The party may be over for automated trend-following strategies on Wall Street. As a recent report by highlights, the once legendarily profitable investment systems run on computers by hedge fund managers have lost their edge. Although still dominating a , the machines are not as invulnerable as they once were. Wild volatility in the Dow Jones and other major US stock market indices makes that abundantly clear.

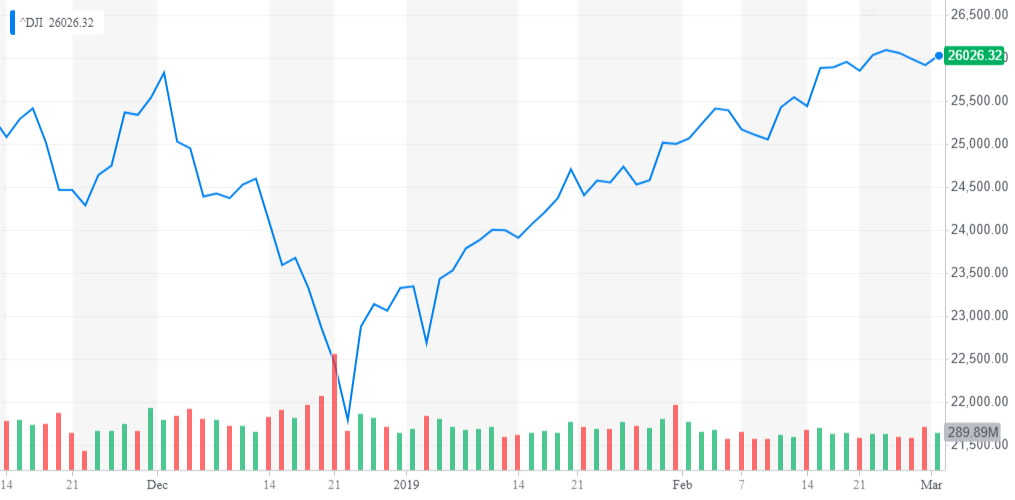

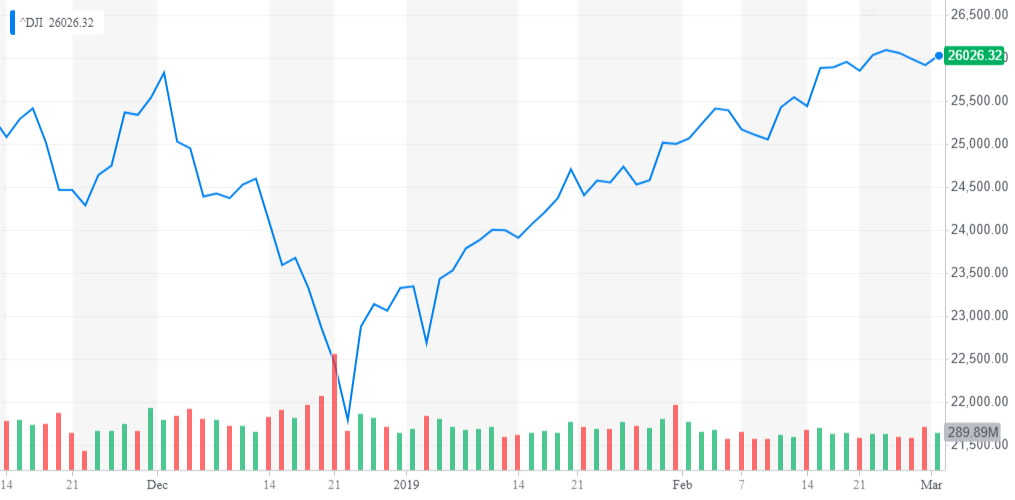

Smooth economic cycles are one thing, but unnatural monetary policy from the Federal Reserve – alongside from Donald – are something else altogether. As the chart below demonstrates, the bulls are back, ?

For the Dow Jones Industrial Average, volatility is becoming the . | Source: Yahoo Finance

Why Did Trend-Following Strategies Get so Popular?

The answer to this question is self-evident but has a few prongs. Firstly, in , innovation is as important as it is in any business. If you can do something that no one else does, then not only do you attract a lot of marketing attention, but you can also create a sizeable edge. This advantage manifested itself when trend-following first became popular in the , and a lack of competition allowed them to dominate the less volatile stock market climate.

It has since become apparent that even these early pioneers were , and hence people are now amid an influx of professional traders into the markets. Technical improvements set the stage for the high-frequency arms race, where computers would look for tiny price inefficiency, and saw hedge funds doing things as crazy as to the stock exchanges to get a micro-second edge in their price feed.

Predatory Algorithms Stalk Price Breakouts

Predatory systems stalk the stock market like wolves looking for weak hands. | Source: Pixabay

The automatic trend-following strategies we are talking about today are slower money than this, but they work on similar principles. Does anyone remember the the Dow embarked on during the final days of 2018? This was not human greed, but rather cold-hearted machine singlemindedness that priced in ’s handouts.

If you see the Dow or S&P 500 falling “unnaturally” quickly, then you can probably blame the machines too. When bots pile in on breakouts, “” stalk the markets looking to fade them, just like we began to see human traders do in the 1990s. If the breaks out even further above 26,000 and market momentum fades, the predators will try and bash it back down again immediately as the buyers run out of steam.

We also have the issue that travels faster than ever. This can then be incorporated faster by computers than humans ever could by hand. bots exist which scan central bank press releases at , allowing them to react more quickly. Markets frequently spike wildly, as sometimes the bots disagree and find additional keywords that change their mind. People have even come up with systems that short stocks based on the content of .

Wall Street Hedge Funds Have Grown Bloated and Complacent

Professional traders always like to the importance of standing alone against the crowd. It would seem that the once-privileged few who could afford the millions of dollars of computer systems to run sophisticated algorithms have seen competition erode their edge. Every single strategy devised has market conditions where it is not as successful as it might be. These trend followers were essentially just uber-bulls. Hedge Fund sales teams were as they took on more risk and hence looked smarter. As the Federal Reserve went all-out to lift markets, volatility dipped.

The most intelligent guy in the room was the one that bought highs the most aggressively. The fact a fund could say it was because of his genius new computer-based strategy didn’t hurt the sales efforts, with the added benefit they could now hire programmers to maintain the systems while the managers spent more time on the golf course wooing new clients. If it sounds like I’m criticizing these people that is not my intention. I merely follow the “” inspired premise that risk/return is the accurate indicator of skill.

With over the next few years, confidence remains wobbly in equity markets. Trend-following loves certainty. If there is one thing that , , and other nationalist movements have created, then its uncertainty. Buy high, sell higher bulls got lazy, and they are now paying the penalty.

Age of the Trump Tweet Gives New Hope to Human Traders

Estimates suggest humans make just . Consequently, having a little human perspective might give discerning hedge funds an edge. The arms race was unsustainable and didn’t improve market efficiency. If anything, it created the phenomenon of the “flash crash” such as the one we saw recently in .

So if you are someone who wants to dive into , remember: the market is moving on a flawed premise. A less binary mindset might help you cut the losses quicker and be more careful with your profits.

Trend following is not archaic; it is timeless, but it must be applied intelligently with a holistic view of sentiment and positioning. Even then, the best systems might only win one-third of the time. You can make a fortune winning 33% of the time, but most aren’t selective enough.

In the era of the Tweet, it takes one hell of a programmer to trade systematically and beat the market. It looks like at least some of these asset-accumulators .

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

Published at Mon, 04 Mar 2019 16:09:35 +0000