bitcoin is a decentralized, peer-to-peer electronic payment system that relies on cryptographic keys to secure ownership and transfer of value . At the heart of this system are private keys: long, randomly generated numbers that function as secret spending codes. Possession of a private key grants the ability to authorize transactions and move bitcoin associated with the corresponding public address; anyone who knows the private key can sign and spend those funds, and anyone without it cannot.

Understanding private keys is essential to using bitcoin safely. Their security depends on proper generation, storage, and backup-practices promoted and discussed across the bitcoin community to prevent loss and theft . This article explains what private keys are, how they relate to public addresses and signatures, common ways they are generated and stored (including deterministic wallets and hardware devices), and practical steps to protect them so you retain exclusive control over your bitcoin.

What bitcoin Private Keys Are and How They Control Ownership

At its core, a private key is a secret numeric code that authorizes spending from a bitcoin address. It is indeed not a password stored on a server but a cryptographic secret: whoever holds the private key can create valid digital signatures that move coins. This design is essential to bitcoin’s peer-to-peer, open-source model and means ownership is defined by control of the secret key rather than by any central authority or account balance held by a third party.

Cryptographically, a private key deterministically generates a public key, which is hashed into one or more addresses. When you sign a transaction with your private key, the network verifies the signature against the corresponding public key and address – proving you control the funds without revealing the secret itself. As the network validates signatures rather than identities, possession of the private key is effectively possession of the funds on-chain.

Practical custody of private keys is handled by wallets and key-management tools. Options range from software wallets and hardware devices to full-node clients that let you generate and verify transactions locally – for example, running bitcoin Core as a way to participate directly in the network and manage keys on your own system. Good practice focuses on secure generation, reliable backups, and isolating the secret from network exposure.

- Never share your private key or raw seed phrase.

- Back up seeds in multiple physically separate locations.

- Use hardware wallets for large holdings and cold storage for long-term savings.

- Verify software from trusted sources and consider running a full node for independent validation.

| Risk | Mitigation |

|---|---|

| Loss of key | Encrypted backups, multisig |

| Theft | Hardware wallets, air-gapped signing |

| Software bug | Use audited clients, update carefully |

Because bitcoin transactions are irreversible, loss or compromise of a private key usually means permanent loss of the associated funds. The only realistic way to “prove” ownership on the blockchain is to demonstrate control of the private key by signing a transaction; no central authority can reverse or reassign coins. That immutability makes strong key hygiene the single most important element of protecting value in bitcoin’s distributed system.

How Private Keys Are Generated Securely and Why Entropy Matters

Private keys are generated as large, unpredictable numbers used exclusively to authorize spending; the term “private” emphasizes that this value is for the sole control of the owner and must remain secret to protect funds .In bitcoin the key is typically a 256‑bit scalar used with the secp256k1 elliptic curve, produced either directly by a cryptographically secure random number generator or derived deterministically from a high‑entropy seed (for example BIP‑39/BIP‑32 schemes). The cryptographic algorithms expect uniformly distributed bits: any bias or predictability in the number generation drastically reduces real-world security as it shrinks the effective search space attackers must explore.

Secure generation relies on reliable sources of entropy and proper handling. Common sources include:

- Hardware RNGs: dedicated devices that harvest physical randomness (thermal noise,ring oscillators).

- OS CSPRNGs: operating-system cryptographic PRNGs that mix multiple entropy pools.

- user entropy: mouse movements,keystrokes,or dice rolls used to supplement randomness in some wallets.

- Deterministic seeds: BIP39 seed phrases produced from high-entropy input and protected by optional passphrases.

As “private” commonly denotes personal or restricted use in manny contexts, attention to how those private values are produced and kept is essential to prevent accidental exposure or weak generation paths .

