The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the exchange.

The Barclay Cryptocurrency Traders Index monitors the returns of the 19 funds that trade in virtual currencies. It has taken a beating this year and is down year to date.

However, funds that are market makers and who trade in arbitrage strategies are having a field day, as some have gained in the first quarter.

This shows that whatever the market condition, the traders can always develop a strategy to profit from it.

The miners are not that lucky. According to Morgan Stanley, the miners of bitcoin will remain unprofitable if prices remain below .

The big problem is that no one knows how to evaluate the leading cryptocurrency. The targets range from and , but when prices don’t fall even during bad news, it is usually a sign that the bottom is around the corner. We believe that most digital currencies have bottomed out, at least in the short-term.

BTC/USD

has finally broken out of the 50-day SMA after remaining range-bound for seven days. Though this is a bullish sign, we still don’t see a strong buying conviction, as the up move is lacking momentum. This shows that the market participants are cautious of this rally.

The next target on the upside is $9,400, where we suggest booking partial profits. Once this level is crossed, a move to $10,000 is possible.

If prices fail to hold above the 50-day SMA, it will be a bearish sign and prices can fall back to the first support level of $7,900. Therefore, we suggest the traders should keep the stops on the pair at breakeven.

ETH/USD

convincingly broke out of the 50-day SMA on April 19, which is a bullish sign. It has become positive and should continue to rally towards $730 levels.

Though the 50-day SMA is still falling, the 20-day EMA has turned up. A bullish crossover will provide further strength to the pair.

Though we are bullish, we have not suggested any trade on Ethereum. We will wait for a dip or a consolidation to enter fresh long positions.

BCH/USD

In our , we had noticed that doesn’t face resistance at the 50-day SMA and that is what happened. The price zoomed past the moving average on April 19 and touched our first target objective of .

Traders can book partial profits at the current levels and keep a trailing stop on the remaining position. If the bullish sentiment continues, the pair can rally to $1,300 and then to $1,600.

However, we need to caution the traders that the cryptocurrency has a history of vertical falls, so it’s better to protect the paper profits with a close stop loss.

We should never allow a profitable position to turn into a loss.

XRP/USD

We had recommended long positions in in our . The digital currency easily crossed above our first target objective of $0.83 where we had proposed to book partial profits.

There is a minor resistance at $0.9, above which, the pair can rally to $1.08 levels. We like the way it has rallied over the past three days, which shows that the buyers are back. The moving averages are also close to a bullish crossover, which is another positive.

Traders can hold the remaining positions with a close stop loss.

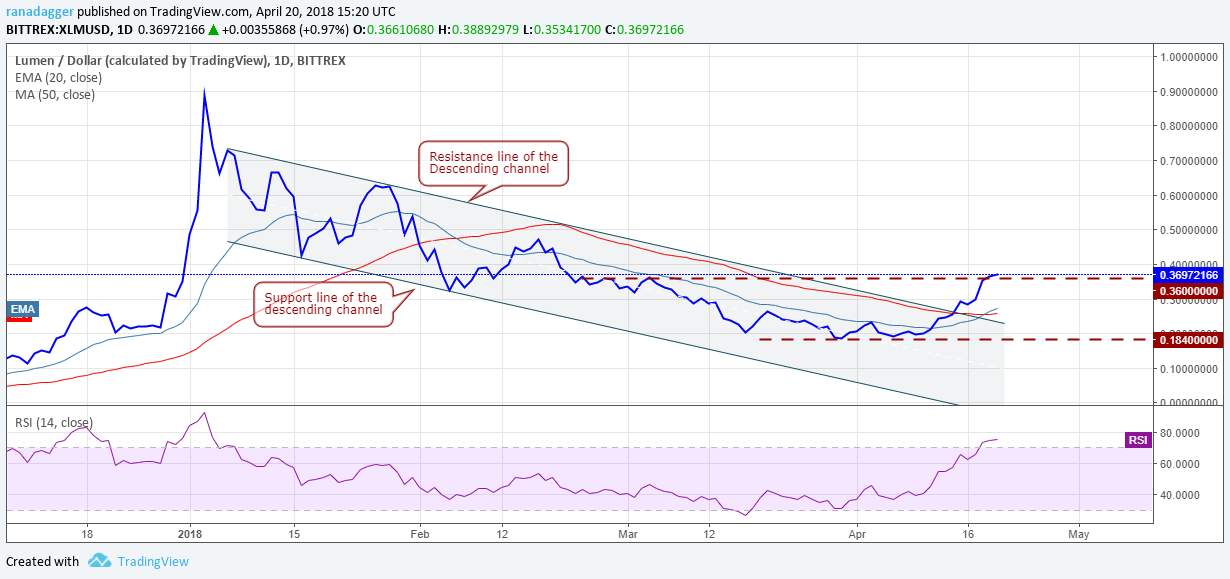

XLM/USD

has broken out of our first target objective of , where we had proposed traders to book partial profits.

The break out can carry the pair towards its next target objective of $0.47. That’s why we had recommended trailing the stops higher on the remaining position.

The moving averages have completed a bullish crossover, which is a bullish sign but it is unlikely to be a one-way move to the highs. Hence, the stops should always be trailed higher.

As prices near $0.47, please keep tighter stops.

LTC/USD

After remaining range bound for a few days, has found buying support. It is currently attempting to break out of the critical overhead resistance from the downtrend line and the 50-day SMA.

If successful, the pair will become positive and rally to $178 levels.

The logical stop loss for the trade is at $127, which doesn’t offer us a good risk to reward ratio. Thus, we shall wait for a new buy setup to form before recommending any trade on it.

If prices turn down from the resistance, it should find support at $141.

ADA/BTC

is again moving closer to our target objective of . If this level is crossed, then the digital currency will pick up momentum and rally to 0.000045 levels.

We suggest trailing stops higher on their , instead of booking profits at 0.000035.

The pair has started a new uptrend, after being in a downtrend for months. During the start of a new uptrend, the RSI can remain in the overbought territory for some time. Hence, traders should not get perturbed with the overbought levels on the RSI. Keep trailing the stops higher to lock in the paper profits. As prices move up, please tighten the stops further.

NEO/USD

has finally broken out of the 50-day SMA, but it will face stiff resistance at the $80 mark, from the downtrend line of the descending triangle and the horizontal line.

We suggest booking partial profits at this level and raising the stops on the rest to breakeven.

If the pair breaks out of $80, it will become very bullish because the failure of a bearish pattern is a positive sign. After breaking out of the downtrend line, there is minor resistance at $92-$94. If this level is crossed, the digital currency should pick up momentum and aim to hit $140.

Hence, we are proposing to keep a part of the position open to benefit from the probable rise.

EOS/USD

has broken out of the ascending channel and the horizontal resistance at $10.0650, which shows bullishness.

We had resistance in the $9.5 to $10 zone, hence had recommended traders to book partial profits around the .

We had initially purchased with a target objective of $11, but looking at the bullishness, we believe that the pair can now rally to $12, which will also coincide with the resistance line of the ascending channel 2.

The remaining positions can be held with a trailing stop loss, which can be kept just below the support line of the ascending channel 2.

The digital currency will lose momentum if prices again fall into ascending channel 1.

The market data is provided by the exchange. The charts for the analysis are provided by .

Published at Sat, 21 Apr 2018 06:31:52 +0000

Altcoin