This is not a legal advice by any means, but issuing ICO in US is not a problem if you follow SEC regulations. You can be exempt for example by following this rules. You need to implement KYC and AML screening.

New Reg AThe final rules expand Reg A into two tiers: Tier 1 for securities offerings of up to $20 million; and Tier 2 for offerings of up to $50 million. The new rules preserve, with some modifications, existing provisions regarding issuer eligibility, offering circular content, testing the waters and “bad actor” disqualification. Tier 2 issuers are required to include audited financial statements in their offering documents and to file annual, semiannual, and current reports with the SEC. Except when buying securities listed on a national securities exchange, purchasers in Tier 2 offerings must either be accredited investors or be subject to certain limitations on their investment.

Also in Canada there are active steps to regulate ICOs.

Here is an example.

Terms & Conditions

Terms & Conditions

CXS Tokens and Crestonium Platform are not intended to constitute securities in any jurisdiction. This Whitepaper does not constitute a prospectus or offer document(s) of any sort and is not intended to constitute an offer of securities or a solicitation for investment in securities in any jurisdiction.

Crestonium’s head office location is at Zurich, Switzerland. It is subject to a market best practice audit in accordance with European regulations thereby ensuring total transparency and absolute accountability of all Crestonium activities.

Risks and Uncertainties

Anyone wanting to purchase CXS Tokens should carefully consider and evaluate all risks and uncertainties associated with Crestonium and CXS Tokens, the Initial Token Sale and the Crestonium Wallet (each as referred to in the Whitepaper).

Risks of Crowdsales

All cryptocurrencies are highly volatile, extremely risky and unstable. You may lose some or all of your money by investing in cryptocurrency market. Since the price of CXS is currently tied to price of BTC the value of CXS may fluctuate based on the volatilities of the market.

Cookies

We employ the use of cookies. By using Crestonium’s website you consent to the use of cookies in accordance with Crestonium’s privacy policy.

License

You may view and/or print pages from for your own personal use subject to restrictions set in these terms and conditions.

You must not:

Republish material from Sell, rent or sub-license material from Reproduce, duplicate or copy material from

What is Crestonium

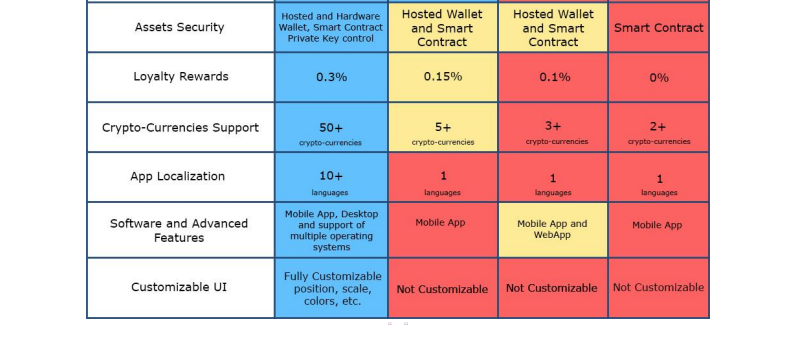

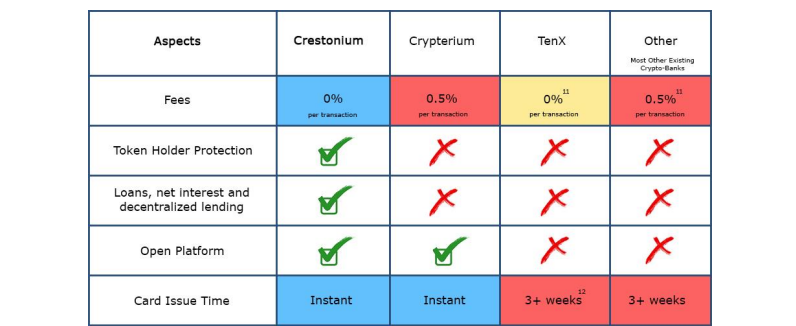

Crestonium offers the seamless experience of sending and receiving currency globally at zero cost. We aim to provide unlimited usage to mainstream users as cryptocurrency becomes a phenomenon accepted by all. Crestonium was built, not only for storage, but for actual spending — which remains one of the significant challenges of modern cryptocurrency.