Entropy quality directly determines how hard it is indeed for an attacker to guess a key: low entropy means fewer possible keys and feasible brute‑force, while high entropy (e.g., 256 bits) means an astronomically large search space. A simple reference table:

| Entropy (bits) | Practical security |

|---|---|

| 32 | Weak – easily brute-forced |

| 128 | Strong – meets common security standards |

| 256 | Very strong - standard for bitcoin private keys |

In operational terms, even a marginal bias in RNG output can reduce effective entropy substantially, so selecting well-audited RNGs and avoiding ad‑hoc generators is critical .

Practical steps to ensure secure key generation include:

- Use hardware wallets or audited software that generate keys offline and store seeds safely.

- Avoid online generators and untrusted machines that might leak or log entropy.

- Verify RNG health where possible (device self-tests, vendor documentation).

- Backup seeds securely (offline, encrypted, redundant) and consider an additional passphrase for extra protection.

Following these checks preserves the high entropy assumptions on which bitcoin’s security depends, preventing trivial compromise of the secret spending code.

Comparing Hot Wallets Cold Wallets and Hardware Wallets for Key Storage

Hot wallets are software-based key stores that keep private keys on devices connected to the internet – typically smartphones, tablets, or web browsers – which makes them extremely convenient for everyday spending and frequent transactions. As they are app-driven, they share the accessibility model of common mobile applications, emphasizing usability and quick access . The trade-off is security: hot wallets are more exposed to malware, phishing, and platform vulnerabilities. Use them for small balances and routine transactions,and always enable strong device security and two-factor authentication when available.

Cold storage removes the private key from internet-exposed environments by keeping it on offline media such as paper,air-gapped computers,or USB drives. Key benefits include reduced attack surface and long-term holding safety; drawbacks include the risk of physical loss, damage, or improper procedure when signing transactions. Best practices include:

- Redundancy: multiple,geographically separated backups.

- Secure generation: create keys on an air-gapped device whenever possible.

- Physical protection: fireproof/waterproof storage and tamper-evident methods.

Dedicated hardware wallets combine the portability of consumer devices with strong offline protections by storing keys inside a tamper-resistant device and requiring the device to sign transactions. Typical features include PIN protection, firmware verification, and recovery seed export. The quick comparison below summarizes typical differences at a glance:

| Type | connectivity | Best for |

|---|---|---|

| Hot Wallet | Online | Daily spending, small balances |

| Cold Wallet | Offline | Long-term storage, large holdings |

| Hardware Wallet | USB/Bluetooth with on-device signing | Balanced security and usability |

Choosing among these options depends on threat model and use case: for active trading and payments, prefer a hot wallet but limit the balance and harden the host device; for holdings that must remain secure for years, cold storage or a hardware wallet paired with a reliable backup scheme is appropriate. Always treat the private key or seed phrase as the ultimate secret – never share it, store it redundantly in trusted physical or encrypted forms, and consider multi-signature arrangements for institutional or high-value custody. Practical steps: encrypt backups, verify firmware updates from vendor sites, and rehearse recovery processes so key loss is survivable without exposing secrets to unnecessary risk.

common Threats to Private Keys and Practical Mitigation Techniques

Private keys face a variety of hostile vectors: software-based attacks such as malware, keyloggers and clipboard stealers that target hot wallets; phishing and social-engineering schemes that trick users into revealing seeds or signing transactions; supply-chain attacks and tampered hardware; and simple physical loss or theft of paper backups or devices. Understanding these threats is critical for anyone managing bitcoin funds and choosing the appropriate storage model for their risk profile .

Practical defenses focus on reducing exposure and increasing verification. Recommended controls include:

- Hardware wallets for signing in isolated environments - buy from trusted vendors and verify firmware.

- Cold storage (air-gapped devices or paper/metal seeds) for long-term holdings; keep backups in multiple secure locations.

- Multisignature setups to split control across devices or individuals so a single compromise cannot spend funds.

- Seed management practices: write seeds on durable media, use passphrases (BIP39) for extra encryption, and never store seeds in plaintext on networked devices.

