bitcoin, as a pioneering peer-to-peer electronic payment system and the leading online currency, has revolutionized the way value is transferred digitally. It enables users to pay for goods and services similarly to traditional paper money,offering a decentralized choice to conventional financial systems. However, despite its growing acceptance and innovative technology, bitcoin faces significant criticism in several key areas. Concerns over its substantial energy consumption, notable price volatility, and various inherent risks have sparked widespread debate among regulators, investors, and environmentalists. this article explores these critical aspects to provide a thorough understanding of why bitcoin continues to attract scrutiny alongside its increasing adoption. [[1]](https://bitco.in/en/release/v0-8-6) [[2]](https://bitco.in/en/choose-your-wallet)

Understanding bitcoin’s Energy Consumption and Environmental Impact

bitcoin’s network operates on a proof-of-work (PoW) consensus mechanism, which necessitates solving complex mathematical puzzles to validate transactions and secure the blockchain. This process is extremely energy-intensive as it requires powerful specialized hardware running continuously. The cumulative effect results in a significant carbon footprint, often compared to that of entire small countries, raising concerns about sustainability.

critics highlight several environmental drawbacks:

- High electricity consumption: Mining operations demand vast amounts of electrical power, which, depending on the source, can contribute extensively to carbon emissions.

- dependency on fossil fuels: In many regions, mining farms are powered by coal or natural gas, exacerbating environmental degradation.

- Electronic waste generation: Rapid obsolescence of mining hardware adds to the global e-waste problem.

Efforts to mitigate these impacts include increasing the use of renewable energy sources and the growth of more energy-efficient consensus protocols, though the transition remains gradual. Additionally, certain bitcoin mining operations strategically locate themselves in regions with surplus hydropower or geothermal energy to reduce carbon intensity. Though, the scalability of such solutions is still debated within the community.

| Aspect | Impact Level | Mitigation Efforts |

|---|---|---|

| Electricity Use | Vrey High | Renewable Energy Adoption |

| Carbon Emissions | High | Energy Mix Shift |

| hardware Waste | Medium | Recycling Programs |

Analyzing bitcoin’s Price Volatility and Market Instability

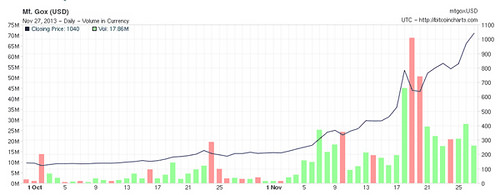

bitcoin’s price volatility is one of the most prominent challenges it faces as a digital asset. Unlike traditional currencies or even established commodities, bitcoin’s value can experience drastic swings within short time frames. This fluctuation is driven by a combination of factors such as speculative trading, regulatory announcements, and macroeconomic trends. Investors often experience rapid gains but must also be prepared for sudden losses, which contributes to a heightened perception of risk.

Market instability is further compounded by bitcoin’s relatively low liquidity compared to conventional financial assets. Since the market is still maturing, large buy or sell orders can disproportionately impact the price. Additionally, the decentralized nature of exchanges, some with limited oversight, allows for price manipulation tactics like pump-and-dump schemes. These dynamics create a less predictable trading habitat, deterring cautious investors and institutional players from fully embracing the asset.

Key contributors to bitcoin’s price shifts include:

- Speculative interest and hype cycles

- Changes in mining difficulty and rewards

- Sudden shifts in regulation or government policy

- Global economic instability boosting demand for alternative assets

| Factor | Effect on Price | Frequency |

|---|---|---|

| News & Announcements | Immediate price movements | Daily |

| Regulatory Changes | Prolonged volatility | Monthly |

| Market Manipulation | Sudden spikes/dips | Intermittent |

The unpredictable environment surrounding bitcoin trading emphasizes the importance of caution for investors and users alike. While the potential for high returns attracts many,the lack of stability can undermine its reliability as a store of value or a widely accepted currency alternative. Understanding these volatility mechanisms is crucial for anyone engaging with bitcoin in any capacity.

