Founders Josef Halom and Alon Goren have put together a spectacular schedule of speakers and events. Presentations from internationally renowned experts will cover topics such as opportunities in crypto-investing, blockchains in e-sports and gaming, how blockchain and AI will revolutionize the future of work, and much, much more.

Those coming to Crypto Investment Summit should bring a stack of business cards and their best ideas, said the founders. Participants can enjoy a wide variety of events designed to bring investors and ideas together. A pitch stage will give ICOs and investors a forum to meet and make deals happen. Participants in the summit also can attend exciting networking parties and other events. Day Three will conclude with airdrops of free tokens directly to participants’ wallets.

Mr. Holm and Mr. Goren bring a wealth of experience to the rapidly developing fields of cryptocurrency and blockchain. Mr. Holm helped to pioneer new directions for grassroots funding when he founded Krowdster in 2014. Krowdster combined crowdfunding, software, and advanced analytics techniques to serve over 25,000 clients in only four years.

Mr. Goren also has a deep background in promoting entrepreneurship. As Principal of Wavemaker Genesis, Alon, and his team offer early-stage venture strategy in crypto and blockchain, bridging the gap between venture expertise and crypto leadership. The group, alongside crypto pioneer, Scott Walker, has invested in over 250 companies worldwide, making them some of the most well-connected individuals and thought-leaders in the crypto space.

In addition to supporting digital entrepreneurship, Mr. Holm and Mr. Goren share a goal in helping to educate the public, that’s why they wanted to partner with Cryptospeaker.com. “While the news media does cover cryptocurrency on the surface, it almost never mentions blockchain,” said Mr. Holm and Mr. Goren.

Crypto Investment Summit serves as an opportunity for everyone interested in a glimpse of the future of finance. Investors, innovators, tech enthusiasts and the media should all take this opportunity to learn about how cryptocurrency, blockchain technology, and investment will create opportunities and reshape lives in the coming years.

“Those who have worked hard to make this exciting summit possible want to thank lead sponsor Hedera Hashgraph,” said the organizers. Hedera Hashgraph, they said, represents the future of online transactions, providing a safe and secure platform for negotiation and agreement. Other sponsors include American Airlines, Dream Team, DNA, Genesis Wavemaker Partners, Spice Venture Capital, and Coinspeaker.

Coinspeaker’s community gets 30% off general admission when entering COINSPEAKER30 at checkout! Grab your tickets .

The post appeared first on .

Amidst the growing regulatory concerns across the United States, Attorney General Eric Schneiderman for the State of New York is having a closer look at the operations of a few crypto exchanges thereby ensuring more transparency in the overall process.

On Tuesday, Attorney General Eric Schneiderman wrote a to 13 crypto exchanges announcing the “Virtual Market Integrity Initiative” saying that it was a “fact-finding inquiry into the policies and practices” of the digital currency trading platforms. In this letter, the Attorney General seeks for information regarding their “operations, use of bots, conflicts of interests, outages, and other key issues.”

The important basis of this new Virtual Market IntegrityInitiative is the push for higher transparency to protect and preserve investor’s rights in this nascent financial markets. Schneiderman said: “With cryptocurrency on the rise, consumers in New York and across the country have a right to transparency and accountability when they invest their money. Yet too often, consumers don’t have the basic facts they need to assess the fairness, integrity, and security of these trading platforms.”

Schneiderman said that the major effort would be to look into digital currency exchanges that operate out of New York due to regulatory concerns. The announcement read: “We are aware that certain trading platforms have formal rules barring access in New York and may not have a license to engage in virtual currency business activity in New York. Among other topics, we are asking platforms to describe their measures for restricting trading from prohibited jurisdictions.”

Schneiderman in his letter also mentions that even though cryptocurrencies have provided an alternative approach to financial transactions with advanced blockchain-based technology solutions, their probable use for illicit activities needs to be kept in check. He said: “Representing a technological advance, a medium of exchange, and an investment opportunity all at once, virtual currencies are inspiring innovators, entrepreneurs, and investors—and are fueling an increasingly diverse ecosystem of companies and applications.”