When selecting wallet software or firmware,prefer well-audited projects and official distribution channels to minimize supply-chain risk and verify client downloads where applicable .

| Threat | Practical Mitigation |

|---|---|

| Malware / Keyloggers | Use hardware wallets and air-gapped signing |

| Phishing / Social engineering | Verify domains, never paste seed phrases into websites |

| Physical loss or theft | Distributed backups in secure locations; metal backup plates |

| Compromised firmware/hardware | Buy from trusted sources; verify signatures and firmware |

Operational hygiene complements technical controls: perform regular test restores of backups, use the principle of least privilege (keep only minimal funds in hot wallets), avoid address reuse, and adopt Partially signed bitcoin Transactions (PSBT) workflows when combining hardware and software tools. Maintain an incident plan for key compromise (recovery, notification, and migration to new keys) and periodically review the entire key lifecycle-from generation and storage to rotation and destruction-to keep controls aligned with evolving threats .

Backup Strategies and Key Recovery Recommendations for Long Term Access

Preserve access, not just copies. Treat private keys and seed phrases as the single artifacts that authorize spending, and design backups to eliminate single points of failure. For most users the practical route is a hardware wallet with an exportable seed phrase (stored offline) or a deterministic wallet with a documented seed-both approaches are supported by mainstream wallet software and guidance resources. Keep at least three independent recovery locations so loss, theft, or localized disaster will not lead to permanent loss of funds.

- Paper cold backups: Printed seed phrases stored in a fireproof, waterproof safe.

- Metal backups: engraved or stamped steel plates resistant to fire, water and corrosion.

- encrypted digital copies: encrypted container stored on multiple offline drives; use strong passphrases and hardware encryption.

- Multisignature architecture: Split control across multiple physical keys or custodians to reduce single-key exposure.

Combine methods from the list above to balance recoverability, survivability, and security.Label and version each backup clearly-include the cryptographic scheme (e.g., BIP39, BIP32) and the date to avoid confusion during recovery.

| Method | Restore Speed | Durability |

|---|---|---|

| Paper seed | Fast | Low-Medium |

| Metal plate | Fast | High |

| Encrypted SSD | Medium | Medium |

| Multisig (3-of-5) | Medium-Slow | Very High |

Regularly test your recovery process in a controlled way: perform test restores to a new wallet, verify addresses and balances, and confirm you can sign transactions. Document step-by-step recovery instructions and store them with the backups in a sealed envelope or encrypted file-this reduces human error when access is needed after long durations or under stress.

Plan for generational access and lifecycle management. Include clear legal instructions for heirs, trusted executors, or co-signees without exposing secret material in plain text.Rotate and re-encrypt backups if you change passphrases or move keys, and securely destroy superseded copies. Operators running full-node wallets shoudl also maintain secure copies of wallet files and node data per software guidance, and record the software version used to generate the keys so future recovery is not impeded by incompatible tools.

Seed Phrases Deterministic Wallets and Tradeoffs in Recoverability

Seed phrases are the human-readable gateway to deterministic wallets: a short list of words that encodes the wallet’s master seed, from which every private key and address can be derived. Using standards like BIP39 the same mnemonic will reproducibly generate the same cryptographic root across compatible software and hardware, enabling full wallet restoration after device loss. As a single phrase can recreate an entire set of keys,it functions as both the most convenient backup and the most critical vulnerability – whoever controls the phrase controls the funds.

Hierarchical Deterministic (HD) wallets organize keys along derivation paths (e.g.,BIP32/BIP44/BIP84),letting wallets create many addresses from one seed. this design brings clear tradeoffs that every user should weigh:

- Recoverability vs. Single Point of Failure – one mnemonic simplifies recovery but centralizes risk.

- Convenience vs. Privacy – a single seed makes management easy but can link activity across addresses if not used carefully.

- security Enhancements – optional passphrases or multi-factor schemes increase protection but add complexity for recovery.

