Key Highlights:

Further increase in price is certain;

bulls were in control of the BCH market;

price pullback is inevitable.

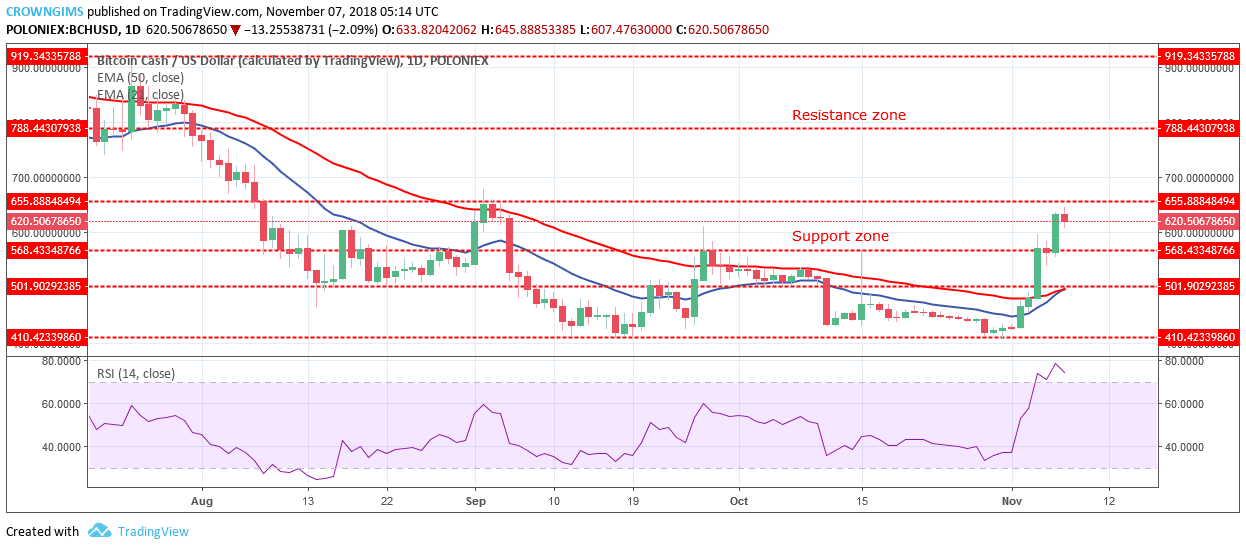

BCH/USD Price Long-term Trend: Bullish

Resistance zone: $655, $788, $919

Support zone: $568, $501, $410 BCH/USD resume bullish trend. The cryptocurrency has been on the downtrend movement since May 7th, immediately after the Doji candle formation followed by the bearish engulfing candle. The 21-day EMA also crossed the 50-day EMA downside to confirm the bearish trend. Since then, the bears were in control of the bitcoin Cash market. The coin found its lower low at $410 support zone on October 31.

BCH/USD resume bullish trend. The cryptocurrency has been on the downtrend movement since May 7th, immediately after the Doji candle formation followed by the bearish engulfing candle. The 21-day EMA also crossed the 50-day EMA downside to confirm the bearish trend. Since then, the bears were in control of the bitcoin Cash market. The coin found its lower low at $410 support zone on October 31.

The bears lose pressure in this zone and the bulls gained momentum. The strong bullish pressure after the Doji formation at $410 in the support zone signaled the bulls returned. Confirmation to the bulls’ takeover was seen as the next daily candle closed as bullish engulfing above the two EMAs. Increased bullish momentum led to the breakup of the former resistance zones of $501 and $568.

BCH price is above the two EMAs and 21-day EMA is crossing the 50-day EMA upside to confirm the bulls’ pressure and certainty of BCH price increase. Meanwhile, RSI period 14 is at the 80 levels ( overbought zone ) and its signal line point down indicates sell signal which may be a pullback which is necessary for the market correction as this will guarantee uptrend continuation.

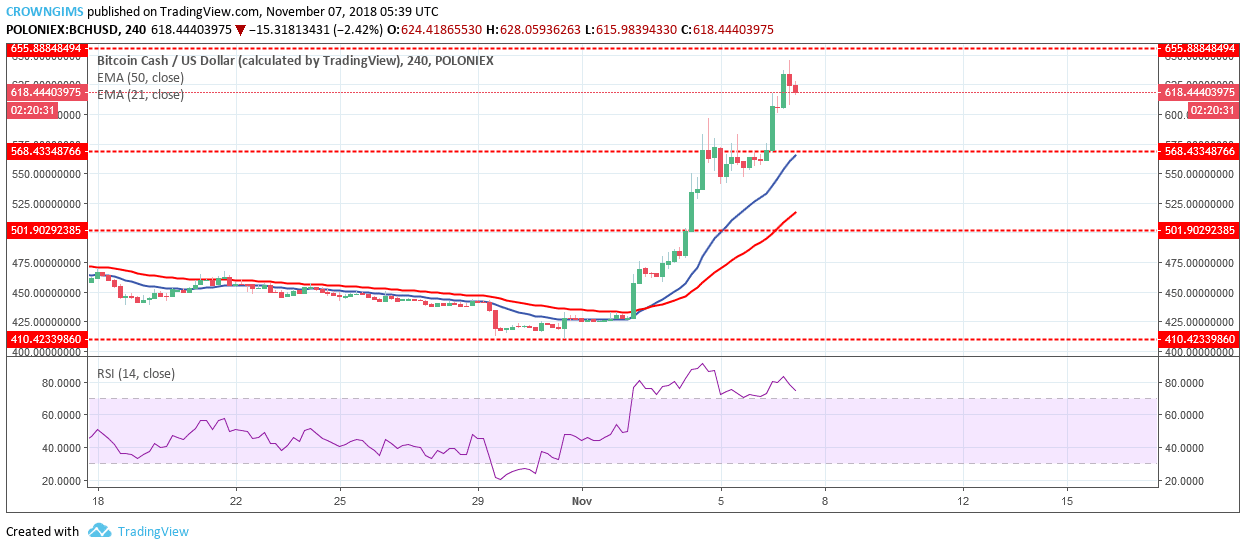

BCH/USD Price Medium-term Trend: Bullish

BCH price is above the 21-day EMA and 50-day EMA which is an indication of a bullish trend. The RSI period 14 is at 80 levels (overbought zone) and its signal line points toward south connote sell signal which may be a pullback.

