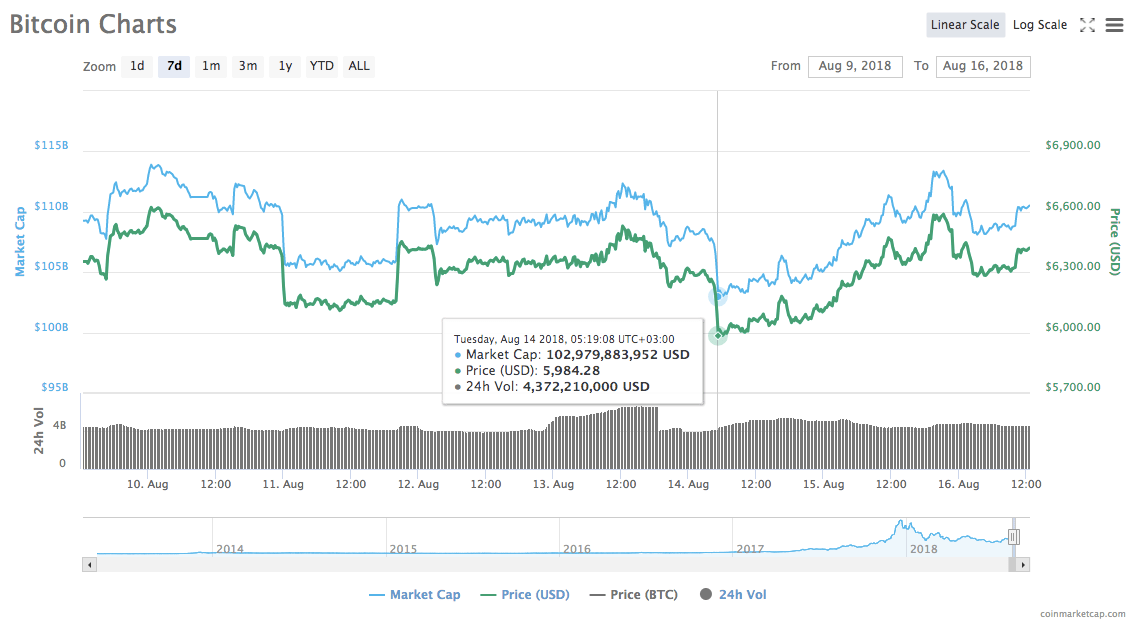

(BTC) prices are up around .05 percent on Thursday, August 16, bringing the leading cryptocurrency solidly back over $6,000 after a market fall that had seen BTC dip that psychological price point on August 14.

