November 15 will definitely be remembered as one of the worst single-day corrections in all of 2018. The crypto market then saw a wipe-out of more than $27 billion and the market extended losses throughout the past two days.

The talks about ‘flippening’ the came along as Twitter user called “The Ripple Shadow” tweeted an interesting message saying:

Screenshot this, retweet this, like this. Do whatever you want with this. Here we go…

Before EOY, XRP will be #1 for market cap. No riddles, straight up message. Big things are right around the corner…

— The Ripple Shadow (@therippleshadow)

Also, the CEO of in his Tweet the strength of the XRP community, and asked its brethren to send him their best pitches for why he should pair every coin on the exchange with the digital asset.

He was also responding to suggestions from the XRP fans who believe that doing so would help cushion most altcoins from bitcoin’s volatility. Additionally, an XRP base currency would allow cheap and efficient movement of value between exchanges.

, even with the combined value of bitcoin Cash SV (BCHSV) and bitcoin Cash ABC (BCHABC), has fallen by more than seven percent. Subsequent to the fork, the price of BCHABC, the original bitcoin Cash chain with the roadmap set forth by bitcoincash.org, dropped by more than 15 percent to $250.

Last week, Crypto Rand, a cryptocurrency technical analyst and trader, said that the probability of a $4,800 to $5,000 bottom for bitcoin (BCH) is increasing.

Both major cryptocurrencies and small tokens have already started to demonstrate independent price movements by breaking its correlation with BTC, a further 12 percent drop from $5,500 to $4,800 what could result in intensified downward movements for cryptocurrencies with lower daily volumes.

The Crypto Dog, another prominent analyst, said that a bottom at $4,800 has become more likely for BTC.

Same target I've held since February of this year, I think there is a strong possibility that ~$4800 is the bottom.

Let's see what happens.

— The Crypto Dog📈 (@TheCryptoDog)

Ran Neuner, host of the TV show “Crypto Trader” on CNBC and founder of OnChain Capital, explained via Twitter that crypto investors should distance themselves from bitcoin and bitcoin Cash and invest exclusively in XRP.

“These hash wars show why everyone should get rid of BTC and BCH and just put all their money into XRP.”

I can't tell if this is a joke or not…

— Fuadiansyah (@fuadviking)

He also made a Twitter poll:

The results of this poll really surprised me – they show we really have a big problem in Crypto. I REALLY thought American Airlines miles would do way better!!!

— Ran NeuNer (@cryptomanran)

This has attracted comments both in favor and against. For instance, a tweet from Crypto Bull believes that NeuNer is not serious. The tweet added,

“XRP over BTC, REALLY, what makes bitcoin special? Not much really other than being the 1st cryptocurrency ever, but that’s enough to keep it around longer than a ripple.”

The truth is, the numbers speak clearly for an investment in XRP. As the Twitter user Christian Schneider stated, the XRP price is very good in comparison to the 17th November 2017 by +113%. bitcoin, on the other hand, fell by -29%, Ethereum by -46% and bitcoin Cash by -64%.

Positive developments for Ripple firm and its token have made XRP one of the few cryptocurrencies to make a gain over the past month. It has made over 10% in the last thirty days while bitcoin and have nosedived 14 and 16 percent respectively.

KPMG: Cryptocurrencies Are Still Not Real Currencies

These gains have pushed XRP above $20 billion market capitalization and into second place as Ethereum continues to slide. The crypto twitter-sphere is awash with talk of a ‘flippening’ today as the notion of XRP catching bitcoin becomes more valid. It still has a long way to go however with a market cap gap of over $75 billion and many observers are commenting in jest.

Accounting giant last week warned bitcoin and other cryptocurrencies not ready to be classified as real currencies and that using bitcoin as a store of value is a “fool’s errand.”

They noted that there are real problems in the global financial services ecosystem that cryptoassets are looking to address.

“More participation from the broader financial services ecosystem, will help drive trust and scale for the tokenized economy and help the crypto market grow and mature. Examples of crypto use cases bitcoin, which is becoming an investible asset class like unallocated gold, has the potential to become a store of value that is natively digital, generationally relevant, and an alternative to traditional asset classes.”

KPMG seem to be a great believer in cryptoassets. As said, the staying power of many cryptoassets will be defined by their ability to reduce friction and inefficiencies that currently exist within the global economy. And while volatility is certainly a problem, it is important to recognize that these assets are still fairly immature and will become less volatile as they mature.

There are also significant efforts that are underway across the industry for the creation of what are called stablecoins to address the volatility problem.

