makes hedging and rapid conversion common operational responses .

Operational controls reduce exposure. Practical options include:

- Instant fiat conversion: route received BTC through a payment processor that converts to local currency on receipt to eliminate post‑payment volatility.

- Quoted‑fiat invoicing: price goods or services in fiat and calculate BTC at payment time to avoid guessing future BTC value.

- Stablecoin settlement: accept or swap into a stablecoin temporarily when immediate fiat rails are unavailable.

- Hedging tools: use futures/options or forward contracts for large or repeated payments to lock effective BTC costs.

- Short payment windows: require on‑chain or off‑chain settlement within a narrow timeframe to limit exposure to intra‑day swings.

Select a mix of these based on transaction size, counterparty trust and operational complexity; real‑time price feeds improve the reliability of any of the above .

| Strategy | When to use | Trade‑off |

|---|---|---|

| Instant fiat conversion | Retail sales, small invoices | Processor fees; counterparty risk |

| Hedging (derivatives) | Large purchases, recurring costs | Complexity and margin requirements |

| Stablecoin bridge | When fiat rails are slow | Smart‑contract/issuer risk |

Record keeping and settlement discipline are essential: log BTC prices at invoice, execution and conversion times and reconcile against reliable market sources to support accounting and tax reporting. Track historical price data when evaluating volatility exposure and when measuring the effectiveness of conversion or hedging strategies .

Wallet and Custody Best Practices for Safe bitcoin Purchases

Decide your custody model before transacting: the trade-off is typically control versus convenience – full self-custody gives you direct control of private keys, while custodial platforms simplify access and recovery. bitcoin’s design as digital peer‑to‑peer cash with cryptographic ownership underpins why custody matters for every purchase, from consumer goods to property . If you opt for a custodial provider,verify their security practices,insurance and regulatory standing – examples of mainstream custodial services are available on major exchanges and platforms .

- Control: key custody and multisig capability

- Convenience: account recovery and fiat rails

- Insurance & Regulation: custodian coverage and compliance

Prefer hardware + multisig for larger purchases: for meaningful transactions like real estate, combine a hardware wallet with a multisig policy to reduce single‑point failures. Buy devices from verified vendors, keep firmware current, and never enter your seed on an internet‑connected device. Below is a rapid reference comparison to guide choice of custody type.

| Custody Type | Pros | Cons |

|---|---|---|

| Hardware wallet | Strong offline security | Physical loss risk |

| Multisig | Shared control, theft resistance | Higher complexity |

| Custodial exchange | Ease of use, liquidity | Counterparty risk |

Operational hygiene reduces risk: enforce encrypted backups of seeds, use a passphrase (25th word) where supported, and store recovery material in geographically separated, secure locations. Always send a small test payment when using a new address or counterparty, sign transactions on air‑gapped devices for high‑value deals, and keep wallet software and device firmware updated. Maintain an execution checklist and review counterparty contracts, especially given market volatility and liquidity shifts that can affect timing and settlement of purchases .

- Backup: encrypted,multiple locations

- Test: small transfers before large ones

- Audit: periodic reviews of keys,devices and counterparties

Choosing payment Routes: On Chain,Lightning and Custodial Solutions

On-chain,lightning and custodial options present distinct trade-offs between finality,cost and operational complexity. On-chain transfers give native settlement and legal clarity for high-value purchases like real estate, while Lightning offers near-instant, low-fee micro-payments ideal for everyday goods and services. Custodial routes simplify UX and integration for merchants but introduce counterparty and privacy considerations – bitcoin’s design supports peer-to-peer settlement and open participation, which is why self-custody remains the benchmark for cryptographic finality.

Choose by matching the route to the payment attributes you need: amount, speed, privacy and dispute handling. Below is a compact comparison to apply as a decision heuristic (simple, actionable):

| Route | Speed | Typical fee | Best use |

|---|---|---|---|

| On-chain | Minutes-hours | Variable (higher for priority) | High-value, legal settlement |

| Lightning | Sub-second-seconds | Tiny/negligible | Retail, tips, metered services |

| Custodial | Instant (internal ledger) | Platform-dependent | Recurring billing, fiat-rails, escrow |

Macro volatility and liquidity events can alter fee dynamics and counterparty risk on short notice-plan large settlements and escrow arrangements with this in mind.

Practical heuristics help operationalize these choices:

- Small, frequent sales: prioritize Lightning for cost and speed; provide customers with a single-click invoice experience.