He further added: “But virtual currency is also a highly speculative sector, featuring significant volatility, instability, and risk. Moreover, published reports indicate the sector has attracted fraudsters, market manipulators, and thieves.”

The list of 13 crypto exchanges who have received the letter includes GDAX, Gemini, bitFlyer, Binance, itBit, Gate.io, Huobi.Pro, Bitfinex, Bitstamp, Bittrex, Kraken, Tidex and Poloniex.

Each letter comprises of a 34-point questionnaire which the exchanges have been asked to get it completed by filling all necessary details and submit before May 1st. Some of the questions are quite detailed probing deep into the operational policies of the exchange and other procedures related to trading, KYC/AML practices, information on banking relationships and insurance. In order to ensure transparency with customers, the AG’s office will publish this information “in a publicly accessible format.”

New York is said to have one of the most precise and strict rules for exchange operators who are required to have a mandatory “BitLicense” from the state’s Department of Financial Services (NYDFS) in order to continue their business.

Cameron and Tyler Winklevoss, co-founders of the New York-based crypto exchange Gemini who requested for having a nationwide regulatory approach with the best practices in this early-stage crypto industry.

The post appeared first on .

Information as of April 16, 2018

This report was created by:

Professor , Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox

This report presents data on the ICO market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that have taken place in April 2018, including over the past week (April 9-15, 2018).

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

Table 1.1. Brief ICO market overview, key events, news for the week of April 9-15, 2018

| № | Factors and events

(link to source) |

Date of news | Description | Type of impact |

| 1. | Venezuela Says Trump Ban on Petro Backfires, Doubles Investors

Telesurtv] |

April 9, 2018 | The ban by Donald Trump on US citizens performing any transactions with the Venezuelan state cryptocurrency was “free publicity” for the currency, announced executive secretary for Venezuela’s Blockchain Observatory, Daniel Pena. | Favorable

ICO ⇑

|

| 2. | Russia to Ban Telegram Messenger Over Encryption Dispute [source: ] | April 13, 2018 | On April 13 it took the Tagansky Court of Moscow only 19 minutes to consider the claim of Roskomnadzor and the FSB against the messenger and to rule that access to it be immediately restricted. | Unfavorable

ICO ⇓ |

| 3. | Louisiana Mayor Proposes Government-Backed Crypto and ICO [source: ] | April 15, 2018 | Joel Robideaux, the Mayor-President of Lafayette Parish (Louisiana, USA), has proposed that the local government create its own cryptocurrency and hold an ICO in order to attract funds for development of the region. | Favorable