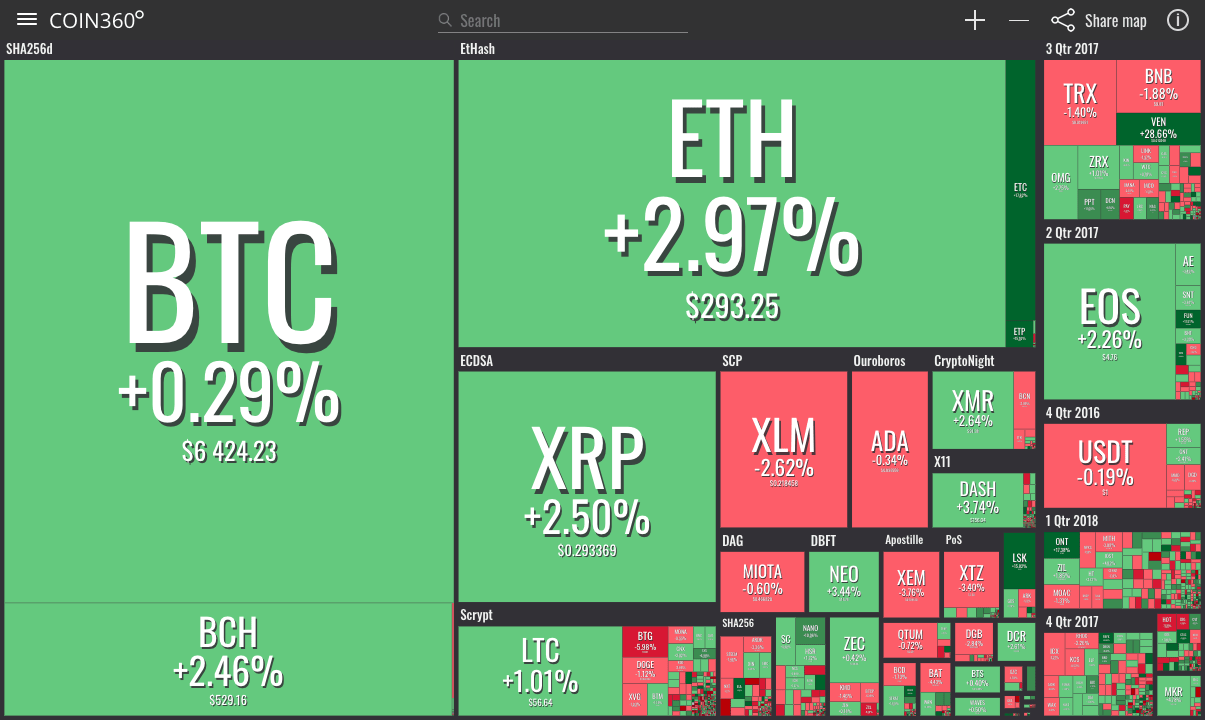

Market visualization from

Data from Cointelegraph’s shows overall 2.5 percent monthly gains for bitcoin as of press time, despite the latest correction from it’s weekly high of around $6,600, against weekly losses of almost 10 percent.

Continuing its trend of short-term volatility, BTC/USD is currently around $6,407, with commentators eager to see if support at $6,000 has solidified.

bitcoin’s 7-day price chart. Source: Source:

The price performance comes as the cryptocurrency industry becomes increasingly indifferent to the potential effect of a bitcoin exchange-traded fund () acceptance or rejection by U.S. regulators.

Previously hailed as a factor which could propel or deflate markets significantly, joined in fresh skepticism of ETFs this week, the latter they “might cause more problems than they’re worth.”

In a , Antonopoulos described ETFs as “a multibillion dollar ‘not your keys, not your bitcoin’ scheme.”

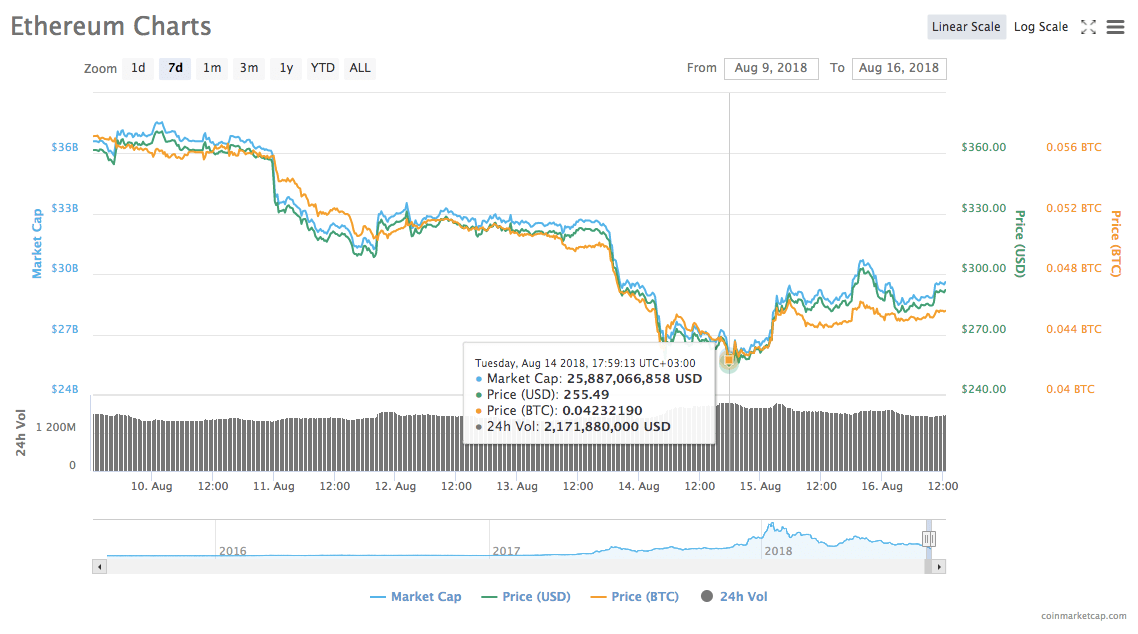

Beyond bitcoin, altcoin worries continue, with (ETH) gaining slightly Thursday but still continuing weekly losses close to 30 percent and monthly ones approaching 33 percent.

At press time, ETH/USD traded around $292, several percentage points off earlier lows this week which marked the largest altcoin’s biggest plunge since September 2017.

Ethereum’s 7-day price chart. Source:

Other major altcoins posted broadly flat growth, with the exception of (XLM), which is down around 3 percent on the day, trading at around $0.22 by press time. Another altcoin outlier is (ETC), whose to may have sent prices soaring by over 16 percent on the day, with the coin currently trading around $14.09 by press time.

