Today, we’re very excited to announce that Alesia Haas will join Coinbase as the company’s Chief Financial Officer (CFO). In her role at Coinbase, Alesia will allow us to accelerate our goal of building a world-class financial team that scales with the company through this period of profound growth. She is a seasoned financial services executive who brings extensive experience in managing highly regulated complex financial institutions.

“I’m incredibly excited to have Alesia join Coinbase as our new CFO. She brings deep financial services experience to our growing company. As a fintech company, finance is core to everything that we do. We plan to continue bringing the best and brightest from both finance and technology companies to help create an open financial system for the world.” — Brian Armstrong, Co-founder & CEO at Coinbase

Alesia joins us from Oz Management, a global alternative asset management firm based in NYC, where she served as Chief Financial Officer. In her role there she oversaw all aspects of accounting, tax, treasury, financial operations, internal audit and shareholder services.

Prior to Oz Management, Alesia served as Chief Financial Officer and Head of Strategy for OneWest Bank, N.A. Her prior experience includes senior finance, investment and strategy roles with Merrill Lynch and General Electric.

She begins immediately while helping Oz Management with the transition through June 1, 2018.

Welcome Alesia!

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

Information as of April 16, 2018

This report was created by:

Professor , Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox

This report presents data on the ICO market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that have taken place in April 2018, including over the past week (April 9-15, 2018).

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

Table 1.1. Brief ICO market overview, key events, news for the week of April 9-15, 2018

| № | Factors and events

(link to source) |

Date of news | Description | Type of impact |

| 1. | Venezuela Says Trump Ban on Petro Backfires, Doubles Investors

Telesurtv] |

April 9, 2018 | The ban by Donald Trump on US citizens performing any transactions with the Venezuelan state cryptocurrency was “free publicity” for the currency, announced executive secretary for Venezuela’s Blockchain Observatory, Daniel Pena. | Favorable

ICO ⇑

|

| 2. | Russia to Ban Telegram Messenger Over Encryption Dispute [source: ] | April 13, 2018 | On April 13 it took the Tagansky Court of Moscow only 19 minutes to consider the claim of Roskomnadzor and the FSB against the messenger and to rule that access to it be immediately restricted. | Unfavorable

ICO ⇓ |

| 3. | Louisiana Mayor Proposes Government-Backed Crypto and ICO [source: ] | April 15, 2018 | Joel Robideaux, the Mayor-President of Lafayette Parish (Louisiana, USA), has proposed that the local government create its own cryptocurrency and hold an ICO in order to attract funds for development of the region. | Favorable

ICO ⇑

|

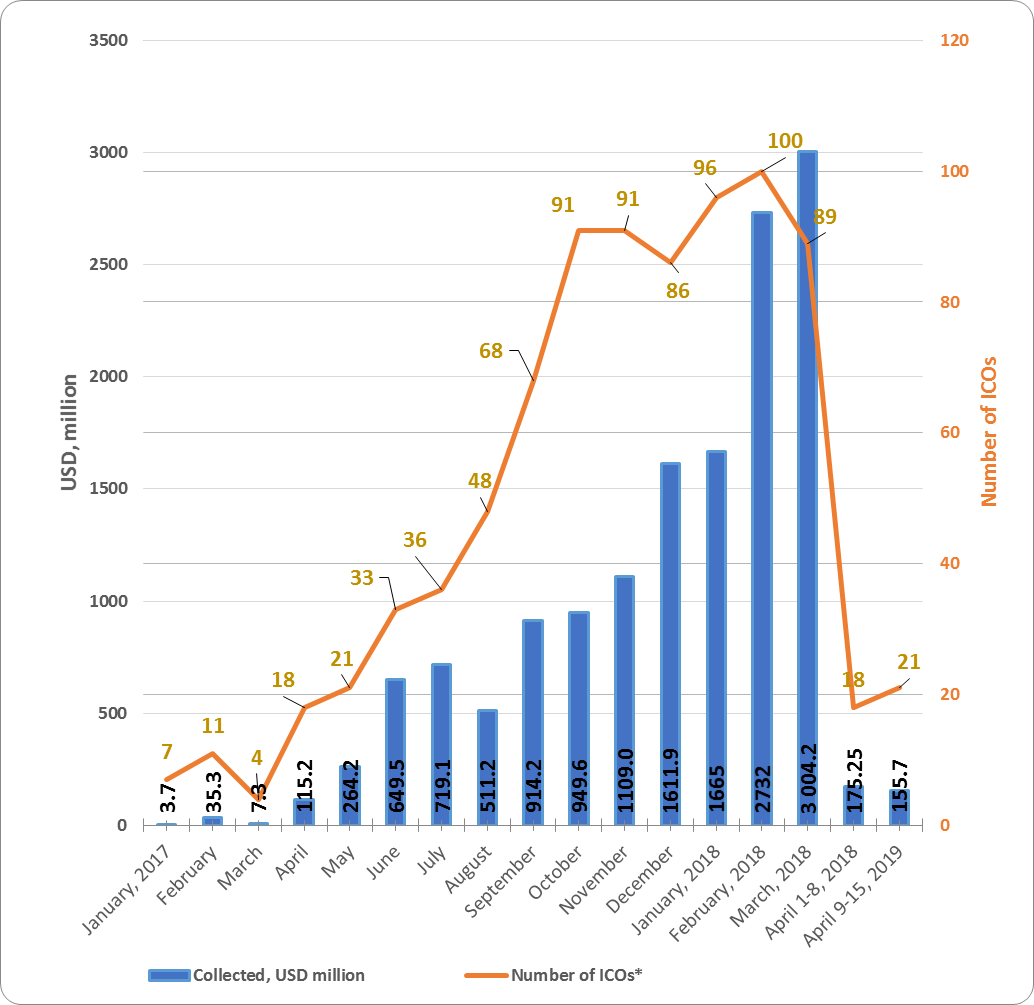

Table 1.2 shows the development trends on the ICO market since the beginning of 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2

| Indicator | January

2018 |

February

2018 |

March

2018 |

April 1-8,

2018 |

April 9-15,

2018 |

| Total amount of funds collected, USD million | 1 665 | 2 732 | 3 004.2 | 175.25 | 155.7 |

| Number of companies that completed an ICO1 | 96 | 100 | 89 | 18 | 21 |

| Maximum collected, USD million (ICO name) | 100

(Envion) |

850

(Pre-ICO-1 TON) |

850

(Pre-ICO-2 TON) |

50

(Nexo) |

50.92 (MOOVER) |

| Average collected funds, USD million | 17.3 | 27.3 | 33.8 | 9.7 | 7.4 |

Note:

1 Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com. For some ICOs information may currently be incomplete (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

2 Including the Pre-ICO-1,2 TON, Petro Pre-ICO.

3 The data for 2018 have been updated (date updated: April 15, 2018).

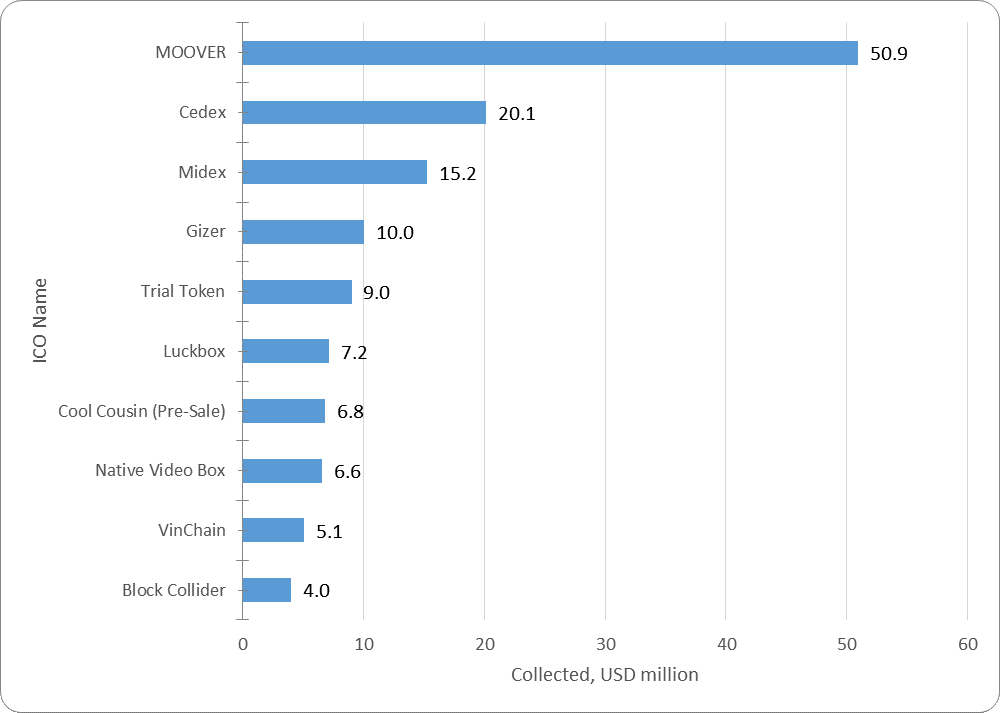

The data for the previous period (April 1-8, 2018) have been adjusted to account for the appearance of more complete information on past ICOs. Last week (April 9-15, 2018) the amount of funds collected via ICOs equaled $155.7 million. This amount consists of the results of 21 successfully completed ICOs, with the largest amount of funds collected equaling $50.92 million (MOOVER project). The average collected funds per ICO project equaled 7.4 million (see Tables 1.2, 1.3).

Table 1.3. Amount of funds collected and number of ICOs

| Month | Collected,

$ million |

Number of ICOs* | Average collected,

$ million |

| January 2017 | 3.7 | 7 | 0.53 |

| February | 35.3 | 11 | 3.21 |

| March | 7.3 | 4 | 1.82 |

| April | 115.2 | 18 | 6.4 |

| May | 264.2 | 21 | 12.58 |

| June | 649.5 | 33 | 19.68 |

| July | 719.1 | 36 | 19.97 |

| August | 511.2 | 48 | 10.65 |

| September | 914.2 | 68 | 13.44 |

| October | 949.6 | 91 | 10.44 |

| November | 1 109 | 91 | 12.19 |

| December | 1 611.9 | 86 | 18.74 |

| Total, 2017 | 6 890.1 | 514 | 13.4 |

| January 2018 | 1 665 | 96 | 17 |

| February 2018 | 2 732 | 100 | 27.3 |

| March 2018 | 3 004.2 | 89 | 33.8 |

| April 1-8, 2018 | 175.25 | 18 | 9.7 |

| April 9-15, 2018 | 155.7 | 21 | 7.4 |

| Total for 2018*** | 7732.0 | 324 | 23.9 |

* Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com.

Information on funds collected is not available for all ICOs (information for last week is tentative and may be adjusted). ICOs that collected less than $100,000 were not considered.

