The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the exchange.

Instant messaging service Telegram reportedly to launch its Telegram Open Network (TON) in the third quarter of this year. It has a new programming language called Fift, which will help develop and manage TON smart contracts and interact with the TON Virtual Machine.

On the other hand, Facebook is allegedly planning to its own in early 2020. The company expects its large user base to start using its in a dozen countries for making purchases, transferring money and more. Mark Zuckerberg, the founder and chief executive of Facebook, has reportedly discussed the project with U.S. Treasury officials along with Mark Carney, the governor of the Bank of England.

bull Michael Novogratz believes that one of the crypto assets created by the above-mentioned companies is likely to be and can even have a “chance to be a real currency.” He also reiterated that the “crypto winter is over” in comments this week. And, according to rating platform ICObench, the is showing a higher success rate as the sentiment improves.

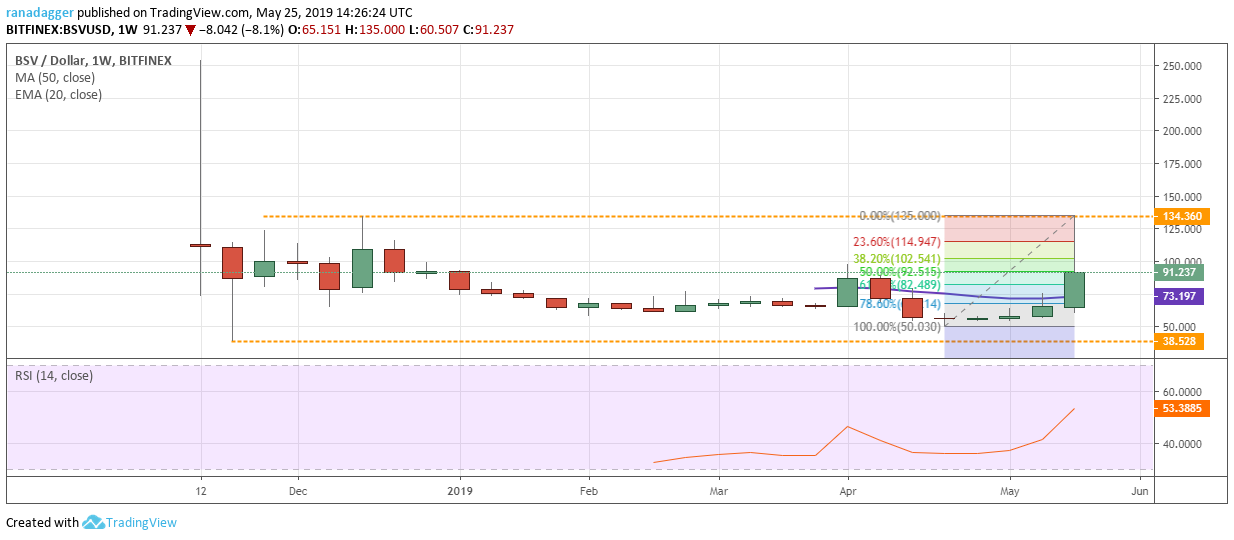

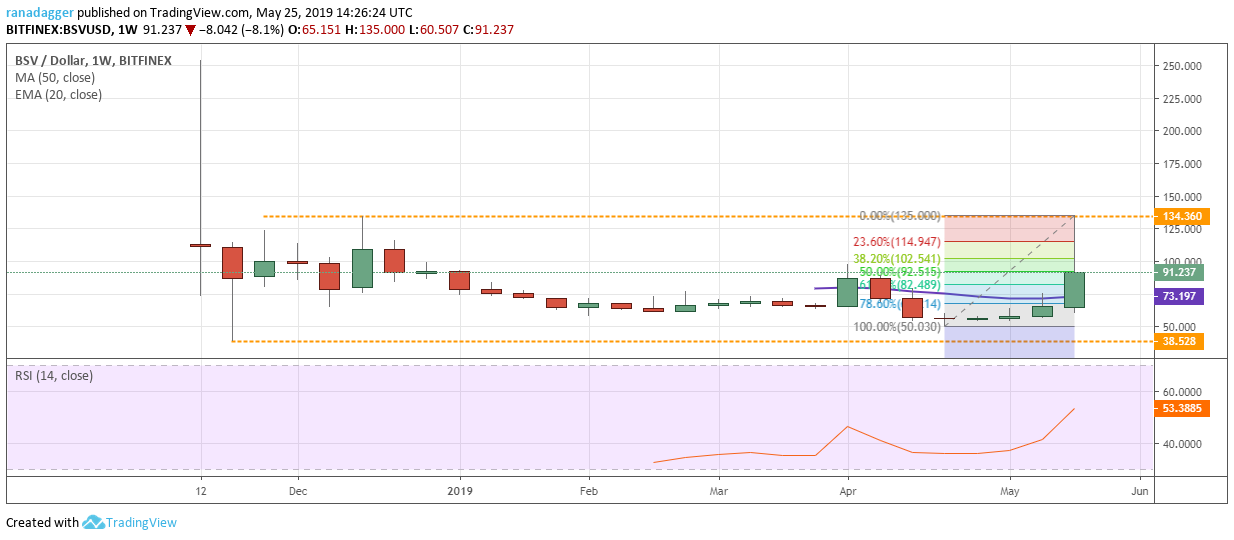

BSV/USD

sv () was the best performer among the major with a rally of above 60% in the past seven days. The boost came amid the that nChain founder Craig Wright had United States copyright registrations for the white paper and the original code used to build . However, the community and a few experts consider this to be an important event that can alter the fortunes of sv. But what do the charts project? Let us find out.

The pair skyrocketed this week and reached the overhead resistance of $134.360. However, profit booking and selling just above this resistance resulted in the pair giving up a large part of its gains. The should find some support at the current levels, failing which, the drop can extend to $82.489 and lower.

While the sharp up move from the lows shows buying at lower levels, the failure to hold onto the gains shows a lack of demand at higher levels. The pair will pick up momentum on a close (UTC time frame) above $134.360 and will weaken below $38.528. Until then, it is likely to remain range bound between these two levels.

BNB/USD

coin () has been one of the strongest performers among the major coins: it has consistently made new highs and is in a strong uptrend. Riding high on its success, exchange is reportedly planning to offer to its clients. The exchange is also giving away $1,000 of $ONE to celebrate the of the forthcoming . How far can the rally continue? Let us find out.

The pair is in a strong uptrend and has picked up momentum after breaking out of previous lifetime highs. Earlier, the resistance line had acted as a major roadblock, but the bulls are currently attempting to breakout of it. If successful, the rally can extend to $40 and above it to $46.1645899, which is a 1.618 Fibonacci extension level.

But the rally is getting vertical and the RSI on the weekly charts is threatening to enter deeply overbought territory. This shows that the up move has been overdone in the short-term, and that a minor correction or consolidation can start between $40 and $46.1645899.