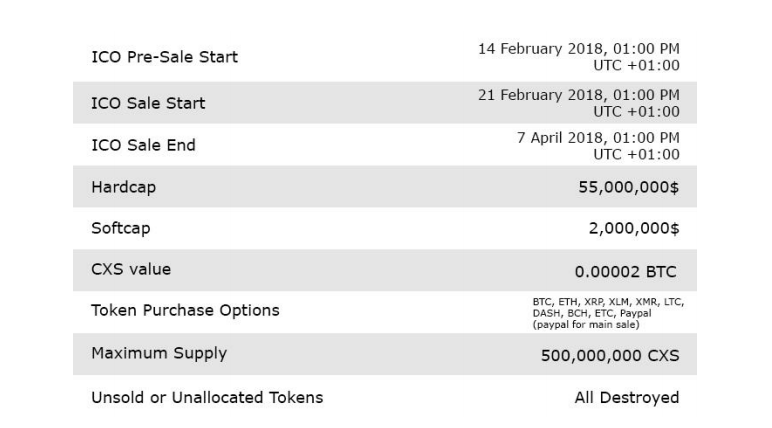

ICO Summary

The initial market value of 1 CXS is set to be 0.00002 BTC. Currently we accept the following crypto-currencies:

— bitcoin BTC

— Ethereum ETH

— Ripple XRP

— Stellar Lumens XLM

— Monero XMR

— Litecoin LTC

— Dash DASH

— Bitcon Cash BCH

— Ethereum Classic ETC

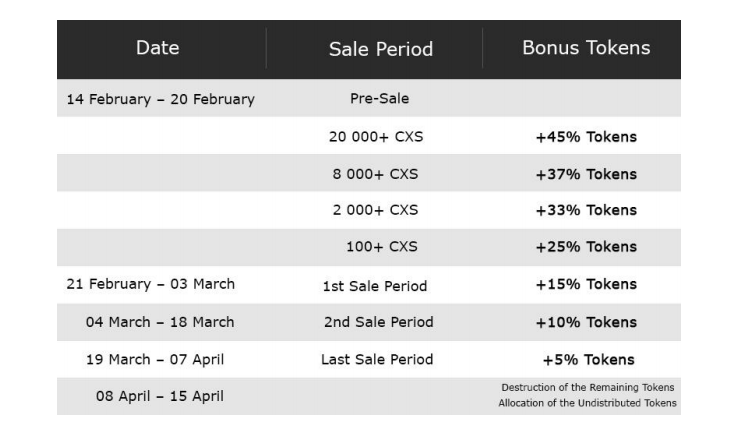

On the page below, you can find a table with a representation of the ICO overview.

“Lot of people have great ideas but what matters is the execution of them.”

At Crestonium the customer service and delivering and outstanding product are our number one priorities.

Crestonium’s development team is always active and perpetually in close contact with the community.

We understand the true value of building and developing an initiative and have made our reward program and loyalty a core part of the Crestonium dream.

Selected Team Members:1

Security Issue

There are approximately 3.7 billion6 people with access to the Internet and approximately 2.1 billion7 people with mobile devices and majority of these people don’t currently have access to traditional exchange. These people are primed for the Cryptocurrency market.

Spending Obstacles

The reluctance to spend one’s cryptocurrency holdings can be attributed to a few different reasons. First of all, most people believe the value of their digital currencies is going to continue to increase indefinitely.

High Cost of Transactions

Finally, you have the issue of the costs associated with selling cryptocurrency. Every exchange has its own fee structure and design, but as a general rule, users can expect to pay fees on a per transaction basis on top of a high exchange rate.

The Solution

Secure

Crestonium is tailored for everyday use and provides a robust and secure environment for Cryptocurrency. Direct transactions and instant exchange are just some of the features of Crestonium.