** More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017 (data updated: April 1, 2018).

*** Including Pre-ICO-1,2 TON and the Petro pre-sale

Table 1.3 shows that the largest amount of funds was collected via ICOs in March 2018, mainly due to the appearance of major ICOs. The highest average collected funds per ICO was also seen in March 2018.

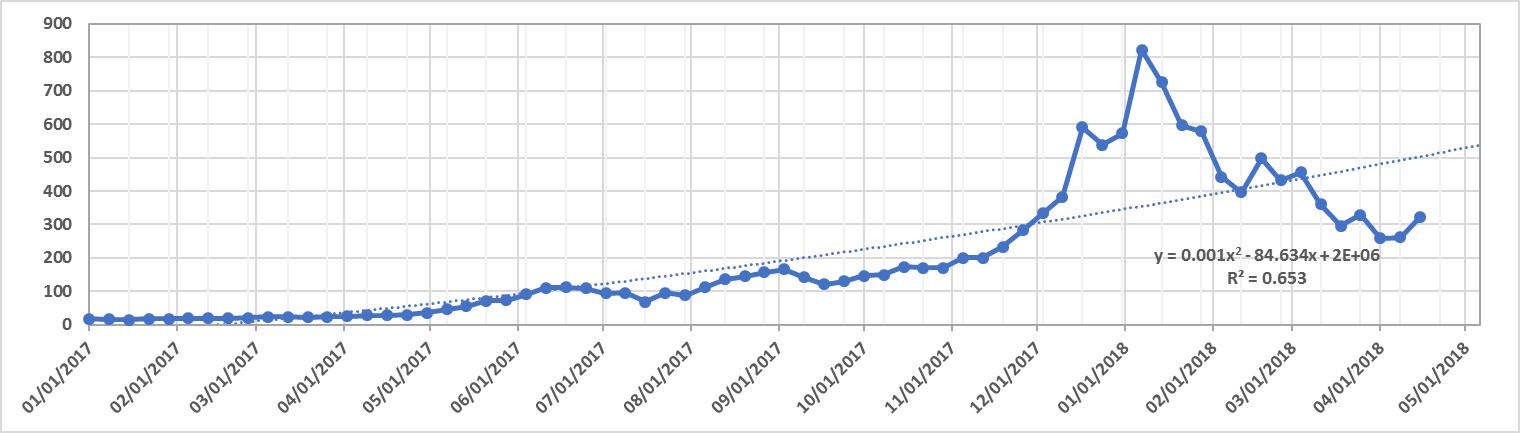

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs of last week

Table 1.4 shows the ten largest ICOs of the week.

Table 1.4. Top 10 ICOs in terms of the amount of funds collected (April 9-15, 2018)*

| № | Name of ICO*** | Category** | Collected, $ million | Date |

| 1 | MOOVER | Communication | 50.9 | April 15, 2018 |

| 2 | Cedex | Trading & Investing | 20.1 | April 13, 2018 |

| 3 | Midex | Finance | 15.2 | April 15, 2018 |

| 4 | Gizer | Gaming & VR | 10.0 | April 10, 2018 |

| 5 | Trial Token | Legal | 9.0 | April 12, 2018 |

| 6 | Luckbox | Gambling & Betting | 7.2 | April 11, 2018 |

| 7 | Cool Cousin (Pre-Sale) | Travel & Tourism | 6.8 | April 11, 2018 |

| 8 | Native Video Box | Commerce & Advertising | 6.6 | April 15, 2018 |

| 9 | VinChain | Transport | 5.1 | April 15, 2018 |

| 10 | Block Collider | Infrastructure | 4.0 | April 14, 2018 |

| Top 10 ICOs* | 135 | |||

| Total funds collected from April 9-15, 2018 (21 ICOs)* | 155.7 | |||

| Average funds collected | 7.4 |

* When compiling the lists of top ICOs, information from the websites tokendata.io, icodrops.com, icodata.io, coinschedule.com and other specialized sources is used.

** The category was established based on expert opinions.

*** Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered. Information may be incomplete for some ICOs (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

The data for past periods (April 9-15, 2018) may be adjusted as information on the amounts of collected funds by completed ICOs is finalized.

The leader of the week was the MOOVER project. This is a protocol that allows mobile users to share (sell or buy) excess mobile data outside the confines of the contract-based communications operators. It represents a new exchange economy that will give value to surplus resources. MOOVER performs the exchange of mobile data in a P2P network, encrypted using blockchain technology. This makes it possible for the system to work autonomously without centralized control. It is an inexpensive platform where third parties who do not know one another (all participating users) can safely communicate with one another while maintaining their anonymity.

Figure 1.2 presents the ten largest ICOs completed during the past week.

Figure 1.2. Top 10 ICOs in terms of the amount of funds collected (April 9-15, 2018)

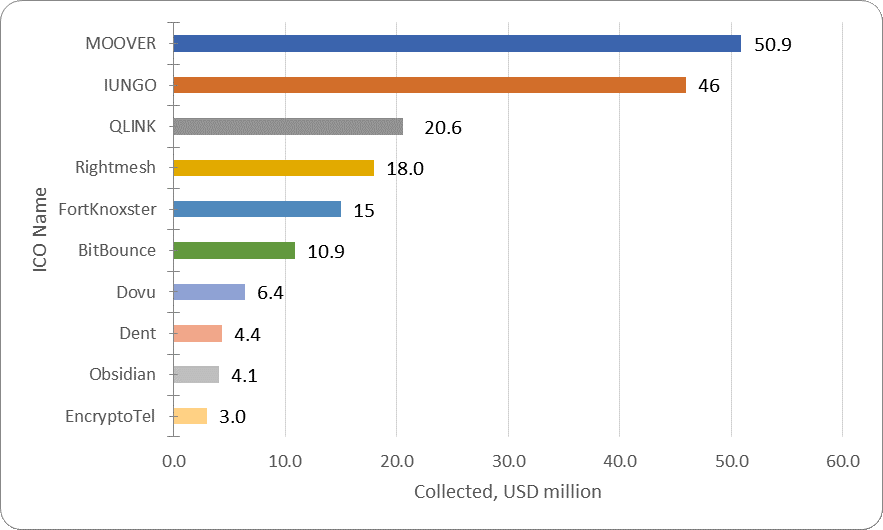

1.3. Top ICOs in their categories

The list of top ICOs by category is compiled with due account of the categories of the leading ICOs for the week.

Table 1.5. Top 10 ICOs in terms of the amount of funds collected, Communications category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | MOOVER | Communications | 50.9 | April 15, 2018 | n/a |

| 2 | IUNGO | Communications | 46 | February 1, 2018 | 0.10x |

| 3 | QLINK | Communications | 20.6 | December 22, 2017 | 1.87x |

| 4 | Rightmesh | Communications | 18.0 | February 28, 2017 | n/a |

| 5 | FortKnoxster | Communications | 15 | March 18, 2018 | n/a |

| 6 | BitBounce | Communications | 10.9 | August 28, 2017 | n/a |

| 7 | Dovu | Communications | 6.4 | October 17, 2017 | 0.71x |

| 8 | Dent | Communications | 4.4 | July 27, 2017 | 22.50x |

| 9 | Obsidian | Communications | 4.1 | August 25, 2017 | 0.48x |

| 10 | EncryptoTel | Communications | 3.0 | May 10, 2017 | 0.40x |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in March and April 2018 are highlighted in red.

The MOOVER project was the leader of the week and the leader of the Communications category. At present, all projects from the top 10 in this category have a token performance indicator of 0.1x to 22.5x. The Dent project can be considered one of the most successful exchange listings, as this project has a current token price to token sale price ratio of 22.5x. When considering this indicator, it is important to remember that the Dent ICO was completed on July 27, 2017, i.e. the 22.5x growth took place over approximately eight months. The market capitalization of Dent currently exceeds $105 million.

Figure 1.3. Top 10 ICOs in terms of the amount of funds collected, Communications category

The Cedex, Midex, and Gizer ICO projects, which can be assigned to the Trading & Investing, Finance, and Gaming & VR categories, respectively, were also completed last week. These projects did not make it into the top 10 of the corresponding categories (Tables 1.6, 1.7).

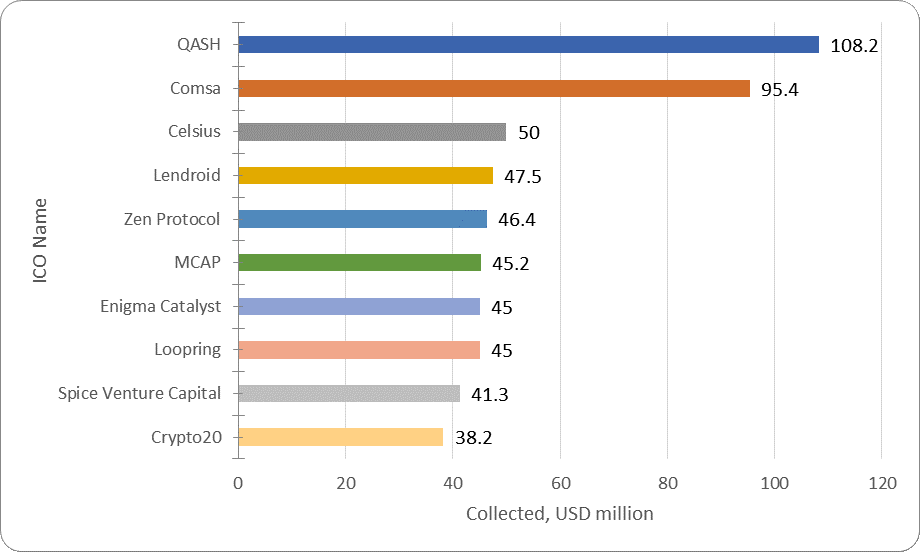

Table 1.6. Top 10 ICOs in terms of the amount of funds collected, Trading & Investing category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | QASH | Trading & Investing | 108.2 | November 11, 2017 | 2.02x |

| 2 | Comsa | Trading & Investing | 95.4 | November 6, 2017 | 0.55x |

| 3 | Celsius | Trading & Investing | 50 | March 23, 2018 | n/a |

| 4 | Lendroid | Trading & Investing | 47.5 | February 20, 2018 | 0.44x |

| 5 | Zen Protocol | Trading & Investing | 46.4 | December 30, 2017 | n/a |

| 6 | MCAP | Trading & Investing | 45.2 | May 7, 2017 | n/a |

| 7 | Enigma Catalyst | Trading & Investing | 45 | September 11, 2017 | 3.09x |

| 8 | Loopring | Trading & Investing | 45 | August 16, 2017 | n/a |

| 9 | Spice Venture Capital | Trading & Investing | 41.3 | March 3, 2018 | n/a |

| 10 | Crypto20 | Trading & Investing | 38.2 | November 30, 2017 | 1.27x |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in March 2018 are highlighted in red.

At present, the QASH project has the largest amount of funds collected in the Trading & Investing category. The Enigma Catalyst ICO has the best token performance indicator among the top 10 projects. Its market capitalization currently exceeds $135 million.