- High-value transactions: prefer on-chain settlement or custodial escrow with verifiable release conditions and legal documentation.

- Merchant integration & UX: custodial platforms minimize friction but require KYC/AML and accept regulatory exposure.

Always document who controls keys, how refunds and disputes are handled, and whether the chosen route preserves the privacy and legal finality your counterparty requires.

Evaluating Merchants, Invoices and Payment processors for Transactions

When choosing a seller or service provider, prioritize verifiable reputation and transparent invoicing: check for clear refund and escrow policies, published customer reviews, and whether the merchant requires KYC for high-value sales. Pay attention to how the merchant prices items (fixed BTC, fiat-denominated with a BTC quote, or dynamic pricing) and whether they use a payment processor that supports instant fiat conversion to reduce volatility exposure - many leading processors advertise these features to merchants< a href="https://paymentproviders.io/payment-method/bitcoin">[[3]]. A simple merchant checklist helps:

- Reputation: review history and dispute records

- Pricing model: BTC fixed vs. fiat-quoted

- Security: invoice signing, HTTPS, and 2FA

Invoices for bitcoin transactions must be explicit and machine-readable: include a destination address or payment URI, the exact BTC amount, a fiat equivalent, and a clear expiration timestamp to prevent overpayments or replay risk. Processors often generate QR codes and monitor blockchain confirmations; choose ones that display confirmations and settlement status in the invoice UI. Example invoice fields and purpose:

| Field | Why it matters |

|---|---|

| BTC amount | Exact on-chain payment required |

| Fiat equivalent | Prevents pricing disputes |

| Expiry | protects against volatility |

| Confirmation count | Verifies settlement |

Payment processors vary in fee structures and settlement options; consult directory reviews to compare features and merchant tools before committing< a href="https://coincodecap.com/best-bitcoin-payment-processors">[[2]].

Assess payment processors by a concise set of criteria: fees (on-chain vs. gateway fees), settlement speed (instant conversion to fiat vs.periodic payouts), and integration (plugins, API documentation, POS support). Also verify operational protections such as clear chargeback policies, multisig custody options, and merchant support during disputes. Practical selection tips:

- Compare total cost: fees + conversion spreads

- Check settlement options: daily fiat payout vs. crypto balance

- Test integration: sandbox transactions and invoice accuracy

Review aggregated vendor lists to shortlist providers that fit goods, services, or real estate use-cases before onboarding a merchant or accepting invoices< a href="https://www.analyticsinsight.net/cryptocurrency-analytics-insight/top-10-crypto-payment-service-provider-companies">[[1]].

Tax,Regulatory and AML considerations for Goods,Services and Real Estate

Taxable events occur when bitcoin is used to acquire goods,services or real estate: the spend is treated as a disposition of property and triggers a capital gain or loss measured by the difference between the bitcoin’s fair market value at the time of the transaction and its cost basis. Businesses and buyers must determine whether the sale is short‑term or long‑term for rate purposes and whether any special rules apply to inventory or dealer sales (for example, real‑estate developers). Recent IRS guidance and enforcement initiatives underscore heightened reporting expectations for crypto transactions beginning with the 2025 tax year,so accurate basis tracking and timely reporting are essential , and general tax treatment and reporting mechanics are discussed in contemporary guides and practitioner resources and .

Regulatory and anti‑money‑laundering obligations frequently enough accompany acceptance of bitcoin: merchants and real‑estate professionals should assess licensing requirements (money‑transmitter, broker-dealer or equivalent), implement KYC/AML screening, and maintain transaction monitoring.Practical compliance steps include:

- KYC – verify customer identity for higher‑value transactions;

- Transaction monitoring – flag unusual patterns and large transfers;

- Recordkeeping – retain receipts, timestamps and on‑chain evidence;

- Reporting – prepare for enhanced IRS reporting and third‑party data returns.

These measures align with current enforcement trends and tax reporting expectations described by tax authorities and industry guides .

| Transaction | Tax Treatment | Key compliance Action |

|---|---|---|

| Goods/retail purchase | Capital gain/loss on disposal | Record value at time of sale |

| Provision of services | Income at FMV; later disposal taxed | Invoice in fiat‑equivalent, track basis |

| Real estate purchase | Property acquisition; potential gain for seller | Document sale contract, escrow records |

- Immediate actions: capture fiat equivalent and timestamp at execution, preserve exchange/exported data, and consult tax counsel for structuring large property buys.

