By : If you’re placing bets on where the price is going next, the data is overwhelmingly in favor of a bull market. Crypto analyst attaches a whopping 95% or higher probability that the worst is over for . Woo participated in an hosted by derivatives trader Tuur Demeester, the topic of which was whether or not the price has bottomed. Incidentally, the two traders couldn’t be further apart on the price spectrum.

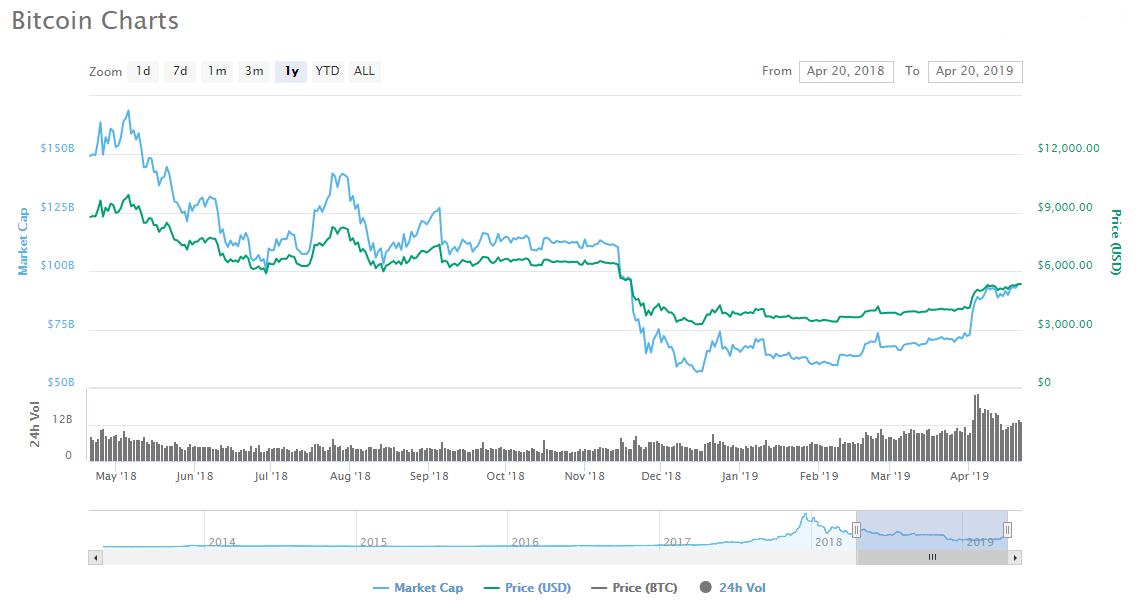

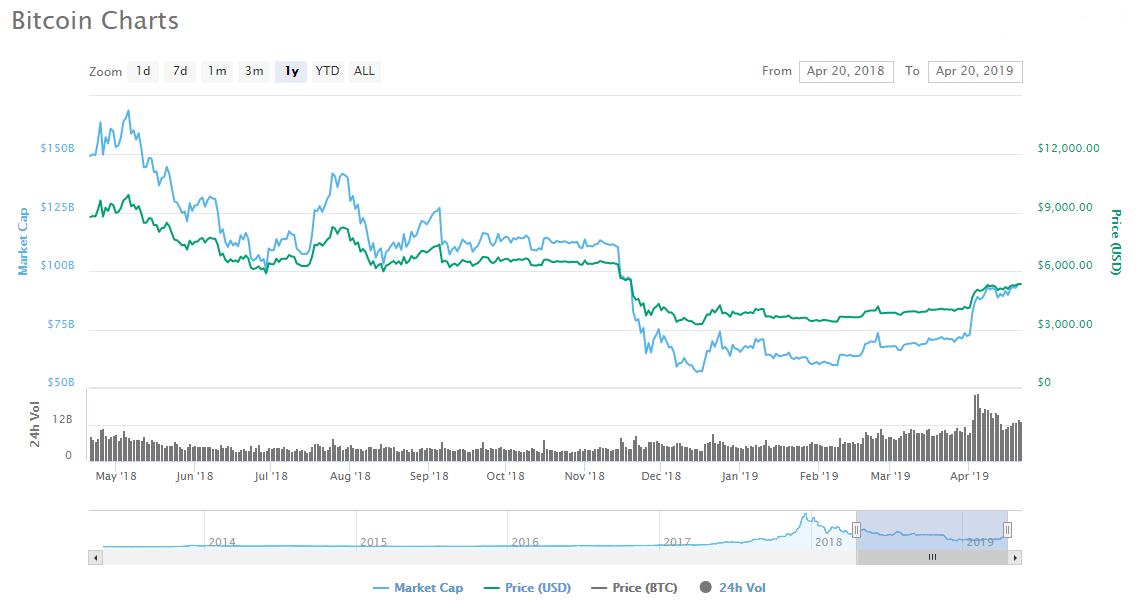

Woo is a technical analyst and spends his days pouring over charts and data. As far as he’s concerned, the numbers don’t lie. bottomed out at $3,100 at year-end 2018 and unless hell freezes over, it won’t hunt new lows. The price is currently hovering at $5,351.

“I’m swimming in data and you kind of get an intuition about things. I’d say a one-in-20 to one-in-40 chance that this floor falls through. So that’s 95%-97.5% that the bottom is in. I’d consider if we drop below $4,300, they [bears] would be very lucky,” said Woo.

Is the bottom in, final figures…

% probability has bottomed:

BULLS 75% 80% 95%

BEARS 40% 39% 20%

— Willy Woo (@woonomic)

While he’s the most bullish, Woo is in good company, including the likes of Adamant Capital’s Tuur Demeester, who attaches an 80% probability that the bottom is in. Meanwhile, Tone Vays fired off several warning shots that there is more ahead, suggesting there’s only a 40% chance that the price has bottomed.

bottomed at $3,100, according to crypto analyst Willy Woo. | Source: Yahoo Finance

‘More Important than the Internet’

In addition to the technical signals, Woo also considers the fundamentals in his bullish argument. Looking at through the lens of an curve, he said:

“[We’re] seeing a doubling in user base every year very consistently over 10 years…So what we see is this mapping of the world coming in and in this case the world coming in with capital that’s injecting into .”

Woo and Vays both point to the dynamics in the Nasdaq and the dot-com era in their analysis. Woo likens the Nasdaq to , saying:

“The Nasdaq was essentially the curve of the internet. And ’s actually the curve of the internet digital scarcity, the digital version of gold. As we move into this digital age, as we move into all these things we see in the physical world being eaten by software, we’re seeing also the need for digital scarcity and a monetary instrument that is natively digital and transacted on the internet. And so in that regard, I think it’s even more important than the internet.”

Soul-Crushing bitcoin

Not to be outdone, Tone Vays gave his bearish argument on the price. He argued that “ has yet to capitulate from a fundamental perspective,” saying:

“Lots of these big institutional holders have not capitulated. The Novogratz’s and the Tim Drapers that have been holding onto these coins for a long time. I believe finds a way to crush people’s souls…I believe the market will find a way to separate them from those coins somehow. And these are the big holders I’m actually waiting to capitulate.”

Vays was around for the bear market of 2013-2015, and he uses the despair he felt during that period as a point of reference. He doesn’t believe people have felt enough yet in the latest bear cycle and as a result, haven’t “learned their lesson.”

With a price that remains approximately 70% below its peak, however, many investors would beg to differ.

Published at Sun, 21 Apr 2019 13:08:47 +0000