ICO ⇑

|

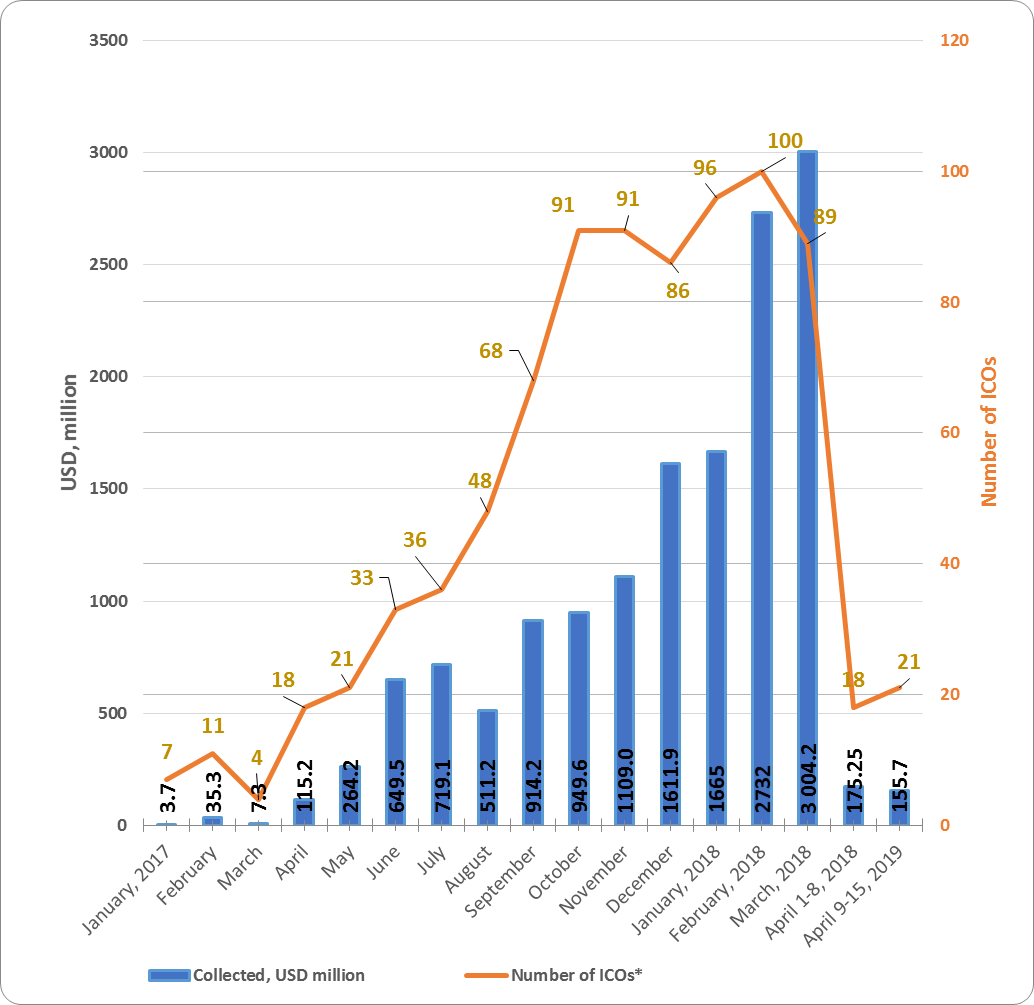

Table 1.2 shows the development trends on the ICO market since the beginning of 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2

| Indicator | January

2018 |

February

2018 |

March

2018 |

April 1-8,

2018 |

April 9-15,

2018 |

| Total amount of funds collected, USD million | 1 665 | 2 732 | 3 004.2 | 175.25 | 155.7 |

| Number of companies that completed an ICO1 | 96 | 100 | 89 | 18 | 21 |

| Maximum collected, USD million (ICO name) | 100

(Envion) |

850

(Pre-ICO-1 TON) |

850

(Pre-ICO-2 TON) |

50

(Nexo) |

50.92 (MOOVER) |

| Average collected funds, USD million | 17.3 | 27.3 | 33.8 | 9.7 | 7.4 |

Note:

1 Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com. For some ICOs information may currently be incomplete (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