Figure 1.4. Top 10 ICOs in terms of the amount of funds collected, Trading & Investing category

Table 1.7. Top 10 ICOs in terms of the amount of funds collected, Gaming & VR category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

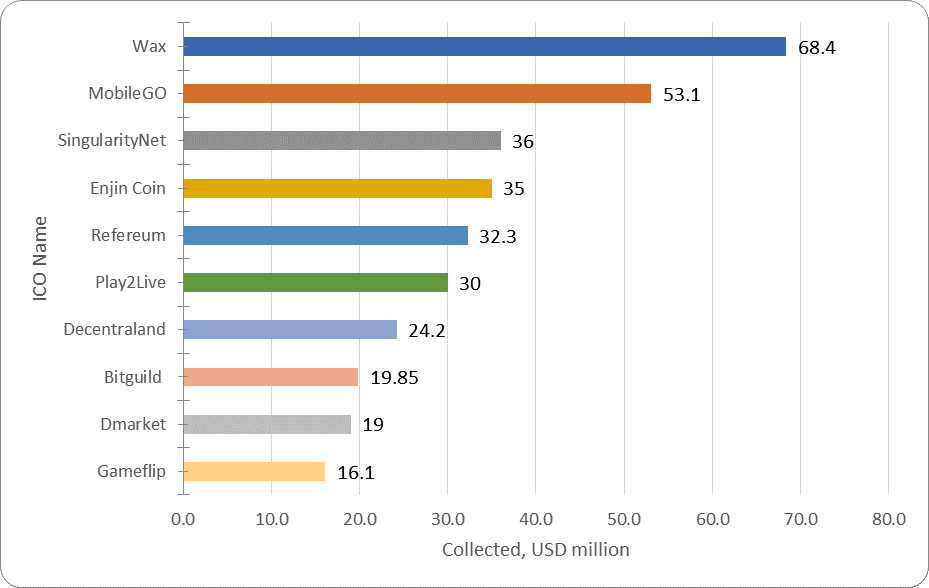

| 1 | Wax | Gaming & VR | 68.4 | November 29, 2017 | 2.36x |

| 2 | MobileGO | Gaming & VR | 53.1 | May 25, 2017 | 0.55x |

| 3 | SingularityNet | Gaming & VR | 36 | December 22, 2017 | 1.93x |

| 4 | Enjin Coin | Gaming & VR | 35.0 | November 1, 2017 | 2.23x |

| 5 | Refereum | Gaming & VR | 32.3 | February 8, 2018 | 0.49x |

| 6 | Play2Live | Gaming & VR | 30.0 | March 14, 2018 | n/a |

| 7 | Decentraland | Gaming & VR | 24.2 | August 17, 2017 | 3.14x |

| 8 | BitGuild | Gaming & VR | 19.9 | April 6, 2018 | n/a |

| 9 | Dmarket | Gaming & VR | 19.03 | December 1, 2017 | 1.46x |

| 10 | Gameflip | Gaming & VR | 16.1 | January 5, 2018 | n/a |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in March-April 2018 are highlighted in red.

Most of the projects in this category have a token performance indicator of more than 1. The Decentraland project has the best token performance indicator. Its market capitalization currently exceeds $93 million, and its token performance indicator equals 3.14x.

Figure 1.5.Top 10 ICOs in terms of the amount of funds collected, Gaming & VR category

During the analyzed period (April 9-15, 2018) at least 21 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected exceeding $155 million. Last week’s leader was the MOOVER project, which collected $50.9 million. The total amount of funds collected by a number of ICOs failed to reach even $100,000 (the information for some projects is still being finalized).

Annex – Glossary

| Key terms | Definition |

| Initial coin offering, ICO | A form of collective support of innovative technological projects, a type of presale and attracting of new backers through initial coin offerings (token sales) to future holders in the form of blockchain-based cryptocurrencies and digital assets. |

| Token sale price

Current token price |

Token sale price during the ICO.

Current token price. |

| Token reward | Token performance (current token price ÷ token sale price during the ICO), i.e. the reward per $1 spent on buying tokens. |

| Token return | (see token reward) Performance of funds spent on buying tokens or the ratio of the current token price to the token sale price, i.e. performance of $1 spent on buying tokens during the token sale, if listed on an exchange for USD. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | Alternative performance indicator of funds spent on buying tokens during the ICO or the ratio of the current ETH price to its price at the start of the token sale, i.e. if instead of buying tokens $1 was spent on buying ETH at its rate at the start of the token sale and then it was sold at the current ETH price. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the above: Alternative performance indicator of funds spent on buying tokens during the token sale, i.e. if instead of buying tokens $1 was spent on buying BTC at its price at the start of the token sale and then it was sold at the current BTC price. |

| Token/ETH reward | This ratio describes a market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying ETH. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on ETH. |

| Token/BTC reward | This ratio describes the market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying BTC. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on BTC. |

The post appeared first on .

Information as of April 16, 2018

This report was created by:

Professor , Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox

This report presents data on the cryptocurrency market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that have taken place in April 2018, including over the past week (April 9-15, 2018).

1. General cryptocurrency and digital assets market analysis (by week, month, quarter). Market trends.

1.1 General cryptocurrency and digital assets market analysis (by week, month).

Table 1.1. Trends in capitalization of the cryptocurrency market and main cryptocurrencies from January 1, 2018, to April 15, 2018*

| Parameter | 1-Jan-18 | 1-Feb-18 | MoM, % | 1-Mar-18 | MoM, % | 1-Apr-18 | MoM, % | 8-Apr-18 | DoD, % | 15-Apr-18 | DoD, % | |

| 1 | Total market capitalization, USD billion | 612.9 | 517.2 | -15.6% | 440.0 | -14.9% | 263.9 | -40.0% | 260.0 | -1.5% | 319.0 | 22.7% |

| 2 | Altcoin market capitalization, USD billion | 376.2 | 344.8 | -8.3% | 264.6 | -23.3% | 145.2 | -45.1% | 142.6 | -1.8% | 183.2 | 28.5% |

| Altcoin dominance, % | 61.4% | 66.7% | – | 60.1% | – | 55.0% | – | 54.8% | – | 57.4% | – | |

| 3 | bitcoin price, $ | 14 112.2 | 10 237.3 | -27.5% | 10 385.0 | 1.4% | 7 003.1 | -32.6% | 6 920.0 | -1.2% | 7 999.3 | 15.6% |

| bitcoin market capitalization, USD billion | 236.7 | 172.4 | -27.2% | 175.4 | 1.8% | 118.7 | -32.3% | 117.4 | -1.1% | 135.8 | 15.7% | |

| bitcoin dominance, % | 38.6% | 33.3% | – | 39.9% | – | 45.0% | – | 45.2% | – | 42.6% | – | |

| 4 | Ethereum price, $ | 755.8 | 1 119.4 | 48.1% | 856.0 | -23.5% | 397.3 | -53.6% | 385.7 | -2.9% | 502.9 | 30.4% |

| Ethereum market capitalization, USD billion | 73.1 | 109.0 | 49.1% | 83.8 | -23.1% | 39.1 | -53.3% | 38.1 | -2.8% | 49.7 | 30.6% | |

| Ethereum dominance, % | 11.9% | 21.1% | – | 19.0% | – | 14.8% | – | 14.6% | – | 15.6% | – | |

| 5 | bitcoin Cash price, $ | 2 534.8 | 1 491.1 | -41.2% | 1 204.8 | -19.2% | 688.0 | -42.9% | 640.9 | -6.8% | 741.9 | 15.8% |

| bitcoin Cash market capitalization, USD billion | 42.8 | 25.3 | -41.0% | 20.5 | -19.0% | 11.7 | -42.7% | 10.9 | -6.8% | 12.7 | 15.8% | |

| bitcoin Cash dominance, % | 7.0% | 4.9% | – | 4.7% | – | 4.4% | – | 4.2% | – | 4.0% | – | |

| 6 | Litecoin price, $ | 231.7 | 163.7 | -29.3% | 203.1 | 24.1% | 116.9 | -42.4% | 116.3 | -0.5% | 126.7 | 8.9% |

| Litecoin market capitalization, USD billion | 12.6 | 9.0 | -28.8% | 11.3 | 25.0% | 6.5 | -42.0% | 6.5 | -0.3% | 7.1 | 9.1% | |

| Litecoin dominance, % | 2.1% | 1.7% | – | 2.6% | – | 2.5% | – | 2.5% | – | 2.2% | – | |

| 7 | Volume (24h) 4 crypto, USD billion | 15.7 | 17.3 | 10.2% | 10.1 | -41.4% | 6.4 | -36.9% | 4.9 | -22.9% | 7.9 | 60.2% |

| Market cap 4 crypto, USD billion | 441.6 | 351.6 | -20.4% | 315.1 | -10.4% | 189.7 | -39.8% | 185.5 | -2.2% | 223.0 | 20.2% | |

| ZAK-4 Crypto index | 3.6% | 4.9% | – | 3.2% | – | 3.4% | – | 2.7% | – | 3.5% | – | |

| 4 crypto dominance, % | 72.0% | 68.0% | – | 71.6% | – | 71.9% | – | 71.3% | – | 69.9% | – | |

| 8 | Volume (24h) 8 crypto, USD billion | 17.2 | 19.0 | 10.2% | 11.3 | -40.3% | 7.2 | -36.3% | 5.4 | -25.7% | 9.3 | 74.0% |

| Market cap 8 crypto, USD billion | 488.6 | 393.4 | -19.5% | 349.3 | -11.2% | 208.7 | -40.2% | 204.2 | -2.2% | 246.8 | 20.9% | |

| ZAK-8 Crypto index | 3.5% | 4.8% | – | 3.2% | – | 3.5% | – | 2.6% | – | 3.8% | – | |

| 8 crypto dominance, % | 79.7% | 76.1% | – | 79.4% | – | 79.1% | – | 78.5% | – | 77.4% | – |

* Data as of April 15, 2018 (all figures calculated at 03:00 UTC)

** Since December 1, 2017, the ZAK-4 index has been calculated using the cryptocurrencies bitcoin, Ethereum, Ripple, and bitcoin Cash.

*** When calculating the ZAK-8 index, the cryptocurrencies with the largest capitalization are used. At present (April 15, 2018), the cryptocurrencies bitcoin, Ethereum, Ripple, bitcoin Cash, Cardano, Litecoin, Stellar, and EOS are used to calculate the ZAK-8 index.