Storage and Spending

We provide a cryptocurrency storage of many crypto-currencies — BTC, LTC, ETH, BCH, XRP, EOS, XMR, XLM, NEO, ADA, TRX, DASH, XVG, IOT, ZEC, XRB, and the list is growing every day.

Zero Cost of Transactions

You can spend many crypto-currencies and pay instantly without the necessity and hassle of having to exchange the cryptocurrency beforehand. All with 0% fees.

Cres tonium Token Sale O f fering

We offer extensive bonuses for our pre-sale period:

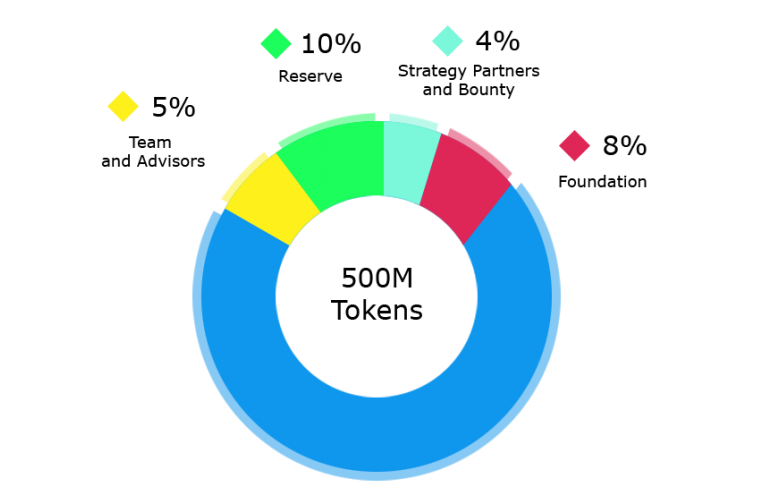

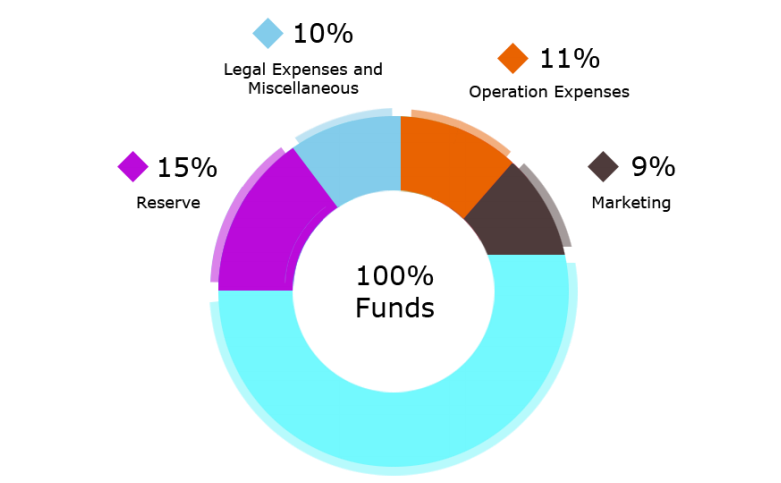

It is important to us that our community knows how the funds will be spent. Which is why we have also produced a Use of Proceeds graph to illustrate this.

We believe that blockchain technology and cryptocurrency payments are the future, and they should be free. We aim to connect the blockchains and offer the user an easy-to-use, elegant, fully customizable interface with instant access to any blockchain assets, but also offer advanced features to experienced users.

Tag Information

Wibsite:

Whitepaper:

Twitter:

Facebook :

Telegram :

My Bitcointalk:

We all agree the energy sector has been a highly centralized and monopolised industry for a long time. Affordability, reliability and emissions-intensity have become core concerns for households and businesses.

In most countries the supply and retail of electricity has shifted from fully government owned operations to a regulated, centralised, and privatised ownerships. The monopoly still remains however as do the concerns for people: prices continue to climb while the transition to clean renewable energy has been slow.