Assessing Security Risks and Vulnerabilities in bitcoin Transactions

bitcoin transactions leverage decentralization and cryptography to secure the transfer of funds, yet they remain susceptible to a variety of security threats. One critical vulnerability lies in the possibility of 51% attacks,where if a single group controls over half of the network’s mining power,they could perhaps double-spend coins or halt transaction confirmations. This threat, even though resource-intensive to execute, poses a essential risk to the trustworthiness of the transaction ledger.

Another prominent risk is related to phishing and social engineering attacks aimed at bitcoin holders and service users. Unlike traditional bank accounts, bitcoin wallets lack centralized oversight or recovery options; lost private keys mean permanent loss of funds.Attackers exploit this by masquerading as trustworthy entities to trick users into revealing sensitive credentials or sending funds to fraudulent addresses.

- Malware targeting wallet software that intercepts private keys or alters transaction details.

- Man-in-the-middle attacks on insecure networks that manipulate transaction details.

- Fake exchanges or phishing websites designed to harvest user credentials.

Moreover, the inherent transparency of the bitcoin blockchain, while boosting accountability, can inadvertently leak user behavior patterns, which may enable de-anonymization. Sophisticated attackers or surveillance actors can analyze transaction flows to link identities to wallet addresses, eroding privacy. This vulnerability challenges those seeking truly confidential transactions without additional obfuscation tools.

| Security vulnerability | Potential Impact | Mitigation Strategies |

|---|---|---|

| 51% Attack | Double spending, network disruption | Decentralized mining, protocol upgrades |

| Phishing & Social Engineering | Loss of private keys, stolen funds | User education, multi-factor authentication |

| Privacy Leakages | User identity exposure | Use of mixing services, privacy-focused wallets |

Balancing transparency with privacy, while securing the network against increasingly sophisticated threats, remains a dynamic challenge for bitcoin. Users must remain vigilant by utilizing secure storage practices, verifying transaction details carefully, and staying informed about emerging vulnerabilities and protection mechanisms within the ecosystem.

Evaluating Regulatory Challenges and Legal Concerns

The regulatory landscape surrounding bitcoin is highly fragmented and continually evolving. Different countries adopt divergent stances ranging from outright bans to cautious acceptance, making it difficult for market participants to navigate compliance requirements. For instance, regulatory bodies worry about bitcoin’s potential to circumvent capital controls and facilitate money laundering, leading some jurisdictions to impose stringent restrictions or bans. This patchwork of regulations not only complicates international trade but also inhibits broader financial integration of cryptocurrencies.

Legal concerns often focus on the lack of centralized oversight in bitcoin transactions.While decentralization is a core principle, it raises significant challenges for regulators trying to enforce anti-fraud laws, taxation mandates, and consumer protection rules. Without clear accountability, victims of hacks or fraudulent schemes find limited legal recourse. Moreover, the anonymity or pseudonymity aspects embedded in bitcoin protocols exacerbate difficulties in tracing illicit activities, prompting governments to push for enhanced know-your-customer (KYC) and anti-money laundering (AML) frameworks within crypto exchanges and platforms.

Several critical regulatory challenges persist:

- Disparities in legal definitions and classifications of bitcoin as asset, currency, or commodity

- uncertainty over taxation policies and reporting obligations for crypto holdings and gains

- ensuring technological neutrality while regulating a rapidly innovating ecosystem

- Balancing financial innovation with systemic risk management

| Jurisdiction | Regulatory Approach | Key Legal Concern |

|---|---|---|

| United States | Comprehensive but fragmented oversight | capital gains tax, securities rules |

| European Union | Unified frameworks like MiCA | Consumer protection, market integrity |

| China | Complete prohibition | Financial crime, economic stability |

Ongoing initiatives, such as the EU’s Markets in Crypto-assets (mica) regulation and U.S.government reports, aim to harmonize regulatory parameters without stifling technological progress. However, the inherent decentralized nature of bitcoin challenges the notion of traditional regulatory control, and so legal frameworks must adapt dynamically. Until a global consensus emerges, regulatory uncertainty remains a key risk factor contributing to bitcoin’s criticism and its volatile reputation in the financial ecosystem.