Analysts think that XRP needs to be decoupled from bitcoin which has driven the state of crypto markets since they began. The only way to do this would be for more exchanges to offer trading pairs in XRP in addition to BTC, ETH and stablecoins. Weiss Ratings tweeted that BTC should not dictate the outcome of every single project in the industry.

What's it gonna take for to decouple from ? Simple: XRP-based trading pairs. The sooner we add more diversity to the crypto space, the safer we'll all be. shouldn't dictate the outcome of every single project in this industry. , are you listening?

— Weiss Ratings (@WeissRatings)

bitcoin – A Calm Before the Storm?

Mainstream media, renowned economists and other crypto critics have killed bitcoin more than 300 times since its launch. But the digital currency always come back from the dead.

The latest bitcoin crash was more intense presumably because of analysts. Almost every prominent bitcoin bull had pushed $6,000 as an unbeatable bottom. Miners recognized it as break-even level based on their return on investments.

However, the market can extend its selling action, for the correction appears weak. In short, BTC is bleeding and in need of blood bags.

bitcoin bull Tom Lee almost doubled down his price prediction for the digital currency, from a whopping $25,000 to a modest $15,000 by the end of this year. Whether the market will be able to recover to a five-figure value cannot be known yet, but it certainly has enough going on in the background.

The possibility of XRP hitting 400% growth and overtaking bitcoin’s market cap of $97 billion does seem somewhat unlikely. That would require XRP to hit a coin price of $2.50, while BTC would have to remain anchored to its current valuation.

Positive Aligments for BTC Market in Sight

Over the past 24 hours, more than $14 billion has been wiped out of the crypto market as bitcoin (BTC) dropped by five percent. bitcoin, the most dominant cryptocurrency in the market in terms of price, market cap, and volume, demonstrated the smallest loss out of all major cryptocurrencies. bitcoin Cash (BCH), Ethereum (ETH), Ripple (XRP), Stellar (XLM), Litecoin (LTC), EOS, and many other cryptocurrencies recorded losses in the range of 7 to 15 percent.

Cryptocurrencies have been in a bear market since January 2018 and have not initiated a proper mid-term recovery since then.

There are several positive developments lined up for the BTC market including the BTC futures market launch by Bakkt and ICE, the parent company of the New York Stock Exchange.

Dissimilar to existing futures markets operated by CME Group and CBOE, Bakkt physically delivers BTC to its buyers and as such, Bakkt could have a real impact on the supply of BTC and ultimately, its price.

“ICE entering crypto feels like a big deal. It’s an established, respected & powerful player in the finance industry. In other words, large institutions trust ICE with their money, including those institutional investors who many people think are key to the next bull run. Also noteworthy is the fact that Bakkt will custody & deliver real bitcoin. That means institutional inflows would reduce supply & thus (maybe) increase price too,” said Jake Chervinsky, a government enforcement defense and securities litigation attorney at Kobre & Kim LLP.

Key Highlights:

Bears were in control of market;

the BTC price may decrease further;

there is a probability of the pullback.

