What’s Was Behind Friday’s Crypto Boom?

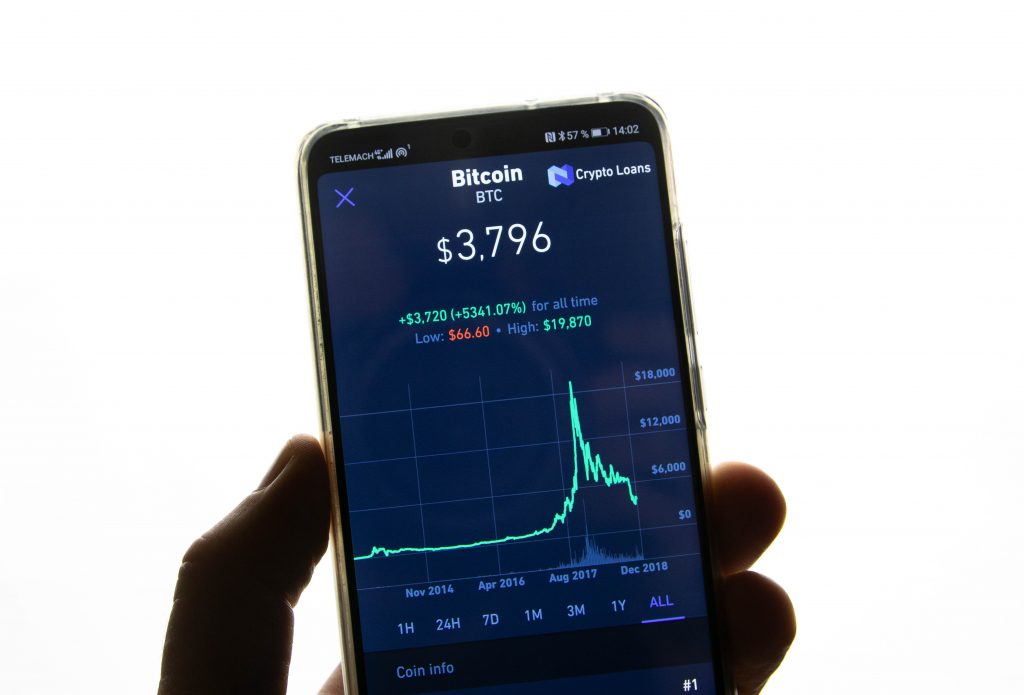

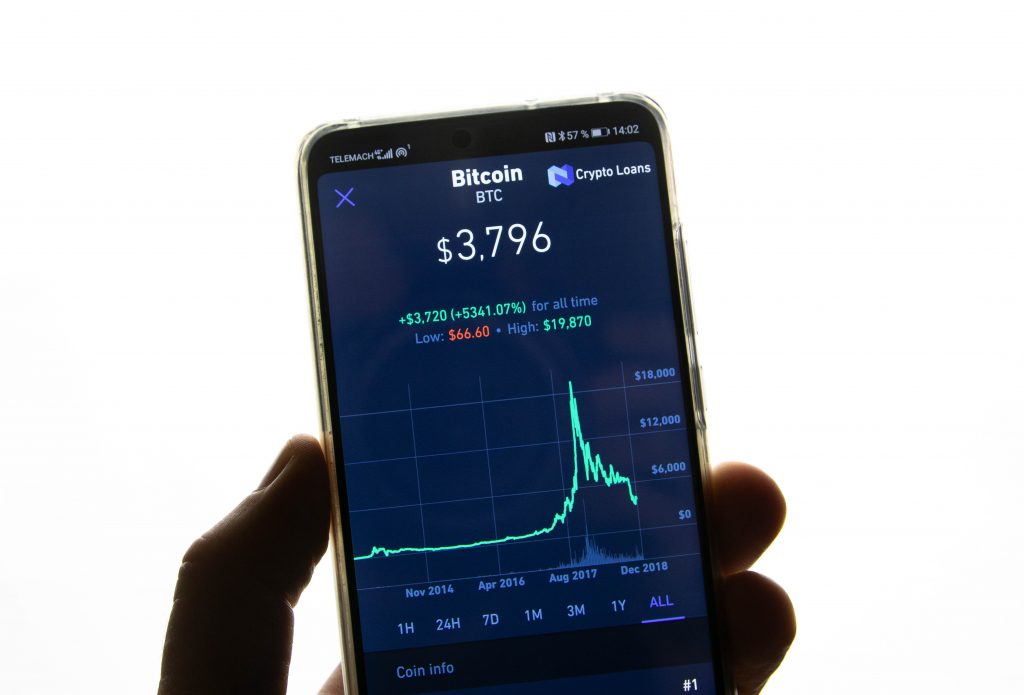

Your eyes aren’t kidding themselves. On Friday, the price truly did boom, with moving higher than $3,700 for the first time in seemingly forever, seemingly on the back of zero catalysts. As normal, followed, with a 30% gain, as a majority of other posted daily returns that ranged between and LTC’s 30%.

This move, which was the first bout of notable crypto volatility in weeks, pushed the aggregate value of all beyond $121 billion, which comes after the figure traded in and around $110 billion, as the price stalled at $3,400 — inches above its ever-important yearly low price point.

But what caused the surge in the price?

Some have argued that this was single-handedly catalyzed by the bump in , as the hype regarding the project’s block reward reduction, coupled with its potential integration of Grin-esque technology and/or more traditional confidential transactions in the near future. Yet, some say it has more to do with the broader fundamentals in the cryptosphere, especially regarding the flagship asset and its not-so walled garden ecosystem.

Some notable fundamental , which has been deemed catalysts by some, include Abra’s launch of crypto-to-stock capabilities, rumors regarding the approval of a, the incessant stream of Wall Street-centric products, and funny enough, from Fundstrat.

bitcoin Price: Where To Next?

While this all is well and good, what’s next for the price?

Well, most notable analysts on Twitter, who sport tens of thousands of followers, claim that upside for , especially , is inbound due to technical analysis. Benjamin Blunts, a markets analyst enamored with volatility, claimed that a declining diagonal that he’d been tracking for the past four weeks had concluded with this move.

