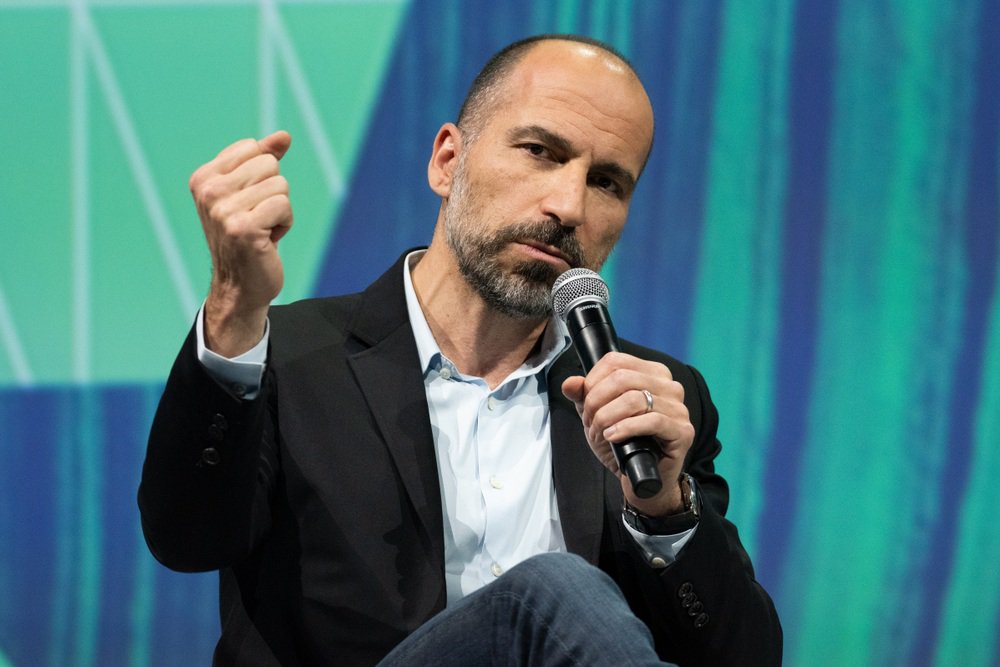

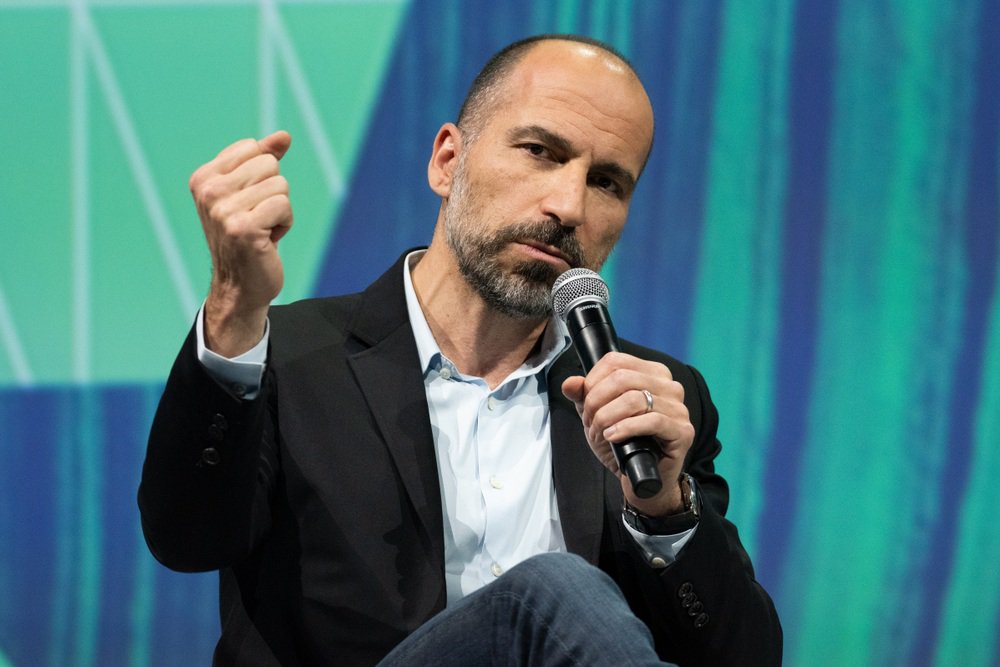

By : Uber CEO Dara Khosrowshahi could laugh all the way to the bank if the ride-sharing pioneer’s valuation hits $120 billion, or if he manages to find a buyer for that amount.

Uber’s IPO Could Make Khosrowshahi Very, Very Rich

According to Uber’s IPO , Khosrowshahi will be granted 1.75 million stock options as a part of an equity incentive plan. Those options vest over the next four years and can be exercised at a price of $33.65 per share.

The CEO will also be granted 185,735 shares that vest immediately if either of two conditions is met. More specifically, market capitalization must stay at $120 billion for a period of 90 straight days post IPO. He also must remain in continuous service to qualify.

The other condition sees Uber getting acquired for at least $120 billion. Business Insider that the entire incentive package could make Khosrowshahi richer by at least $100 million.

Uber is reportedly seeking a in its IPO. CNBC that a $100 billion valuation will translate into a price of around $95 a share. If so, Khosrowshahi will make slightly more than $100 million from his equity incentive plan ($95 minus $33.65 multiplied by 1.75 million shares). His windfall gains would be much higher with a $120 billion valuation. But with the way things currently stand, Khosrowshahi’s $100 million payday looks like a pipe dream.

CEO-live tweeting from global all hands from our awesome Palo Alto office. Our photographer/CTO Thuan is on top screen taking pic. Subjects today = StandforSafety and update.

— dara khosrowshahi (@dkhos)

Khosrowshahi’s Big Payday Might Not Arrive

Uber’s IPO filing offered a glimpse into the startling state of affairs at the company. The document states that Uber might not be able to achieve profitability because of an anticipated substantial increase in operating expenses. That’s because Uber faces tremendous competition in the ride-sharing industry, which might force it to bump driver incentives and reduce fares in order to remain competitive.