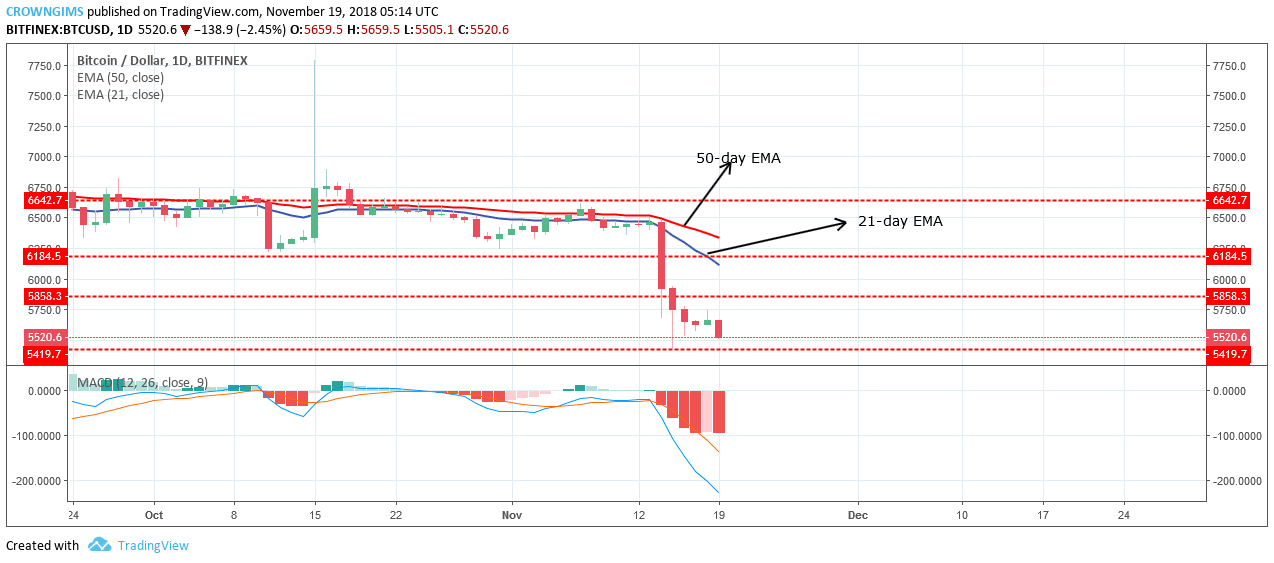

BTC/USD Long-term Trend: Bearish

Distribution Territories: $5,858, $6,184, $6,642

Accumulation Territories: $5,419, $5,346, $5,220

BTC is still bearish on the long-term outlook. bitcoin price experienced a sharp drop a few days ago. The bears took the whole control of the market after broken out from the consolidation phase. Last week distribution territories were broken downside such as; $6,184, $5,858. BTC price is currently exposed to the accumulation territory of $5,419.

A bearish move can’t currently be ruled out as more bearish Japanese candles are still emerging; an indication that BTC price may still experience southward movement. 21-day EMA is under 50-day EMA fanned apart and the bitcoin price is below the two EMAs which implies that the bearish movement is ongoing with high bears’ pressure.

The MACD with its histogram is below zero levels with the signal lines well separated and pointing to the south which indicates that the bears are still in control of the BTC market and the BTC price may still sell further.

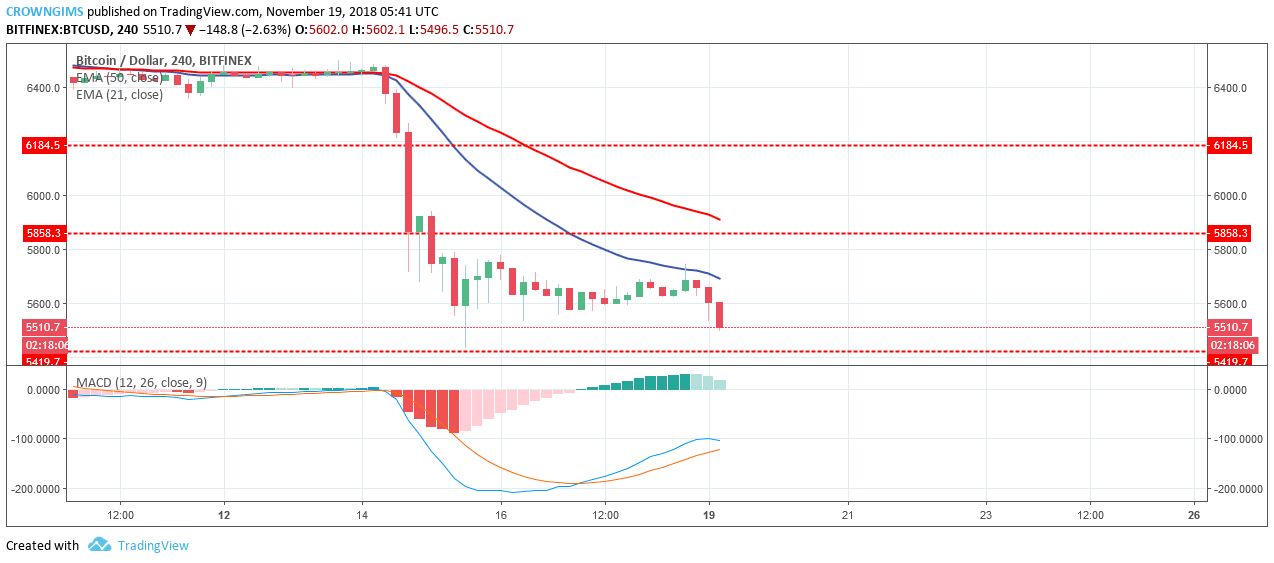

BTCUSD Medium-term Trend: Ranging

Currently, the bitcoin price is below the 21-day EMA and 50-day EMA which implies a decrease in the BTC price is ongoing. However, the MACD with its histogram is above zero level fading gradually toward zero level. In case the bears were able to break downside the accumulation territory of $5,419 the BTC price will have its low at $5,336. If the accumulation territory of $5,419 holds the bulls may take over the market.