Data source: coinmarketcap.com,smithandcrown.com

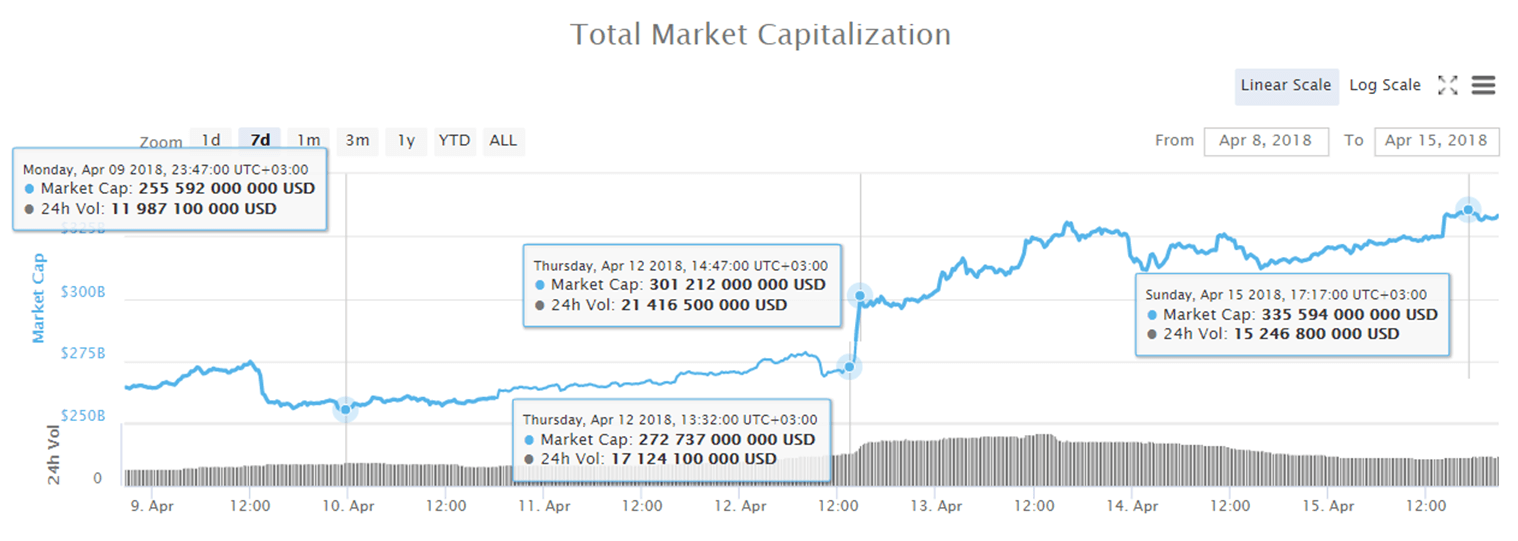

Over the past week (April 9-15, 2018) cryptocurrency market capitalization increased, and equaled $319 billion as of 03:00 UTC on April 15 (see Table 1.1, fig. 1). Two-thirds of capitalization growth during the week was due to the growth of altcoins (+$40 billion) and 1/3 was due to the growth of bitcoin (nearly +$20 billion).

The dominance of the four and eight largest cryptocurrencies as of 03:00 UTC on April 15, 2018, equaled 69.9% and 77.4%, respectively, with bitcoin dominance decreasing to 42.6% (see Table 1.1). The fairly robust growth last week in cryptocurrencies from the second (top 100) and third (top 500) echelons by capitalization should be noted. For example, Mithril (+242.17%), BABB (+235.36%), Matchpool (127.42%), Golem (110.29%).

The fluctuation in capitalization over the week equaled $80 billion, from $255.6 billion to $335.6 billion (fig. 1), with growth skyrocketing on April 12 by nearly $30 billion in one hour (including due to growth in the bitcoin price by $16 billion).

Figure 1. Cryptocurrency market capitalization since April 9, 2018

Data source: coinmarketcap.com

During the period from April 9-15, 2018, the price change of cryptocurrencies in the top 500 ranged from -34.75% (Mooncoin) to +1,335.59% (Greencoin). However, the 24-hour trading volume of Greencoin fluctuated this week between $100 and $10,000. Due to the low trading volumes, the price of this currency is extremely volatile. The price of all the cryptocurrencies and digital assets in the top 100 showed growth, and only 22 of the top 500 currencies showed a decreased in price. Overall, cryptocurrency market capitalization increased by approximately 24%, or by $60 billion, over the week.

This past week the number of cryptocurrencies with a capitalization of more than $1 billion increased from 19 to 23, with the change in their prices ranging (not including Tether) from +7.17% (Binance Coin) to +53.13% (IOTA).

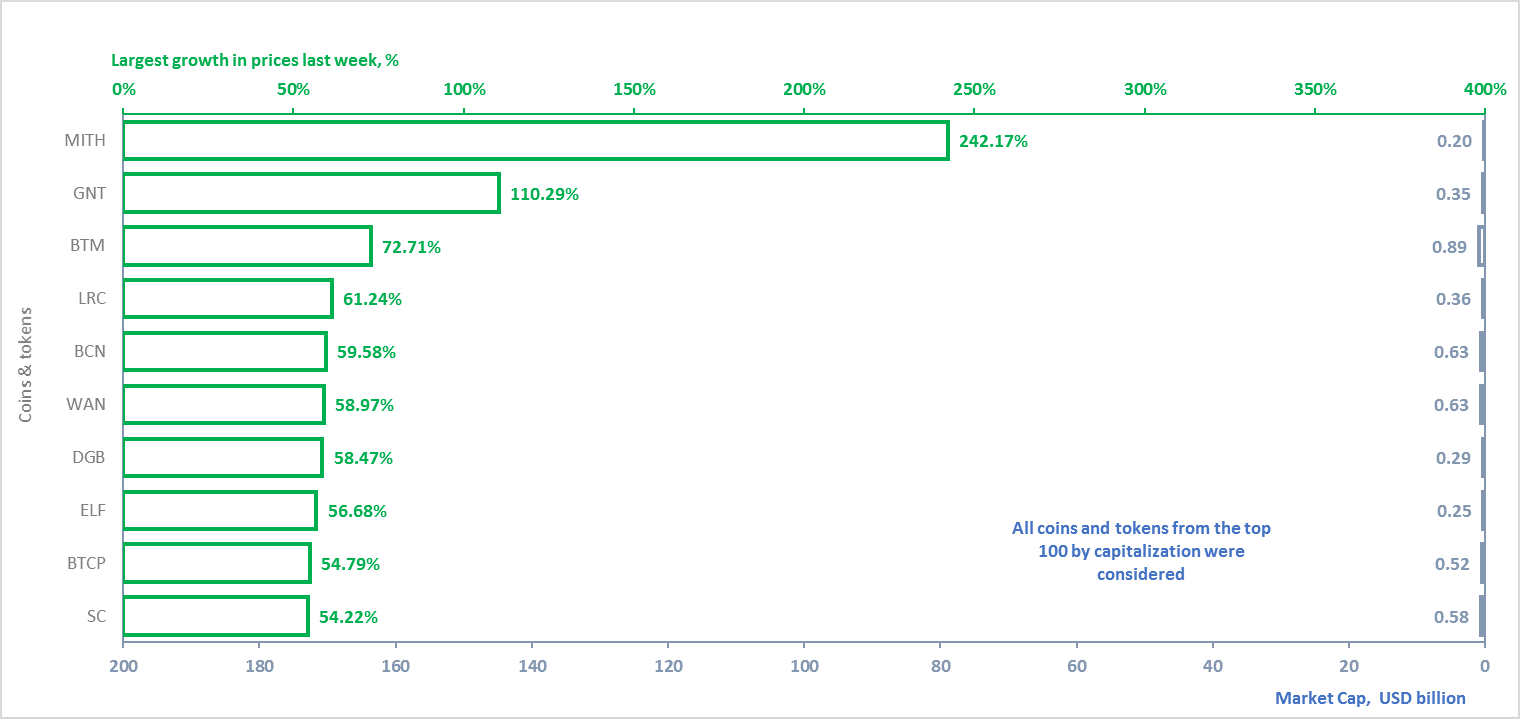

The coins and tokens from the top 100 that demonstrated the largest growth in prices are given in fig. 2.

The rise and fall of cryptocurrency prices over the past week (April 9-15, 2018)

The prices of some cryptocurrencies may fluctuate from -50% to +50% over the course of a single day. Therefore, when analyzing cryptocurrency price trends, it is advisable to use their average daily amounts on various cryptoexchanges.

Below we consider the 10 cryptocurrencies that demonstrated the most significant change in price over the past week (fig. 2-3). In this regard, only those coins and tokens included in the top 100 in terms of market capitalization (according to the data of coinmarketcap.com) were considered.

Figure 2. Largest growth in prices over the past week

Data source: coinmarketcap.com

The change in price was calculated based on average daily data

Tables 1.2 and 1.3 show the possible factors or events that might have influenced the fluctuation in prices for certain cryptocurrencies. Table 1.4 shows the possible factors or events that might have influenced the cryptocurrency market in general.

Table 1.2. Factors or events that might have led to a growth in cryptocurrency prices over the past week

| № | Coins and tokens | Symbol | Price growth over the week, % | Average price in $ on April 15, 2018 | Market capitalization, USD billion | Factors or events that might have led to a growth in cryptocurrency prices over the past week |

| 1 | Mithril | MITH | 242.17% | $0.644138 | 0.20 | The price of Mithril appreciated by 240% this week, primarily due to the news on its listing on the major cryptoexchange BitHumb ().

Golem’s price increased by more than 100% on April 13, after the publication of news on the launch of the product’s main network (). Bytom also grew due to positive news items this week. The price increased after the announcement on April 9 that the public release of the algorithm will take place in five days (). The Loopring price appreciated by 60% on the back of favorable news concerning its listing on the UpCoin cryptoexchange (). This week was also successful for Bytecoin, which launched its Asian community on Wednesday (). The best news for WanChain this week was its listing on the major cryptoexchange KuCoin (). Early this week DigiByte began its new bounty campaign, which could have led to the buzz around the coin and helped the price to jump by 60% (). The AELF price also increased due to its listing on the large exchange BitHumb (). bitcoin Private released SegWit support this week, which raised the public’s interest and helped the price to grow (). The week was also positive for SiaCoin, with one of the most important favorable news items being the expansion of the supply of tokenized securities on the French and Israeli markets (). |