- Ongoing: reconcile wallets, report disposals on tax returns, and update AML policies as guidance evolves .

Negotiating Real Estate Deals and Drafting Contracts to Accept bitcoin

Price mechanics and risk allocation - When negotiating a sale you must decide whether the contract will be denominated in fiat, in BTC, or use a hybrid formula that fixes a fiat price but pays in bitcoin at an agreed conversion time. Define the exchange-rate source (an exchange or an average of exchanges), the exact timestamp for conversion, and who bears the volatility risk if the market moves between signing and closing. bitcoin’s role as a digital peer-to-peer medium informs these choices, and parties should account for its price behavior when allocating risk and when planning for sudden market shifts tied to macro events .

Key contract clauses to include – Clear, unambiguous language prevents disputes later. Typical provisions should cover wallet/payment details, confirmations of on‑chain receipt, escrow and multisignature instructions, tax allocation, and remedies for payment failure or double-spend concerns. Useful items to draft explicitly:

- Payment mechanism: exact wallet address, required confirmations, and who pays transaction fees.

- Exchange-rate clause: data source, timestamp and rounding rules.

- Escrow/closing agent: identity, authority to convert BTC to fiat (if any), and dispute-resolution steps.

Consider using custodial or exchange services for transfer and settlement logistics when parties lack direct on‑chain experience; regulated platforms can simplify custody and reporting obligations .

Closing logistics, compliance and practical checklist – Coordinate with title companies and escrow agents up front: confirm they will accept, hold, or convert bitcoin, and document how funds will be cleared for recording and disbursement.include KYC/AML representations and specify tax reporting responsibilities to avoid post‑closing surprises.Practical steps to add to the contract or an annex:

- Identify the settlement flow (BTC → escrow → conversion → disbursement) and timeline.

- Require evidence of on‑chain confirmations and a final settlement statement showing the BTC→fiat conversion.

- Set a short reserved period for price disputes and a clear default remedy if conversion fails at closing.

Because price swings can be material, build in short, practical cure periods and explicit allocation of conversion losses or gains at closing to reduce litigation risk and ensure commercial certainty .

Escrow,Title Transfer and Settlement Mechanisms for bitcoin Property Purchases

Escrow arrangements for bitcoin-backed purchases commonly combine on‑chain mechanisms with off‑chain trust arrangements to protect buyer and seller until contractual conditions are met. Typical service models include custodial third‑party escrows that hold bitcoin until delivery, multi‑signature escrow requiring multiple private keys to release funds, and programmatic escrow implemented via smart contracts or automated scripts that release payment on event verification. These options balance custody risk and practicality: custodial services simplify settlement for non‑technical parties, while multi‑sig and programmatic escrows reduce single‑point failure risk by keeping control distributed .

Transferring legal title in real estate or high‑value goods requires explicit coordination between blockchain settlement and traditional registries. for real estate purchases, the practical closure remains a two‑track process: the buyer must obtain control of the bitcoin funds (or have them released by escrow) while the seller completes deed execution and registry recording under local law. Estate and title planning also matter when bitcoin is the purchase medium – securing legal title often means documenting the transfer of property in conventional instruments while ensuring private key access is handled by trusted custodians or multi‑institution custody solutions to preserve ownership continuity for beneficiaries or purchasers . Closing agents and notaries typically act as the off‑chain counterpart that certifies fulfillment of contractual conditions prior to escrow release .

Practical settlement workflows emphasize clear roles,auditability and dispute paths. A common checklist includes: buyer deposits bitcoin to escrow, seller delivers deed or goods and provides evidence to the closing agent, escrow verifies conditions (including on‑chain confirmations) and then releases funds; dispute resolution clauses and KYC/AML checks run in parallel. To clarify responsibilities at a glance, the table below summarizes core parties and on‑chain actions (WordPress table class used for styling):

| Party | Primary Role | On‑chain action |

|---|---|---|

| Buyer | Funding & approval | Deposit to escrow address |

| Escrow Agent | Hold & release funds | Monitor confirmations, execute release |

| Seller | Deliver deed/goods | Provide proof of delivery |

| Closing Agent/Notary | Record legal transfer | Certify off‑chain completion |

Risk mitigation best practices include multi‑sig escrow, documented closing checklists, autonomous audits of custodial services and explicit contractual remedies for failed settlements .