If you don’t agree then the following might sway your opinion:

In Australia the thermal generation market is becoming increasingly concentrated with two players accounting for over 50% market share in every State–Oil is also a major contributor to climate change, which the U.S. Department of Defense has identified as a “major threat multiplier” — .From 1980 to 2010, while the India’s per capita GDP grew by $193, to $4,514, its emissions per capita grew from 1.49 tons per year to more than six tons per year– .In just the first half of 2012, the five biggest oil companies in the US earned $62.2 billion in profits. That’s $341 million each day- .At least 300 million of India’s 1.25 billion people live without electricity — .Holding monopoly over power plants and transmission, Eskom is the sole generator and purchaser of electricity in South Africa. It rely’s on coal to generate bulk of the energy supply — .The electricity sector is the largest source of greenhouse emissions in Australia. 87 per cent of our electricity still comes from coal and gas fired power stations-

There are signs of hope though. Lobby groups and certain governments around the globe are doing all that can be done to overcome these issues.

Centralised institutes or bodies will not be the complete solution.

There are now positive signs that in the year 2018, we will start to experience transformation within the energy sector, with the underlying model moving away from a centralized structure towards a decentralized system.

This could lead to the elimination of trading platforms, public grids and other suppliers. Although it won’t happen instantly the energy sector is being seen as one of the industries where the blockchain technology could have the most disruptive impact.

Some : energy produced from oil doesn’t just fuel our cars. It also fuels wars and terror.

It has been estimated that between one-quarter and one-half of all interstate wars since 1973 have been linked to oil, and that oil-producing countries are 50% more likely to have civil wars. For example:

Oil was the reason the Nigerian military conducted “wasting operations” against the Ogoni community who opposed Shell in the 1990s.Exxon was accused of providing machinery for digging mass-graves in Indonesia’s war against secessionists in the province of Aceh (the company denies this).Oil development was at the center of Colombia’s bloody civil war.BP ignored warnings that its Baku-Tbilisi-Ceyhan oil pipeline would exacerbate conflict, passing through or near seven war zones. The pipeline became a major cause and target of Russia’s war with Georgia in 2008

Following are the significant ways through which blockchain technology can disrupt the energy sector:

Peer-to-peer Energy Trading Models: As a result of increased awareness among the users regarding the production and usage of renewable energy, many consumers are turning into producers, dubbed as pro-sumers. These pro-sumers aim to eliminate the various intermediaries in selling energy and utility services. For example, Vector, a New Zealand based company works with Power Ledger, an Australian start-up, for providing the blockchain based peer-to-peer energy trading platform.In this case, the pro-sumers trade their excess electricity or surplus solar power with one another without any middlemen. . Another example is Vattenfall, a Dutch energy company, which has also created a peer-to-peer exchange trading model with its subsidiary company, Powerpeers, for their residential pro-sumers. Other similar companies trying pilot runs include LO3 Energy in the U.S. and Bouygues in the city of Lyon.Distributed Energy Grids: Thanks to the rapid growth of micro-grids or distributed energy grids (DERs) many start-ups are now also aiming to produce their own power and sell the excess back to the grid.Brooklyn Microgrid and Grid Singularity are looking to facilitate the exchange of granular and private data in the energy marketplace using blockchain technology.“A more intelligent grid would include policies and regulations to encourage private renewable energy production, with citizens installing their own generation capacity and selling their surplus back into the grid.” .Financing Renewable Energy Projects: In addition to promoting peer-to-peer energy trading models, blockchain technology is also being used to finance start-ups that aim to develop renewable energy generation projects.Companies like Assetron Energy, Solar Dao, and Sun Fund are using crowdfunds to build such renewable energy plants using blockchain technology. They, in turn, give the investors a stake in the future plant profits.Giants like ImpactPPA and The Sun Exchange are striving to get more such projects in the marketplace. They enable purchase and sale of solar cells through ‘crowd-sale’ to power several businesses and communities.Cryptocurrencies for monetary payments: Blockchain technology can possibly transform the way we arrange, record, and verify transactions. It enables direct processing and recording of transactions between the users without their having to rely on middlemen, such as a power grid, a bank, or a public authority.Several companies in the oil and gas industry are already working towards adopting blockchain technology in their businesses.Many start-ups and test projects are being initiated to tap into the potential of this revolutionary technology.One such example is Marubeni Corporation (MARUY) that is already accepting cryptocurrency payments for use within the marketplace in some parts of Japan. Another blockchain startup company based in South Africa, , has entered into a partnership with Usizo to enable cryptocurrency payments for bitcoin-compatible smart metering vendors.Using blockchain technology would mean that millions of transactions would now be visible worldwide providing a high level of transparency. While the buyers and sellers would remain anonymous, the transactions would remain public. So every time a barrel of oil is bought or sold, it would get digitally entered in the blockchain ledger database.

