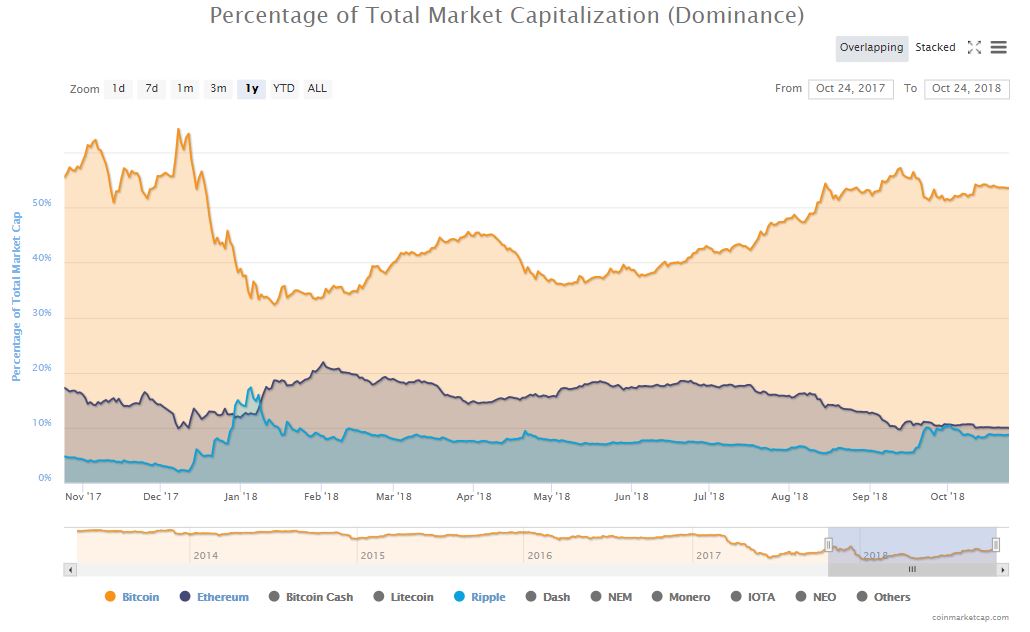

It’s been 10 years since bitcoin creator Satoshi Nakamoto published his white paper on bitcoin, and the global economy hasn’t been the same since. The original cryptocurrency now boasts a of more than $112 billion, while bitcoin’s dominance hovers at more than 53%.

But if you ask Nigel Green, founder and CEO of financial advisory firm deVere Group, which boasts , the next 10 years will look a lot different than bitcoin’s first decade. He’s quick to attribute the “crypto revolution” to , saying that it has changed the way money is transacted forever. Green’s outlook, however, is a mixed bag, with bitcoin’s “influence and dominance of the cryptocurrency sector” expected to “drastically reduce” while the value of the broader crypto market is poised to expand by 5,000%, which would attach a combined market cap of $20 trillion in the coming decade. Green :

“[While] I don’t wish to rain on anyone’s parade, I believe that bitcoin’s influence and dominance of the cryptocurrency sector will drastically reduce in its second decade. This is because as mass adoption of cryptocurrency grows, more and more digital assets will be launched – by organizations in both the private and the public sectors. This will increase competition for bitcoin and dent its market share.”

Ripple (XRP) and ETH to Steal bitcoin’s Shine

Green, whose firm is based in Dubai but has offices around the world, pointed to other reasons for the forecast, such as better technology, features, and solutions to problems that competing cryptocurrencies will provide, coins like (XRP) and . He told CCN:

“I believe that…XRP will be one of the main digital assets to dent bitcoin’s market share over the next few years due to its apparent focus on integrating with banks and other financial institutions.”

XRP already for cryptocurrencies on CoinMarketCap more than once this year, though it has since fallen back to the No. 3 spot. Meanwhile, despite the fact that ETH has with the crypto community of late, Green remains bullish on the future though he falls short of calling for a “” event.

“Another one would be its current main challenger Ethereum. This is because a growing number of platforms are adopting Ethereum as a means of trading; there’s an increasing use of smart contracts by Ethereum; and due to the decentralization of cloud computing.”

Even if bitcoin’s dominance fades, Green says there is a clear shift among retail and institutional investors away from fiat money and into crypto, one whose momentum will only intensify in the coming decade. As a result, he expects “the market will have grown beyond recognition when bitcoin celebrates its 20th anniversary.”

Featured Image from Shutterstock

Follow us on or subscribe to our newsletter .

Published at Wed, 24 Oct 2018 23:25:06 +0000