Mitigating Risks through Sustainable Mining and Informed Investment Strategies

Addressing the environmental impact of bitcoin mining requires a committed shift towards sustainable resource management. Sustainable mining incorporates practices that reduce energy consumption and minimize ecological disruption by leveraging renewable energy sources and enhancing operational efficiency. This approach aligns with the broader principles of sustainability-balancing ecological, economic, and social needs without depleting resources for future generations.

investors play a crucial role in promoting responsible mining through informed strategies that prioritize transparency and environmental accountability. By carefully evaluating mining operations’ sustainability credentials, such as energy source profiles and carbon footprints, investors can mitigate financial risks associated with regulatory changes or public backlash. Strategic diversification and engagement with sustainable projects contribute to long-term portfolio resilience amid bitcoin’s inherent volatility.

- Prioritize mining firms adopting renewable energy

- Support initiatives improving energy efficiency

- Monitor emerging environmental regulations

- Incorporate risk assessment focused on sustainability

Integrating sustainable mining techniques with informed investment frameworks creates a feedback loop encouraging continuous environmental advancement in cryptocurrency ecosystems. This dual approach not only addresses immediate energy concerns but also furthers economic sustainability by fostering stable growth and public trust. As the cryptocurrency sector evolves, embedding sustainability principles becomes essential for maintaining operational viability without compromising future resource availability.

| Aspect | Sustainable Practice | Expected Benefit |

|---|---|---|

| Energy Use | Switch to solar/wind power | reduced carbon emissions |

| Investment | Green portfolio screening | Lower regulatory risk |

| Mining Tech | Efficient ASIC chips | Reduced electricity consumption |

| Community Impact | Local engagement programs | Enhanced social license |

Q&A

Q: why is bitcoin frequently enough criticized for its energy consumption?

A: bitcoin mining requires substantial computational power to solve complex cryptographic puzzles, a process called proof-of-work. This leads to high electricity usage, frequently enough compared to the energy consumption of entire countries. Critics argue this environmental impact is significant, especially when miners use electricity from non-renewable sources.

Q: How does bitcoin’s price volatility contribute to criticism?

A: bitcoin’s price is highly volatile, with frequent and substantial fluctuations. This unpredictability makes it risky as an investment or store of value and complicates its use as a stable medium of exchange. Volatility can result from market speculation, regulatory news, and shifts in investor sentiment.

Q: What are the main risks associated with using bitcoin?

A: Risks include security vulnerabilities such as hacking of wallets and exchanges, loss of private keys leading to irreversible loss of funds, regulatory uncertainties, and potential for use in illicit activities. Additionally, the lack of consumer protections compared to traditional financial systems means users bear significant risks.

Q: Are there any efforts to reduce bitcoin’s environmental impact?

A: Some initiatives promote the use of renewable energy sources for mining operations and the development of more energy-efficient consensus mechanisms. However,bitcoin itself currently relies on proof-of-work,which inherently requires substantial energy consumption.

Q: Why does bitcoin’s volatility remain high despite its growing adoption?

A: bitcoin’s market is still relatively small compared to traditional currencies and financial assets, making it susceptible to large price swings. Additionally, speculative trading, regulatory developments, and media coverage can amplify price movements.Q: What should potential users and investors be aware of before engaging with bitcoin?

A: They should understand bitcoin’s technical nature, recognize the environmental concerns, be prepared for volatile price changes, secure their private keys carefully, and stay informed about evolving regulations and market conditions.

These points summarize why bitcoin faces ongoing criticism related to energy use, price volatility, and various risks inherent in its technology and adoption.

Closing Remarks

while bitcoin remains a groundbreaking innovation in the realm of digital currency, it is indeed critically important to critically examine the challenges it presents. The substantial energy consumption required for mining has raised environmental concerns, the inherent price volatility poses risks to investors and users, and various security and regulatory issues continue to impact its adoption and stability. Understanding these criticisms is essential for anyone engaging with bitcoin, as it paints a fuller picture of both its potential and its limitations in the evolving landscape of finance and technology.