LTC/USD

() is benefitting from the positive sentiment in the crypto space, and the forthcoming has added to the bullishness. A series of by OKEx pointing to some kind of an announcement regarding has also heightened interests. Can the upward move continue?

The pair has completed a cup and handle reversal pattern that has a minimum target objective of $158.81. If the momentum continues, the upward move can extend to $172.647. The moving averages completed a bullish crossover a couple of weeks back and the 20-week EMA is sloping up: this shows that the bulls have the upper hand.

Our bullish view will be invalidated if the fails to sustain the breakout and dips below the support of $91 once again. The support levels to watch on the downside are $84.3439, $74.6054 and below it to $60.1980.

BCH/USD

Two miners who control about 43% of the cash () pool, .top and .com, joined hands this week and executed a to stop an unknown miner from taking coins that were accidentally sent to “anyone can spend” addresses. In this case, the attackers did not carry out the 51% attack for their own benefit, but still some believe that it shows that the is too centralized. How does its chart look?

The pair is currently rising inside an ascending channel. It has crossed above both the moving averages, which is a positive sign. The bulls are facing selling at the resistance line of the channel, but the positive thing is that the pair has not given up ground. If the price holds above the 50-week SMA, we should see another attempt to breakout of the channel. If successful, a rally to $620 is probable.

On the contrary, if the bulls fail to scale the resistance line of the channel, the digital currency can dip to the support line of the channel, closer to $300. A breakdown of this support will break the trend.

DASH/USD

Dash () released its latest version 0.14 on the mainnet, which is another step leading to version 1.0, dubbed evolution. The upgrade improves the security of the network against 51% attacks, the first for proof-of-work networks, according to Dash Core CEO Ryan Taylor. An analysis by Cryptoslate shows that DASH has seen a growth of 58% in the active address count from 2018 to 2019, the largest growth among the major coins. This was reportedly mainly due to the surge in usage in crisis-hit Venezuela.

The pair has been facing resistance at $176.81 since the past week, and a breakout of this barrier will propel the pair to the next level of $229.24. We expect the bulls to again face selling at these levels. Currently, both the moving averages are on the verge of a bullish crossover and the RSI is in the positive territory. This shows that the bulls are at an advantage.

However, if the digital currency turns down from $176.81, it might enter into a consolidation. The support of the range will be at $107.36, and a break of this support will be a bearish sign.

The market data is provided by the exchange. Charts for analysis are provided by .

Published at Sun, 26 May 2019 17:10:57 +0000