Practical Checklist and Case Examples for buying Cars, Services and Homes with bitcoin

Start every purchase by running a concise pre-transaction checklist:

- Confirm acceptance: verify the seller explicitly accepts bitcoin and agree on the pricing currency (BTC or fiat peg).

- Volatility plan: decide whether to convert to fiat, use a stablecoin, or lock a BTC amount at spot via an OTC/escrow mechanism.

- Settlement method: choose on‑chain vs Lightning for speed/cost, and estimate fees and confirmation times.

- Legal & tax: collect invoices, record cost basis and consider local reporting/KYC requirements.

- Security & escrow: use escrow or multisig for high-value deals; never share private keys and confirm wallet addresses twice.

These practical steps reflect basic buying and custody principles for bitcoin and the risks you should manage before executing payment .

Example case – buying a car with bitcoin: locate a dealer or private seller that accepts BTC,agree on a firm fiat price and the exact BTC amount at settlement time,then use an escrow or dealership-integrated custody service to hold funds until title transfer is complete. Recommended quick checklist for the transaction:

- Agreement: written sale contract stating price, payment method and refund conditions.

- Escrow: third-party or multisig escrow to release funds on title transfer.

- Documentation: bill of sale, VIN verification, registration steps and taxable event records.

Following these procedural checks reduces counterparty and volatility risk and mirrors practical buying advice and on‑chain usage guidance common in bitcoin primers .

For services and real estate, scale your controls: small services can frequently enough be paid directly (invoice + receipt), mid-value items like cars need escrow and title procedures, and homes require legal counsel, escrow companies and sometimes OTC or custodial settlement to handle large sums.A compact comparison table:

| Transaction Size | typical Settlement | Recommended Control |

|---|---|---|

| services (small) | Direct BTC / Lightning | Invoice + receipt |

| Cars (mid) | Escrow / on‑chain | Multisig + transfer docs |

| Homes (large) | Escrow / OTC / custodian | Title & legal escrow |

Always involve licensed professionals for real estate closings and consider converting to fiat through regulated channels to manage tax and settlement risk; these practical controls align with general buy/hold and transactional guidance for bitcoin users .

Q&A

Q: What kinds of goods and services can I buy with bitcoin?

A: bitcoin can be used to buy a wide range of goods and services: online retail items, digital services (hosting, software, subscriptions), travel bookings, restaurants and physical retail where accepted, professional services, and increasingly some high-value items such as real estate and vehicles when sellers accept crypto or use intermediaries. Acceptance varies by merchant and jurisdiction.

Q: Can I buy real estate with bitcoin?

A: yes. Real estate can be purchased directly if the seller agrees to accept bitcoin,or indirectly by converting bitcoin to fiat and using conventional channels. Transactions often use escrow services or lawyers experienced with crypto to handle title transfers,anti-money-laundering checks,and closing in local law. Sellers commonly convert proceeds immediately to fiat to reduce price volatility exposure.

Q: How do bitcoin payments work for everyday purchases?

A: Typical steps: the merchant provides a bitcoin address or a QR code; you send the specified amount from your wallet; the blockchain records the transaction; the merchant waits for the number of confirmations they require before considering the payment final. Many merchants use payment processors that handle conversion to fiat and return a fiat settlement to the merchant, minimizing their exposure to price swings.

Q: Are bitcoin payments instant?

A: Not always. On the base bitcoin network a transaction needs to be included in a block and may require several confirmations, so settlement can take from several minutes to an hour or more depending on fees and network congestion. Layer‑2 solutions such as the Lightning Network can enable near-instant, low‑fee payments for supported merchants and wallets.

Q: What fees should buyers and sellers expect?

A: Fees can include network (miner) fees, which vary with network demand; payment-processor fees if the merchant uses a service; and currency conversion spreads if bitcoin is converted to fiat. Real‑estate or high‑value transactions may also incur escrow, legal, and compliance costs.