In the , the CEO of is noting the strength of the community, and asking its brethren to send him their best pitches for why he should pair every coin on the exchange with the digital asset.

He was also responding to suggestions from the XRP fans who believe that doing so would help cushion most altcoins from volatility. Additionally, an XRP base currency would allow cheap and efficient movement of value between exchanges.

CZ did something unexpected though. He actually included a LinkedIn link that gives tips on how to get your coin listed on Binance.com. Of particular importance, is the following statements in the step-by-step instructions:

“We require the project founder or CEO to fill out the form. Why? If there ever is a bug with your wallet, a fork or double-spend in your blockchain, we need to talk to a key person.”

The xrp base shill is strong. Let's get it out of your system, and put all your shills under this one tweet, and let's see how much we get.

— CZ Binance (@cz_binance)

After taking over as the world’s second largest cryptocurrency, XRP investors say Binance should pair all of its cryptocurrencies with XRP. Just for a reminder, after a close battle with and surpassing Ethereum in total market cap twice in a month, XRP has now managed to edge out the rival and grab the second spot right behind bitcoin.

This is mainly due to Ripple’s efforts to expand its customer base over the recent months. More banks are joining the RippleNet where XRP is used as a base currency in cross-border funds transfer using xRapid.

The latest addition to the list of Ripple’s partners is . CIMB Group, the fifth bank in ASEAN adopts Ripple’s tech and enters RippleNet, the company’s network of banks. This will allow the bank to provide its customers with instant cross-border payments.

According to Ripple, CIMB is one of the first banks to leverage blockchain technology in a region where payments are historically slow and efficient.

“Ripple’s blockchain-based solution has been deployed to enhance CIMB’s proprietary remittance product called SpeedSend. This service allows customers to send and receive money with direct account crediting and instant cash collection. The enhancement improves their access to cross-border remittances across the globe — both inbound into ASEAN and outbound to other countries. It is already enabling remittances to corridors such as Australia, USA, UK and Hong Kong.”

There is a small, but growing list of cryptocurrency exchanges that have adopted XRP as a trading base standard. Last August, AlphaPoint, a financial technology company that helps companies access the blockchain and make illiquid assets liquid, launched DCEX, a next-generation digital currency exchange for retail and institutional investors that was the first exchange to have XRP as its exclusive base currency.

This Binance’s move could further detach altcoins from the price swings of bitcoin. And if multiple exchanges add XRP as a base pair, traders could easily utilize the speed of XRP to move value between exchanges.

Shaky Ground for bitcoin

The recent upgrade of the network sparked a fierce between the camps of Craig Wright’s bitcoin Cash Satoshi Vision (BCHSV) and Roger Ver’s bitcoin Cash ABC (BCHABC). As a result, bitcoin was affected price-wise, dragging the entire market down with it. After BCH hard fork has completed, announced that they added both a BCHSV and BCHABC trading pair to their website, indicating it will likely honor both bitcoin Cash forks, issuing double tokens to all BCH holders.

There is a good percentage of investors that already have turned to other alternatives looking for better utility and security. In that sense, XRP has emerged as a pretty great choice. The fact that the crypto is slowly recovering even as bitcoin and others struggle to stay afloat adds to the charm.

The reasons the community has cited as to why XRP should be the base on Binance are that is already a base on the CoinField Exchange and also the base currency on the XRP United Exchange.

One of the biggest rating companies Weiss Ratings already in August shared in their that they agree XRP should be the base.

We would like to see as one of the base assets on in order to move value much more quickly!

Please do it !

Let's get some retweets to let them know. 🙂

— C3|Nik (@C3_Nik)

The truth is, XRP has proven itself in the past week as it gained value as the rest of the market fell due to the bitcoin Cash Hash wars, it’s fast and has cheaper transaction fees and it won’t hurt to know that it will definitely attract more users towards trading on Binance.

Just day before this Binance announcement, Ran Neu-Ner, the host of CNBC Africa’s “Crypto Trader”show, said that these hash wars highlight why everyone should dump BTC and BCH and just put all their money into XRP.

At the time of writing, XRP has been trading at $0.4837 while in the red by 5.37 percent with a market cap of $19.4 billion while Ethereum is down by 7.76 percent at $168 with a market cap of $16.8 billion.