La historia del holandés Martijn Wismeijer, quien hizo público este procedimiento en 2014, es seguida por muchos.

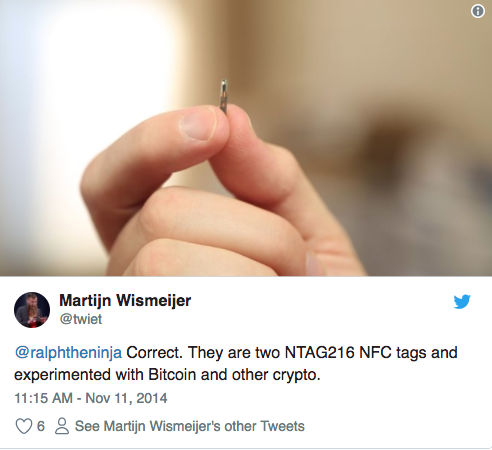

El holandés Martijn Wismeijer es muy cauteloso a la hora de almacenar bitcoin, tanto que en 2014, guardó bajo su piel dos chips NFC (Near Field Comunication – comunicación de campo cercano) implantados quirúrgicamente en cada mano para guardar sus claves cifradas de bitcoin.

Wismeijer declaró una serie de razones para el método drástico de almacenar crypto, diciendo que había perdido la mayoría de su bitcoins en los últimos años por fallos en los exchanges, piratería informática y robo.

Puedo decir con seguridad la mayor parte del bitcoin, más del 80 por ciento, lo he perdido debido a hacks, robos, intercambios fallidos y otros problemas. Si hubiera tenido el chip en 2010, probablemente ya fuera un hombre rico”.

Sin embargo, Wismeijer también estaba simplemente curioso sobre la idea de almacenar su moneda digital bajo su piel. Dijo a IBTimes en 2014:

Lo hice porque quería experimentar con bitcoins fuertes usando implantes subdérmicos porque pensé que eso sería el Santo Grial de los pagos sin contacto”.

Le hicieron el procedimiento en un estudio de piercing corporal, que recomienda a cualquiera que desee hacer lo mismo. Los chips se fabrican a partir de vidrio y miden 2 mm x 12 mm de extremo a extremo, es decir, son del tamaño de un pequeño grano de arroz. Wismeijer dijo que el proceso fue menos doloroso que una inyección, y señaló que el procedimiento es parecido al que se lleva a cabo para ponerles chip de seguridad a las mascotas.

Los chips NFC almacenan 888 bytes de datos cada uno, que es suficiente para el almacenamiento de 26 claves de direcciones cifradas de bitcoin. Wismeijer dice que utiliza sus chips todos los días para hacer compras: el proceso consiste en escanear las fichas con su teléfono inteligente para recibir y luego descifrar las claves para realizar una transacción. Las claves se pueden quitar y reemplazar con nuevas claves para otras criptomonedas de forma remota con un teléfono inteligente, y el cifrado impide que las personas simplemente escaneen las manos de Wisemeijer para leer sus llaves.

Debido a la atención que recibió, nunca almacena grandes cantidades en las fichas para evitar ser blanco de los ladrones, pero dice que no es el único que almacena monedas digitales de esta manera. Wismeijer es propietario del Sr. bitcoin, una compañía que instala cajeros automáticos bitcoin.

Después de aparecer en las noticias, muchos de sus empleados siguieron sus pasos. Wismeijer dice que conoce a “al menos 50” personas en el área de Praga que solo usan billeteras bitcoin subdérmicas.

Si bien el método puede parecer drástico, la seguridad de bitcoin es un problema importante. Según algunos informes, hasta un 23% de todos los bitcoin ya se han perdido de manera irreversible, lo que hace que la gente se tome su seguridad muy en serio. Aunque aprobado por la FDA (Food and Drugs Administration), el proceso aparentemente no está exento de riesgos, pues hay ciertos estudios que vinculan los chips de NFC con el cáncer. Sin embargo, los riesgos para la salud no disuaden a todos, pues muchas personas continúan siguiendo el ejemplo de Wismeijer tomando esta máxima precaución de seguridad para proteger sus bitcoins.

Puede ver en este video cómo fue el procedimiento:

Fuentes: y

Traducido por DiarioBitcoin

Imagen de

Any time the market rising people flock to cryptocurrency looking for "the next big win" and are constantly asking others to tell them what the best opportunity is.

Because in many countries the cryptocurrency market is not a regulated industry, it is one that is ripe with manipulation and scams. The mod team here at /r/cryptocurrency regularly has to ban professional manipulation groups (sometimes as large as 800 members) who have been paid to promote projects.

Given this, it's important to be able to do your own research and so I've assembled this handy guide for you.

Some tools that might be useful:

– this is my preferred research site as they have a lot more data, and more diverse data than other price monitoring sites.

– this is one of the oldest price tracking sites, and is more popular than CoinCheckUp, but has less data.

