Despite those often mainstream institutional critics, cryptocurrency has gone on to establish itself as at least a viable asset class, in addition to creating countless millionaires from so-called ordinary investors. Not without its controversy, few could deny that cryptocurrencies look set to play an increasing role in the financial system of tomorrow.

For some of the critics, cryptocurrency is equivalent to gambling, pure speculation by investors hoping their lucky numbers come up. But does this viewpoint stand up to scrutiny? And if cryptocurrency investment and gambling aren’t necessarily the same thing, could the rise in demand for take over from online gambling as the financial entertainment of choice for those with money to play with?

Is Cryptocurrency Investing Gambling?

Investing in cryptocurrency shares some of the same characteristics as gambling, so it’s not hard to see why people link the two. Firstly, the aim of the game in both cryptocurrency investing and gambling is to make money, and there’s always personal money at risk. The future is uncertain in both cases, and participants use their best skill, judgement and good fortune to their advantage in maximising any possible return. But despite the similarities, there are obviously some significant differences between the two.

When you gamble, you’re not buying an asset, and you’re not subject to the forces of the market. If you spend £200 , you might lose £200, of win £200,000. But whatever the outcome, it’s internal to your game. You’re playing the game, you’re taking your chances, it’s all on you, win or lose. With investing in any asset, it’s the market that decides how successful you’ll be, and that’s not a random variable.

This is perhaps the key difference. While it’s difficult to read or interpret the cryptocurrency markets let alone predict them, there is some degree of predictability in cryptocurrency analysis that doesn’t exist with gambling. In this sense, cryptocurrency can be considered an investment rather than a form of gambling, in spite of the common features they share.

It’s worth noting that in both cases, there is significant risk. While some asset classes like traditional commodities and fiat currencies are more stable, it’s the high risk/high return nature of cryptocurrency investing that has fuelled the explosion in its popularity in recent months.

The Rise and Rise of Cryptocurrency

To describe cryptocurrency as a phenomenon would probably underestimate just how successful these digital currencies have been. From a fringe interest amongst computer geeks only several years ago to a mainstream topic of everyday discussion, bitcoin and other cryptocurrencies such as the have clearly captured the imagination. Multiple billions are flowing into the crypto markets as investors from all backgrounds leap to take their positions, as prices rise and then rise some more.

Some analysts have urged caution, and others have called it a bubble. But there’s no denying that cryptocurrency has been growing into something of a big deal. With more coins being launched seemingly every day, and new applications of the underlying blockchain technology, it’s looking as if cryptocurrency and digital tokens might just be the future.

A large part of the attraction is the astronomical gains, and cryptocurrencies across the board are capable of posting annual growth rates in the hundreds or even thousands of percent. With returns like this, for as long as they last, investors are more than likely going to want to continue to get involved.

No Takeovers Here

For all that cryptocurrency has become the hottest topic in investing, it is unlikely that it will ever take over from online gambling. While gamblers might naturally be drawn to the speculative potential of currencies like bitcoin, it serves a different need. People don’t gamble as an investment in most cases – but with cryptocurrency, you can treat your holdings like an investment, and you are taking stock of a valuable asset in exchange for your fiat investment – this is an asset, whether the mainstream banks like it or not.

Then there are the pure demographics. While both online gambling and cryptocurrency investing are popular, there is not an exact crossover in the audiences, nor a limit on how much individuals might choose to spend or invest respectively. For this reason, it’s possible easily possible that cryptocurrency and online gambling can co-exist, without cryptocurrency eating up any sizeable part of the gambling industry.

For the time being at least, it looks certain that despite the successes of cryptocurrency so far, there will be no takeovers here.

The post appeared first on .

The team of Russian programmers creates such Jarvis for you.

The project is called SmartO. It is a versatile mobile app that will organize your schedule, make your life more comfortable, easy and fulfill the eternal dream of millions of people: gaining regular profit without any efforts. Learn more about it in the of the project.

While you are reading these lines, the team continues to develop the application. All works are carried out in accordance with the project Roadmap. The amount of back-end development that usually takes almost a year is already done. You will be able to download a working framework of the SmartO app from the PlayMarket by the beginning of the pre-ICO.

Why anyone can make a pretty penny out of STO tokens?

The team is engaged in the project with full dedication, and its Public token-sale has excellent prospects. According to experts, the SmartO project deserved 4.8 points out of 5 possible and according to its rating is 10 points out of 10. We are confident that the SmartO project ICO pre-sale will be completed in a matter of minutes!