| 2 | Golem | GNT | 110.29% | $0.413998 | 0.35 | |

| 3 | Bytom | BTM | 72.71% | $0.898193 | 0.89 | |

| 4 | Loopring | LRC | 61.24% | $0.632397 | 0.36 | |

| 5 | Bytecoin | BCN | 59.58% | $0.003424 | 0.63 | |

| 6 | Wanchain | WAN | 58.97% | $5.91 | 0.63 | |

| 7 | DigiByte | DGB | 58.47% | $0.029114 | 0.29 | |

| 8 | aelf | ELF | 56.68% | $0.994346 | 0.25 | |

| 9 | bitcoin Private | BTCP | 54.79% | $25.26 | 0.52 | |

| 10 | Siacoin | SC | 54.22% | $0.017187 | 0.58 |

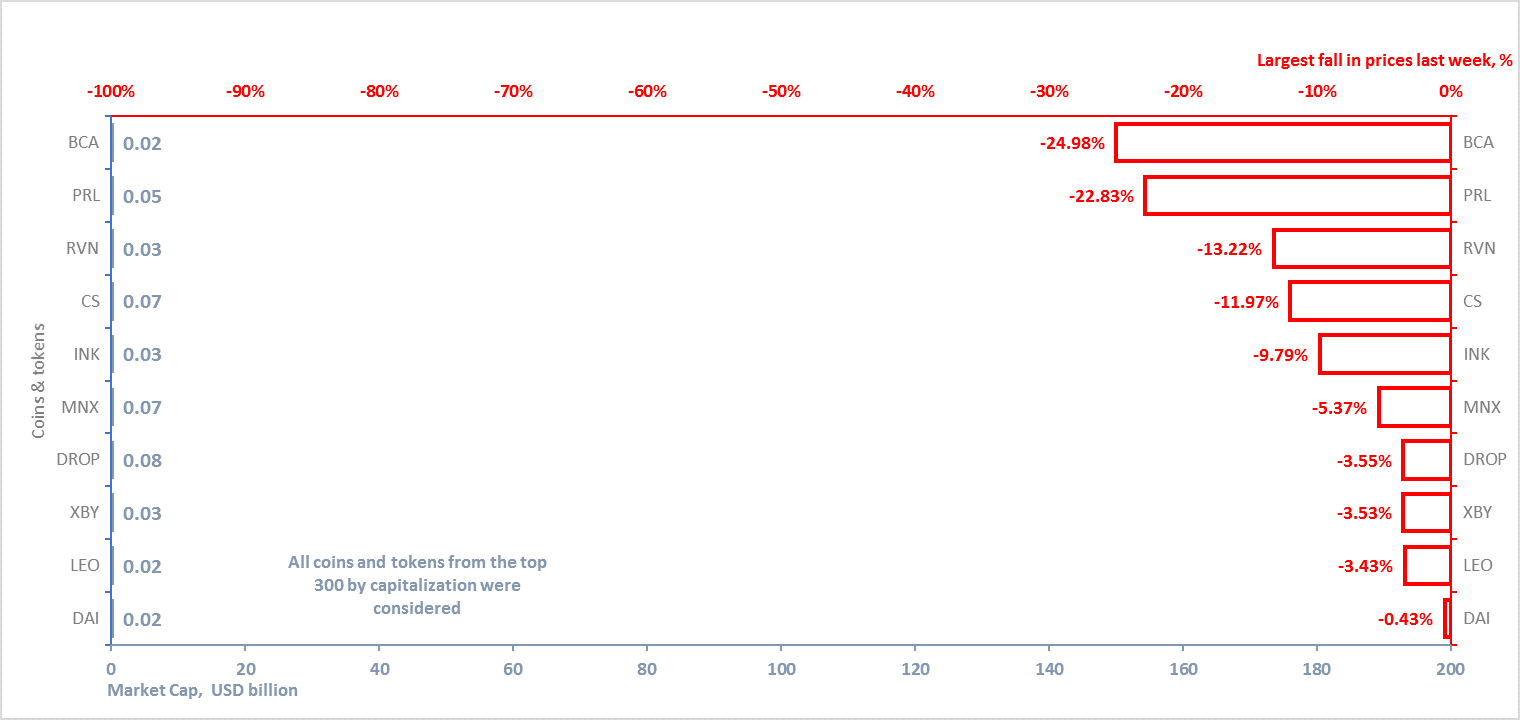

A depreciation in price was seen for 22 coins and tokens from the top 500 cryptocurrencies and digital assets by capitalization last week. The ten cryptocurrencies from the top 300 that experienced the most noticeable drops in price are shown in fig. 3 (Table 1.3)

Figure 3. Largest fall in prices over the past week

Table 1.3. Factors or events that might have led to a fall in cryptocurrency prices over the past week

| № | Coins and tokens | Symbol | Fall in price over the week, % | Average price in $ on April 15, 2018 | Market capitalization, USD billion | Factors or events that might have led to a fall in cryptocurrency prices over the past week |

| 1 | bitcoin Atom | BCA | 24.98% | $1.28 | 0.02 | This week only the price of bitcoin Atom and Oyster depreciated by more than 15%. In the case of bitcoin Atom, this movement against market trends can be explained by its heightened price volatility due to its small 24-hour trading volume, which did not exceed $15,000. As for Oysters, on April 14 market participants began to sell the coin in connection with the completion of the release of SHL tokens. Everyone who had Oysters coins before April 14 were entitled to receive SHL tokens at a rate of 1 to 1 (). All the other coins depreciated by less than 14%, which can be explained by market volatility. You will recall that Ravencoin is a cryptocurrency based on the X16R algorithm, the main purpose of which is to transfer assets through blockchain.

Credits (CS) is a digital token for the new financial ecosystem that makes it possible to use smart contracts based on blockchain technology. Ink is a decentralized solution for the problem of intellectual and other property in creative industries. MinexCoin is the digital token of a global payment system consisting of MinexBank, MinexPlatform, MinexMarket and MinexExchange. The cryptocurrency Dropil (DROP) is a token to be used within a cryptocurrency investment platform. The idea behind the project is anonymous investment in cryptocurrencies with minimum risks. The XBY cryptocurrency is the digital coin of a platform for development of decentralized XTRABYTES applications. The DAI cryptocurrency is the first project developed on the Maker platform and represents a stable virtual currency (also sometimes referred to as a stablecoin). |

| 2 | Oyster | PRL | 22.83% | $0.623089 | 0.05 | |

| 3 | Ravencoin | RVN | 13.22% | $0.035833 | 0.03 | |

| 4 | Credits | CS | 11.97% | $0.491327 | 0.07 | |

| 5 | Ink | INK | 9.79% | $0.056754 | 0.03 | |

| 6 | MinexCoin | MNX | 5.37% | $20.41 | 0.07 | |

| 7 | Dropil | DROP | 3.55% | $0.004168 | 0.08 | |

| 8 | XTRABYTES | XBY | 3.53% | $0.076300 | 0.03 | |

| 9 | LEOcoin | LEO | 3.43% | $0.243874 | 0.02 | |

| 10 | Dai | DAI | 0.43% | $0.999297 | 0.02 |

Data source: coinmarketcap.com

The change in price was calculated based on average daily data

Table 1.4 shows events that took place from April 9-15, 2018, that had an impact on both the prices of the dominant cryptocurrencies and the market in general, with an indication of their nature and type of impact.

Table 1.4. Key events of the week having an influence on cryptocurrency prices, April 9-15, 2018

| № | Factors and events

(link to source) |

Date of news | Description | Nature of impact | Type of impact |

| 1. | $1.6 Billion Chinese Fund Launches in Support of Blockchain Startups [source: ] | April 9, 2018 | Xiongan Global Blockchain Innovation Fund will contribute to promising Chinese startups working with blockchain technology. One of the founders of the Fund was the Yuhang District Government. | Market ⇑

|

Favorable |

| 2. | ICE CEO Won’t ‘Rule Out’ Crypto Futures Launch [source: ] | April 9, 2018 | ICE chief executive Jeffrey Sprecher announced that cryptocurrency-based futures contracts are still in their “early days” as a financial tool, but “the trend can’t be ignored”. | Market ⇑

|

Favorable |

| 3. | Pakistan’s Central Bank Prohibits Crypto Dealings with a Circular [source: ] | April 11, 2018 | The Central Bank issued a circular that prohibits financial institutions from “processing, using, trading, holding, transferring, and investing” in digital coins and tokens. | Market ⇓ | Unfavorable |

| 4. | 22 European Countries Enter into a Partnership to Boost Blockchain [source: ] | April 11, 2018 | A group of countries, including the United Kingdom, France, Germany, Norway, Spain and Netherlands, have signed a declaration on creating a single digital market and on partnership in the blockchain industry. | Market ⇑

|

Favorable |

| 5. | bitcoin Price Exceeds $8000

Coinmarketcap.com |

April 13, 2018 | Yesterday the price of the cryptocurrency jumped by more than $1000 in just 20 minutes on several exchanges. So far, no clear explanation for this sudden ascent has been found. | Market ⇑

|

Favorable |

| 6. | bitcoin Market Opens to 1.6 Billion Muslims as Cryptocurrency Declared Halal Under Islamic Law [source: ] | April 13, 2018 | Mufti Muhammad Abu-Bakar, a Sharia law advisor of the Indonesian crowdfunding platform Blossom Finance, has published a document that, in essence, officially permits Muslims to use bitcoin. | Market ⇑

|

Favorable |

To analyze trading activity on cryptocurrency exchanges, the ZAK-n Crypto index is calculated (see the Glossary). The values of the ZAK-4 Crypto and ZAK-8 Crypto indices are presented in Tables 1.1, 1.5.a, and 1.5.b. In early April the 24-hour trading volumes (Volume 24h) for the four dominant cryptocurrencies (bitcoin, Ethereum, bitcoin Cash, Ripple) equaled from $4.9 billion to $13.2 billion (Table 1.5.a). The value of the daily ZAK-4 Crypto fluctuated from 2.7% to 6.8% of capitalization. The highest trading volume was seen on April 12-13.

Table 1.5.a. Daily ZAK-4 Crypto index calculation (from April 1, 2018, to April 15, 2018)

| Crypto | bitcoin (BTC) | Ethereum (ETH) | bitcoin Cash (BCH) | Ripple (XRP) | 4 Crypto | ||||||||||

| Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Volume (24h) 4 crypto | Market cap 4 crypto | ZAK-4 Crypto index | |

| Date | $ | USD billion | USD billion | $ | USD billion | USD billion | $ | USD billion | USD billion | $ | USD billion | USD billion | USD billion | USD billion | % |

| Apr 15, 2018 | 7 999 | 5.2 | 135.8 | 503 | 1.7 | 49.7 | 742 | 0.3 | 12.7 | 0.63 | 0.6 | 24.8 | 7.9 | 223.0 | 3.5% |

| Apr 14, 2018 | 7 875 | 5.2 | 133.7 | 493 | 1.5 | 48.7 | 739 | 0.3 | 12.6 | 0.64 | 0.6 | 24.9 | 7.6 | 219.9 | 3.5% |

| Apr 13, 2018 | 7 901 | 7.8 | 134.1 | 493 | 2.4 | 48.7 | 736 | 0.4 | 12.6 | 0.63 | 1.2 | 24.7 | 11.8 | 220.0 | 5.4% |

| Apr 12, 2018 | 6 955 | 8.9 | 118.0 | 430 | 2.5 | 42.5 | 666 | 0.4 | 11.4 | 0.54 | 1.3 | 21.1 | 13.2 | 193.0 | 6.8% |

| Apr 11, 2018 | 6 843 | 4.6 | 116.1 | 415 | 1.4 | 41.0 | 649 | 0.3 | 11.1 | 0.49 | 0.3 | 19.3 | 6.7 | 187.4 | 3.6% |