Tradeoffs also influence long-term resilience strategies: relying solely on a single printed mnemonic is simple but fragile; combining hardware wallets, split backups, or multisig arrangements increases survivability at the expense of setup and operational complexity. A mnemonic protected with a passphrase (sometimes called a 25th word) raises the bar for attackers but introduces a recoverability dependency on remembering or securely storing that additional secret. Equally important is the awareness that deterministic convenience does not eliminate the need for secure physical and operational practices - theft, loss, and human error remain dominant risks.

below is a compact comparison to help weigh options quickly:

| Option | Recoverability | Privacy | Complexity |

|---|---|---|---|

| Single-seed mnemonic | high (simple) | Moderate | Low |

| Mnemonic + passphrase | High (but depends on passphrase) | Higher | Medium |

| Multisig (multiple keys) | High (distributed) | High | High |

| Sharded backups (split seed) | Medium-High | High | Medium-High |

Best practices for Key Rotation Transaction Signing and Multisignature Security

Limit exposure through disciplined rotation: Adopt a clear rotation policy that defines when keys are retired, how replacements are generated, and how old keys are destroyed or archived. Generating new keys on air‑gapped hardware wallets or dedicated HSMs reduces the risk of remote compromise, and keeping rotation intervals proportional to balance and transaction velocity ensures that a single leaked key cannot spend funds indefinitely. For parallels in account hygiene and scheduled credential management, study commercial online banking practices to see how scheduled operations reduce risk .

Sign transactions defensibly: Prepare and verify transaction data before exposing it to signing devices. Use Partially Signed bitcoin Transactions (PSBT) workflows to separate the construction, review, and signing steps; enforce strict policy checks (outputs, fees, timelocks) on the offline signer; and never reuse ephemeral signing paths. operational controls such as role separation and multi‑stage approval mimic secure online payment flows like bank bill‑pay scheduling and expedited payment controls, helping prevent accidental or malicious signing of improper transactions .

harden multisignature setups: Design multisig with geographic and vendor diversity, and choose thresholds that balance security and recoverability (e.g., 2-of-3 or 3-of-5 depending on stakeholders). Maintain a written map of which key is on which device and where backups live, and practice physical separation of signers so a single breach cannot produce enough signatures. recommended operational controls include:

- Store each cosigner on a different hardware wallet model or HSM vendor.

- Keep one signer air‑gapped and another in a geographically separate, secure location.

- Update multisig policy documents and rotate cosigners on a defined schedule.

Require authenticated administrative access to signing orchestration systems to reduce insider risk, following secure login and session practices similar to institutional online access controls .

Operationalize recovery and incident response: Maintain and test key‑rotation playbooks and recovery procedures so a compromised signer can be replaced quickly without loss of funds. Regular drills reveal gaps in backup integrity and handoff procedures and minimize downtime when sweeping to new keys is required.

| Action | Frequency |

|---|---|

| Rotate ephemeral keys | monthly / per large deposit |

| Test recovery plan | Quarterly |

| Audit cosigner inventory | Annually |

Legal Privacy and Recovery Considerations When Managing Private Keys

Treat private keys as both technical secrets and potential legal assets: courts and regulators may view control of keys as control of the underlying funds, which affects seizure, estate transfer, and regulatory reporting. maintain clear, written records of custody arrangements and intent – these documents can be decisive in probate or compliance proceedings. For clarity on the notion of ”private” as exclusive or for individual use in legal language, consult common usage examples of the term in English reference sources and translations for related concepts like “exclusive” or “for private use” .

Operational privacy measures reduce legal exposure while preserving recoverability.Implement strong compartmentalization and multi-layer strategies such as:

- Air-gapped storage: keep seed material offline and physically protected.

- Multisignature setups: distribute signing authority across trusted parties or devices to avoid single-point legal risk.

- Encrypted backups: combine physical safes with robust encryption and documented access instructions.

Within these choices, consider ”semi-private” custody models (shared but limited access), which blend privacy and delegable recovery and may resemble established semi-private arrangements in other domains .