Slowing growth is another factor that could dent Uber’s IPO. The company’s 2018 revenue stood at $11.3 billion, an increase of 42% over the prior year. But that was way below the 106% top-line growth that Uber clocked in 2017. Uber also reported almost $2 billion in losses after excluding the profit it made from selling some of its businesses in Southeast Asia and Russia. Uber’s IPO filing indicates that losses will pile up on account of ballooning expenses.

Uber’s IPO filing today revealed a mix of good and bad about the company.

The good: In 2018, Uber made $11.3 billion in revenue and provided 5.2 billion rides.

The bad: It lost $3 billion last year and revenue growth fell by half

— WIRED (@WIRED)

The Naysayers Are Here

Reuters that Uber’s private market valuation stood at $76 billion in August 2018. It might not be worth much more than that when it starts , as the market now knows about the bumpy road ahead.

NYU Stern professor and valuation expert Aswath Damodaran that Uber’s valuation could be $61.7 billion at best and $58.6 billion at worst. That’s around half of what Khosrowshahi needs in order to get his money.

Uber follows Lyft with IPO, framing itself as personal mobility pioneer. Uber potential is clear but pathway to profitability remains murky. I value Uber, top down and rider-up, but I have been hopelessly wrong before on this company. So, reader beware!

— Aswath Damodaran (@AswathDamodaran)

Uber’s IPO could become a success thanks to its diversification beyond ride-sharing and into the delivery and the freight businesses. It’s also finding its footing in self-driving vehicles following some setbacks earlier.

But it wouldn’t be entirely surprising to see Uber’s CEO failing to get his fat paycheck because of the red flags the IPO filing has raised.

Published at Wed, 17 Apr 2019 21:26:00 +0000