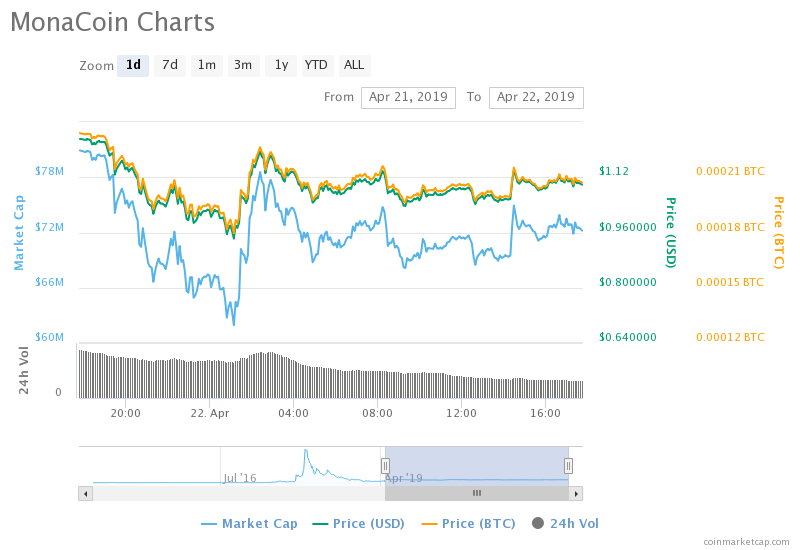

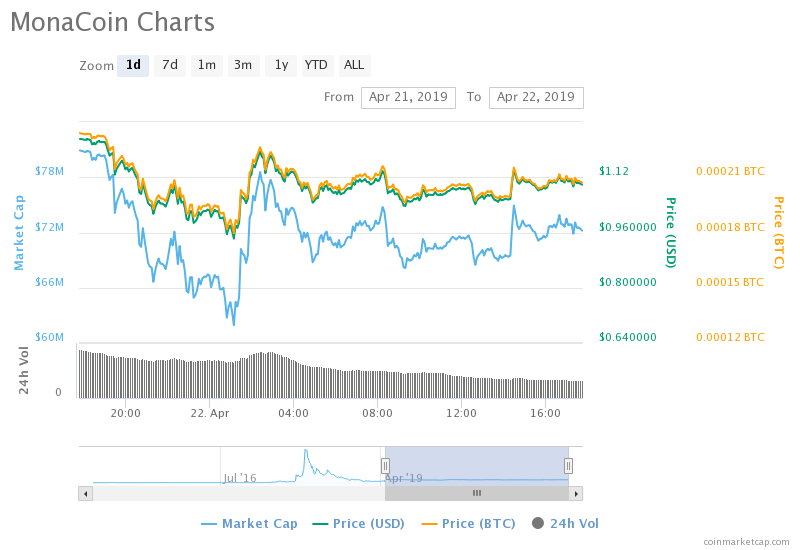

Monacoin traded lower on Monday after ending last week on a 50-percent gain.

The fell as much as 30-percent to $0.94 from its Sunday peak. As of 1344 UTC, the pair had recovered towards $1.10 with the coin’s market capitalization at $72.3 million. However, based on a 24-hour adjusted timeframe, both the price and valuation was still down by circa 10-percent against the dollar and 10.5-percent against .

Monacoin undergoes a dump after raising over 50% the previous week.| SOURCE: COINMARKETCAP.COM

The past 24 hours saw exchanges around $15.75 million worth of MONA-enabled pairs. -based Bitbank hosted more than 90-percent of the total MONA volume against the Japanese Yen. At the same time, the exchange noted $367K worth of -enabled trades in the MONA market. Bitbank is a regulated platform, which means that the probability of price manipulation by the exchange was the least in its case.

Mysterious Buyer

Monacoin is neither a Tezos featured in a high-profile staking service nor a backed by a persistent marketer. The asset is merely a digital which took its cues from a more established project like and launched itself as a Japanese-version of Dogecoin in 2013. The project has been there for far too long which should keep the “” away. But that still does not explain the fundamentals around the mysterious MONA pump.

Twitterati Bobcat Crypto reported a “medium strength buy signal” on Bittrex, a US-based exchange that raised the buy volume by circa 276-percent. It appears the mysterious buyer(s) exhausted its buying frenzy at a certain level, followed by an exit. That is the only explanation which could explain Monacoin’s intraday performance on Saturday throughout Sunday, followed by a sharp correction Monday.

Bobcat has detected a potential MEDIUM strength BUY Signal for (Monacoin). Buy Volume Increase of 275.99%. Price Increase of 14.76%. Current Price 0.000162 ($0.8625447) Trade detected on exchange: Bittrex ()

— Bobcat Crypto (@BobcatCrypto)

Opportunities

Entering new long positions in the MONA market looks risky since the potential of an extended downside correction is high. Meanwhile, a Short target towards the intraday support level at $0.94 could yield a decent interim profit. A stop loss order maintained a few points above the entry position would minimize losses in the event of the asset rebounding ahead of testing the Short target.

Published at Mon, 22 Apr 2019 15:41:26 +0000