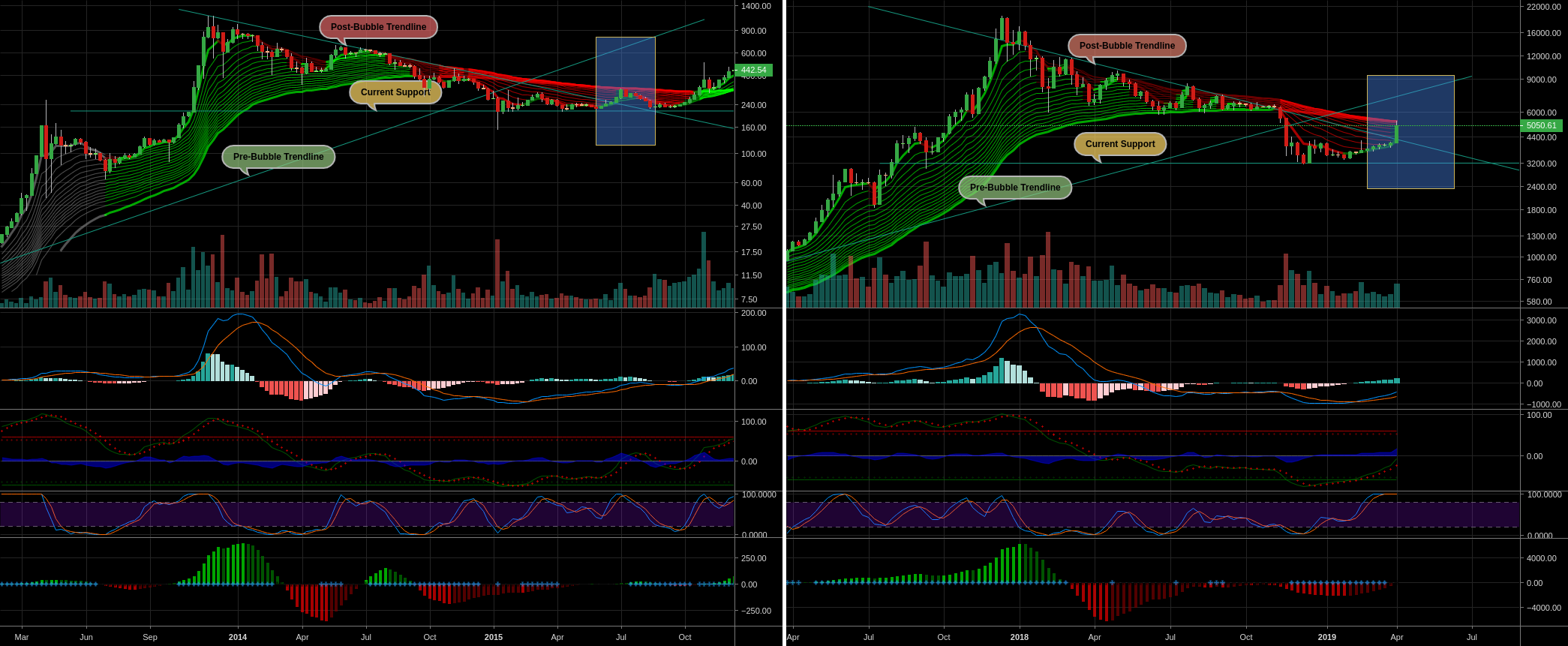

Q: How does bitcoin’s price volatility affect purchases?

A: Volatility creates risk for both buyers and sellers. A seller receiving bitcoin may lose value if the price drops before conversion; a buyer may see the fiat cost change rapidly between quote and settlement. Many merchants price goods and services in fiat and use live exchange rates or payment processors to calculate a bitcoin amount at the time of sale to mitigate this risk. Recent market movements illustrate that bitcoin can move sharply in short periods, impacting transactional risk . Current market quotes and historical prices are available from major finance sites and exchanges .

Q: How should buyers and sellers set the price in bitcoin?

A: the usual approach is to set the price in a fiat currency (e.g., USD, EUR) and convert to bitcoin at the prevailing exchange rate at the time of sale. This can be automated by payment processors or performed manually using a reputable price feed. For negotiated or high‑value deals (e.g., real estate), parties can contractually fix the fiat price and specify how and when bitcoin will be converted or valued.

Q: What tax implications arise when spending bitcoin?

A: In many jurisdictions bitcoin is treated as property or a taxable asset. Spending bitcoin can create a taxable event: the difference between your acquisition cost (basis) and the fair market value at the time of spending may generate capital gains or losses. Tax rules vary, so retain records (transaction ids, timestamps, fiat values) and consult a tax professional for jurisdiction-specific advice.Q: What reporting and record-keeping should I maintain?

A: Keep copies of invoices, transaction IDs, wallet addresses, timestamps, and fiat-equivalent values at transaction time. For real‑estate and large transactions keep escrow and closing documents, KYC/AML records where applicable, and any contracts that specify how crypto will be handled.

