Key Highlights:

price may increase;

bulls were in control of the market;

there may be price retracement.

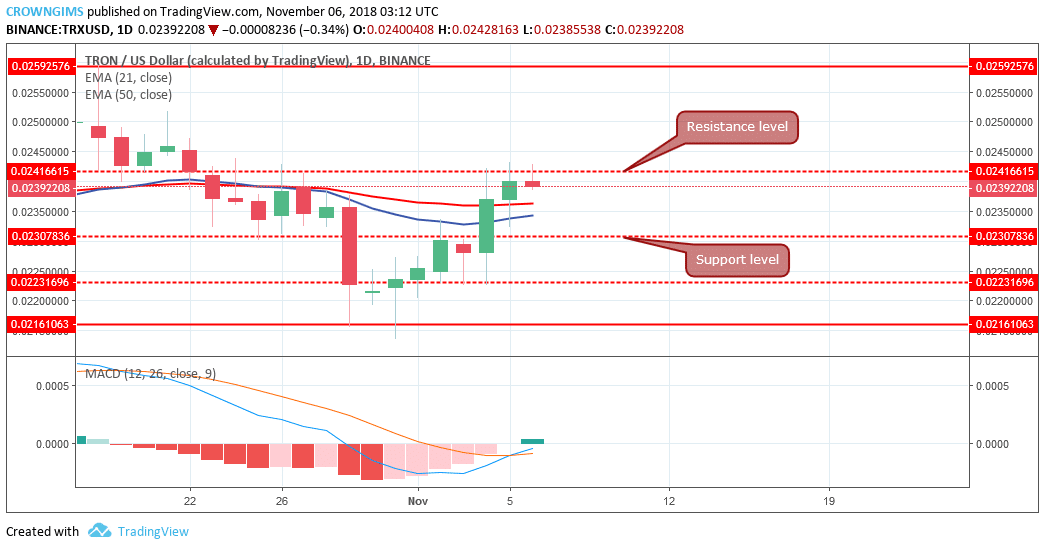

TRX/USD Price Long-term Trend: Bullish

Resistance levels: $0.024, $0.025, $0.028

Support levels: $0.023, $0.022, $0.021 TRX price resumes its bullish trend movement on the long-term outlook. The Bulls return to the Tron market was clearly seen after the formation of a doji candle at the support level of $0.022. The next candle that closed above the support level of $0.022 as the bullish engulfing candle confirm the bulls pressure. Bulls gained momentum and led to the broken of last week resistance levels of $0.022, $0.023, $0.024. Last week, TRX price was gradually increased as the Bulls maintained their pressure.

TRX price resumes its bullish trend movement on the long-term outlook. The Bulls return to the Tron market was clearly seen after the formation of a doji candle at the support level of $0.022. The next candle that closed above the support level of $0.022 as the bullish engulfing candle confirm the bulls pressure. Bulls gained momentum and led to the broken of last week resistance levels of $0.022, $0.023, $0.024. Last week, TRX price was gradually increased as the Bulls maintained their pressure.

Tron price has broken the two EMAs that act as a dynamic support and resistance upside which is an indication of bulls taking over the TRX market. TRX price is increasing above the 21-day EMA and the 50-day EMA, an indication of bull’s pressure which means there is a probability for further increase of the TRX price.

Should the resistance level of $0.024 breaks by the bulls, TRX price will rally to the north and $0.025 resistance level will be the next target. Though, price pullback is inevitable in any trending market.

The MACD with its histogram, starting above the zero level and its signal lines points to the north on the daily chart indicating a buy signal.