When the SmartO application tokens (STO tokens) are listed at the exchanges, their price will increase ten times according to the experts. This is due to the following factors:

preliminary demand from investors,

a very small hard cap – only $8,150,000 (affordable for only 2-3 investors)

So, unsatisfied demand for tokens will be transferred to the exchanges.

Now that you know why STO tokens have such brilliant prospects, you only need to write down the dates of pre-ICO (06 – 15 April) and the Public token-sale (April 26 – May 7) in your calendar.

Pre-ICO and ICO of the SmartO project in a

The post appeared first on .

Information as of March 12, 2018

This report was created by:

Professor , Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

This report presents data on the ICO market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that took place in March 2018, including over the last week (March 5-11, 2018).

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

The attitude toward ICOs in South Korea may change in the near future, as the possibility for legislative regulation and legalization of ICOs is being considered at the government level. We remind you that in September 2017 the Financial Services Commission of South Korea (following China’s lead) announced a ban on all forms of token placement

Table 1.1. Brief ICO market overview, key events, news for the week of March 5-11, 2018

| № | Factors and events

(link to source) |

Date of news | Description | Type of impact |

| 1. | Inspired By Venezuelan Petro, Cambodia May Issue A National Cryptocurrency [source: ] | March 5, 2018 | After the creation of the national cryptocurrency of Venezuela, the Petro, Cambodia has also started considering the possibility of creating its own national cryptocurrency. | ICO ⇑

Favorable |

| 2. | Venezuelan Cryptocurrency Petro Gets An Illegal Status From the Country’s Lawmakers [source: ] | March 6, 2018 | On March 6 the Asamblea Nacional of Venezuela, which includes the opposition to the country’s current president, Nicolas Maduro, announced that the issue of the national cryptocurrency Petro is unconstitutional and illegal. | ICO ⇓

Unfavorable |

| 3. | Praetorian Group Files To Be First ICO To Sell Registered Security Tokens In US [source: ] | March 9, 2018 | Praetorian Group has become one of the first companies to officially apply to the US Securities and Exchange Commission to hold an ICO and issue tokens that meet the definition of securities worth $75 million. | ICO ⇑

