By: As price experienced a surge this week, it seems merchants and consumers are more interested in crypto than ever.

Local-search company Yelp has joined the pact by reportedly adding a filter to help users find merchants that accept cryptocurrency. No matter if you’re looking for a burger bar, dog groomer, or any other kind of business listed on its site, you can now zero in on those that let you pay with crypto.

Yelp’s move is reflective of a larger move that the crypto space has craved – . Whether merchants are rolling out ways to draw in customers or demand to pay with crypto is on the rise, this is clearly a good sign.

GREAT news if your life is all go-go-go 🏎 You can use the Yelp app on the new smartwatch and find a refueling bite right from your wrist. ⚡

— Yelp (@Yelp)

Fresh Wave of New Faces

Yelp’s filter hunts down establishments that accept crypto. It doesn’t accept digital currencies itself.

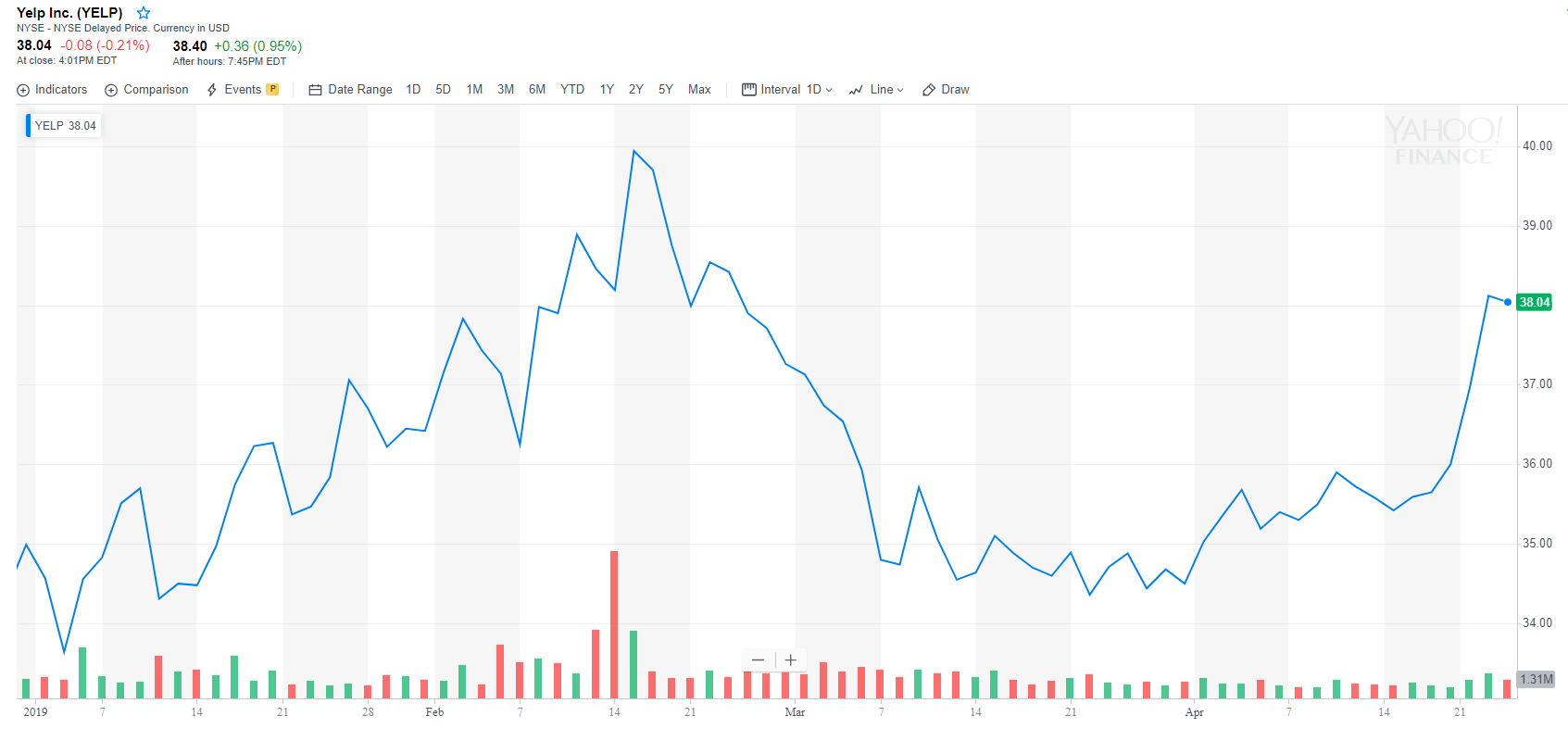

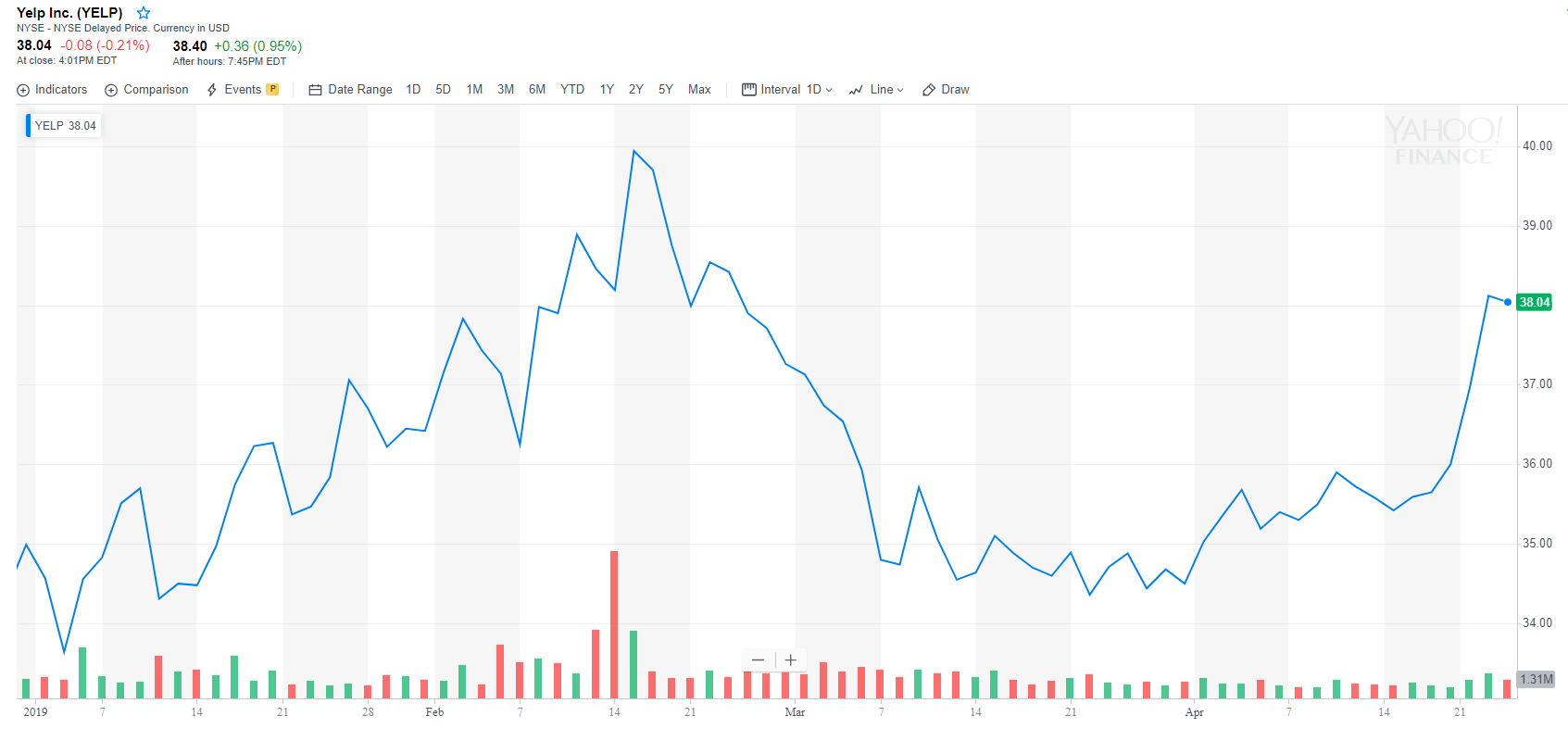

Yelp’s filter is significant because its user base is huge. It had more than 30 million unique visitors on its mobile application and 69 million unique users on its mobile website last year. Roughly 62 million desktop users visited. This was just in its last fiscal quarter.

Another popular site that has made such moves is travel giant Expedia. bitcoin.travel reportedly is now supporting payments in seven different cryptocurrencies, including bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, and Dogecoin.

It’s no wonder that the travel space would have been among the first to start making concessions for crypto payment acceptance. The industry thrives on making the travel experience as painless as possible, and this includes customers having convenient payment options.

Putting Naysayers to Rest?

Yelp and the other online outfits becoming more comfortable with crypto should begin to put more of the critics to rest.

As recently as March, a discounted an article from the Economist that attempted to say bitcoin may never have a “long-lasting” recovery.

CCN also on a key bitcoin bull leaving his spot at financial services giant EY. Angus Champion said that while he’s still a bitcoin bull, he’s discouraged by how long he believes it will take for mass adoption and doesn’t want to wait around.

Angus hopes tougher-minded, more resilient people will continue to make strides in the space.

“I’m as confident in bitcoin’s ability to radically transform the world as I ever have been. However, I believe the time horizon to do that is very long, and I believe my best bet in the industry is to simply buy and hold.”

Published at Thu, 25 Apr 2019 00:51:55 +0000

![Bitcoin cash [bch] falls by 4%; ethereum [eth] and eos down by over 3% Bitcoin cash [bch] falls by 4%; ethereum [eth] and eos down by over 3%](https://ohiobitcoin.com/storage/2019/01/BCH1d.png)