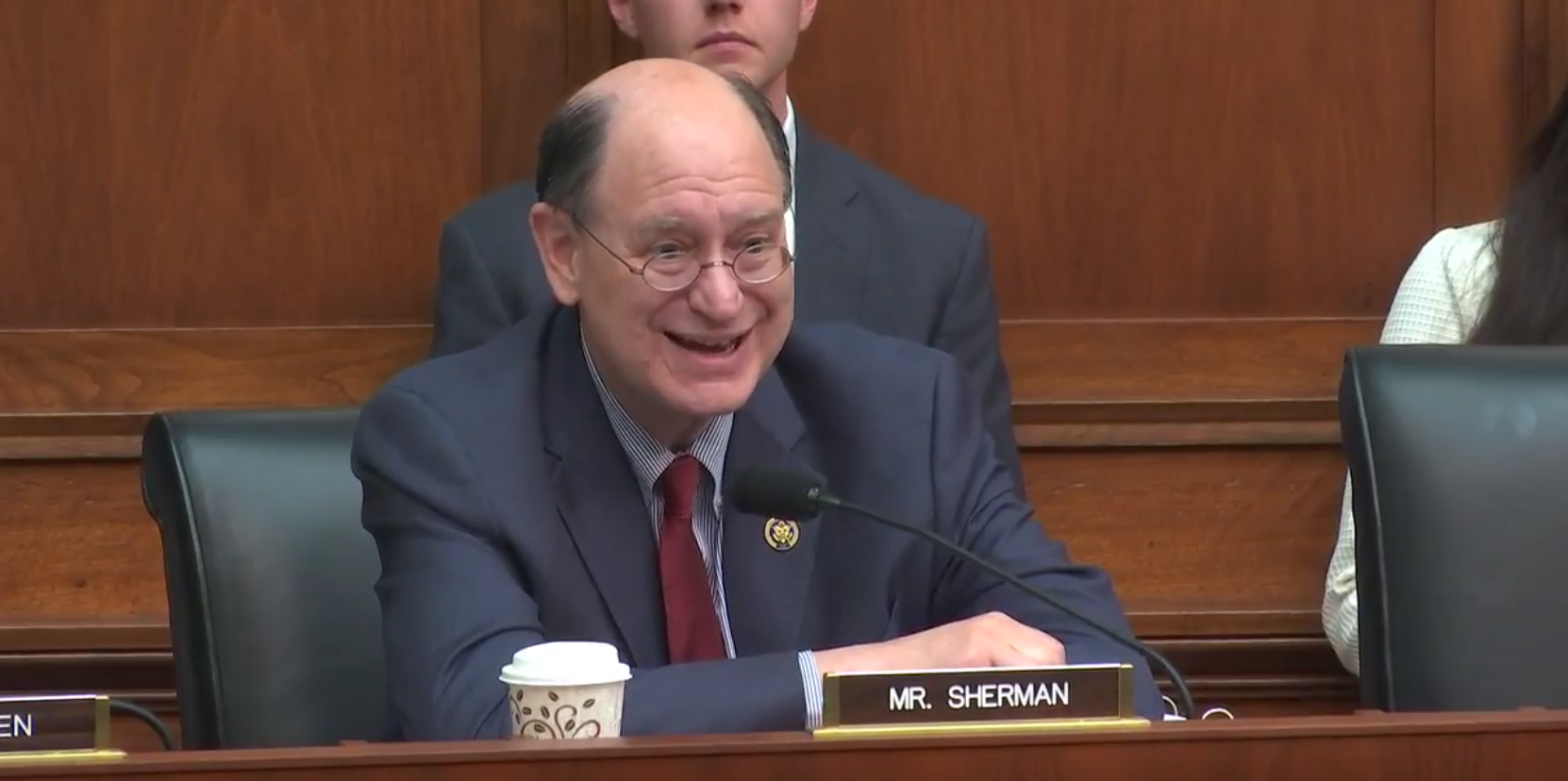

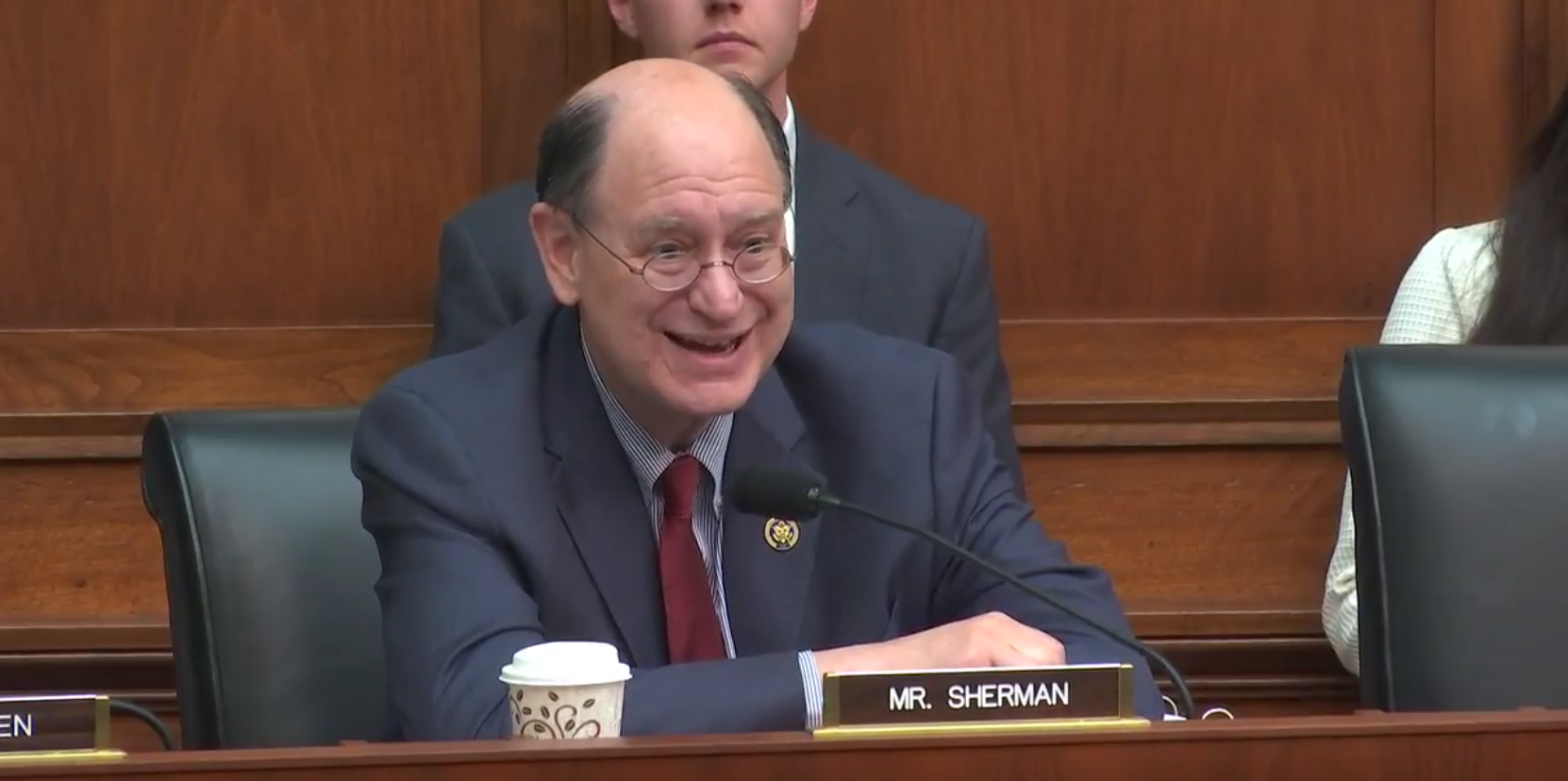

A U.S. lawmaker has called for a blanket ban on cryptocurrency buying.

Congressman Brad Sherman is no stranger to controversial statements on the subject – back in March – and of a subcommittee for the House of Representatives Financial Services Committee, he went so far as to advocate keeping Americans out of the market entirely.

“We should prohibit U.S. persons from buying or mining cryptocurrencies,” the California Democrat – whose is credit card processor Allied Wallet – declared. He added that, beyond cryptocurrencies being potentially used as a form of money in the future, it can currently be used by tax evaders and rogue states seeking to bypass U.S. sanctions.

One of the panelists, Norbert Michel, director for the Center for Data Analysis at the Heritage Foundation, pushed back against the idea that criminal use should define cryptocurrencies as a whole.

Michel told the subcommittee:

“Yes it is true that criminals have used bitcoin, but it’s also true that criminals have used airplanes, computers and automobiles. We shouldn’t criminalize any of those instruments simply because criminals used them.”

“Those components I believe are the main barriers to widespread adoption in the U.S,” he added.

No love for CBDCs

Though much of revolved around general monetary policy and history, the crypto-specific portions revealed a general opposition to the idea of a central bank digital currency (CBDC).

To quickly recap: a number of central banks around the world have been investigating the idea of using some of the technology concepts behind bitcoin and other cryptocurrencies as part of new, wholly digital money systems. The idea is that the tech can boost transparency and efficiency.

But some of those looking into the subject have warned that it could of bank runs, and several institutions have the idea entirely following their research.