Favorable |

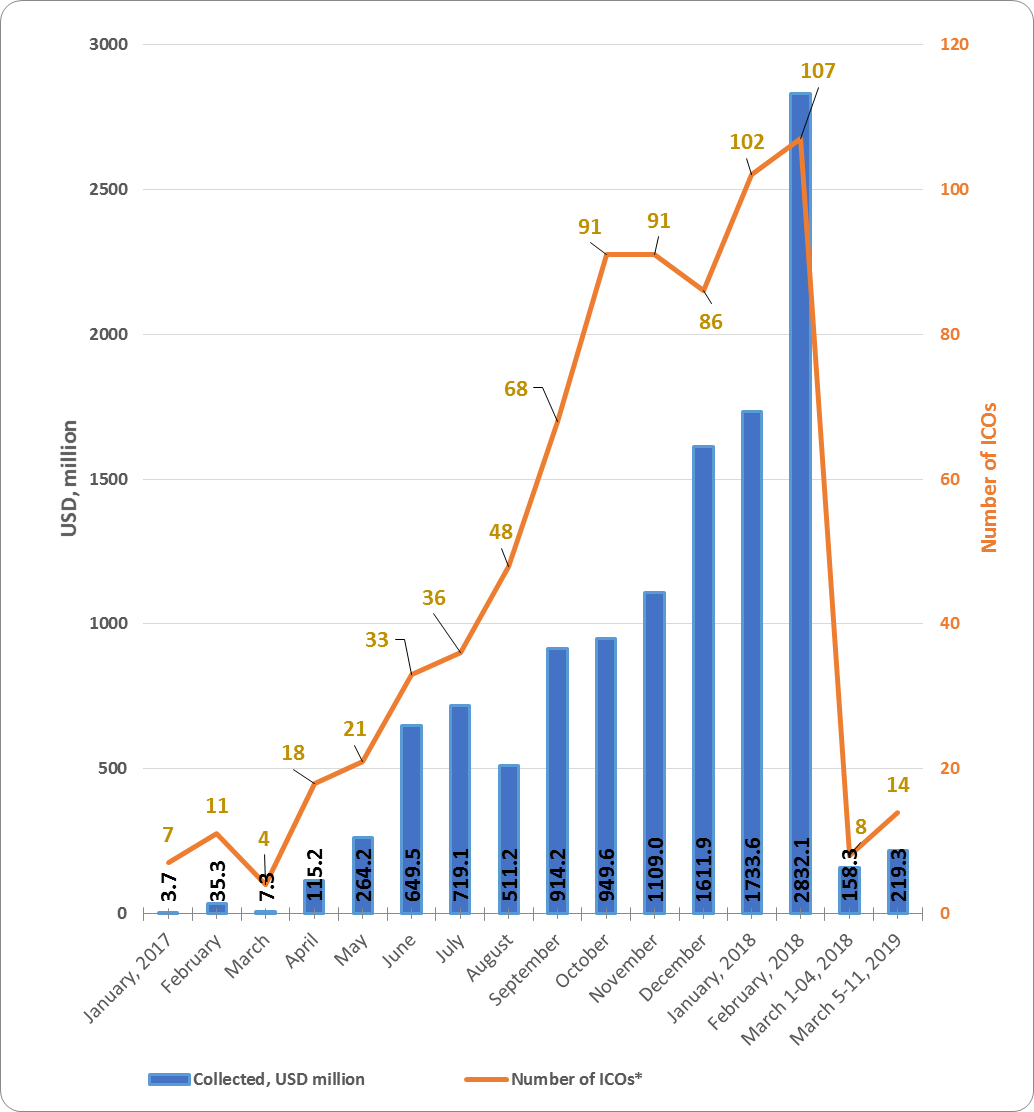

Table 1.2 shows the development trends on the ICO market since 2017. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1

| Indicator | Total

20172 |

December

2017 |

January

20183 |

February

2018 |

March 1-4,

2018 |

March 5-11,

2018 |

| Total amount of funds collected, USD million | 6 890 | 1 611.9 | 1 733.6 | 2 832.1 | 158.3 | 219.3 |

| Number of companies that completed an ICO1 | 514 | 86 | 102 | 107 | 8 | 14 |

| Maximum collected, USD million (ICO name) | 258

(Hdac) |

258

(Hdac) |

100

(Envion) |

850

(Pre-ICO-1 TON) |

50

(LeadCoin) |

48.8 (Savedroid) |

| Average collected funds, USD million | 13.4 | 18.7 | 17 | 26.5 | 19.8 | 15.7 |

Note:

1 Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com. For some ICOs information may currently be incomplete (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

2 More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017.

2 The data for 2018 have been updated (date updated: March11, 2018).

The data for 2017 and for January and February 2018 were adjusted to account for the appearance of more complete information on past ICOs. The amount of funds collected via ICOs during the past week (March 5-11, 2018) equaled $219.3 million. This amount consists of the results of 14 successfully completed ICOs, with the largest amount of funds collected equaling $48.8 million (Savedroid ICO). The average collected funds per ICO project equaled 15.7 million (see Tables 1.2, 1.3).

Table 1.3. Amount of funds collected and number of ICOs

| Month | Collected,

$ million |

Number of ICOs* | Average collected,

$ million |

| January 2017 | 3.7 | 7 | 0.53 |

| February | 35.3 | 11 | 3.21 |

| March | 7.3 | 4 | 1.82 |

| April | 115.2 | 18 | 6.4 |

| May | 264.2 | 21 | 12.58 |

| June | 649.5 | 33 | 19.68 |

| July | 719.1 | 36 | 19.97 |

| August | 511.2 | 48 | 10.65 |

| September | 914.2 | 68 | 13.44 |

| October | 949.6 | 91 | 10.44 |

| November | 1 109 | 91 | 12.19 |

| December | 1 611.9 | 86 | 18.74 |

| Total, 2017 | 6 890.1 | 514 | 13.4 |

| January 2018 | 1 733.6 | 102 | 17 |

| February 2018*** | 2 832.1 | 107 | 26.5 |

| March 1-4, 2018 | 158.3 | 8 | 19.8 |

| March 5-11, 2018 | 219.3 | 14 | 15.7 |

| Total | 11833.4 | 745 | 15.9 |

* Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com.

Information on funds collected is not available for all ICOs (information for last week is tentative and may be adjusted). ICOs that collected less than $100,000 were not considered.