– A popular cryptocurrency potfolio tracker. (Downloadable app not vetted by /r/cryptocurrency)

– A popular cryptocurrency potfolio tracker. (Downloadable app not vetted by /r/cryptocurrency)

Disclaimers:

Crypto isn't an investment strategy.

Crypto is highly volatile and highly risky. Any money put into crypto could be lost in a crash. It could take years to recover. It could never recover.

The following information is not financial advice.

This is a guide on how to perform research, and is formed from an individual opinion. It's focus is helping you debunk some of the under qualified advice that others try to give in this space. It should not be considered complete or sufficient. You should never base any decisions on things you read online. Use your own best judgement.

Here is my personal approach to researching coins:

Step 1 – Understanding your risk profile:

A lot of people advocate for users purchasing cryptocurrencies and tokens that are "low-cap" ($10M – $100M) because they have the most opportunity to grow.

While this may be the case, the smaller a coin, and the earlier the project the more risk there is that the project can go to 0.

In traditional stocks some people are happy to make a 3% – 4% annual return, but would be in financial hardship if they lost money, and will invest in larger, safer and more stable stocks.

Other people, would only be satisfied with a return of 7% – 12% annual return. These people may also be willing to lose all of their investment. In their case they'd look at higher risk and turn around companies.

We say these two people have different 'risk profiles.'

It's important with any purchase (even something like a car) to decide what your financial risk profile is.

My personal view is that just because something has the highest chance of return, doesn't mean that it is the best opportunity.

Step 2 – Identify New Coins:

There are three ways I generally discover 'new' coins:

1) Bitcointalk.org forum posts in the altcoin and token announcement sections.

2) Coins mentioned here on /r/cryptocurrency

3) Coins newly listed on as coins tend to list on price trackers very early on.

Step 3 – How I rule out coins:

One of the first things I do when examining new projects is find really strict criteria to remove projects from the list.

Everyone should come up with their own list of things that voids a coin from being on their list, but here are a few I personally use:

I don't buy coins in industries I don't understand. I don't buy coins in regulated industries. I don't buy coins that are inactive in communication on social media. I don't buy coins that are registered in countries where I can't validate that a corporate entity. I don't buy coins if I can't find their executives on LinkedIn and validate it is a real profile. I don't buy coins that spam low quality partnerships on channels like /r/cryptocurrency If a coin is building a brand new technology, I won't buy it unless there is a detailed technical paper explaining the new technology. If a coin had an pre-ICO with discount, I tend not to buy it. If I do, it would need to be a small ICO discount and significant time would have needed to pass so that early investors have likely already dumped on the market. I don't buy coins if I wouldn't use them as a customer.

These criteria I use to quickly filter down my list before I do some more detailed analysis.

Step 4 – Doing detailed research:

First and foremost I read the white paper and then I ask myself the following questions:

Would I use this as a customer? Would I pay that price as a customer? Does this project require a new technology to be built? If I look at the team behind the project, do they have a previous track record? Have they run a successful company previously? What happened to that company? Does this team have the ability to build this technology? Are their engineers published in this industry? Do they have product managers and customer support? Is it clear how the project will get users/customers? Why are they using the blockchain – does it add value here? What are the pros and cons to using the blockchain here and why would the blockchain improve the current alternative? (Remember, right now blockchains are slow and costly in most cases) Watch out for absolutist claims. Every projects has downsides and cons, a real project will be realistic in outlining those.

After that, if it is an already launched project I check out the coin's detail page on CoinCheckUp for example the bitcoin page:

I then look at:

Tab "Analysis" > "GitHub Development" to see if there is active engineering development on the project.

Tab "Analysis" > "Coin facts & figures" if it is a company I check the information on the CEO/CTO as well as some info on the team.

Tab "Markets" – I check where the coin is trading to see if any of my preferred exchanges are available yet. If it's on limited exchanges, I look for non-sketchy ones. I also may look to see if there is a large spread between currencies.

Tab "Charts" – I check that the volume has a decent, growing and steady turnover. It's easy to get trapped at a bad price in a currency that has a low volume.

Once I've gone through those pieces of information, I usually check out the subreddit of the project and ask myself questions like:

Are they constantly announcing partnerships etc? If so, what will those partnerships do for me? Are they legitimate? If they are frequent low quality posts, I assume they are just trying to pump the market and I'll avoid it.

Are the users hostile towards people who are critical of their project, or who are asking questions? If it is a brainwashed, angry, subreddit that can't have any questions, I usually try and avoid.

Does their team's marketing/communication people respond to posts in a genuine fashion or is there a lot of "marketing" language with no real answer?

Final Tips:

Finding "the next big coin" is overrated. When you weigh up the risk the odds are better that a divrese set of coins would be better.

Share your research methods!

Everyone has different research methods, and things they look out for. Consider sharing yours in the thread below so that others, especially new users, can learn from your methods!

submitted by