It’s that time of the day again. You hear about a new coin entering the cryptocurrency space. An — an . How do you analyze it?

With thousands of coins already on the market — and new ones being created daily (as can be seen by the numerous ICOs on ), how exactly do you determine which ICO is legitimate — and which ICO is a scam? I believe that there are six key factors you can look at to quickly determine whether or not an ICO is worthy to be invested in. These factors shouldn’t be the end all be all of what you look at to analyze an ICO’s potential, but hopefully this will give you a good starting point to doing your own research for ICOs.

1. The team & investors

This is one of the most important aspects of any ICO. Who is the team behind it? Who are the investors? Who’s backing and supporting it? Before determining the legitimacy of a coin, get an understanding of the people behind it. Do they have any credentials or the skillsets required to run the coin’s technology? Are they transparent?

Are there any videos of the team discussing the project at blockchain/cryptocurrency conferences and meetups? Are there any interviews with the founder(s) of the token? A good example is Sergey Nazarov (founder of Chainlink) discussing his project at the DevCon3 conference:

The amount of members on the team is also important. If an ICO only has 1 or 2 members — how powerful do you think the team will be in fulfilling their roadmap?

2. ICO Information & Whitepaper

How much information about the ICO is available? How much news and data can you find about it? Look for pre-sale start and end dates, directions, etc. Is this information present? Look at how much money the ICO is attempting to raise. Does it seem like a reasonable amount to you? can help you setup a daily ICO funding report so you can keep track of the progress of ICOs easily.

Look at the token distribution — how much of the token will the ICO team hold, and how much will they distribute to investors? For example, if an ICO team will hold 90% of the token supply, it’s too overly centralized. If an ICO team holds only 1% of the token supply, the team probably won’t be that motivated to develop the token because they don’t have much skin in the game. Is the ICO a utility token or a security token?

Most ICOs will have a whitepaper of sorts. At least, the real ones do. That being said, shady ICOs will have shady whitepapers. Double-check the advisors in the whitepaper are real people.

Take time to analyze and read an ICO’s whitepaper — and whether or not their vision seems realistic and feasible. There’s no universal structure or best practice when it comes to presenting a whitepaper — but you could really tell a quality whitepaper from a poor one. How is the quality of the language? How long or short is it? Is it detailed? Does it answer your questions? Does it sound reasonable to solve the problem it’s taking on?

3. The purpose behind the token

What’s the purpose behind the token? What problem is it solving? What’s the story behind it? Does an existing coin — like bitcoin or Ethereum — solve this problem already? Try to avoid coins that are redundant. Take, for example, the . Why couldn’t payments on the platform simply be made with Ethereum instead? Ask yourself if the ICO is attempting to solve a problem that doesn’t really exist — or if the solution they are proposing makes sense.

4. The website

First impressions count. In the online world, websites are the mediums we use to judge the trustworthiness and professionalism of any business or product. Is their product clear and easy to understand? Does their website look like the real deal — or does it look like it was made in less than an hour using Wix?

An example of a bad website for an ICO is the website for the “PayPro” token: .

The Telegram link goes to a “Free AirDrop Alert” chat room. (Telegram is the most common platform that ICOs use to interact with its investors), no team members are listed, and the website looks like it was hacked together in an hour.

An example of a (now completed) ICO with a good website is the website for Request: .

The website looks clean and organized. It includes links for its various social media channels (Reddit, Telegram, Twitter, etc.). The website shows the use-cases of the token, a clear development roadmap, the team, and business partners.

5. Social media presence

Another aspect to consider is their social media presence. How big is their following? Are they active on social channels? Facebook? Twitter? Telegram? Most legitimate ICOs will post frequent updates and create a bitcoin Talk thread announcement.

On the same note, keep an eye out for “shill” profiles on social media. Illegitimate ICOs will often run an army of fake accounts that are used to hype the coin. These accounts are run by their own team members or marketers they’ve hired online.