Alex Pollock, a senior fellow at the R Street Institute, blasted the concept during Wednesday’s hearing, declaring it “a terrible idea – one of the worst financial ideas of recent times.”

Other committee members couldn’t help but agree that the idea, at the very least, raised more fundamental questions about how blockchain and cryptocurrencies actually work.

Congressman Bill Foster asked about blockchain immutability, saying “the promise of blockchain is a non-falsifiable ledger … [what] remains an unsolved problem in the digital world is how do you authenticate yourself?”

Payments boon

On a more positive note, Dr. Eswar Prasad, senior professor of Trade Policy at Cornell University, argued that the existence of cryptocurrencies had the potential to impact the financial services system, particularly the payments system, in positive ways.

According to Prasad, cryptocurrencies could “make transactions much easier … and bring down the cost,” but the benefits are limited at the moment.

Michel himself noted:

“It is certainly difficult to imagine a cryptocurrency replacing the U.S. dollar as long as the Federal Reserve acts as a moderately good steward of the national currency, but it is for this very reason that Congress should eliminate barriers that impede people from using their preferred medium of exchange.”

Ultimately, the hearing was cut short in order to make way for a House vote.

However, just prior to dispersing the attendees, chairman Andy Barr noted that cryptocurrencies will “continue to have a greater and greater impact on our financial system,” making it a topic the committee would likely have to “revisit” once again.

You can follow CoinDesk’s live coverage of the hearing .

Editor’s note: This article has been updated.

Image via

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a . CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Published at Wed, 18 Jul 2018 21:35:39 +0000

Regulation[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]