UnitedHealth Group, the US healthcare giant plans to utilize blockchain to keep their records up to date claims on April 2.

Optum subsidiary is going to be working with several other industry specialists to address US medical directories of over 50%, containing incorrect information according to the US government.

The medical industry estimates that 2.1 billion is spent annually on chasing healthcare providers data.

There are often mismatched records provided by claims compared to the actual records stored by healthcare providers. Blockchain ledger will be able to resolve this issue and avoid these inconsistencies.

“The pilot will examine how sharing data across health care organizations on blockchain technology can improve data accuracy, streamline administration and improve access to care.”

This marks a major step forward in blockchain within the US healthcare…

A Tutu driver in Bangkok waiting to serve his next customer. Photo by Keith

A Tutu driver in Bangkok waiting to serve his next customer. Photo by Keith

About 50% of the population in Asia still live in rural areas although rapid urbanisation is changing that ratio. However, even many city dwellers do not have access to banking services, and there are not enough qualified agents to sell insurance products. These factors make financial inclusion a challenging issue to resolve.

Thankfully, the trend in smartphone adoption across Asia seems unstoppable, with the penetration rate rising six percentage points year-on-year to 51% at end-December 2016. The Philippines posted the fastest growth, as smartphone adoption jumped from 42% at the close of Q4 2015 to 57% in Q4 2016. Other Asia countries are not far behind. More economically mature countries such as Singapore and Hong Kong register a much higher penatration rate of about 83% at the end of 2016.

The trend in smartphone adoption across Asia seems unstoppable, with the penetration rate rising six percentage points year-on-year to 51% at end-December 2016Going Online

With almost two-thirds of the Asia population holding mobile phones, it is not difficult to guess where the consumer would want to buy his or her next insurance product. According to Ant Financial and CNBData, there were approximately 330 million online insurance customers in China in 2016, an increase of more than 40% from the year before. This trend looks set to continue as more Asia consumers go online, and as more insurers are publishing their products online. With artificial intelligence technology, the consumers are now served by chatbots that act as virtual financial advisors on their mobile devices.

In 2017, Hearti collaborated with IBM to develop a chatbot that provides price quotations and answers for insurance purchases and claims. Sompo Insurance Singapore Pte. Ltd was the first insurance company to use the chatbot, which was trained to ‘learn’ from Sompo’s database of answers to queries on travel, personal accident, motor and home insurances.

Advancement on natural language understanding and features on chatbots will be enriched, and this will make insurance purchase an enjoyable and rewarding consumer experience.

Watch IBM, Sompo and Hearti talk about insurance chatbot during Singapore’s FinTech Festival in November 2017.

Product Innovation

Naysayers will argue that chatbots are not advanced enough to sell complex insurance products. Indeed, some insurance products still need to be sold through human financial advisors, either due to regulatory reqirements or product complexity. However, insurers are increasingly looking to create more innovative and “easy to understand” features such as mirco-insurance products.

Micro-insurance is insurance with low premiums and low caps / coverage where each insurance policy generates a small financial transaction. This type of insurance product can cover health insurance contract, any contract covering the belongings, such as, gadgets, livestock, tools, or any personal accident contract, either on individual or group basis. Therefore, it can cover a wide range of protection, yet affordable and simple to understand. The low insurance premium also makes it easier for payment to be made through mobile, where mobile payment are commonly used for small transactions such as for food and beverages.

Insurers are increasingly looking to create more innovative and “easy to understand” features such as mirco-insurance products.Technological Innovation: Blockchain

In a report by World Economic Forum (WEF) titled “An Industry Project of the Financial Services Community” which was published in August 2016, the WEF noticed that Distributed ledger technology (DLT), more commonly called “blockchain”, has captured the imaginations, and wallets, of the financial services ecosystem.

In the report, WEF identified a few key findings, among them, DLT has “great potential to drive simplicity and efficiency” through the establishment of new financial services infrastructure and processes. In addition, “digital identity is a critical enabler to broaden applications to new verticals”. In our view, crypto tokens has the ability to amplify benefits.

These findings are critical in supporting the establishment of insurance contracts, especially micro-insurance products, on blockchain. Blockchain will increase the efficiency of the insurance sale and claim processeses, and its immutability and distributed record-keeping will ensure trust among the ecosystem stakeholders. Interestingly, digital identity brings a number of benefits to consumers and insurance companies as correct identity information is critical to ensuring financial transactions are accurate and compliant.

WEF identified a few key findings, among them, DLT has “great potential to drive simplicity and efficiency” through the establishment of new financial services infrastructure and processes

In the next chapter, we will discuss the details of our project “SURETY” and how it utilises mobility, artificial intelligence, micro-insurance products and blockchain to aid financial inclusion in Asia.