6. GitHub Activity

The amount of activity on the ICO’s GitHub page is an excellent indicator on the technical progress that the team has made for the token. If you don’t know, GitHub is an incredibly popular code repository used by teams to store their code.

Check to see if a team has a public GitHub repository for the platform they are building. Although having a technical background helps, it’s not necessary. Checking to see if the GitHub repository is continually being updated should give you a good idea of the technical progress for the ICO. Here’s a few examples of Github repositories for popular cryptocurrencies:

Notice how these projects have been updated recently and changes are continuously made. This is usually a sign of a token that is progressing well technically. Check out to get statistics on GitHub repositories of many cryptocurrencies.

Conclusion

These are just some factors you should consider while determining whether or not an ICO is legitimate. You should not look at any one factor in isolation, but rather look at all factors as a comprehensive analysis of the ICO.

At the end of the day, if you are planning on investing in a token it is best to do your own research (DYOR). Token recommendations from friends or family can be useful, but they should only be used as a starting point to DYOR. Invest wisely.

Join our Telegram community to learn more or send us an email at info@icowatchdog.com. Also, feel free to visit our website at .

Think an ICO is running a potential scam? Report it to !

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

CloudFish, backed by GeorgiaTech ATDC is on a mission to become the leading innovator and revolutionize enterprise cloud security by leveraging Artificial Intelligence and Block chain technology. The ICO is an opportunity for investors to be part of our company. We are offering handsome bonuses to our early investors. Cloud-Fish is a unique one of its kind product disrupting the cloud security industry. We have a ready product, that has been tested and validated, and our enterprise release is ready to roll out in the next few months.

Why CloudFish exists?

There are two common trends observed in the industry: First, businesses are moving their data from on-premise servers to cloud. And second, as the block-chain assets’ market like investment in cryptocurrencies is getting traction, the business decision makers are planning to diversify their assets and invest in the currencies market. This creates the need for an enterprise class solution that provides a unified security platform not only for their digital assets like documents, files, emails, IPAs etc. but for also for their block chain assets like cryptocurrencies that are stored on cloud servers.

CloudFish provides a data security platform that secures digital assets stored in the cloud, by using block-chain technology. The product provides a distributed security mechanism that enables companies and individual users to secure their documents, emails, pictures, crypto-currencies and wallet keys by leveraging the block-chain technology.

The CloudFish Token — CFH

CloudFish token is NOT A SECURITY. It is a utility token that can be traded on ERC20 compliant exchanges or used for buying products and services from CloudFish. The holders of CFH token are only entitled to trade the token or use them to buy CloudFish products, if successfully developed, as described in this document. The CFH token itself is based on Ethereum, a blockchain-based computing platform. Ethereum allows smart contracts — distributed computer programs which can facilitate online contractual agreements in a cryptographically secure manner.

Below you read our objective review and analysis of Cloud-Fish ICO.

Strengths

Data markets are a huge and growing business, that can adopt new innovative business approachesInternational data markets can be facilitated using exchangeable tokensBacked by Georgia Tech’s accelerator, it is one of the top universities in the world

Potential Concerns

Not all team members’ commitment to the project could be verifiedData market competitors are some of the World’s biggest companiesLow community outreach at the moment of review

Visit: for more information on the Token sale.

Join the CloudFish communities for updates.

Ann Thread BTT:

Telegram:

WHAT IS BITRUST?

BITRUST is an affordable, decentralized, easy to use peer-to-peer (P2P) cryptocurrency insurance marketplace that is based on Ethereum, a blockchain-leveraging smart-contract technology. The objective of BITRUST is to be affordable for retail digital currency investors with an average monthly trading volume of between $100 and $100,000.

In 2017, 179 new altcoins were launched, many of which have since decreased in value dramatically. With BITRUST, investors who are interested in coins that are new to the market will be able to hedge the risks associated with such pitfalls. We offer a secure and easy-to-use risk management solution for cryptocurrency enthusiasts which enables cryptocurrency investors and day-to-day users to significantly mitigate risks associated with high market volatility.

