bitcoin may be a new indicator for the traditional stock market, according to an influential Wall Street investor.

If recent history is any indicator, when the price of bitcoin falls, so to do equities and high-yield bonds.

According to Jeffry Gundlach of employee-owned investment manager DoubleLine Capital, bitcoin has become a new indicator for the traditional stock market. Explained the influential investor known as ‘Wall Street’s Bond King’ in an interview with :

bitcoin closed at the low of the year last week, SPX (Standard & Poor’s 500 Index) is now at the low of the year this week. bitcoin keeps leading.

Gundlach’s statement is ultimately a reiteration of what he’s been claiming for months. As noted by Reuters, the man in charge of overseeing $119 billion has made repeated claims that bitcoin is the leader when it comes to risky assets. When the , he’s correctly noted, equities and high-yield bonds follow suit.

Additionally, Gundlach also claimed in the interview that bitcoin “was the poster child of the speculative mood late last year.” That speculative mood, however, has since run its course. Says Gundlach:

That [December] crash means the speculative mood got exhausted. The hip bone is connected to the thigh bone.

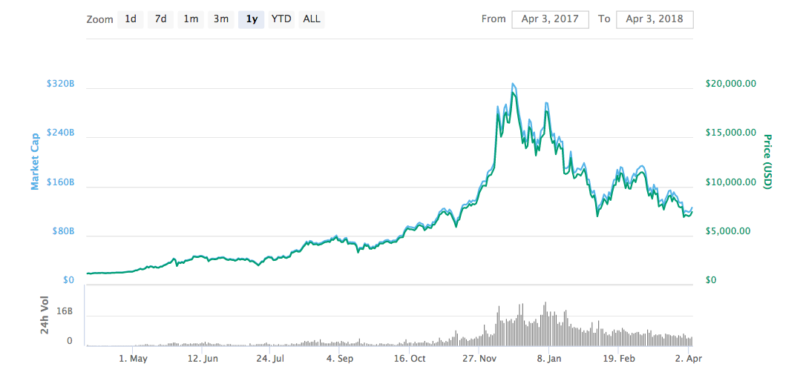

bitcoin hit all-time highs of roughly $20,000 in the month of December, before drastically falling to price levels in the mid-$6000s. After a temporary rebound, bitcoin has remained firmly in the bears’ control. Things are looking up, however, with the cryptocurrency market leader trading at $7,413.84 at press time.

Despite Gundlach’s moniker and credentials, it’s worth noting that the Wall Street Bond King might not be as in-the-know about bitcoin as he’d like you to believe. Said the investor in a January webcast:

The high for bitcoin is in. It’s just a thing that is out there, unproven. I have a theory that bitcoin is very different than what people think. People think that it is tremendously safe and anonymous and can’t be hacked and all that stuff. I have feeling that it is the opposite.

He also noted that he does not own bitcoin, claiming, “This type of investment is very, very different from my conservative DNA.”

Do you agree that bitcoin leads stock market movements? Do you believe the high for bitcoin is already in? Let us know in the comments below!

Images courtesy of Shutterstock, CoinMarketCap, DepositPhotos

Published at Tue, 03 Apr 2018 17:00:41 +0000