This is a quote from Germany’s solar champion Hermann Scheer. Little would Hermann Scheer know at the time that blockchain technology could help win the race for decentralised energy democracy.

The adoption of blockchain technology in the energy sector is still in the nascent stages. You and I will still have to wait and watch when can it become mainstream, but the progress made so far seems to be hinting, that day isn’t far.

This could trigger some institutional changes in the electricity sector which would affect both the retail as well as the distribution sector.

We are shifting towards an era where the entire energy industry could get decentralized and retail would not remain an independent part of the supply chain. It would instead become an automated process handled by pro-sumers worldwide using blockchain technology.

“A decentralised would encourage competition in every possible part of the system: electricity would be priced according to demand and supply, efficiency would increase as suppliers gained clearer knowledge of high and low demand hours, and consumers would have a choice of suppliers.”

So, will blockchain kill the energy monopoly? wishful thinking, but probably not quite yet. However with better electricity planning, operations and policies, Blockchain could be a big game changer that we’ve been looking for.

Blockogy’s mission is to educate the market on blockchain technology and cryptocurrency, and to play a strong part in the mass adoption of these. We see the potential for this technology, the advantages it will bring, and how it will shape the future. Along with it though will come the downfalls, the downturns, and the uncertainty. We hope to alleviate this uncertainty, by creating awareness, providing education, and tool sets that will help promote the adoption of blockchain technology.

Beginners 101

We used the month of March to focus on app development; we also on-boarded additional resources to continue with a higher speed of development. We are currently doing final internal testing with the team until we deliver it to our beta subscribers. Please allow us a bit time to get things right here so we can push out a stable and tested product. So, we updated the roadmap on our website and pushed the closed beta release by approx. 2 weeks. The code review was also very positive and we are refactoring parts of the DApp to increase performance.

The website will continuously be improved and a few more pages are already pending within our internal approval loop. We have also increased the visibility of the site for new people who may want to reserve some SOCX tokens in advance, for them to interact within the SocialX Ecosystem. We hope to be able to reveal the 3rd source where SOCX will be able to be traded.

After further consideration, we’ve adjusted our roadmap slightly. We encourage you to check out the updated roadmap via the link — we do this in an effort to be as transparent as possible with our community. We will also add more features to the roadmap as we move forward with SocialX. Please keep in mind, we only add points to the roadmap when we are actively working on them. That being said, the old roadmap is still valid for 2018 and we are still following this roadmap in terms of the topics.

In case you haven’t yet signed up for the , we limited our closed beta to 200 testers.

We are currently in the final process for the bounties so make sure to check out our blog to find out more information on how to claim SOCX tokens Internal testing was finished over the Easter weekend. We apologize for the delay, but due to over 1800 bounty participants, we had to rethink our distribution of bounty tokens after the ICO in late January.

We also had an internal update regarding the issuance of prepaid credit cards this year, but we need more time to get the deal sourced right. Who knows, we might not even need that kind of plastic in the future!

![The **bottom** of bitcoin [btc] >>>> historical comparison /////// The **bottom** of bitcoin [btc] >>>> historical comparison ///////](https://ohiobitcoin.com/storage/2019/01/jcQlqy.png)