BLOCKCHAIN

Blockchain technology is constantly developing and the cryptocurrency market is growing and we couldn’t be more happy about it. This represents not only a significant technology breakthrough in data architecture and in terms of security providing distributive or decentralized networks, but we also get the feeling that a major movement is happening globally. BITRUST aims to promote the even greater involvement of blockchain technology in our daily lives by reducing the risks associated with investments in cryptocurrency, thereby allowing new and existing projects to flourish for the benefit of the entire system.

HOW IT WORKS

Since BITRUST is a peer-to-peer decentralized cryptocurrency insurance platform, a BITRUST smart contract can involve two or more counteragents. For simplicity, we use the following terms: those seeking an insurance are Buyers (B-side), and those willing to insure are called Sellers (S-side).

· B-side places a bid on the BITRUST platform to insure a certain position :

Insure against ETH (with a value of $100) dropping in price by 30% against BTC for 96 hours (based on a certain index).

· With or without certain conditions:

Willing to pay in digital currencies an equivalent of $5 as an insurance. Claim an equivalent of $15 in case the price drops to $70 or below.

· S-side may be just one seller or a cluster of several sellers, which can :

Agree to the terms proposed by B-side. Or make a counter offer proposing slightly amended terms.

ETHEREUM-BASED SMART CONTRACT GUARANTEES

BITRUST utilizes Ethereum smart contract technology, which guarantees the execution of a transaction that has been pre-agreed by both parties. The entire transaction within BITRUST requires both parties — the buyer of insurance and the seller of insurance — to lock their funds in BITRUST tokens (BTF) or a certain set of other cryptocurrencies as permitted by our platform. After the insurance contract date expires (as pre-agreed by both parties) and based on the provided, the BITRUST smart contract is executed in a decentralized and automated way — ensuring the agreed terms are carried out. This mechanism eliminates the possibility of fraudulent behavior by any of the parties involved, e. g. not delivering on the promise (payment) in case the “bet” did not go in their favor.

TOKEN

TOKEN ALLOCATION

· The maximum number of tokens created will be BTF 250,000,000.

· The number of tokens available during the token sale will be BTF 150,000,000.

· 60% of all tokens issued will be allocated to ICO participants.

· 15% of tokens issued will be allocated to the BITRUST team and will be automatically locked for 24 months by smart contract.

· 15% of tokens issued will be allocated to members of the bounty campaign, advisors, and towards ICO campaign costs.

· 10% of all tokens will be automatically locked for 24 months by smart contract as a reserve for further development in the BITRUST platform or Secondary Coin Offering.