** More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017 (data updated: March 11, 2018).

*** Taking into account the pre-ICO-1 of TON.

Table 1.3 shows that the largest amount of funds was collected via ICOs in February 2018. The highest average collected funds per ICO was also seen in February 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

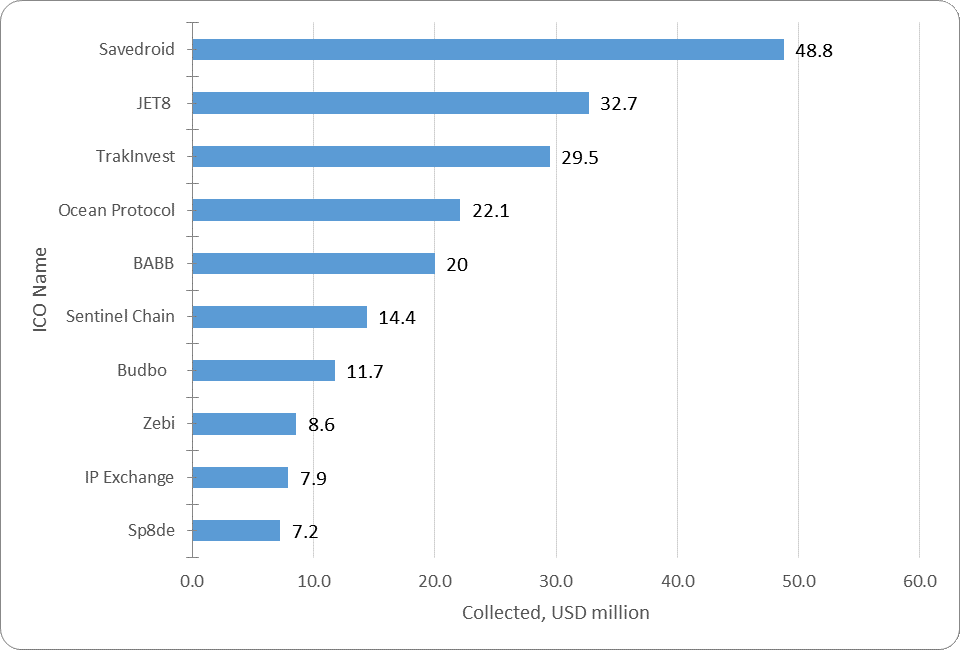

1.2. Top ICOs of last week

Table 1.4 shows the ten largest ICOs of the week*

Table 1.4. Top 10 ICOs in terms of the amount of funds collected (March 5-11, 2018)

| № | Name of ICO*** | Category** | Collected, $ million | Date |

| 1 | Savedroid | Trading & Investing | 48.8 | March 9, 2018 |

| 2 | JET8 | Commerce & Advertising | 32.7 | March 6, 2018 |

| 3 | TrakInvest | Machine Learning & AI | 29.5 | March 7, 2018 |

| 4 | Ocean Protocol | Content Management | 22.1 | March 9, 2018 |

| 5 | BABB | Finance | 20 | March 6, 2018 |

| 6 | Sentinel Chain | Finance | 14.4 | March 9, 2018 |

| 7 | Budbo | Drugs & Healthcare | 11.7 | March 5, 2018 |

| 8 | Zebi | Data Storage | 8.6 | March 5, 2018 |

| 9 | IP Exchange | Privacy & Security | 7.9 | March 5, 2018 |

| 10 | Sp8de | Gambling & Betting | 7.2 | March 11, 2018 |

| Top 10 ICOs* | 202.9 | |||

| Total funds collected from March 5-11, 2018 (14 ICOs)* | 219.3 | |||

| Average funds collected | 15.7 |

* When compiling the lists of top ICOs, information from the websites tokendata.io, icodrops.com, icodata.io, coinschedule.com and other specialized sources is used.

** The category was established based on expert opinions.

*** Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered. Information may be incomplete for some ICOs (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

The data for last week (March 5-11, 2018) may be adjusted as information on the amounts of funds collected by completed ICOs is finalized.

The leader for the week was the Savedroid project. This is an investment platform for the creation of cryptocurrency portfolios, savings and purchasing of derivatives. Savedroid already launched its mobile savings app on the market in 2016. Users receive benefits from easy access to cryptocurrencies, and can take advantage of investment in crypto portfolios, futures and ICOs with a minimum of technological barriers.

Figure 1.2 presents the ten largest ICOs completed last week.

