Korean exchange reported volumes more than 10x its summertime averages in early November.

CryptoExchangeRanks.com, a research firm linked with , decided to vet the data. They made the report available to CCN and it’s at the bottom of this article.

Interesting patterns were uncovered when Bithumb’s trading patterns were put under a microscope. The researchers broke the trading activity down into three periods: August 25th to October 7th, October 8th to November 11th, and the third period, November 12th to present day.

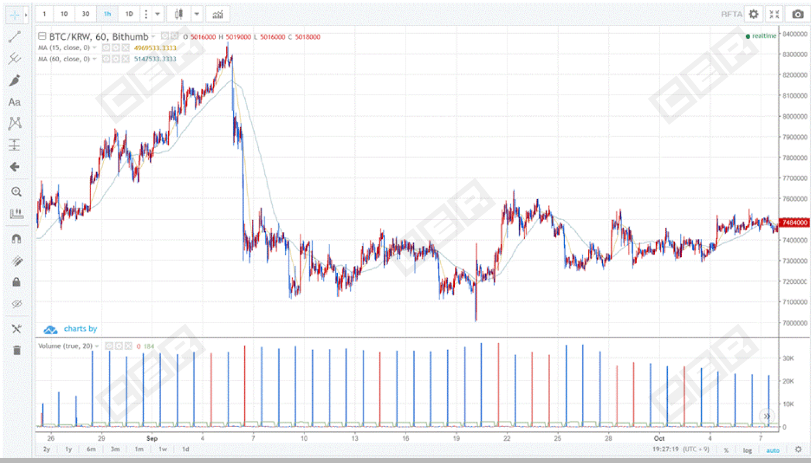

During the first period, they discovered that every day around the same time, the majority of Bithumb’s bitcoin trading would take place in the space of an hour.

Between 90 and 95% of the day’s trading volume at Bithumb took place around 11AM each day. As the researchers write, it created a “comb-like” pattern on the chart above. That chart is the hourly volume for the month of September.

During the second period beginning October 8th, Bithumb’s volumes divorce from the price movement of the same period, posting irregular volumes on a regular basis. On October 8th, the daily volume was 22,000 BTC, while on November 6th, they posted more than 100,000 BTC in trade volume.

Volume Did Not Correspond To Significant Price Movements

On November 12th, volume was just over 1,500 BTC. If this volume isn’t fake, the researchers conclude, then it’s highly irregular. Something’s not right with this, to say the least. If similar trading activity were seen on any regulated mercantile exchange of the old world financial system, regulators would be interested, to say the least.

An interesting thing to note is that following November 12th, the bitcoin price dropped nearly $1,000. It was the beginning of the slide from over $6,500 to the current levels of today. Typically, any major price movement will spur volume, regardless of direction. People will panic sell and people will seize buy opportunities. Even when people aren’t in charge of the decisions, trading bots will take advantage of price movement. Again, they will do this regardless of price momentum. Also, pre-configured trades are often triggered when unexpected price changes take place. But a slide of hundreds upon hundreds of dollars did nothing to return the volume of Bithumb to its previous highs. Volume following November 12th was what the researchers consider “natural” levels.

The researchers calculated the average trading size on Bithumb and noted that it drastically increased over the periods studied. At the beginning of the summer, the average trade at Bithumb was around .21 BTC prior to the first period studied.

During the first period, it increased to more than 1.8 BTC. The second period saw even greater increases, to more than 5.8 BTC per trade. In real terms, this would mean that even the low ends of the average were trading more than $4,000 worth of BTC in every swap – all of a sudden.

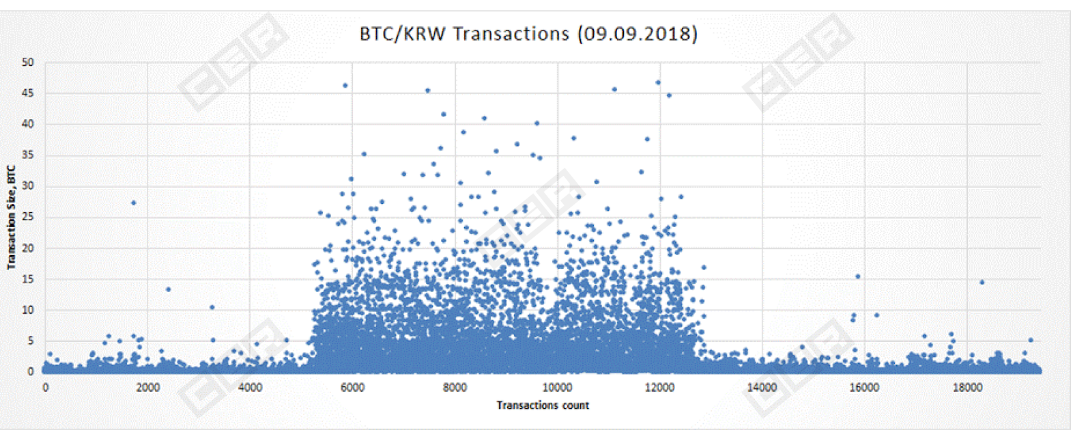

Also, prior to the first period, only a handful of trades (200 or so) were over 2 BTC at all. Yet the average trade size just a month or so later is more than twice that amount. The following chart shows BTC/KRW trades on Bithumb for September 9th. The period that raises the average and is significantly higher lasted only 5 minutes.

