Although the crypto industry has changed dramatically in its decade-long lifespan, the narrative surrounding (), along with its cardinal value proposition. has been steady, more or less. Yet, there have been a few nuances.

Case in point, over recent years, proponents of the have been wishy-washy with the asset being a Store of Value (SoV) or a of Exchange (MoE). As both arguments have their merits and proofs, a sometimes volatile dichotomy has formed between commentators, researchers, analysts, and investors touting the distinct thought processes.

Related Reading:

In fact, many argue that what catalyzed the now infamous hard fork of mid-2017 was an argument about whether was actually, well, digital cash. More and more are coming to the conclusion though that prior to becoming a new form of money, will first need to become the go-to of value.

bitcoin As Gold 2.0

In a recent tweet, Tyler Winklevoss, one of the Winklevi(i) twins and the chief executive of Gemini, noted that he sees as “gold 2.0”. He states that the “matches or beats” gold across the board. As he in a previous interview, the only thing that gold has over is a “3,000-year headstart.”

is gold 2.0. It matches or beats gold across the board. It’s market cap is ~140bil, gold’s market cap is ~7tril. Do the math!

— Tyler Winklevoss (@tylerwinklevoss)

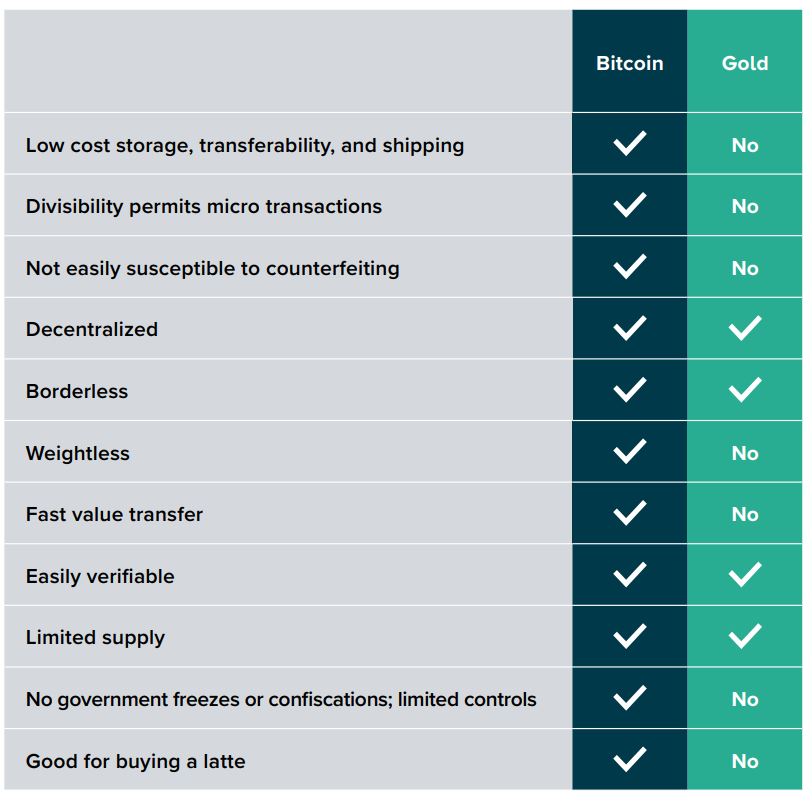

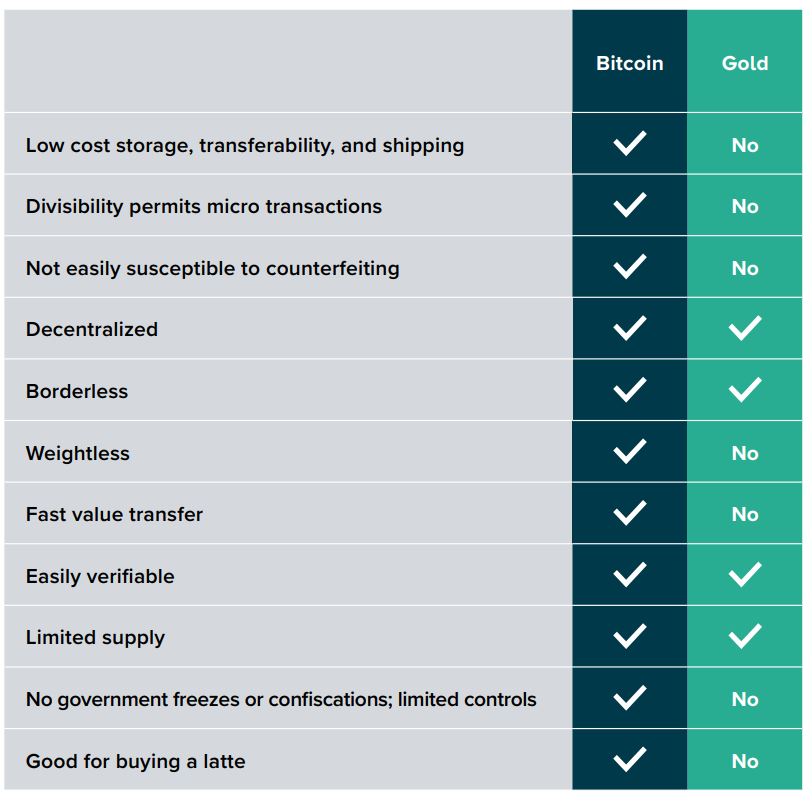

Factual data would confirm this. As Grayscale Investments , unlike the metal, is mathematically scarce, capped at 21 million units; is decentralized and verifiable through the Internet; is portable and divisible through digital technologies, and is unconfiscatable. Gold, on the other hand, has an unlimited supply, centralization risks, an inability to be easily divided and moved around, and concerns around its purity. The chart below from Grayscale sums this controversial yet seemingly valid argument up fairly well.

Maybe that’s why Grayscale has begun to push for investors to “drop gold”. As NewsBTC previously, the firm launched an extensive ad campaign that touted as “gold 2.0.” Grayscale released a 45-second advertisement that depicted two youngers physically “dropping gold” as those around them struggle with the heavy, cumbersome commodity, escaping to what is assumed to a society predicated on the use of digital assets.

A No-Gold World

Let’s say the world realizes the potential that holds, resulting in the world looking to their value in compared to gold. What would this hypothetical (yet totally possible) world look like? According to HodlWhale, a Seattle-based investor, a world where has absorbed all the value of the gold in circulation would see valued at $350,000.

This figure isn’t exactly baseless. Pre from this outlet, all physical gold products in circulation are currently valued at approximately $7.83 trillion, while all has a mere $94 billion valuation. If the latter was to fully displace the value of the first, Crypto Voices, an industry analytics and research group, estimated that would swell to a value of a casual $450,000 — slightly above HodlWhale’s estimate.

Featured Image from Shutterstock

Published at Mon, 20 May 2019 00:07:17 +0000