Key Highlights:

Formation of a symmetrical triangle is confirmed;

price breakout is imminent;

consolidation is ongoing.

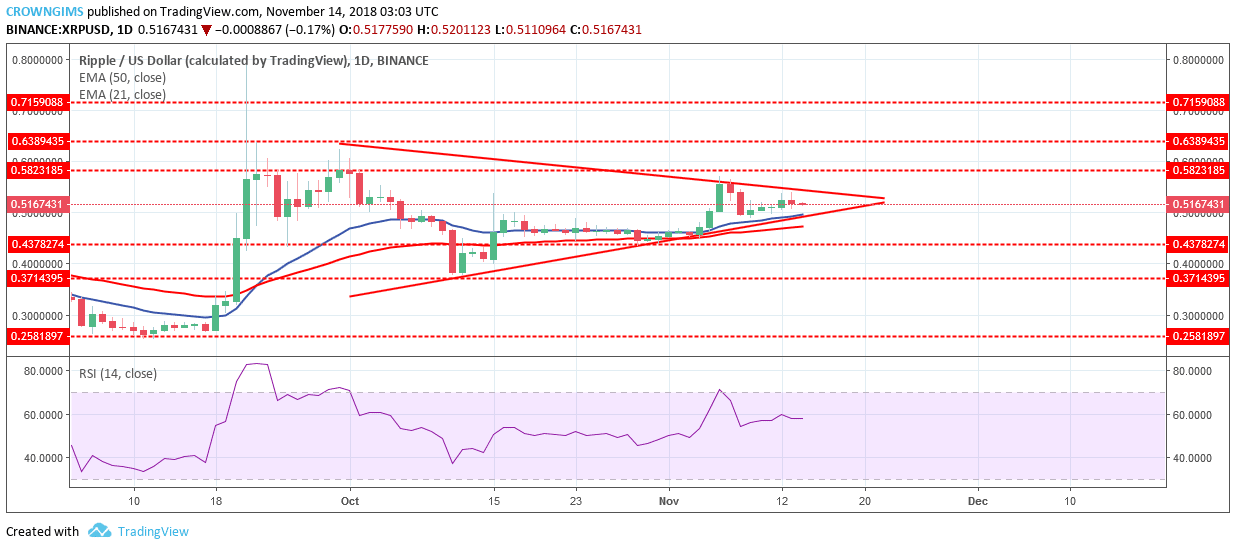

XRP/USD Price Long-term Trend: Ranging

Supply levels: $0.58, $0.63, $0.71

Demand levels: $0.43, $0.37, $0.25

XRP price needs a force to break out of the symmetrical triangle before a trending market could be experienced. If the bulls gain enough pressure to break out the upper trend line of the triangle, the XRP price will rally to the north and may break the supply level of $0.58 up to $0.63. Likewise, the bears will have to gain momentum, break the lower trend line of the triangle and push the XRP price to the south. Traders should watch out for the breakout.

XRP price is above 21-day EMA and the 50-day EMA which indicates the bulls’ pressure. However, RSI period 14 is at the 60 level parallel without direction which indicates consolidation is ongoing.