This trend would be repeated daily for the next 30 or more days. In the particular example shown above, 39% of the day’s trades were conducted in that five minute period for a total of more than 34,000 BTC, which accounts for nearly all of the volume reported by Bithumb that day.

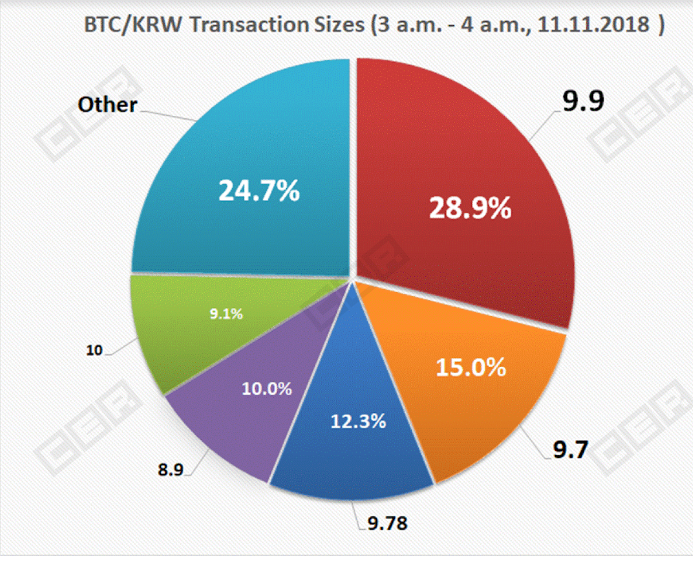

Fast forward to the day before the drop-off point, which happens to also be the day bitcoin prices began to slide. The following pie chart shows the average transaction sizes during a one hour period which started at 3AM local time. IT is vastly higher than normal transaction size on the same exchange.

Waltonchain (WTC) Pumped and Traded During Same Period

All the pairs traded on Bithumb saw similar trading patterns at various times, though never all at once. Thus, the volume reported ultimately to places like CoinMarketCap was not just representative of bitcoin/fiat pairs, but also the pairs offered on various altcoins, further inflating the figures. The token that stands out among them, according to the report, is . As the reports’ authors write:

WTC stands out from all the coins we observed, as it was only listed on the exchange on the last day of August and had the shortest pump period which started on October 28th and lasted till November 11th. For or that reason its pump was one of the most intensive. The inflated daily volume of Waltonchain jumped by 350 times from 348k WTC (on average prior to the pump) to 122.5mln WTC (on average during the pump) only to then drop by by 1,450 times in one day from 206.7mln WTC to 141.8k WTC on November 12th.

Waltonchain is an independent bitcoin implementation which aims at the mercantile and other large industries for the purpose of tracking units using RFIDs. It allows factories or companies to create their own sidechain to track various data relating to their wares. It has periodically seen large pumps, but there wasn’t much driving the activity that began in the periods described.

According to the report, Monero and ZEC seem to have been exempt from the fluffing that was going on in other markets:

Interestingly, in contrast to the other pumped coins, XMR and ZEC volume didn’t drop to their pre-pump levels on November 12th. While XMR volume maintained the average daily values of the “second period” after sliding down from the peak, ZEC volume slid from the peak as well but dropped to August levels on November 19th, spiking the next day to half of the average “second period” value and dropped again on November 21st. ATS performance of both coins was in line with their trade volume trends.

Average Trading Size Huge Increases: Most Conclusive Evidence

The conclusions of the report are hard to refute because they are based on exhaustive research and publicly available data. The bottom line is that you can see massive volume spikes, especially during price fluctuations, but it’s unlikely that the class of clientele Bithumb was servicing came in for a few minutes or a few hours of every day and traded more than 8 times the previous average trading size.

For “average” numbers increasing in such a fashion, the change should be at least somewhat sustained over a long period of time. Still, the pre-existing smaller trading sizes would drag the average down over time, so it would be a more healthy sign.

The reader may wonder why Bithumb would want to inflate their volumes, which this reporter does not find the evidence conclusive enough to absolutely say for sure. Some internal leakages would be necessary to verify it.

The answer to why they might, however, is simple: in the exchange wars, volume is king. is the dominant exchange precisely because it is a magnet the world over. It has dozens upon dozens of trading pairs and conducts a massive amount of trades on a daily basis. Traders often feel they’ll get the most representative rate on the exchange with the most volume in a given token. Often, Binance’s overall USD volume is almost double its nearest competitor.

Even being the nearest competitor is a lucrative position to be in, and Bithumb frequently appears in the top 10 not very far behind Binance. We reached out to Bithumb for comment on this article. After a full day we had not heard anything back at all, but we will update this story if they do send comment.

by phm.link on Scribd

Featured image from Shutterstock. Thanks to for other data.

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free.

Published at Thu, 20 Dec 2018 15:11:54 +0000