Crypto players are advised by the WGC to reconsider their stance in investing in digital money.

Now, this…

The lingering perception that ₿itcoin (BTC) is an investment position meant to cushion potential losses against market instability – and will one way or another – substitute gold as a safe-haven asset, has been an interesting fodder for argument among crypto circles.

This week, the London-based World Gold Council – a well-known authority on the precious metal – has made an effort to douse this somewhat nagging concept, with a confirmation that the globally popular virtual commodity tried to hold a candle to being the new gold — but fell short.

The stated that during the fourth quarter last year, when stock markets around the world suffered a serious beating since 2008, digital currency had a chance to show its mettle as a game-changing investment of the future, much like gold – yet some of the biggest names in the crypto market, like ₿itcoin, demonstrated drawbacks at the outset, leaving gold to shine, literally, as it always does.

Did it blow up its chance?

“Cryptocurrencies had a prime opportunity to demonstrate qualities associated with havens like gold. However, digital currencies, such as ₿itcoin, behaved like unstable assets and took a dive while gold rallied,” the report said.

Spearheading the ₿itcoin-gold advocacy are American rowers and Internet entrepreneurs, Cameron and Tyler Winklevoss – the main figures behind the success of New York-based virtual currency exchange and stewards of Gemini Trust Company.

By the numbers

In an interesting piece of argument, the twins emphasized that ₿itcoin’s ‘exchangeability’, otherwise known as “fungibility”, makes it a more ideal choice compared to the yellow metal. Cameron, during a television interview with Balancing the Ledger recently, shared that “the only thing gold has over ₿itcoin is a 3,000-year headstart.”

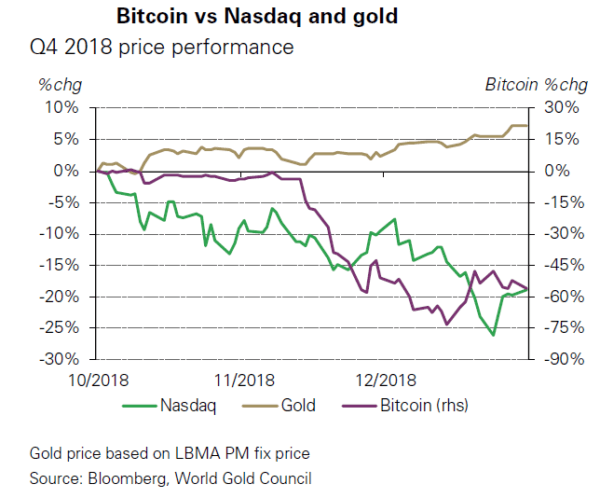

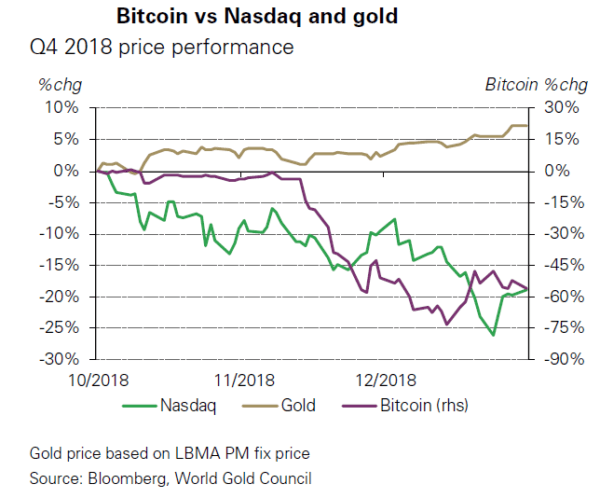

Be that as it may, however, analysts at the World Gold Council sees it rather differently: “The price behavior of ₿itcoin resembles a technology stock,” underscoring the crypto’s output in the last four months, which was a paltry 56 percent decline. On the NASDAQ Composite in the same period, ₿itcoin was down almost 20 percent, compared to gold which climbed 9.5 percent.

While those who are willing to bet their fiat on ₿itcoin remain unfazed by this bleak notion, finance experts at the WGC cautioned eager-beavers on ₿itcoin to be always on the look-out for another market setback.

“This was one of the few periods during which true market stress has transpired since the financial crisis, and should lead investors to re-assess their reasons for investing in cryptocurrencies,” the WGC said.

bitcoin had its opportunity to outshine gold as the biggest investment of the future. Do you agree?

Published at Wed, 30 Jan 2019 06:59:39 +0000