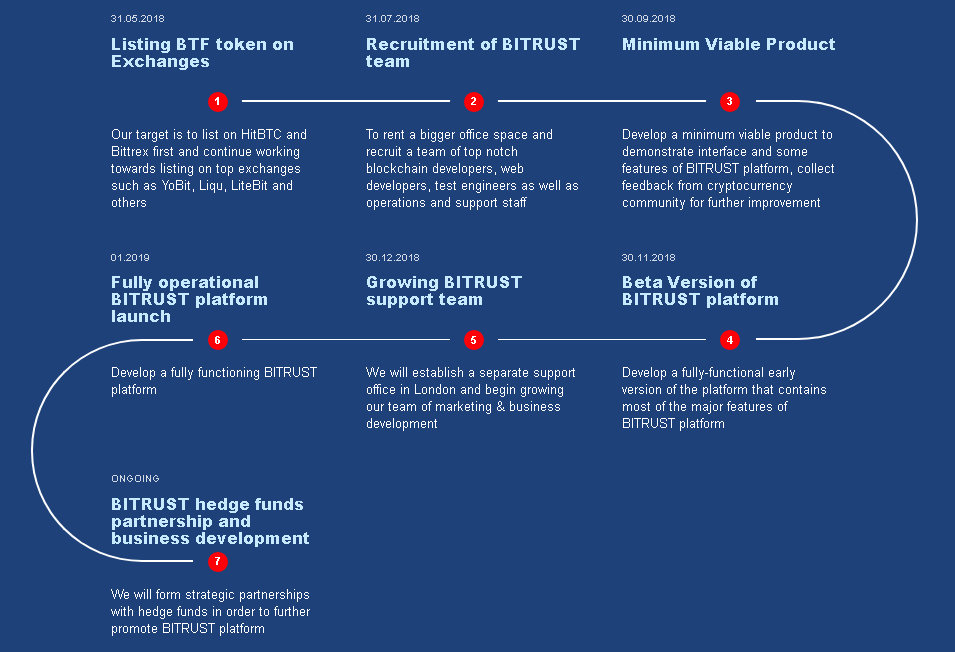

ROADMAP

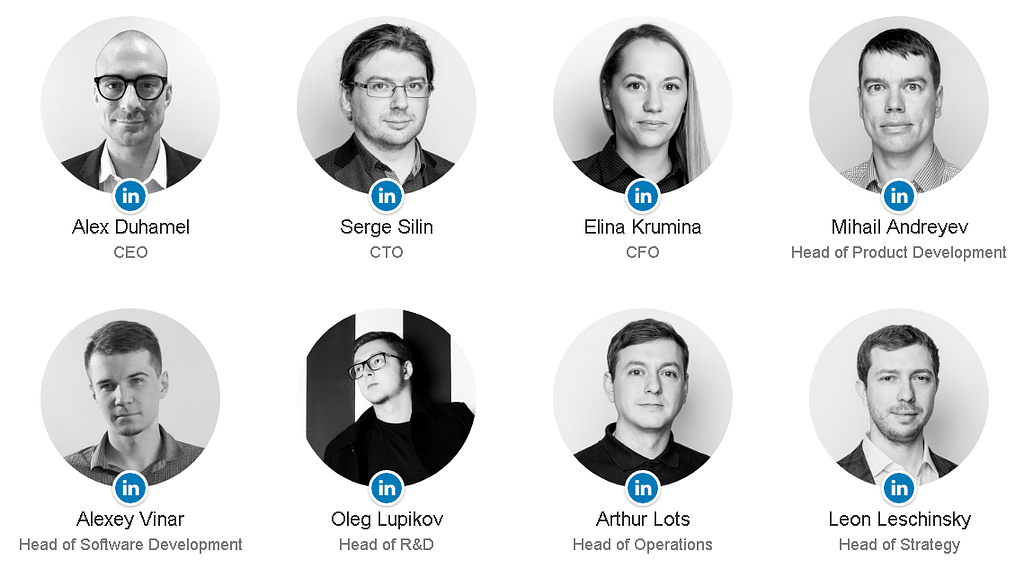

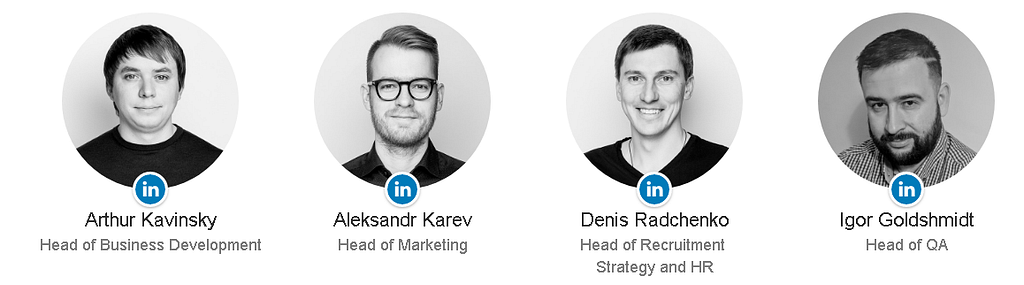

TEAM

for more details please visit the link below:

AUTHOR

BITCOINTALK USERNAME & PROFIL :

Frds get free

bitcoin

ETHEREUM

LITECOIN

DOGECOIN

http://luckybits.io/r/4009

THERE ARE MANY WAYS TO EARN ALL THESE CRYPTOCURRENCY