| Apr 10, 2018 | 6 795 | 4.3 | 115.3 | 399 | 1.2 | 39.4 | 638 | 0.2 | 10.9 | 0.49 | 0.2 | 19.2 | 5.8 | 184.9 | 3.2% |

| Apr 9, 2018 | 7 044 | 4.9 | 119.5 | 401 | 1.5 | 39.6 | 656 | 0.3 | 11.2 | 0.50 | 0.3 | 19.6 | 6.9 | 189.9 | 3.6% |

| Apr 8, 2018 | 6 920 | 3.7 | 117.4 | 386 | 0.9 | 38.1 | 641 | 0.2 | 10.9 | 0.49 | 0.1 | 19.1 | 4.9 | 185.5 | 2.7% |

| Apr 7, 2018 | 6 631 | 4.0 | 112.5 | 370 | 1.0 | 36.5 | 611 | 0.2 | 10.4 | 0.48 | 0.2 | 18.6 | 5.4 | 178.1 | 3.0% |

| Apr 6, 2018 | 6 816 | 3.8 | 115.6 | 383 | 1.0 | 37.8 | 642 | 0.2 | 10.9 | 0.49 | 0.2 | 19.3 | 5.2 | 183.6 | 2.8% |

| Apr 5, 2018 | 6 849 | 5.6 | 116.1 | 380 | 1.2 | 37.5 | 649 | 0.2 | 11.1 | 0.50 | 0.4 | 19.6 | 7.5 | 184.3 | 4.0% |

| Apr 4, 2018 | 7 456 | 4.9 | 126.4 | 416 | 1.3 | 41.1 | 710 | 0.3 | 12.1 | 0.55 | 0.4 | 21.7 | 6.9 | 201.3 | 3.4% |

| Apr 3, 2018 | 7 102 | 5.5 | 120.4 | 387 | 1.4 | 38.2 | 664 | 0.3 | 11.3 | 0.50 | 0.6 | 19.6 | 7.7 | 189.5 | 4.1% |

| Apr 2, 2018 | 6 845 | 4.3 | 116.0 | 380 | 1.1 | 37.4 | 644 | 0.3 | 11.0 | 0.49 | 0.3 | 19.0 | 6.0 | 183.5 | 3.3% |

| Apr 1, 2018 | 7 003 | 4.5 | 118.7 | 397 | 1.3 | 39.1 | 688 | 0.3 | 11.7 | 0.51 | 0.3 | 20.1 | 6.4 | 189.7 | 3.4% |

* Data as of April 15, 2018, 03:00 UTC

** Data source: coinmarketcap.com

The 24-hour trading volumes (Volume 24h) for the eight dominant cryptocurrencies (bitcoin, Ethereum, bitcoin Cash, Ripple, Litecoin, Stellar, EOS, and Cardano) equaled $9.3 billion by the end of last week (Table 1.5.b), i.e. 3.8% of their market capitalization, which attests to the gradual resumption of activity on cryptoexchanges. The ZAK-4 Crypto and ZAK-8 Crypto indices are considered in more detail in Tables 1.5.a and 1.5.b.

Table 1.5.b. Daily ZAK-8 Crypto index calculation (continuation of Table 1.5.а)

| Crypto | Stellar (XLM) | Cardano (ADA) | EOS (EOS) | Litecoin (LTC) | 8 Crypto | ||||||||||

| Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Volume (24h) | Market cap | ZAK-8 Crypto index | |

| Date | $ | USD billion | USD billion | $ | USD billion | USD billion | $ | USD billion | USD billion | $ | USD billion | USD billion | USD billion | USD billion | % |

| Apr 15, 2018 | 0.25 | 0.13 | 4.7 | 0.201 | 0.17 | 5.2 | 8.6 | 0.86 | 6.8 | 127 | 0.27 | 7.1 | 9.3 | 246.8 | 3.8% |

| Apr 14, 2018 | 0.25 | 0.04 | 4.6 | 0.199 | 0.11 | 5.2 | 8.8 | 0.81 | 6.9 | 125 | 0.26 | 7.0 | 8.8 | 243.5 | 3.6% |

| Apr 13, 2018 | 0.24 | 0.11 | 4.5 | 0.212 | 0.23 | 5.5 | 8.7 | 0.94 | 6.9 | 129 | 0.46 | 7.2 | 13.6 | 244.1 | 5.6% |

| Apr 12, 2018 | 0.21 | 0.10 | 3.9 | 0.167 | 0.49 | 4.3 | 8.5 | 1.72 | 6.7 | 118 | 0.59 | 6.6 | 16.1 | 214.5 | 7.5% |

| Apr 11, 2018 | 0.20 | 0.04 | 3.7 | 0.157 | 0.09 | 4.1 | 6.0 | 1.82 | 4.7 | 114 | 0.23 | 6.4 | 8.9 | 206.3 | 4.3% |

| Apr 10, 2018 | 0.20 | 0.03 | 3.7 | 0.153 | 0.06 | 4.0 | 5.9 | 0.23 | 4.6 | 115 | 0.20 | 6.5 | 6.4 | 203.5 | 3.1% |

| Apr 9, 2018 | 0.21 | 0.04 | 3.8 | 0.157 | 0.09 | 4.1 | 6.0 | 0.23 | 4.7 | 118 | 0.26 | 6.6 | 7.5 | 209.0 | 3.6% |

| Apr 8, 2018 | 0.20 | 0.02 | 3.7 | 0.149 | 0.05 | 3.9 | 5.9 | 0.17 | 4.6 | 116 | 0.19 | 6.5 | 5.4 | 204.2 | 2.6% |

| Apr 7, 2018 | 0.19 | 0.03 | 3.6 | 0.145 | 0.05 | 3.8 | 5.9 | 0.22 | 4.6 | 113 | 0.21 | 6.3 | 5.9 | 196.3 | 3.0% |

| Apr 6, 2018 | 0.20 | 0.03 | 3.7 | 0.148 | 0.05 | 3.8 | 6.4 | 0.45 | 4.9 | 119 | 0.23 | 6.6 | 5.9 | 202.7 | 2.9% |

| Apr 5, 2018 | 0.21 | 0.05 | 3.8 | 0.156 | 0.11 | 4.0 | 5.7 | 0.54 | 4.4 | 118 | 0.29 | 6.6 | 8.4 | 203.2 | 4.2% |

| Apr 4, 2018 | 0.23 | 0.06 | 4.3 | 0.171 | 0.15 | 4.4 | 6.1 | 0.26 | 4.7 | 134 | 0.38 | 7.5 | 7.8 | 222.3 | 3.5% |

| Apr 3, 2018 | 0.23 | 0.08 | 4.2 | 0.158 | 0.16 | 4.1 | 5.9 | 0.31 | 4.5 | 120 | 0.38 | 6.7 | 8.7 | 209.0 | 4.1% |

| Apr 2, 2018 | 0.21 | 0.07 | 3.8 | 0.152 | 0.10 | 3.9 | 5.7 | 0.31 | 4.3 | 115 | 0.27 | 6.4 | 6.7 | 202.0 | 3.3% |

| Apr 1, 2018 | 0.21 | 0.04 | 3.9 | 0.157 | 0.10 | 4.1 | 6.0 | 0.40 | 4.6 | 117 | 0.27 | 6.5 | 7.2 | 208.7 | 3.5% |

Table 1.6 gives a list of events, information on which appeared last week, which could impact both the prices of specific cryptocurrencies and the market in general.

Table 1.6. Events that could have an influence on cryptocurrency prices in the future

|

№ |

Factors and events

(link to source) |

Date of news | Description | Nature of impact | Type of impact |

| 1. | Coinbase Plans to Obtain Broker License [source: ] | April 10, 2018 | The American cryptocurrency exchange Coinbase has applied to the US Securities and Exchange Commission (SEC) to receive a license as a broker. This step will help Coinbase to significantly expand its list of supported assets, by adding those tokens that the SEC classifies as securities. | Market ⇑

|

Favorable |

| 2. | UAE Government Launches Blockchain Strategy 2021 [source: ] | April 13, 2018 | Sheikh Mohammed bin Rashid, Vice President and Prime Minister of the UAE, announced the start of the Blockchain Strategy 2021 program, which should make the country a world leader in blockchain. | Market ⇑