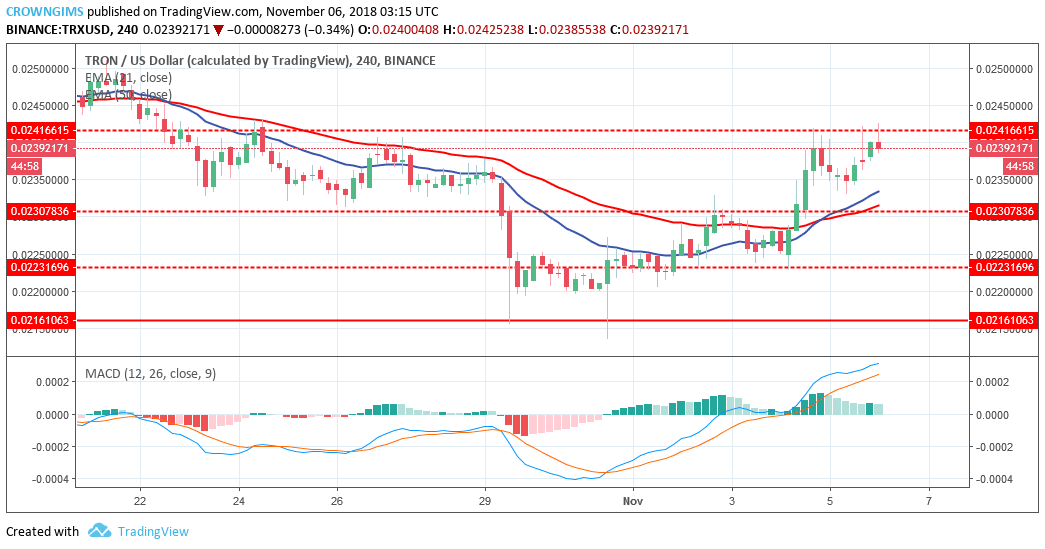

TRX/USD Price Medium-term Trend: Bullish

TRX price is above 21-day EMA and the 50-day EMA with 21-day EMA crossed 50-day EMA upside, indicates a continuation of uptrend movement.

There is a tendency for TRX price to break the resistance level of $0.024 upside as the MACD with its histogram is above zero level and its signal line pointing to the north.

If you’ve been anywhere near social media in the past fortnight, or even used your favorite messaging app, there’s a good chance you’ve been shilled a referral link to Initiative Q. A mate probably forwarded it to you or tagged you in a post offering an invite to the first five responders. Maybe you FOMO’d in, or maybe you scrawled a one-word response — “Bitconeeeeect!” — and gave it a wide berth. For those who are still on the fence, here’s what you need to know about Initiative Q.

Also read:

Scheme or Scam?

Betteridge’s law of headlines holds that any headline ending in a question mark can be answered in the negative. Therefore, the short version of this article runs as follows: No, Initiative Q is definitely not the next bitcoin. The slightly longer version goes like this: Any new monetary system that is (a) centralized and (b) acquired with an expectation of profit will be shut down faster than you can say “Liberty Reserve.”

Here’s What’s Good…

Before Initiative Q is completely , it is worth acknowledging what the project has gotten right: Not only is it a monetary idea that has managed to avoid using the term “blockchain,” but its virality is the envy of marketers the world over. No payment protocol, or however Initiative Q can be described, has come close to matching its runaway success. You might be sick of hearing about it, but the fact that you are sick of hearing about it is testament to the nous of its savvy founder, Saar Wilf.

…And Here’s What’s Bad

While bitcoin’s founder operated under a pseudonym, Initiative Q’s is using his real name. Yes, Saar Wilf is a real guy who’s soliciting recruits based on the premise of his currency, Q, being akin to “getting free bitcoin seven years ago.” and you’ll be entitled to free Qs that could one day be worth $34,000. If that sounds like an expectation of future profits, you’d be absolutely right. If that sounds like the sort of scheme the SEC could shut down in a heartbeat, you would be equally correct. If you really want to capitalize on the next big thing, there’s this payment system you should really check out. It’s called bitcoin.

Initiative Q is polluting my feed. Quick review:

– Centralised

– Ponzi

– Shitcoin

The marketing scam is nothing more than the big queue outside an empty club. You can't just make up future value predictions without the business and infrastructure to prove it.

— Peter McCormack #FreeRoss (@PeterMcCormack)

What are your thoughts on Initiative Q? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .