is currently passing through the longest bear market in the history of . Many experts and analysts have recently predicted that the worst is yet to come, even as recently received support from the CEO of Twitter, Jack Dorsey. Dorsey had branded as the native currency of the internet and demonstrated support in the Lightning Network ‘Torch’ experiment.

While the popularity of might be divided among the crypto verse, according to recent data released on the .com, transaction rates are approaching all-time highs even though transaction fees remained evidently lower in the Network.

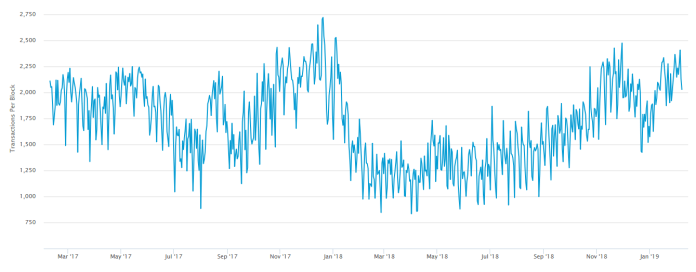

Transactions rates per block | Source:

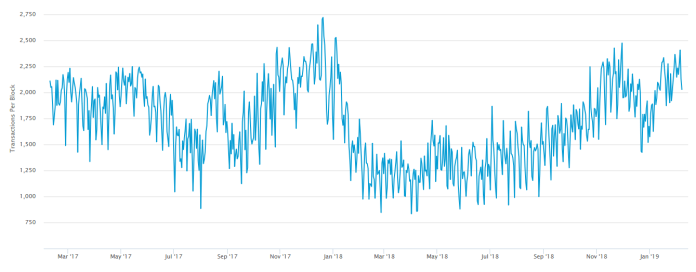

Transaction fee per block | Source:

Based on the data, it can be clearly seen that the last time average transactions per block approached the current trend of high levels, which is well above 2,000/block, was in the very beginning of 2018, and the transaction fees were also fairly higher. Today, only about 20 ₿itcoins were paid as miners’ fees from the entire network, whereas over a thousand ₿itcoins were rewarded to miners during 2018’s hype and enormous price explosion.

The fair explanation for this higher transaction rates can be explained by observing the total number of confirmed transactions per day. Even though has been under a long bearish market, the transactions per day have been consistently rising since June 2018.

Transactions per day | Source:

According to a research conducted last year by analyst and social media blogger Hasu, an increase in batching of transactions was leading to more efficient blocks. Since the number of efficient blocks was up, the blocks were also getting fuller and it meant that there was less demand for mined blocks, and thus, lower fees paid to the miners, which can be observed in the chart.

This research sits consistent with the charts since if overall transactions per day are slightly lower now versus one year ago and block efficiency is roughly equal, we would expect less demand for blocks and lower fees paid to miners.

The post appeared first on .

Published at Sat, 09 Feb 2019 11:18:56 +0000