The Foundation for Interwallet Operability is built on a key principle: for bitcoin or other crypto assets to succeed, they must be as easy to use as possible. The protocol presents some intriguing possibilities, particularly for merchants and new users. CCN , and we interviewed him again about their on crypto usability. The findings only compel Gold to work harder on his mission, for even those who’ve spent a significant amount of time in the crypto space find its usability far from perfect.

Most Crypto Users Feel Uncomfortable After Sending a Transaction

Most crypto users feel their hearts skip a beat when they press send on that bitcoin payment. | Source: Shutterstock

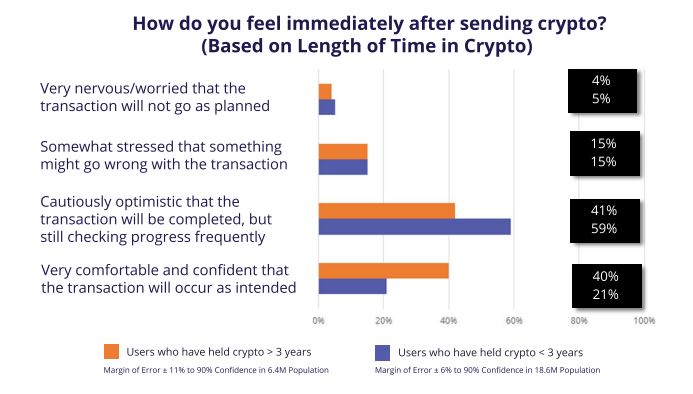

In fact, 60% of newer users failed to answer “very comfortable” when asked how they felt immediately after sending a crypto payment. The number of experienced users who feel “very comfortable” is just shy of the number who answered “cautiously optimistic.” It’s about 79% for users who’ve held crypto for less than three years.