Key Highlights:

price may increase;

bulls were in control of the market;

price retracement is inevitable.

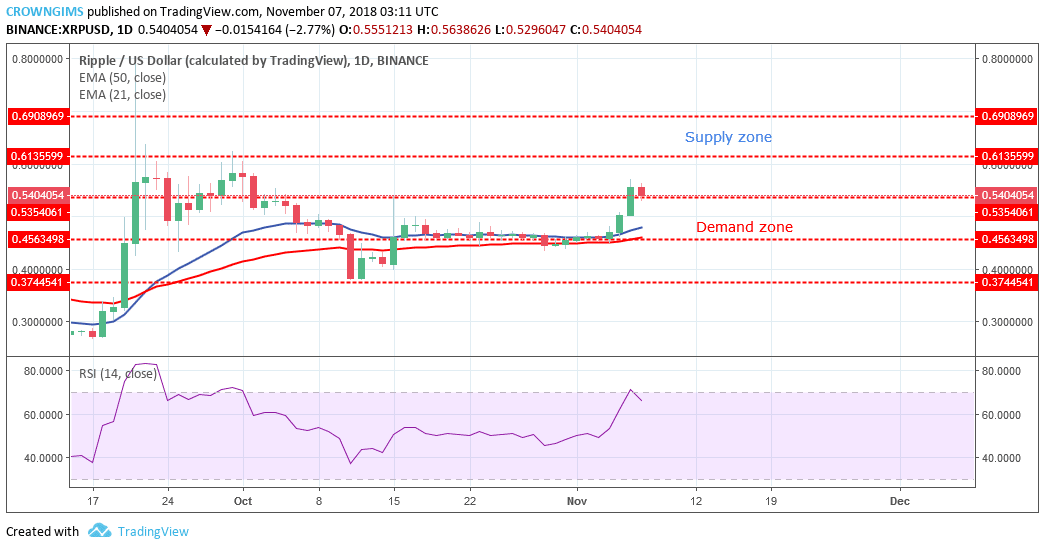

XRP/USD Price Long-term Trend: Bullish

Supply levels: $0.61, $0.69, $0.75

Demand levels: $0.53, $0.45, $0.37

On November 5, the bulls enter the market with high momentum and pushed the pair to the north with the formation of massive bullish candle that broke the former supply zones of $0.53 and exposed the supply zone of $0.61. Currently, there is a sign of price increase rejection which may be price retracement as the daily candle on the daily chart is bearish. In case, the demand zone of $0.53 holds the XRP will rally to the north and the supply zone of $0.61 will be the next target.

XRP price is above 21-day EMA and the 50-day EMA which indicates that the uptrend is ongoing. However, RSI period 14 is at the 70 level pointing towards the south indicates that there are possibilities for downward movement.

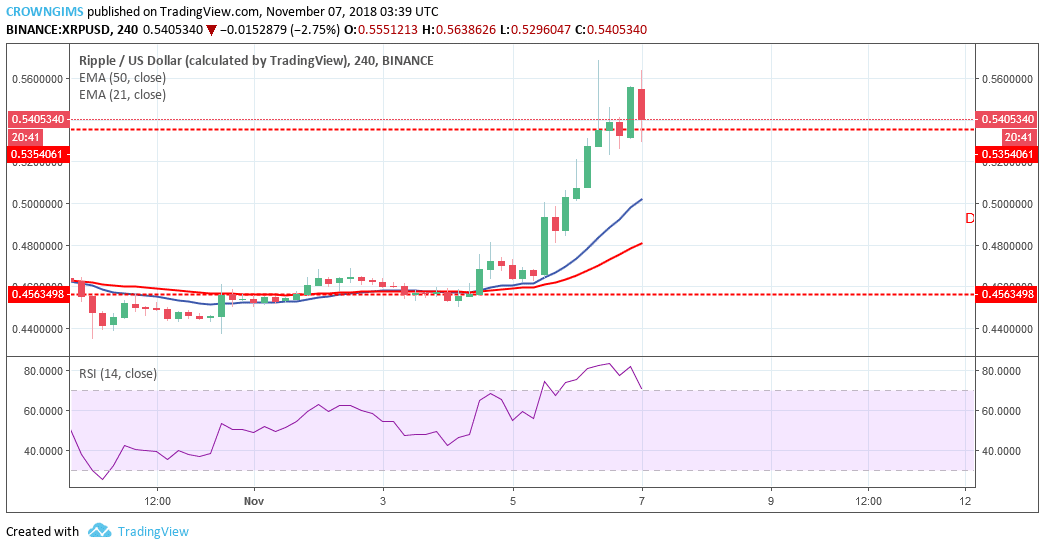

XRP/USD Price Medium-term Trend: Bullish

21-day EMA has crossed the 50-day EMA upside and the price is above 21-day EMA and 50-day EMA which indicates uptrend is ongoing.

In case the bears increase their pressure further and break the demand level of $0.53 downside, the demand level of $0.45 will be exposed. The RSI period 14 is at overbought zone with its signal line pointing to the south indicate sell signal.