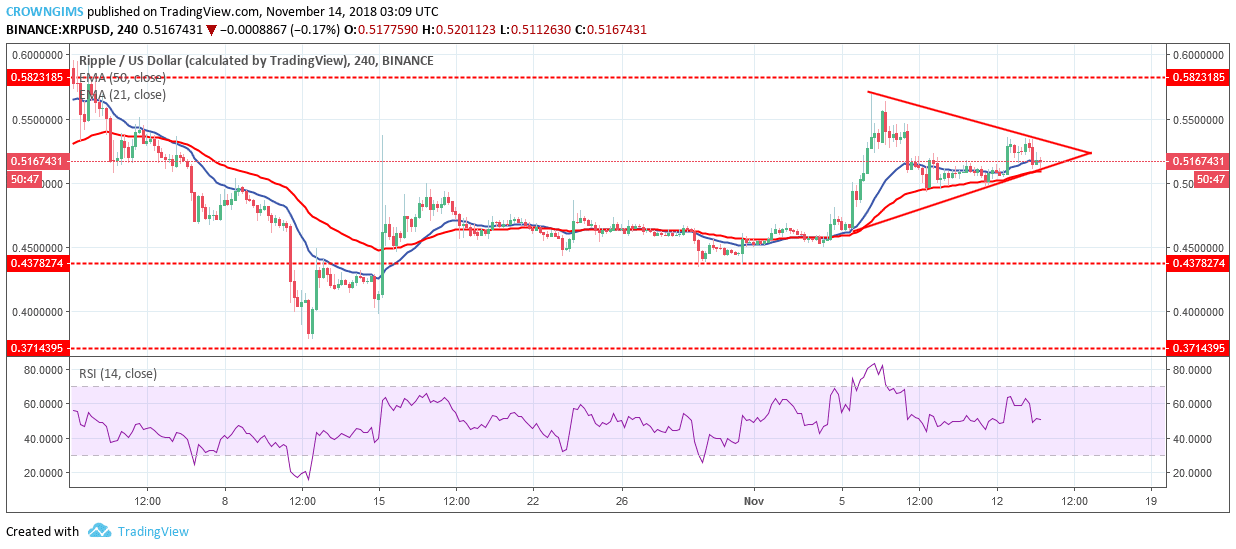

XRP/USD Price Medium-term Trend: Ranging

The XRP price is between the 21-day and 50-day EMA which indicates consolidation is ongoing. In case the bears increase their pressure and break the lower trend line downside, XRP market will experience downtrend movement that may break the demand level of 0.43 and expose $0.37 demand level.

As it’s said in the , this transaction is probably connected to the consolidation of funds into a new Multi-Signature / Segwit ‘M’ address from a handful of Legacy addresses.

The transaction which created the new richest address on the network was made by the previous richest address on the network which is now lies empty. In the process a staggering 71,618,997 coin days were also destroyed.

Presuming of the owner of the address, it’s said to most likely be an exchange cold wallet which is used to securely store funds that are held on an exchange offline away from potential attackers. The move into a multi signature address would provide the owners better security as any transactions would need to be signed off by multiple parties as unlike with Legacy addresses there are multiple private keys to the address.

The transaction contained multiple inputs of 20,000 LTC which themselves appear to be made up of four 5,000 LTC transactions each which originate from an address which still maintains a balance over 150,000 LTC as of writing.

This is not the first transaction of this value on the network, however, it is notable nether the less and serves as a perfect real world example of the benefits of Litecoin and decentralized cryptocurrency in the global settlement and movement of money in the internet age.

Interesting fact on this notable transaction is that the funds were moved from those legacy addresses to a ‘Multi-Signature/SegWit M address’, apparently in an attempt to improve security over this large amount of money.

Multi-Signature wallets add an extra safety layer by introducing several new parties, each one with a private key that is needed in order to sign a transaction and validate it. Since these are ‘Script’ addresses, they start with an ‘M’ instead of an ‘L’ (similarly in , legacy BTC addresses began with ‘1’ while script addresses, which are Multi-Sig and SegWit, start with ‘3’).

This address has many varying transactions being made to and from it on a fairly common basis suggesting this is most likely the hotwallet for the exchange and these transactions are users depositing and withdrawing funds from the platform. If you use an exchange and your withdrawn Litecoin has come from this address then you can figure out the owners.

If fees continue to drop and transactions become more efficient, crypto could become a viable option for the transfer of even very large sums of money. Developments like the are bringing this closer to reality, even for notoriously clunky BTC, and products like Xcurrent and Xrapid are trying to get big banks on the crypto train.

Litecoin.com about the transaction:

“A perfect real-world example of the benefits of Litecoin and decentralized cryptocurrency in the global settlement and movement of money in the internet age.”

Litecoin was created by Charlie Lee in October 2011. This makes Litecoin one of the oldest cryptocurrencies in the crypto space. The source code itself was a fork of bitcoin with a few notable changes and improvements such as decreased block generation time, utilizing different hashing algorithms and decreasing the time needed to process payments. This made Litecoin 4x faster than bitcoin.

In the world of conventional currency where bank fees can run $45 or higher per transaction and can be held up while waiting on confirmation from intermediaries – this seems like a meaningful step forward.

Transaction fees for crypto are going down across the board, with other massive transfers of cryptos like bitcoin being conducted for the equivalent of $0.10 at the time of this writing. The average transaction fee for BTC is still somewhere around $0.36, but that’s still far better than last year’s $25-$55. Other crypto assets like Ripple’s are trying to build a brand based on circumventing the present infrastructure for cross-border payments, which can be the most expensive of all.

Same Story with bitcoin

Last month we wrote about with only $0.1 fee. The research based on data provided by a UK-based multi-billion dollar firm for low-fee banking transfers revealed that even on a platform like Transferwise, to send over $1 million, it costs over $7,500 in transaction fees. That means, through wire transfers and conventional banking methods, tens of thousands of dollars are required to clear a transaction that is larger than $1 million.

Everything old becomes new again with new that is chronicling the best entrepreneurs across the United States and Canada.

From bailing people out of jail to new payment technologies, young innovators are seriously shaking up some of the world’s hard-core industries but also FinTech sector with its niches like Blockchain or Cryptocurrency.

Nader Al-Naji (26)

In April, 26 years old Nader Al-Naji, has raised $133 million from the companies like GV (formerly Google Ventures), Bain Capital Ventures, Lightspeed Venture Partners, Andreessen Horowitz, and Sky9 Capital in order to create a cryptocurrency.

His cryptocurrency Basis, tend to use blockchain technology to replace central banks in countries suffering from currency volatility. This Syrian-Lebanese’s immigrant began with a bitcoin mining rig he built in his Princeton dorm. He even quit his job at Google in order to work on his cryptocurrency, which has a stable value determined algorithmically. In theory, that will make it more useful as a currency, and not just a vehicle for speculation.

After he saw how volatile was he decided to create a digital currency that didn’t wildly fluctuate in value that much. He posted an early whitepaper for the currency in 2017, describing it as a “stable cryptocurrency” that will maintain a relatively fixed value, so that it can be used to make purchases. Unlike the stable token , which has a steady value that’s tied to the US dollar, the value of Basis is controlled algorithmically, on the blockchain. When he started mining, back in 2013, he mined 22 bitcoins. When asked what did he do with it, he says:

“I’m still HODLing”

The use of this cryptocurrency acronym that stands for “hold on for dear life,” means that at the time of writing, 22 bitcoins are valued at around $138,000.

Olaoluwa Osuntokun (25)

Lightning Labs cofounder Olaoluwa Osuntokun, 25, got to raise $2.5 million to increase the speed of transactions on the bitcoin blockchain, making it a more viable system for small, Venmo-like transactions making them more cost effective. An immigrant from Nigeria, Osuntokun is a frequent contributor to the underlying bitcoin protocol.

The Lightning Network is a network duplex micropayment channels that are enabling near-infinite scalability for digital payments based on bitcoin. bitcoin transactions are no longer used directly to transfer bitcoins from a sender to a recipient, instead they are used to setup micropayment channels and handle conflict resolution.

JB Rubinovitz (26)

Machine-learning engineer JB Rubinovitz, 26, cofounded Bail Bloc to create a blockchain-based system in which mined cryptocurrency can be used to pay for bail for those who can’t afford it. Bail Bloc allocates a small percentage of the operating device’s excess computing power to mine cryptocurrency.

Bail Bloc mines Monero, a relatively energy-efficient cryptocurrency, and transfers the rewards it collects to a central pool, which is converted to US dollars and donated to The Bronx Freedom Fund. To accumulate cryptocurrencies such as Monero, users must “mine” it using a computer’s processor. Once installed on a user’s computer, Bail Bloc uses a small amount of the computer’s power to mine for Monero in the background, so daily use of the computer is unaffected.

Hunter Horsley (28)

Hunter Horsley, 28, CEO of Bitwise Asset Management, is trying to build the Vanguard of cryptocurrencies. Bitwise’s four cryptocurrency indices are currently used by over 600 multifamily offices. Last year his company introduced a private index fund that they have been operating on.

In July, during the , he said:

“In our experience operating the (investment) vehicle — dealing with the questions around custody, dealing with all the trading partners, striking the NAV (Net Asset Value) daily, audits, tax, hard forks, airdrops (etc.) — we feel that it is possible to effectively operate an index vehicle.”

