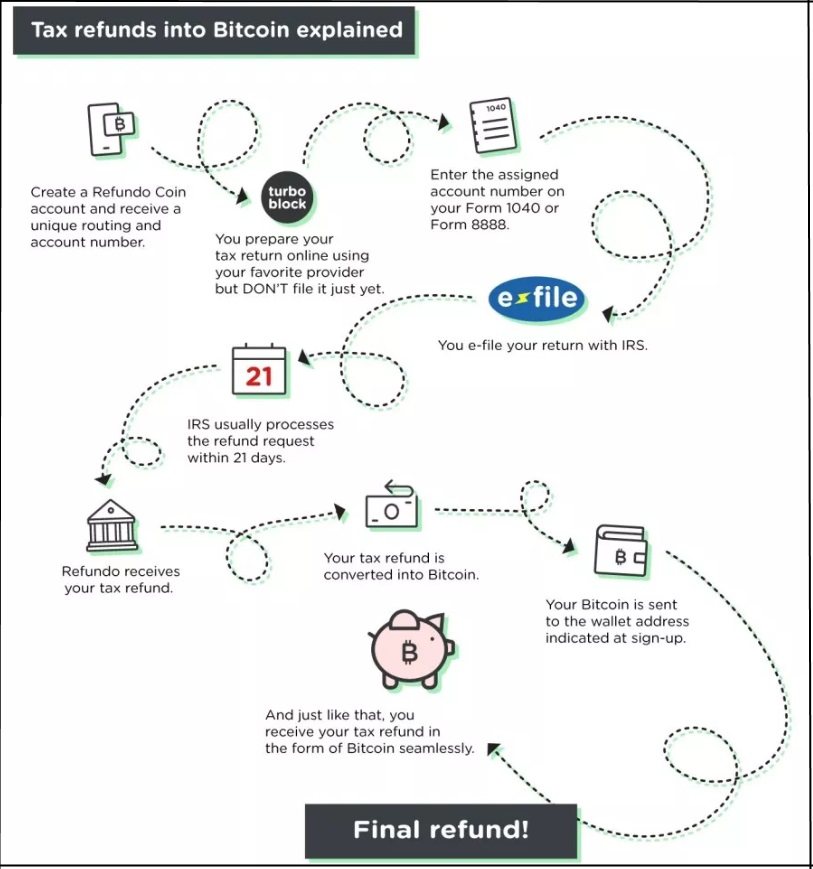

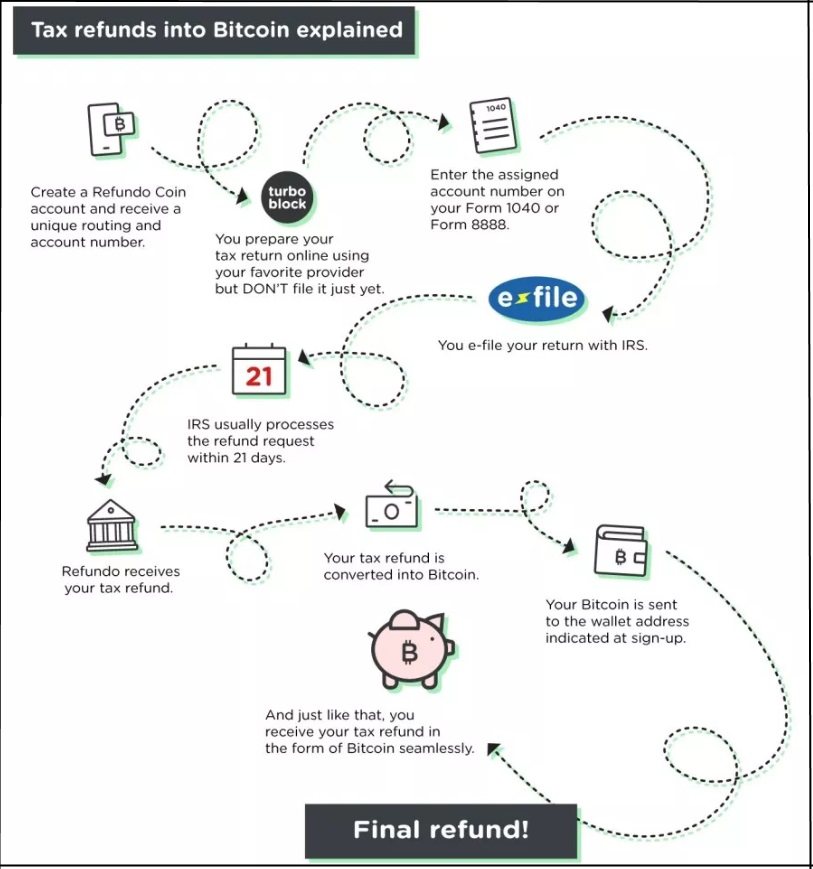

By : U.S. taxpayers can receive all or part of their federal and state tax refunds in . This is being made possible through a collaboration between payments processor and Refundo, a provider of tax-related financial products.

In a , Refundo says its CoinRT product is especially useful for low-income communities that don’t have checking accounts and often resort to paying high check-cashing fees.

That said, Refundo’s CoinRT service is not free. CoinRT costs $34.95 per refund transfer, and that doesn’t include BitPay’s 1% service fee.

Refundo wants to help low-income communities get tax refunds in . | Source: screenshot

Refundo focuses on low-income communities

Refundo specializes in serving low-income communities. Refundo CEO Roger Chinchilla says these communities often send money abroad, so the integration of can streamline both their tax refunds and their international remittances.

“ provides transactional transparency, as every transaction is verified, recorded and stored on the . The transaction itself contains no sensitive personal information.”

“Refundo offers several options to help taxpayers receive their tax refunds safer, faster and more conveniently. Adding was a natural fit for our , who often do not have traditional checking accounts, pay high check-cashing fees, and regularly send money internationally.”

Source: Refondo screenshot

EY rolls out cryptocurrency tax tools

On an institutional level, Big Four accounting firm Ernst & Young (EY) recently introduced a specifically for its clients who invest in digital currencies.

A month later, by launching the second generation of its EY Analyzer. The tool will help clients who hold or trade by automatically calculating their capital gains and losses.

Taxes may be boring, but they’re a part of everyone’s lives. So the slow integration of crypto into something that everyone has to do lends some legitimacy to an industry that’s still struggling for mainstream acceptance.

EY Spends Millions Upgrading ‘ Analyzer’ to File Your Crypto Taxes

— Crypto News (@PaveIt_)

BitPay CEO expects mass adoption in 3-5 years

As CCN reported, BitPay CEO Stephan Pair says he believes that mass crypto is .

“I used to say 10 years. But now I think it’s more like three to five years until you can go into a restaurant, a retail establishment, and everybody’s going to expect that the will be able to accept a payment.”

When asked if approval of a would speed up mass , Pair says the is not the end-all, be-all. However, Pair says a would push prices higher.

Stephen Pair also remarked that prices don’t reflect its “actual utility,” but is a result of speculation over its future .

“A very big component of the [] price is certainly speculation. It’s investors that are speculating on the future usage and of this technology. I’m sure a small component of that price is the actual utility.”

Published at Wed, 01 May 2019 16:09:48 +0000