Recovery planning must bridge cryptography and legal instruments. Use estate directives, digital-asset addenda, or designated custodial agreements to specify how keys or recovery data should be handled after incapacity or death. The table below presents concise recovery options and their legal trade-offs:

| Option | Legal Advantage | Practical Note |

|---|---|---|

| Will with key trustee | Clear legal pathway | may require court process |

| Multisig with heirs | Avoids single failure | Needs coordination |

| professional custodian | Regulated oversight | Trust fees and KYC |

Be prepared for interactions with law enforcement and compliance obligations: preserve logs, maintain chain-of-custody documentation, and seek counsel before signing or surrendering keys. Avoid ad hoc disclosures; informal sharing can create unintended legal liabilities or evidence trails. Where privacy conflicts with mandatory reporting or legal orders, prioritize documented compliance steps and legal advice to minimize risk while protecting user privacy and asset recoverability. For language around privacy and exclusivity that often appears in policy and legal drafting, see practical examples of “private” usage in reference materials .

Q&A

Q: What is a bitcoin private key?

A: A bitcoin private key is a secret 256-bit number used to create cryptographic signatures that authorize spending of bitcoins associated with the corresponding public key/address. Possession of the private key is equivalent to control of the funds.

Q: How is a private key generated?

A: Private keys are generated using cryptographically secure random number generation or derived deterministically from a seed (e.g., BIP32/BIP39). secure entropy and trusted implementations are essential to avoid weak or predictable keys.

Q: What is the relationship between private keys, public keys, and addresses?

A: The public key is derived from the private key using elliptic-curve point multiplication (secp256k1). Addresses are hashes of the public key (or of a script in the case of P2SH/P2WSH). The derivation is one-way: public keys and addresses do not reveal the private key under normal cryptographic assumptions.

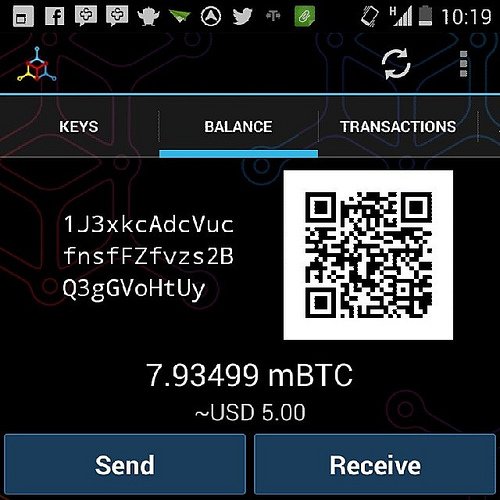

Q: In what formats do private keys appear?

A: common formats include raw hexadecimal, Wallet Import Format (WIF, a Base58-check encoded form), extended private keys (xprv/xpriv from BIP32), and mnemonic seed phrases (BIP39) that encode a seed used to derive many keys.

Q: How does the signing process use a private key?

A: When you spend bitcoins, your wallet uses the private key to produce a digital signature for the transaction. Nodes and wallets verify that signature with the corresponding public key to confirm authorization without exposing the private key.

Q: Where can private keys be stored?

A: private keys might potentially be stored in software wallets (local files, mobile apps), hardware wallets (dedicated devices that keep keys offline), paper wallets (printed keys or mnemonics), or in full-node wallet files (e.g.,wallet.dat in bitcoin Core). Storing keys offline or in hardware devices reduces exposure to online attacks.

Q: Is running a full node necessary to control private keys?

A: No – many wallets let you control keys without running a full node. Running a full node (e.g., bitcoin Core) gives you maximum verification and self-sovereignty because you independently validate the blockchain, but it requires downloading and storing the full blockchain and sufficient bandwidth and disk space (initial sync can take a long time and requires tens of gigabytes of storage) [[1]] [[2]].Q: What are best practices for protecting private keys?

A: – Generate keys with secure, auditable software or hardware. - Use hardware wallets for important holdings. – Backup seeds/keys securely (multiple, geographically separated copies).- Encrypt wallet files and use strong passphrases. – Avoid online key generators and untrusted software. – Prefer multisignature schemes for shared or high-value funds.