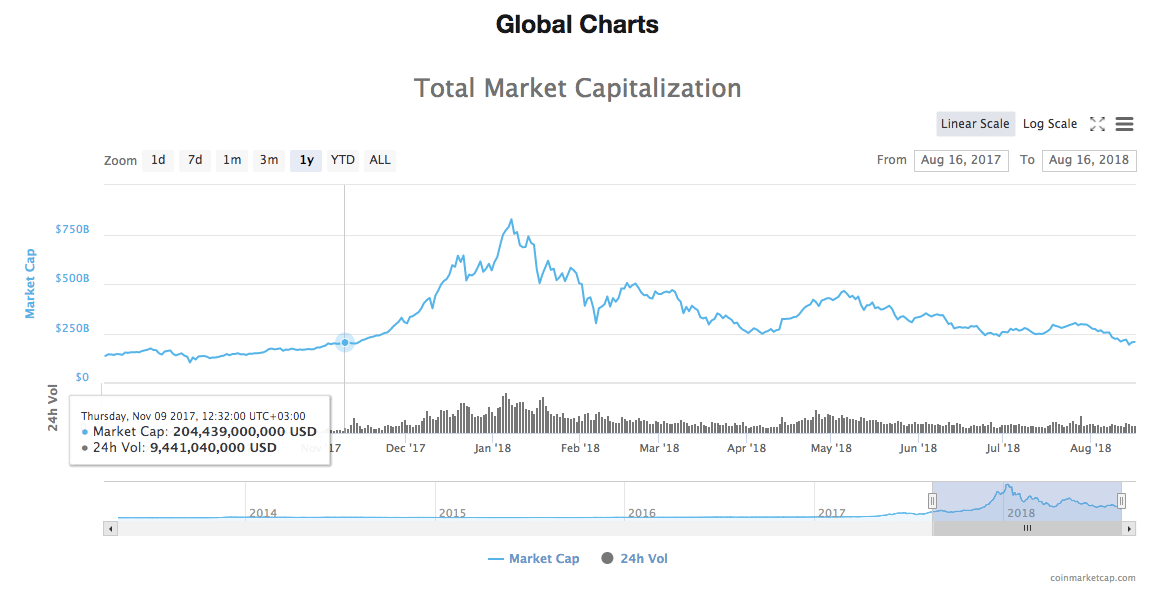

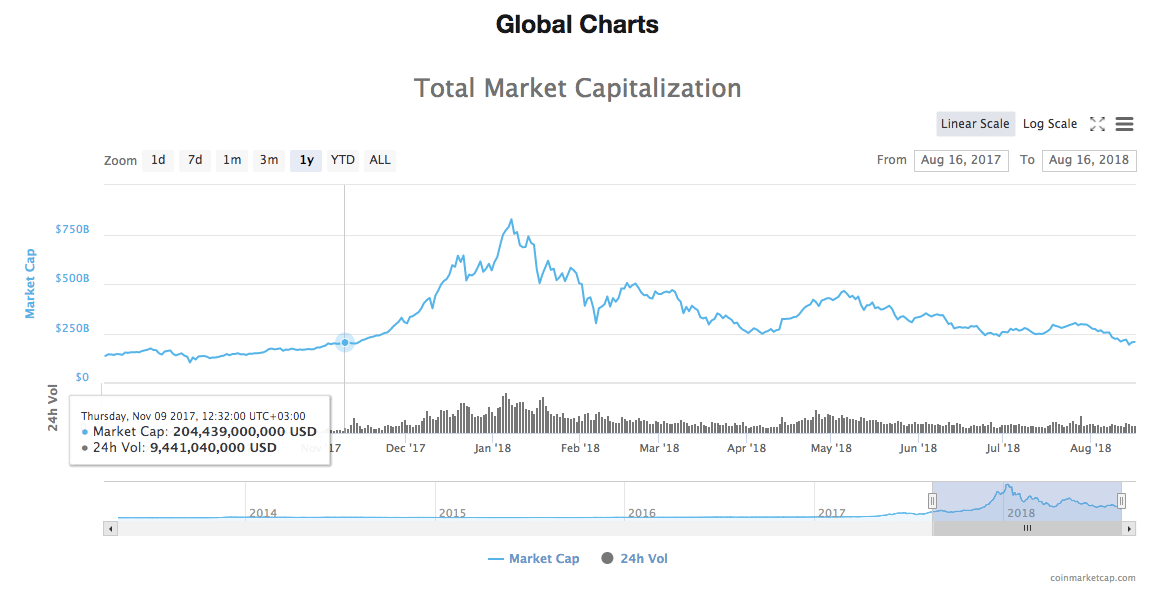

Total market cap is around $207 billion by press time, a number last seen in November 2017.

Published at Thu, 16 Aug 2018 10:01:00 +0000