The Chicago Board Options Exchange [CBOE] decided not to list any [] futures for in March 2018. It is speculated that the competing Chicago Mercantile Exchange [CME] will now see this as an opportunity to seize the digital asset-derivatives market.

In a March 14 statement, detailing the new products added to the CBOE Futures Exchange, the exchange stated that derivative contracts will not be a part of their offerings this month. The statement read,

“CFE is not adding a Cboe (USD) (“XBT”) futures contract for in March 2019. CFE is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for .”

Presently, three Futures are on the CBOE, XBTJ19, XBTK19, and XBTM19, with expiration in April, May, and June, respectively. The exchange stated that while additional XBT contracts will not be listed, the ones on the market will not be pulled out prematurely.

The statement added,

“While it considers its next steps, CFE does not currently intend to list additional XBT futures contracts for . Currently listed XBT futures contracts remain available for .”

In December 2017, when the two aforementioned exchanges announced their intention to launch derivative contracts tied to the top , the crypto-market boomed. recorded its highest price of $19,800, and the collective market rose to $830 billion, following the introduction of Futures.

Given the elasticity of ’s price to the actions of the CBOE, the top was not affected by this delisting. gained against the US dollar by 0.5 percent, and was at over $3,900, with the coin-market holding firm at $135 billion.

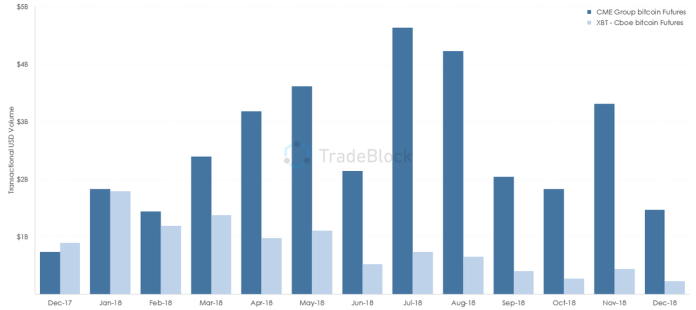

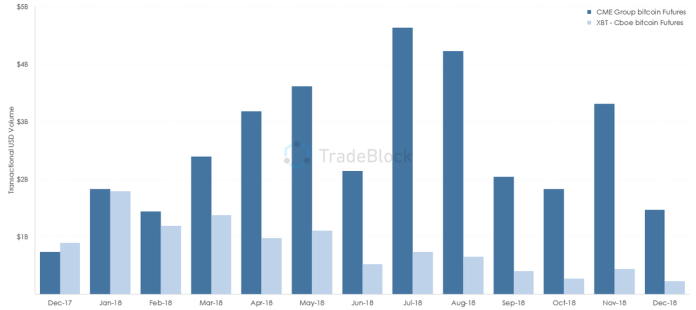

CBOE has been showing consistently poor volumes, compared to the CME. When the contracts were first launched in 2017, barring December, the CME has been ahead of the CBOE with respect to Futures volume.

Mid-way through 2018, on CME was six times ahead of CBOE futures , with the difference only looking to rise. Coinalyze, a crypto-research service, stated that in August 2018 alone, the CME daily futures volumes had averages in excess of 30,000 and 5,000 on CBOE.

Source:

The crypto community expected CBOE to drop out of the futures race, and was speculating whether this would be an indication of the “-bottom”.

Mike Dudas, the CEO, and founder of TheBlockCrypto said,

““$XBT has been getting *crushed* on volume by CME’s future. No surprised that @CBOE is throwing up the white flag.”

Johnny Lingo Music mulled the reason behind CME’s surge. He said,

“Because CME has been offering an incentive/discount all of 2018 to get traders into it. However, this expired last month Feb., so will be interesting how the volume plays out over next few months”

MonoBoly stated,

“The CBOE capitulating is one of the most trend reversal things I’ve ever heard, and if it hasn’t happened already the bottom is very close to in. /vague # tweet”

The post appeared first on .

Published at Sat, 16 Mar 2019 06:01:59 +0000