Q: What happens if I lose my private key?

A: If you lose a private key and have no backup or seed that can derive it, the bitcoins controlled by that key are effectively irretrievable and permanently inaccessible.

Q: Can private keys be stolen remotely?

A: Yes.malware,phishing,compromised backups,or insecure key-export tools can expose private keys. Hardware wallets mitigate many remote-exposure risks by keeping the key inside the device and signing transactions there.

Q: What are seed phrases and how do they relate to private keys?

A: A seed phrase (typically 12-24 words under BIP39) encodes a seed value from which a deterministic wallet (BIP32/BIP44/etc.) derives a tree of private keys. Protecting that phrase is equivalent to protecting all keys derived from it.

Q: What is multisignature (multisig) and how does it affect private-key security?

A: Multisig requires multiple private keys to authorize a spend (e.g., 2-of-3). It reduces single-key risk by distributing control and can be used to build vaults, corporate controls, and recovery schemes.

Q: Are public keys safe to share?

A: Public keys and addresses are safe to receive funds and let others verify ownership, but reusing addresses or exposing your public key unnecessarily (before spending) can reduce privacy and increase linkage between transactions.

Q: How do hardware wallets improve key security?

A: Hardware wallets store private keys in a secure chip and sign transactions internally; only signed transactions or public data leave the device. They limit key exposure even if the host computer is compromised.Q: How should I create a paper wallet safely if I choose to do so?

A: Use an offline, verified generator on an air-gapped computer or trusted hardware, ensure strong entropy, print on durable material, and store the paper in secure, fire-/water-resistant, and access-controlled locations. For most users,hardware wallets are recommended over paper wallets.

Q: Can I import/export private keys between wallets safely?

A: Yes, using standard formats like WIF or BIP32 xprv/xpriv, but only with trusted software and in a secure habitat. Exporting keys to online or insecure devices increases theft risk.

Q: Are private keys vulnerable to quantum computers?

A: Quantum computers could affect elliptic-curve cryptography in theory; however, practical, large-scale quantum attacks remain speculative today. the bitcoin ecosystem is researching post-quantum options; long-term key migration strategies may be needed.

Q: How can I verify I control an address without revealing my private key?

A: Use wallet features for watch-only addresses, or sign an arbitrary message with your private key and provide the signature for verification; do not reveal the private key itself.

Q: Why might someone run bitcoin Core with a wallet?

A: Running bitcoin Core gives independent transaction validation and local key control in a well-audited,open-source client.Be prepared for the initial blockchain download, which can be large and time-consuming [[1]] [[2]].

Q: Where can I get help or discuss private-key topics?

A: Community forums and developer communities are available for questions and discussions about bitcoin software, security, and best practices; community resources include public forums and developer channels [[3]].

Q: Any legal or practical caveats about private keys?

A: Private keys confer control over funds; treat them like valuable assets. Consider estate planning for key access, understand local laws about custody and reporting, and follow compliance requirements if operating custodial services. This is general facts, not legal advice.

Q: Quick checklist for new users concerned about private keys

A: - Use a reputable wallet (hardware recommended for significant amounts). – Generate keys with secure entropy and keep backups of seed phrases. – Store backups offline, encrypted, and geographically separated. – Prefer multisig for shared or high-value holdings.- Keep software up to date and avoid unknown key-export tools.

Closing Remarks

a bitcoin private key is the cryptographic secret that authorizes spending – whoever controls the key controls the funds - so understanding how keys are generated, stored, and protected is fundamental to using bitcoin safely. Treat private keys as high-value secrets: use strong, offline storage methods (such as hardware wallets or cold storage), maintain secure backups, and avoid exposing keys to untrusted devices or services. Remember that bitcoin transactions are irreversible, so lost or compromised keys usually mean lost funds; operational care and good key-management practices are the primary defenses. For readers who want to dive deeper into technical details or participate in broader discussions about bitcoin progress and best practices, consult the project’s development resources and community forums for up-to-date information and guidance .