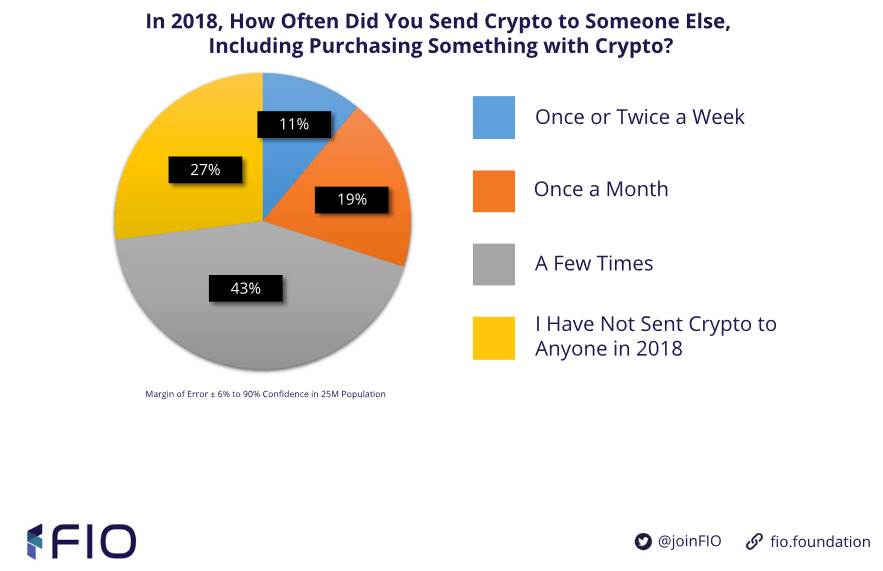

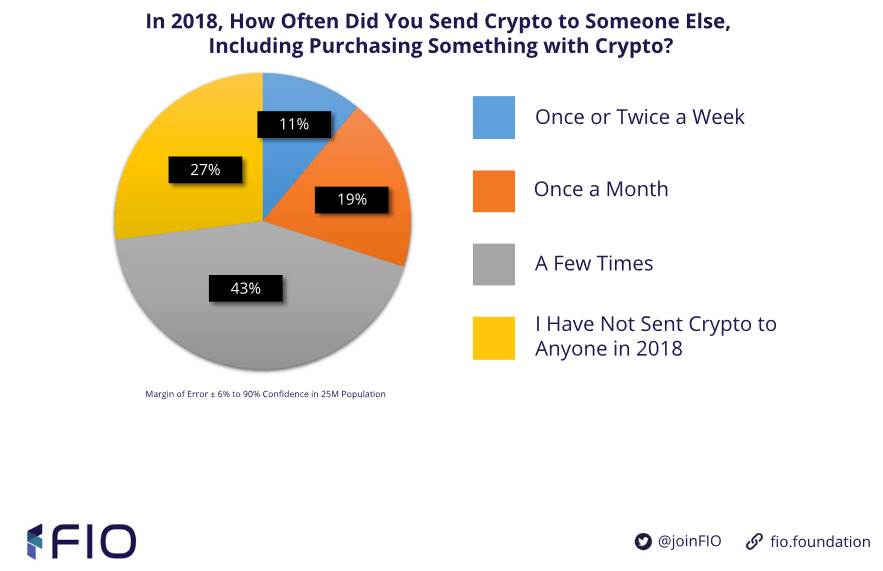

FIO divided the data into two groups: people who’ve held crypto for over three years and people who haven’t. Primarily, the study focused on people who held crypto at some point in 2018 when bitcoin was nearly . Almost three-quarters of respondents (73%) sent at least a few transactions throughout 2018.

Most crypto users are “cautiously optimistic” after sending a payment, but only one-quarter are “very comfortable.” | Source: Foundation for Interwallet Operability

Over two hundred people were polled. They were found via targeted advertising and other marketing techniques. The data gives a lot to unpack, and a lot to think about. Gold told CCN over the weekend:

“There are a lot of usability issues that have to be dramatically improved if crypto ever is going to achieve its potential of enabling the seamless movement of decentralized value and doing for the movement of value what the world wide web has done for the movement of information.”

Over Half of People Who Sent Crypto Last Year Experienced Problems

Most crypto users said they experienced problems when sending bitcoin or another asset to someone else. | Source: Shutterstock

Nearly 1 in 5 people polled had a problem that prevented the actual successful transaction of cryptocurrency. Around 6% reported that they had been victimized by a phishing or man-in-the-middle attack.

Man in the middle clipboard attacks are . An attacker infects a machine and manipulates the clipboard to send to an address. Often the address appears similar.

FIO specifically prevents such an attack vector: users can generate payment requests, based on the wallet software instead of the blockchain itself, so the sender is confident that the funds are properly routed. Attackers may still figure out ways to game such a situation, but it will be far more difficult – especially in merchant-to-person transactions, which are a crucial focus for usability.

Almost twice the number of people who were victimized worried that they might have been. This reporter can attest that any time he doesn’t see an immediate notification by a wallet service, he fears that he has finally fallen victim to one of these attacks.

Notably, a manual trick for the current age is to verify the beginning, middle, and end of a typical address. It gets more difficult with longer addresses, such as those issued by and other cryptonote protocols.

bitcoin & Crypto Competitors Must Be Easier Than Fiat to Succeed

Just 11% of crypto users made a transaction at least once a week during 2018. | Source: Foundation for Interwallet Operability

For some, the most damning result of the study will be the fact that only 11% of people who used crypto in 2018 did so more than once a week. The majority rarely used it at all.

For any alternative system to succeed, it should be easier than existing payment options. After all, it’s easier to send a transaction than to conduct a bank wire. All you need is someone’s e-mail address. Would PayPal be as successful if it were just as inconvenient as gathering bank details and processing them manually?

Gold said:

“If these things don’t get changed, people are not going to be with crypto. It’s got to be actually better than sending fiat. It’s got to be easier, safer, and more comfortable than sending fiat. Because these are immutable transactions, right? You can’t call a bank and say, ‘Hey, put a stop payment on that.’ Or, ‘I didn’t charge that.’”

FIO: One Protocol to Help Them All?

Fortunately, Gold doesn’t believe it’s necessarily up to the blockchain developers to create usability solutions. For one thing, a true maximalist vision would need to come true for that even to matter. If only or achieve full ease-of-use, for example, it doesn’t mean much for the non-crypto world coming into crypto. Even solutions like Lightning Network use complex algorithmic payment information to process transactions. FIO works to provide plain English addressing instead.

“FIO works identically on every single blockchain. […] I’ve talked to Lightning people and they absolutely love FIO, because Lightning doesn’t have a way to solve the complicated address problem.”

That’s where FIO protocol shines: it doesn’t depend on changes by any particular blockchain, as opposed to solutions like ENS, which has some similar features. Instead, FIO solves the problems itself, at a wallet level. FIO strives to make transactions more secure and, put simply, easier.

The counts several major wallets as members: Binance’s Trust Wallet, Coinomi, and Edge Wallet, as well as services like ShapeShift, all of whom are founding members of the FIO Foundation. We discuss the protocol in our interview with David Gold.

Published at Mon, 11 Mar 2019 13:58:01 +0000