|

Favorable |

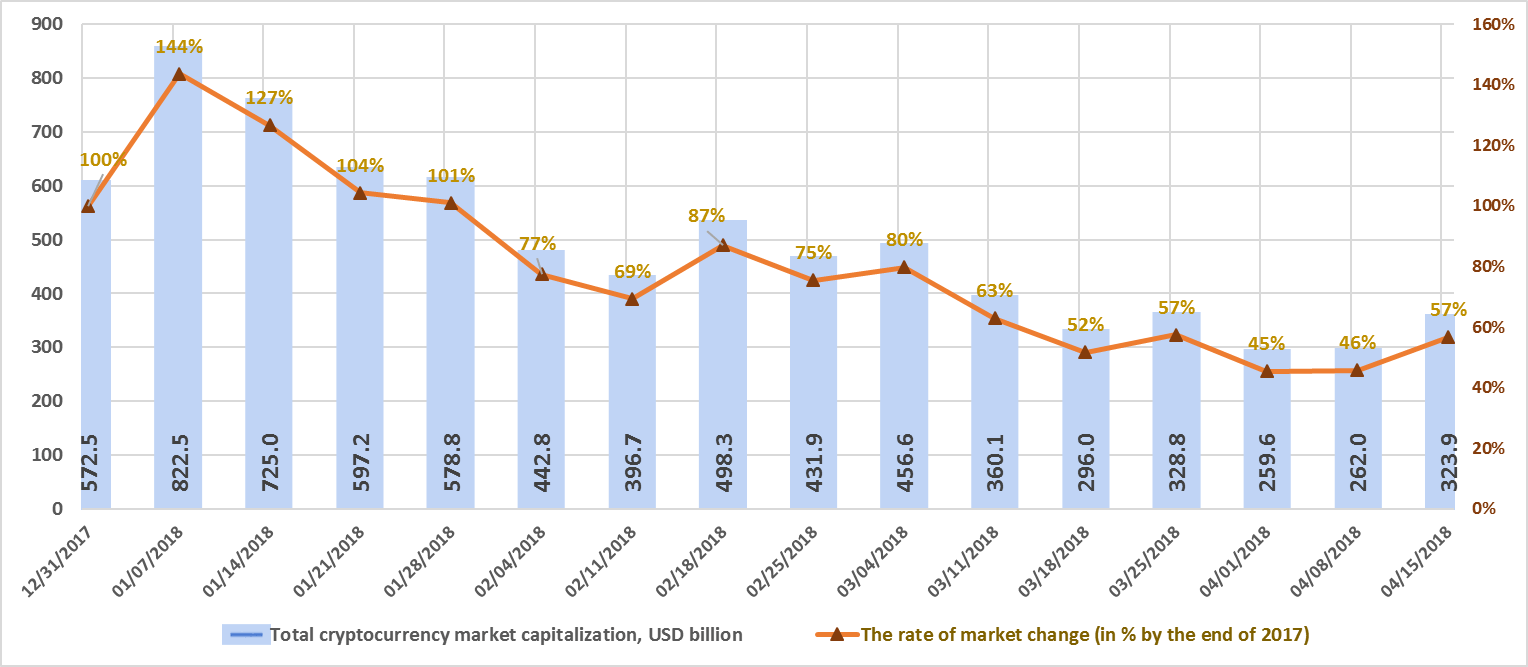

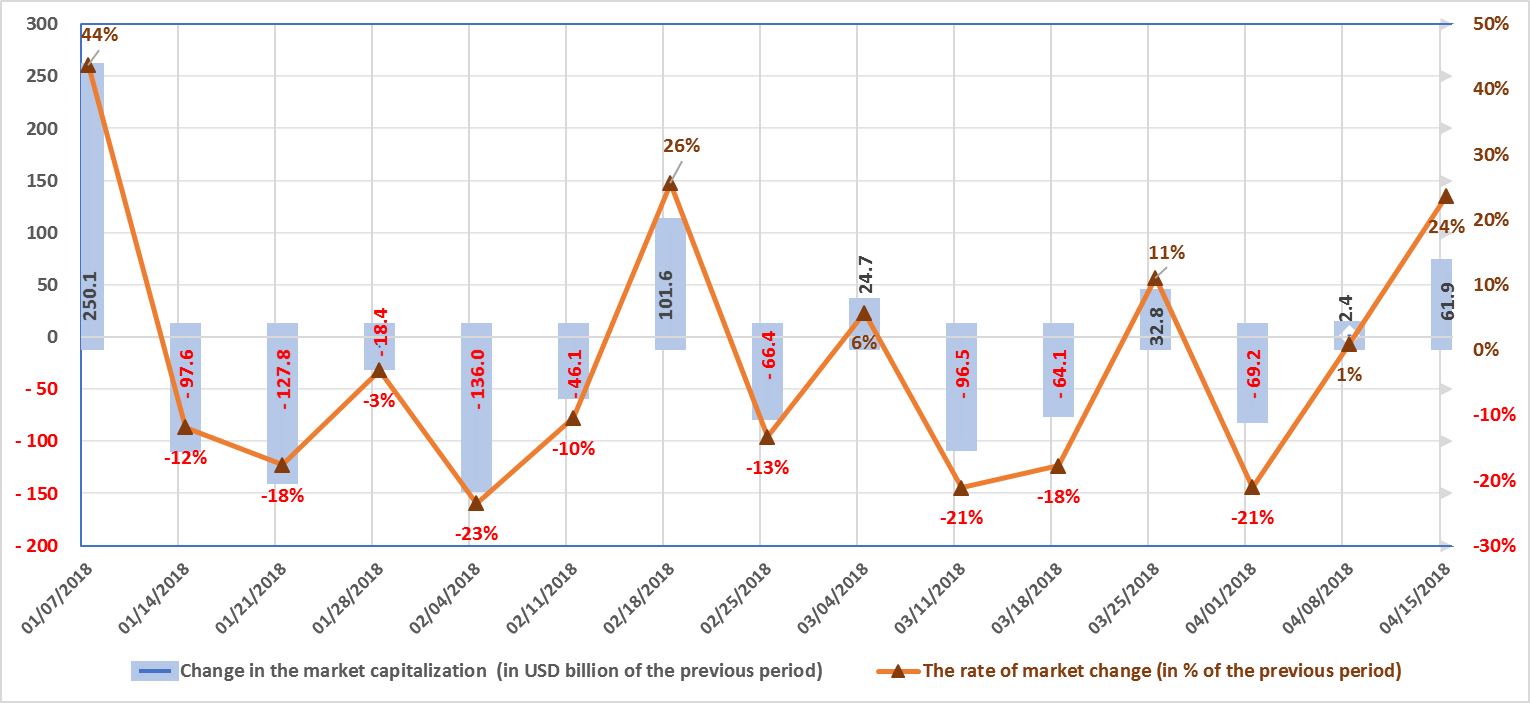

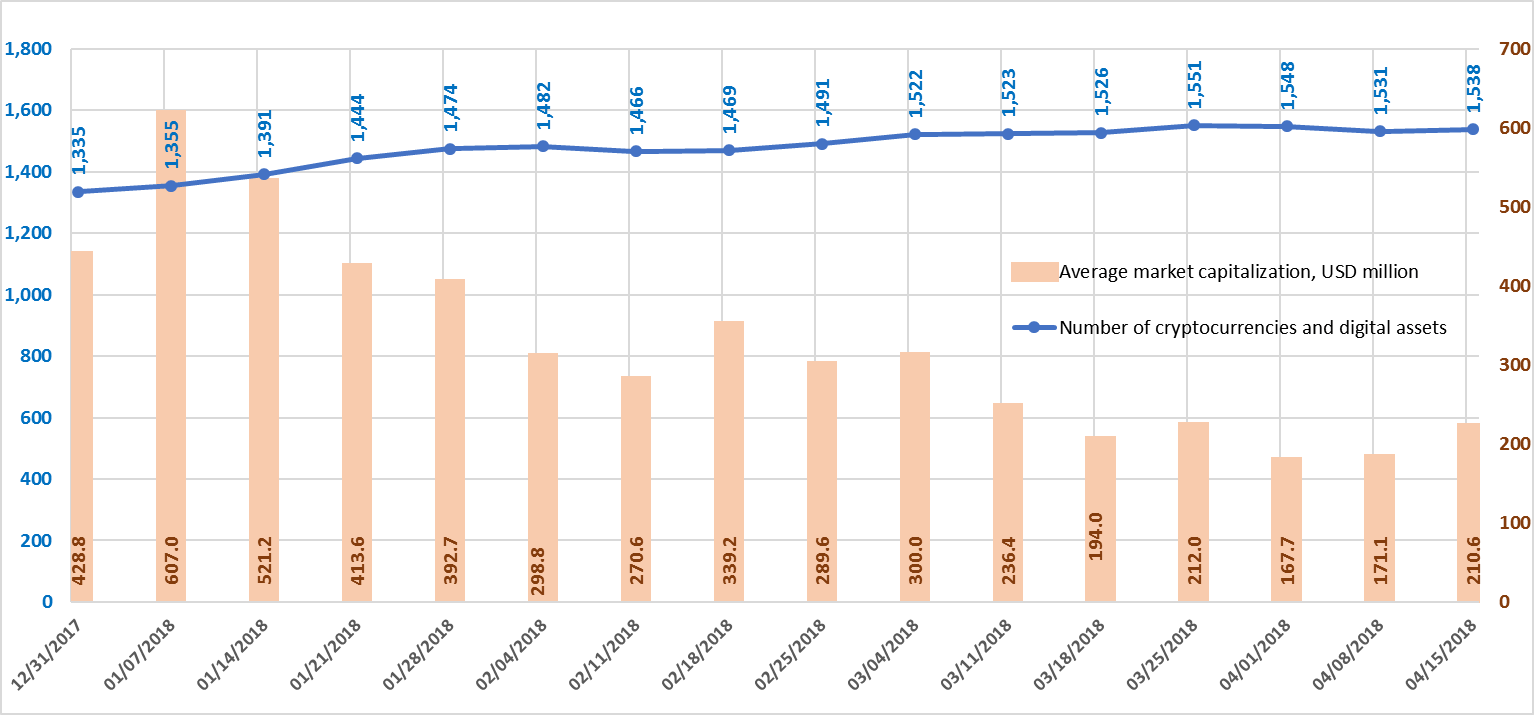

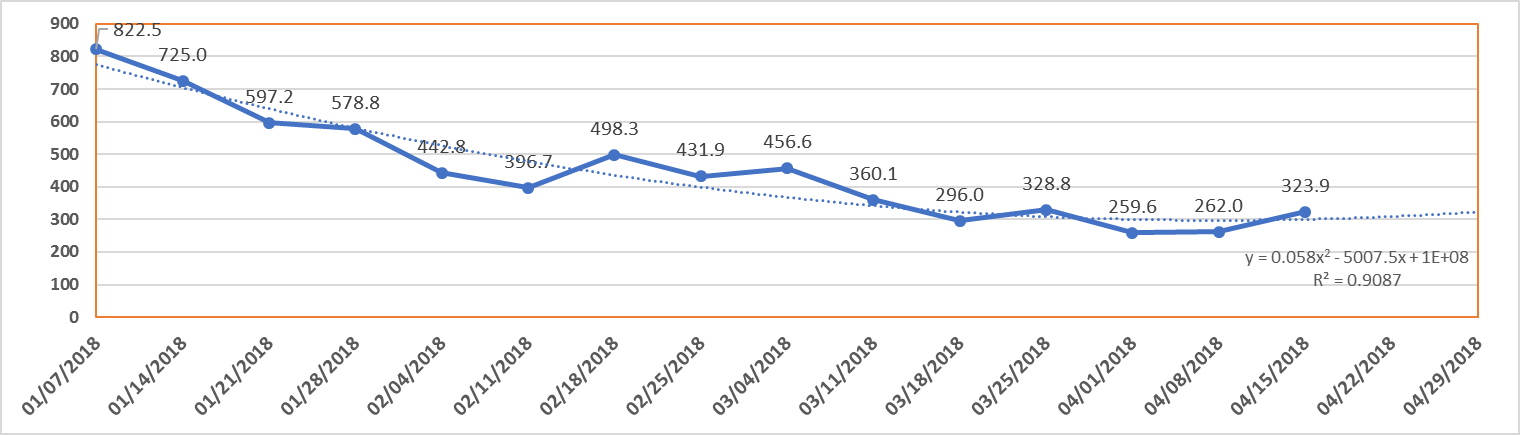

1.2 Market trends

The weekly cryptocurrency and digital asset market trends from December 31, 2017, to April 15, 2018, are presented as graphs (Fig. 1.1-1.5)*.