About Us

Hearti is an InsurTech startup focusing on bringing micro-insurance products to the vast population of Asia through SURETY.AI, our proprietary artificial intelligence and blockchain platform. Join our for updates and discussions:

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

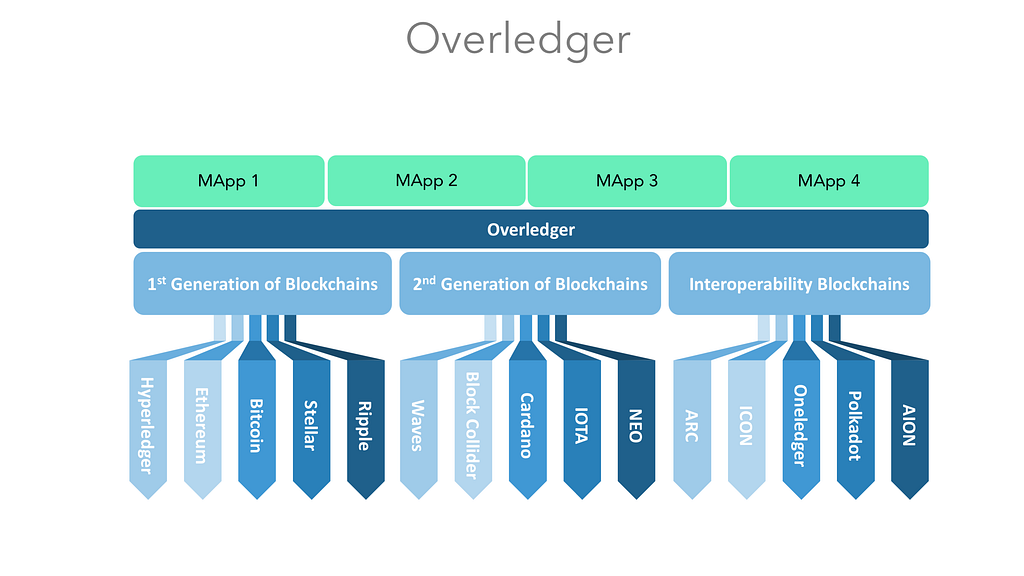

We’re often asked how we compare to other interoperability projects. To answer that, we need to rephrase the question:

How do we use interoperability to harness the power of blockchains and be the catalyst for mass-adoption of blockchain technology?

Enabling interoperability (i.e. the ability of blockchain to interact and communicate with each other and existing networks and systems) is going to be the critical first-step in order for us to witness mass-adoption of blockchain technology. But it is just that, the FIRST step. By enabling two blockchains to be able to directly interact with one another chain-to-chain (N:N).

However, enabling two blockchains to interact together does not mean we have realized the full potential of blockchain technology — far from it. Those two blockchains will simply continue to work in isolation.

Now, if we could ensure that any and all blockchains (current and future) could work together; if we connect to existing networks and the internet to blockchains and if we were able to enable enterprises to tap into the functionality of multiple-blockchains at the same time with multi-chain applications and deliver all of this to enterprises meeting while external security and regulatory requirements, with minimal changes to existing systems and networks — well, that would be a horse of an entirely different colour.

To recap the interoperability blockchains that we are referring to include: AION, Polkadot, Oneledger, ICON, ARC, Sidechain, Virtualchain, Interledger, Cosmos, etc.

These Interoperability Blockchain technologies are grouped together because in their delivery they introduce additional complexity, overhead and technical risk by either:

1) Introducing another blockchain on top existing blockchains2) Adding another consensus mechanism in addition to underlying blockchain consensus3) imposing limitations to connect chain to chain.4) Mandating a fundamental change to an enterprise’s systems to user their technology

We did a thorough analysis in our whitepaper and compared Interoperability Blockchain technologies looking at very specific criteria and while we concluded that they may enable a level of interoperability– they don’t simplify the approach for enterprises to adopt. They also leave many questions unanswered such as:

· How will you secure/de-risk the blockchain implementation against my existing infrastructure?· How will your protocol be adapted for future blockchains?· How will you connect to networks and the internet?· How do you use interoperability to tap into the multiple ledgers?

These are the questions that Overledger answers.

Now in order for Overledger to achieve what these other blockchains simply cannot — is no small task and there are key elements required in order to be successful.

Overledger is taking a — taking a very complicated technology and making it much easier to use for Enterprise and developers.

Overledger is the only platform to facilitate internet-scale development and deployment of decentralised, multi-chain applications (MApps) and Treaty Contracts (multi-chain smart contracts)

Overledger’s the only technology that allows for true N:N interoperability, meeting external security and regulatory requirements, and require minimal change to existing systems and networks to access the networks of blockchains through Overledger.

Other technologies introduce additional complexity, overheard and technical risk by introducing:1) another blockchain on top existing blockchains2) another consensus mechanism in addition to underlying blockchain consensus3) impose limitations to connect chain to chain.Overledger prevents Enterprises and developers to be restricted to:· Lack the freedom or flexibility to easily migrate to another technology when required· Have limited resilience and instead face increased risk and exposure by being dependent on a single technology· Forced to manage cost lock-in by not being able to manage consensus fees which are set with no option to remediate