Thus, he subsequently remarked that upside is inbound, drawing a somewhat nebulous arrow to the $4,300 price level.

looks like this ending diagonal ive been tracking for the last 4 weeks is over.

we go up now, RIP all the 1800 bears,

— 🌲BenjaminBlunts🌲 (@SmartContracter)

Benjamin even noted that it is rest in pieces for all the $1,800 bears, likely referencing a comment from his peer, the Crypto Dog, in which the analyst stated that he wouldn’t be all too surprised to see $1,800 for in the near future.

DonAlt was seemingly just as bullish. The preeminent trader noted that and (ETH) are nearing the top of their short-term ranges, meaning profit-taking would be optimal. Yet, considering the “violence” that has occurred in these markets in recent weeks, Don remarked that he wouldn’t be surprised to see $4,000 for the price, which is around two levels of importance as depicted in the image below.

daily update:

Okay, let’s calm down the euphoria for a second.

We just hit the top of the range – time to take profits & derisk on both ETH and .

That said the violence with which this happened makes me think 4k$ is coming.— DonAlt (@CryptoDonAlt)

Galaxy, a leading crypto bull and self-proclaimed “accumulation machine,” drew an optimistic “Adam and Eve” chart outlining the price. In the analysis, which was optimistic first and foremost, Galaxy noted that could trend slightly lower, for the time being, potentially retesting its yearly lows, before breaking above $4,000 (which would confirm a recovery) and moving back above $5,000, $6,000 and beyond by year’s end.

What if.

— Galaxy (@galaxybtc)

Title Image Courtesy of Marco Verch Via Flickr

Published at Sat, 09 Feb 2019 05:11:15 +0000