Horsley keep trying to bring attention to the fact that the industry is far from a single-sided coin, saying:

“They (investors) think that something promising could come out of public blockchains. A cryptocurrency may emerge that may be really valuable and an index is a way of capturing that. I think that a lot of the focal point around public registered products, like ETFs, has been on bitcoin because there’s a narrative that bitcoin is the digital gold.”

Forbes vs Blockchain

The Forbes 30-Under-30 list is yet another indication of the growing influence of cryptocurrency and blockchain technology as it expands from being a niche area of Fintech into an industrial heavyweight in its own right. Last month, we that this business media giant, has announced its partnership with Civil, blockchain-based journalism platform. The partnership will make Forbes the first major media organization to commit to regularly publishing content to the blockchain.

Matthew Iles, CEO at Civil, then said:

“Civil’s mission is to power sustainable journalism throughout the world, and Forbes’ commitment to regularly publish content on our platform is a major milestone for our approach. We look forward to working with Forbes as we connect with a broader audience interested in new, more direct ways to discover, share and support ethical journalism.”

Under the agreement, Forbes will start publishing some article metadata to a blockchain platform at the beginning of next year.

In this edition of The Daily, we report on Coincheck’s decision to resume nem (XEM) trading and relist two other coins — ether (ETH) and lisk (LSK). Also, Digital asset exchange Okex has added support for the Vietnamese fiat currency on its C2C platform and we cover the reasoning behind the move. Also in The Daily, a Canadian company has reached an exclusive agreement to negotiate the acquisition of a large European cryptocurrency exchange.

Also read:

Nem Price Spikes as Coincheck Resumes Trading

The resumption of XEM deposits, withdrawals and trading resulted in a spike in the price of the cryptocurrency. Its market capitalization briefly surpassed the billion-dollar mark in the hours following the . The market has since corrected itself and after losing almost 10 percent in the last 24 hours, XEM is selling for less than $0.11 at the time of writing and has a capitalization of around $955 million. On Oct. 30, the recently reopened exchange reintroduced bitcoin cash (BCH), bitcoin core (BTC), ethereum classic (ETC), and litecoin (LTC).

Okex Adds Support for Vietnamese Dong

Cryptocurrency exchange has updated its customer-to-customer (C2C) trading system in order to allow users to place orders in another fiat currency, the Vietnamese dong, according to an published on Tuesday. The Malta-based Chinese company launched its last year, a variation of the peer-to-peer model, to enable customers to trade cryptocurrencies using fiat currencies. According to an earlier press release, no additional charges, other than what the users see as a buy/sell price, will be applied.

C2C TRADING: We now support Vietnamese Dong (VND) on our Fiat to Token trading platform.

— OKEx (@OKEx)

In the past few years, Vietnam has become an important cryptocurrency market and blockchain hub in the region of South East Asia. The country’s government, however, is still undecided on the question of how to regulate the industry and whether to legalize crypto-related transactions. Authorities in Hanoi are currently reviewing several alternative approaches to governing the sector, as news.bitcoin.com recently. These range from imposing a total ban on activities involving digital assets to introducing a relatively lax regulatory regime. Several other platforms, such as Remitano, Mesito and Localbitcoins, are already offering peer-to-peer services for Vietnamese residents.

Canadian Company Poised to Acquire Exmo

The news about the upcoming acquisition comes after Exmo’s recent decision to update its deposit/withdrawal terms. The trading platform, popular in countries from the former Soviet space, has increased the fees for some of the available payment options. For example, the commission for withdrawals of funds in Russian rubles to Mastercard and Visa cards has jumped by one percentage point to 6.95 percent plus 100 rubles (~$1.5) per transaction. The fee for Advcash withdrawals in U.S. dollars has been increased as well, from 3.45 percent to 4.45 percent. The applicable commission for ruble withdrawals to Payeer accounts has been cut down to 1.95 percent.

What are your thoughts on today’s news tidbits? Tell us in the comments section.

Images courtesy of Shutterstock, Smartmockups.

Make sure you do not miss any important bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe). We’ve got daily, weekly and quarterly summaries in newsletter form. bitcoin never sleeps. Neither do we.

The post appeared first on .