Q: Are there special legal or regulatory issues for real‑estate purchases with bitcoin?

A: Yes. Compliance with local property law, conveyancing procedures, anti‑money‑laundering (AML), and know‑your‑customer (KYC) requirements is essential. Some jurisdictions may have additional disclosure, tax, or reporting obligations when crypto is used in property transactions. Use legal counsel experienced in both real‑estate and cryptocurrency.

Q: How do escrow and title work when a buyer pays in bitcoin?

A: for security and legal compliance, parties typically use an escrow agent or attorney licensed to handle closings. The escrow agent can hold funds (converted to fiat if agreed) and coordinate with title companies to ensure the deed and title insurance are properly transferred in accordance with local law. Escrow arrangements reduce counterparty risk inherent in direct crypto transfers.Q: Can I get a mortgage to buy property with bitcoin?

A: Traditional lenders usually underwrite and settle loans in fiat, so buyers commonly convert bitcoin to fiat before applying. Some specialized lenders offer crypto‑backed loans or accept crypto as collateral, but these products carry lender-specific terms, valuation, and regulatory considerations. Availability depends on lender appetite and jurisdiction.

Q: How can buyers protect themselves from fraud when paying with bitcoin?

A: Use reputable counterparties, escrow services, or licensed intermediaries; verify wallet addresses carefully (watch for phishing and copy‑paste attacks); require confirmations before transferring goods or title; and use platforms with dispute resolution where available. For high‑value purchases, involve lawyers or title/escrow companies.

Q: What consumer protections exist when buying goods or services with bitcoin?

A: Consumer protections are generally weaker than with card payments because bitcoin transactions are irreversible. Protections depend on the merchant, marketplace policies, and any third‑party processor used.For purchases through regulated platforms or marketplaces, buyer protection policies may apply. For direct peer‑to‑peer transactions, rely on escrow and contractual protections.

Q: How do cross‑border purchases with bitcoin differ from domestic ones?

A: bitcoin simplifies cross‑border value transfer by avoiding traditional banking rails, but buyers and sellers must consider customs duties, VAT/sales tax, currency controls, differing AML/KYC requirements, and local legality of crypto transactions.Clearing and settlement practices for property or regulated services will follow the destination country’s rules.

Q: What are best practices for merchants accepting bitcoin?

A: - Price in fiat and use a reputable payment processor or price feed to calculate BTC amounts at the time of sale. – Convert received bitcoin to fiat if you want to avoid volatility,or set and disclose a held-crypto policy. – Implement KYC/AML procedures where required.- Keep clear records for accounting and tax compliance. – Educate staff on address verification and refund policies. – Consider using the Lightning Network for small, frequent payments to reduce fees and confirm times.

Q: Where can I monitor bitcoin’s price and market conditions relevant to purchases?

A: Use reputable financial news outlets and exchange or market‑data providers for live quotes, charts, and market commentary. Major sources include finance portals and exchange price pages that update in real time . News coverage can help you track volatility and market events affecting transactional risk .

Q: What final precautions should both buyers and sellers take when using bitcoin for purchases or real estate?

A: Conduct thorough due diligence; use escrow and licensed intermediaries for high‑value deals; document fiat values and conversion methods in contracts; understand and comply with tax and regulatory obligations; secure private keys in trusted wallets; and consult legal and tax professionals experienced with cryptocurrency transactions.

Final Thoughts

bitcoin’s utility as a medium for purchasing goods, services and even real estate stems from its design as a decentralized, blockchain-based digital currency that enables peer‑to‑peer transfer without a central intermediary. That same decentralization and digital nature has expanded options for merchants, service providers and property sellers to accept bitcoin, though adoption and payment workflows vary widely by jurisdiction and counterparty.

prospective buyers and sellers should account for the currency’s market behavior and liquidity when planning transactions. bitcoin’s price is actively traded and can move rapidly, so monitoring market quotations and timing conversions between crypto and fiat might potentially be critically importent for preserving value. Macroeconomic events and policy shifts can also produce sharp price reactions, a factor market participants and counterparties routinely factor into negotiations and risk management.

Beyond price risk, legal, tax and settlement considerations are central to any bitcoin purchase of goods, services or real estate: confirm acceptance terms, documentation requirements, closing mechanics for property transfers, and local tax treatment. Informed transactions balance the efficiency and innovation bitcoin can offer with prudent assessment of volatility, regulatory compliance and counterparty reliability.