Figure 1.2. Top 10 ICOs in terms of the amount of funds collected (March 5011, 2018)

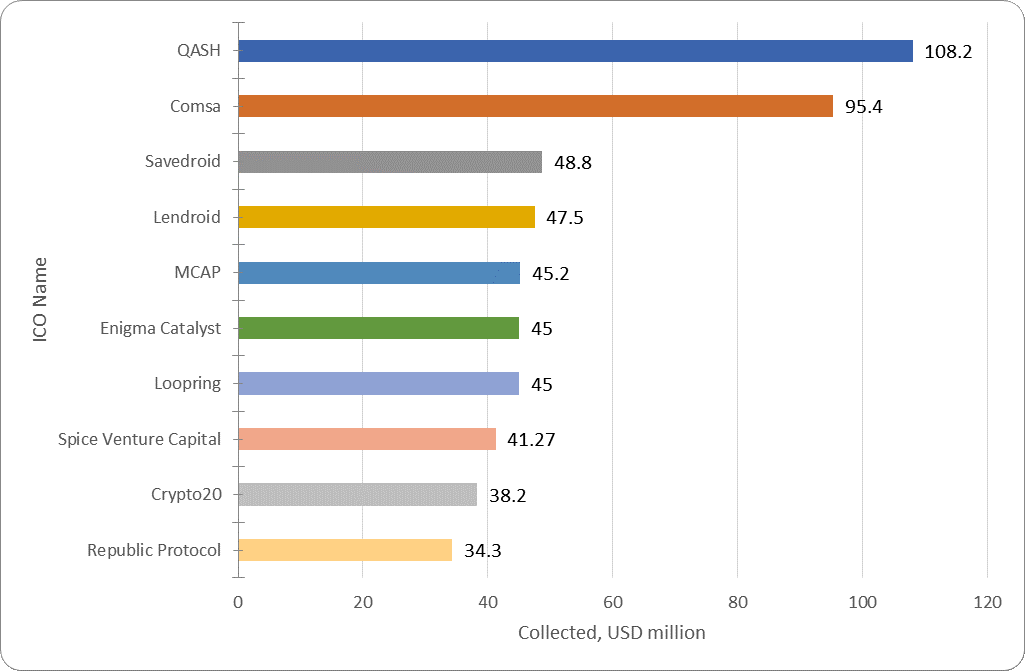

1.3. Top ICOs in their categories

The list of top ICOs by category is compiled with due account of the categories of the leading ICOs for the week.

Table 1.5. Top 10 ICOs in terms of the amount of funds collected, Trading & Investing category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | QASH | Trading & Investing | 108.2 | November 8, 2017 | 2.25x |

| 2 | Comsa | Trading & Investing | 95.4 | November 6, 2017 | 0.66x |

| 3 | Savedroid | Trading & Investing | 48.8 | March 9, 2018 | n/a |

| 4 | Lendroid | Trading & Investing | 47.5 | February 20, 2018 | n/a |

| 5 | MCAP | Trading & Investing | 45.2 | May 7, 2017 | n/a |

| 6 | Enigma Catalyst | Trading & Investing | 45 | September 11, 2017 | 3.13x |

| 7 | Loopring | Trading & Investing | 45 | August 16, 2017 | n/a |

| 8 | Spice Venture Capital | Trading & Investing | 41.27 | March 3, 2018 | n/a |

| 9 | Crypto20 | Trading & Investing | 38.2 | November 30, 2017 | 1.69x |

| 10 | Republic Protocol | Trading & Investing | 34.3 | February 3, 2018 | 1.01x |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in February and March 2018 are highlighted in red.

The Savedroid and Spice Venture Capital projects were completed in March and are included in the top 10 ICOs in the Trading & Investing category. Two projects from the top 10 also completed their ICOs in February 2018.

At present, all projects from the top 10 in this category have a token performance indicator of 0.66x to 3.13x. The Enigma Catalyst ICO can be considered one of the most successful exchange listings, as this project has a current token price to token sale price ratio of 3.13x. When considering this indicator, it is important to remember that the Enigma Catalyst ICO was completed on September 11, 2017, i.e. the 3.13x growth took place over six months. The market capitalization of Enigma Catalyst currently exceeds $136 million.