Table 1.7. Legends and descriptions of the graphs

| Global Figures | Figure** | Description |

| Total cryptocurrency market capitalization, USD million | Fig. 1.1 | This figure shows cryptocurrency and digital asset market capitalization trends from December 31, 2017. |

| The rate of market change (as a % to the beginning of 2017) | Fig. 1.1 | This figure shows the % change in cryptocurrency and digital asset market capitalization compared to December 31, 2017. |

| Change in the market capitalization (in USD million compared to previous period) | Fig. 1.2 | This figure shows the weekly change in USD million (increase or decrease) in cryptocurrency and digital asset market capitalization from December 31, 2017. |

| The rate of market change (as a % compared to the previous period) | Fig. 1.2 | This figure shows the % of weekly change (increase or decrease) in cryptocurrency and digital asset market capitalization from December 31, 2017. |

| Number of cryptocurrencies and digital assets | Fig.1.3 | This figure shows the trends in the increase of the number of cryptocurrencies and digital assets circulating on cryptocurrency exchanges. On January 1, 2017, their number was 617, and as of April 15, 2018, this number had already reached 1,538. |

| Average market capitalization, USD million | Fig. 1.3 | This figure reflects the growth in the average cryptocurrency and digital asset market capitalization from December 31, 2017, i.e. the ratio between the market capitalization of all cryptocurrencies and digital assets and their number. |

| Forecast of total cryptocurrency market capitalization | Fig. 1.4, 1.5 | This figure shows the time trend (forecast) change in cryptocurrency and digital asset market capitalization. |

* Data as of April 15, 2018, 00:00 UTC

** NB! Average daily data are given in the graphs below. For this reason, the figures in the graphs may differ from the data in Table 1.1, where all figures were calculated at 03:00 UTC.

These differences in the values may be significant during periods of high cryptocurrency market volatility.

Data source: coinmarketcap.com

Figure 1.1. Total cryptocurrency market capitalization*

* Average daily data (according to the data of coinmarketcap.com).

Figure 1.1 shows a graph of the weekly cryptocurrency market change from December 31, 2017, to April 15, 2018. Over this period, market capitalization dropped from $572.5 billion to $323.9 billion, i.e. by 57%. Last week (April 9-15, 2018) cryptocurrency market capitalization increased from $262 billion to $323.9 billion (as of April 15, 2018, based on the average figures from coinmarketcap.com).

Figure 1.2. Change in market capitalization

The market is susceptible to sudden and drastic fluctuations. During the first week of January, market capitalization increased by approximately $250 billion, or 44%. The largest weekly fall in the first quarter of 2018 equaled $136 billion, or 23%, during the week of January 28-February 4, 2018.

Nine of the thirteen weeks in the first quarter of 2018 were “in the red”, i.e. capitalization fell based on the results of each of these weeks. The market has grown over the past two weeks, including by $61.9 billion, or 24%, last week (with due account of average daily data, see fig. 1.2).

Figure 1.3. Number of cryptocurrencies and digital assets

Data source: coinmarketcap.com

Since December 31, 2017, the total number of cryptocurrencies and digital assets considered when calculating market capitalization has increased from 1,335 to 1,538. Their number increased by 7 from 1,531 to 1,538 over the past week, and average capitalization equaled $210.6 million. Over the past month, 43 new coins and tokens have appeared on coinmarketcap.com, but it should be noted that a number of other coins and tokens were also excluded from the list.

Figures 1.4 and 1.5. Forecast of total cryptocurrency market capitalization

The process of regulation of cryptocurrencies and ICOs continues to worry millions of traders and token holders. State regulatory policy is being partially adapted based on public demand and is conducted with due account of identified legal violations.

Last week saw the latest hack of a cryptoexchange. According to the of , this time the target of the hacker attack was one of the most well-known Indian cryptoexchanges Coinsecure (cryptocurrency worth $3.5 million was stolen). The Reserve Bank of India issued strict rules for the exchange, use and development of virtual currencies. including BTCXIndia and ETHEXIndia, were forced to shut down trading operations due to increased pressure from the government.

The state regulatory policy in Japan and the USA is also becoming stricter, due to identified cases of theft of financial funds from cryptoexchanges. In , in March the FSA (Financial Services Agency) decided to suspend the work of two cryptocurrency exchanges, FSHO and Bit Station, as a result of audits of cryptocurrency exchanges carried out after the hack of the Coincheck exchange. The regulator also compelled six exchanges to improve their security systems.

A possible sharp increase in regulatory measures is possible in Vietnam due to the events surrounding the lack of payments to investors by the company Modern Tech (according to the information of the payments total around $658 million).

Meanwhile, Switzerland, a country with a large concentration of major banks, is steadily becoming a leader in tolerant International regulation of ICO processes and the use of the main cryptocurrencies.

The government of Malta is also actively creating a supportive legal and technical framework to promote exchange trading and positions itself as the “Island of Blockchain” that is geared toward the digital economy and cryptocurrencies.

The popularity of cryptocurrencies in South Korea is expressed in the active position of the country’s citizens. Last year a petition was filed with the government on overturning the ban on trading in cryptocurrencies in the country, and last week citizens submitted a request on the organization in the country of a “free city,” a zone unencumbered by regulation of cryptocurrencies and blockchain.

As a result, capital, technology and companies are gradually migrating to the countries with friendly laws and conditions for the functioning of the crypto industry.

Annex – Glossary

| Key terms | Definition |

| Market capitalization | Value of an asset calculated based on its current market (exchange) price. This is used to assess the total aggregate value of market instruments, players, and markets. [Source: ]. |

| Cryptocurrency market capitalization | The market value of an individual coin or token circulating on the market. |

| Total cryptocurrency market capitalization | The market capitalization of cryptocurrencies and digital assets, i.e. the aggregate market value of cryptocurrencies and digital assets (coins and tokens) circulating on the market. |

| Dominance | Market share, i.e. the ratio of market capitalization of a particular cryptocurrency (coin, token) to total cryptocurrency market capitalization. Expressed as a %. |

| Not Mineable

|

A coin that is not mineable. The term is used for cryptocurrencies (coins, tokens) which cannot be mined or issued through mining. |

| Pre-mined | A pre-mined coin. The term is used for cryptocurrencies (coins, tokens) which are issued through mining, and a certain number of coins (tokens) have been created and distributed among certain users at the start of the project. |

| The rate of market increase (as a % compared to the beginning of the year) | The rate of market increase (as a % compared to the start of the year), i.e. by how many % points did market capitalization increase compared to the start of the year. |

| The growth rate of the market (as a % to the beginning of the year) | The rate of market growth (as a % compared to the start of the year), i.e. by how many times did market capitalization grow compared to the start of the year. |

| Increase in market capitalization (in USD million compared to the previous period) | Increase in cryptocurrency and digital asset market capitalization (in USD million compared to the previous period), i.e. by how many USD million did market capitalization increase over the period. |

| The rate of market increase (as a % compared to the previous period) | The rate of market increase (as a % compared to the previous period), i.e. by how many % points did market capitalization increase over the period. |

| The market growth rate (as a % compared to the previous period) | The market growth rate (as a % compared to the previous period), i.e. by how many times did market capitalization grow compared to the previous period. |

| Number of cryptocurrencies and digital assets | Number of cryptocurrencies and digital assets. At the beginning of 2018 over 1,300 cryptocurrencies and digital assets (coins and tokens) were circulating on the market. |

| Average market capitalization | Average market capitalization, i.e. the ratio of the market capitalization of all cryptocurrencies and digital assets to their number. |

| ZAK-n Crypto index | The index is calculated as a percentage and represents a ratio between the trading volume (transactions) on cryptocurrency exchanges per day (Volume 24h) for n dominant cryptocurrencies to their total market capitalization.

ZAK-4 Crypto index calculations include four dominant cryptocurrencies with the greatest market capitalization: bitcoin, Ethereum, bitcoin Cash, and Ripple. ZAK-8 Crypto index calculations include the trading volume and market capitalization for eight cryptocurrencies. |

The post appeared first on .

The bitcoin Cash (BCH) network is growing relentlessly as far as infrastructure and development are concerned. So far the decentralized cryptocurrency has gained a lot of support from various exchanges and wallet providers, while other developers are building unique protocols around the BCH chain. On the development side of things there are three pretty useful tools programmers can use to contribute to the BCH environment — ‘Flowee’ the BCH API platform, ‘bitcoinj.cash’ a BCH javascript library, and the ‘Bitbox’ toolkit for bitcoin cash.

Also Read:

Many people often wonder if there are any development APIs and toolkits created for the network so they can help develop some neat platforms on the BCH chain. Right now there are three useful resources for developers who want to build with the bitcoin cash blockchain. The bitcoin cash community is a very open atmosphere with more than six development teams working on the protocol, and in just a few short months there has been a slew of neat apps released using the BCH chain. One particular project created by the former bitcoin Classic developer, wants to progress the growth of BCH development in an accelerated fashion.

Flowee the Easy to Use Development Hub and API for bitcoin Cash

is a hub that can talk to the BCH network by utilizing an easy to understand application programming interface (API). Basically, Zander is building an axis that allows for communication between bitcoin cash data and applications.

“In the hub, we process all those bitcoin data structures and as such, this is the lowest level of the stack where end-user bitcoin applications make the top-level of the stack,” explains the introduction to Flowee concepts. “In the hub, a network-based API is made available which is made to enable fast processing of huge amounts of data in a bi-directional manner. A quick example is that a tool can connect to the Hub and subscribe to a specific bitcoin address — The connection stays open and when a payment comes in for that address the hub will send a notification to the user.”

Flowee components can also connect to each other, one of the future products is a “data warehouse”. This is typically a big SQL server that hosts an index of the block-data. For instance it can store all the transaction IDs linked to which block-height and index they were stored in. This actual transaction data can still be fetched from the Hub.

In addition to the data warehouse concept, Flowee could be used for a configuration app, API-As-A-Service (AaaS), a statistics module, transaction creation, and specialized transactions.

Bitbox a BCH-Centric Toolkit

Your own bitcoin Cash blockchain to configure however you choose. This blockchain is created from scratch each time you start Bitbox. It doesn’t connect to the real network and only consists of transactions and blocks which you create locally so it’s quick and responsive. Execute commands from the command line and client/server.

Building Killer BCH Apps With Javascript

Last but not least is the ‘bitcoin.J.cash’ protocol a bitcoin Cash Java implementation forked from the developer Mike Hearn’s original ‘bitcoin.j’ repository for BTC. Lots of developers like Javascript implementations because programming is very user-friendly as the language is the most commonly used as a client-side scripting language. For instance, the bitcoin.j.cash codebase allows the code to be written in an HTML page and enables compatibility with a website interface.

“This project implements bitcoin Cash signature algorithm. It is based on bitcoinj and forked from PR-1422,” explains library’s readme text.

Alongside this, it allows maintaining a wallet that can send and receive without the need for a full node implementation. Those who want to follow the bitcoin.j.cash development can join the and anyone can contribute or build applications with the BCH Java library.

Developing on bitcoin Cash Without the Need for Closed Software

All of these protocols and toolkits are meant to accelerate the development and overall adoption of the bitcoin Cash network worldwide. With the three resources mentioned above, BCH programmers won’t have to rely upon proprietary APIs or deal with closed software to create ‘killer apps.’ Flowee, bitcoin.j.cash, and Bitbox allow anyone with computer programming skills to build platforms that are compatible with different languages, codebases, and servers all while having the ability to communicate with the bitcoin Cash network.

What do you think about these three bitcoin cash-based development tools and APIs? What types of programming toolkits do you use? Let us know what you think of this subject in the comments below.

Images via Shutterstock, Github, Flowee, and Bitbox.

At .com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post appeared first on .