Figure 1.3. Top 10 ICOs in terms of funds collected, Trading & Investing category

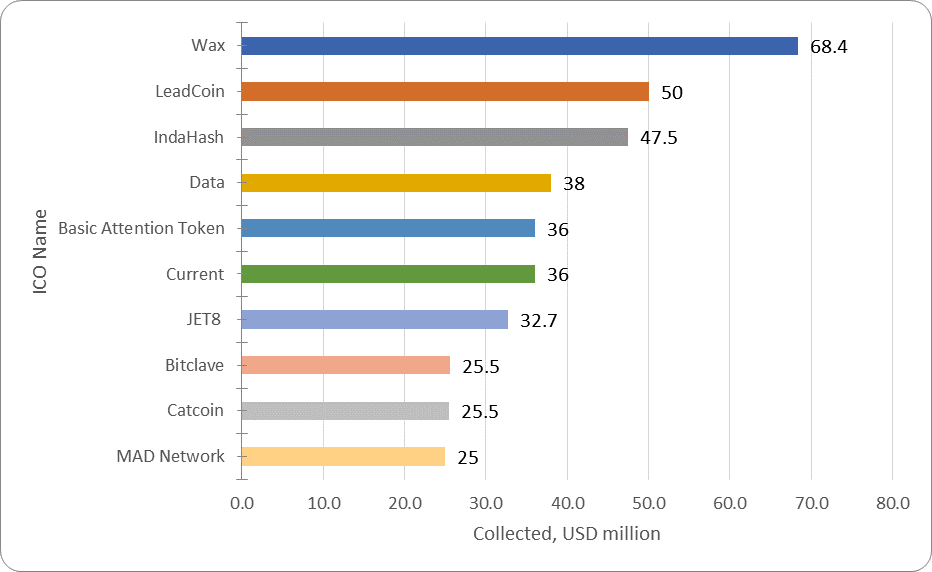

In February and early March, the ICOs of four projects that can be assigned to the top 10 in the Commerce & Advertising category were also completed.

Table 1.6. Top 10 ICOs in terms of the amount of funds collected, Commerce & Advertising category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | Wax | Commerce & Advertising | 68.4 | November 29, 2017 | 1.81x |

| 2 | LeadCoin | Commerce & Advertising | 50 | March 2, 2018 | n/a |

| 3 | IndaHash | Commerce & Advertising | 47.5 | December 20, 2017 | 0.42x |

| 4 | Data | Commerce & Advertising | 38 | January 21, 2018 | 0.87x |

| 5 | Basic Attention Token | Commerce & Advertising | 36 | May 31, 2017 | 7.65x |

| 6 | Current | Commerce & Advertising | 36 | February 7, 2018 | n/a |

| 7 | JET8 | Commerce & Advertising | 32.7 | March 6, 2018 | 0.51x |

| 8 | Bitclave | Commerce & Advertising | 25.5 | November 29, 2017 | 0.37x |

| 9 | Catcoin | Commerce & Advertising | 25.5 | November 29, 2017 | n/a |

| 10 | MAD Network | Commerce & Advertising | 25 | March 1, 2018 | n/a |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in February and March 2018 are highlighted in red.

At present, the Wax project has the largest amount of collected funds in the Commerce & Advertising category. From among the top 10 projects, the Basic Attention Token ICO has the best token performance indicator. Its market capitalization currently exceeds $260 million.

Figure 1.4. Top 10 ICOs in terms of the amount of funds collected, Commerce & Advertising category

Last week (March 5-11, 2018) at least 14 ICO projects were successfully completed, each of which collected more than $100,000, with a total amount of funds collected of around $220 million. Last week’s leader was the Savedroid project ($48.8 million). The total amount of funds collected by a number of ICOs failed to reach even the $100,000 mark (the information for some projects is still being finalized).

The Glossary is given in the Annex.

Annex – Glossary

| Key terms | Definition |

| Initial coin offering, ICO | A form of collective support of innovative technological projects, a type of presale and attracting of new backers through initial coin offerings (token sales) to future holders in the form of blockchain-based cryptocurrencies and digital assets. |

| Token sale price

Current token price |

Token sale price during the ICO.

Current token price. |

| Token reward | Token performance (current token price ÷ token sale price during the ICO), i.e. the reward per $1 spent on buying tokens. |

| Token return | (see token reward) Performance of funds spent on buying tokens or the ratio of the current token price to the token sale price, i.e. performance of $1 spent on buying tokens during the token sale, if listed on an exchange for USD. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | Alternative performance indicator of funds spent on buying tokens during the ICO or the ratio of the current ETH price to its price at the start of the token sale, i.e. if instead of buying tokens $1 was spent on buying ETH at its rate at the start of the token sale and then it was sold at the current ETH price. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the above: Alternative performance indicator of funds spent on buying tokens during the token sale, i.e. if instead of buying tokens $1 was spent on buying BTC at its price at the start of the token sale and then it was sold at the current BTC price. |

| Token/ETH reward | This ratio describes a market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying ETH. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on ETH. |

| Token/BTC reward | This ratio describes the market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying BTC. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on BTC. |

The post appeared first on .