2 Including the Pre-ICO-1,2 TON, Petro Pre-ICO.

3 The data for 2018 have been updated (date updated: April 15, 2018).

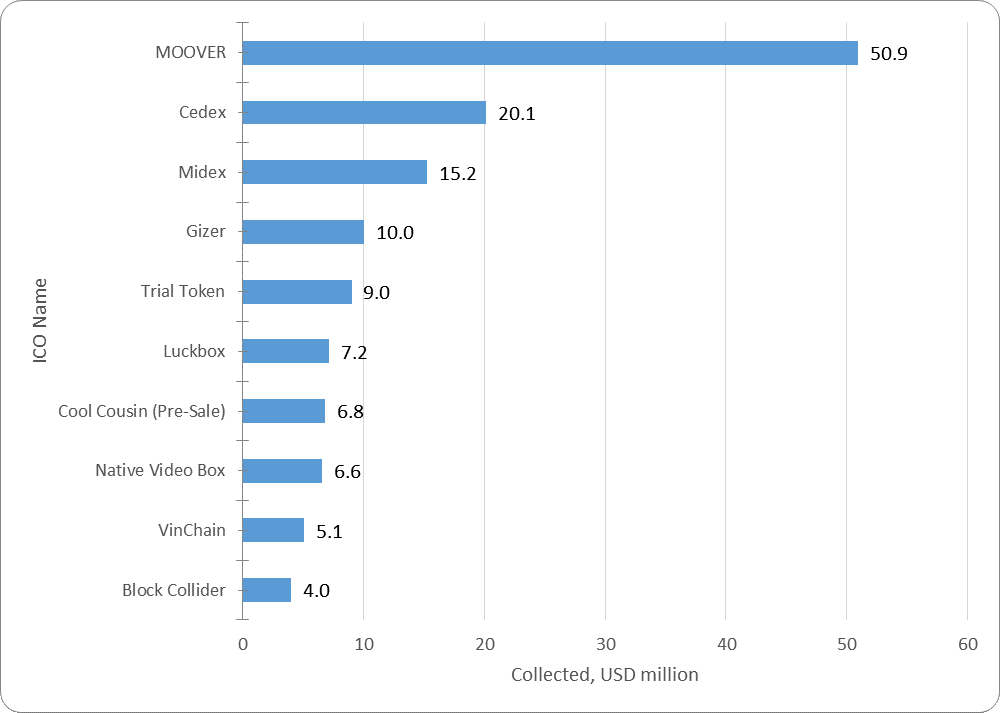

The data for the previous period (April 1-8, 2018) have been adjusted to account for the appearance of more complete information on past ICOs. Last week (April 9-15, 2018) the amount of funds collected via ICOs equaled $155.7 million. This amount consists of the results of 21 successfully completed ICOs, with the largest amount of funds collected equaling $50.92 million (MOOVER project). The average collected funds per ICO project equaled 7.4 million (see Tables 1.2, 1.3).

Table 1.3. Amount of funds collected and number of ICOs

| Month | Collected,

$ million |

Number of ICOs* | Average collected,

$ million |

| January 2017 | 3.7 | 7 | 0.53 |

| February | 35.3 | 11 | 3.21 |

| March | 7.3 | 4 | 1.82 |

| April | 115.2 | 18 | 6.4 |

| May | 264.2 | 21 | 12.58 |

| June | 649.5 | 33 | 19.68 |

| July | 719.1 | 36 | 19.97 |

| August | 511.2 | 48 | 10.65 |

| September | 914.2 | 68 | 13.44 |

| October | 949.6 | 91 | 10.44 |

| November | 1 109 | 91 | 12.19 |

| December | 1 611.9 | 86 | 18.74 |

| Total, 2017 | 6 890.1 | 514 | 13.4 |

| January 2018 | 1 665 | 96 | 17 |

| February 2018 | 2 732 | 100 | 27.3 |

| March 2018 | 3 004.2 | 89 | 33.8 |

| April 1-8, 2018 | 175.25 | 18 | 9.7 |

| April 9-15, 2018 | 155.7 | 21 | 7.4 |

| Total for 2018*** | 7732.0 | 324 | 23.9 |

* Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com.

Information on funds collected is not available for all ICOs (information for last week is tentative and may be adjusted). ICOs that collected less than $100,000 were not considered.

** More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017 (data updated: April 1, 2018).

*** Including Pre-ICO-1,2 TON and the Petro pre-sale

Table 1.3 shows that the largest amount of funds was collected via ICOs in March 2018, mainly due to the appearance of major ICOs. The highest average collected funds per ICO was also seen in March 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs of last week

Table 1.4 shows the ten largest ICOs of the week.

Table 1.4. Top 10 ICOs in terms of the amount of funds collected (April 9-15, 2018)*

| № | Name of ICO*** | Category** | Collected, $ million | Date |

| 1 | MOOVER | Communication | 50.9 | April 15, 2018 |

| 2 | Cedex | Trading & Investing | 20.1 | April 13, 2018 |

| 3 | Midex | Finance | 15.2 | April 15, 2018 |

| 4 | Gizer | Gaming & VR | 10.0 | April 10, 2018 |

| 5 | Trial Token | Legal | 9.0 | April 12, 2018 |

| 6 | Luckbox | Gambling & Betting | 7.2 | April 11, 2018 |

| 7 | Cool Cousin (Pre-Sale) | Travel & Tourism | 6.8 | April 11, 2018 |

| 8 | Native Video Box | Commerce & Advertising | 6.6 | April 15, 2018 |

| 9 | VinChain | Transport | 5.1 | April 15, 2018 |

| 10 | Block Collider | Infrastructure | 4.0 | April 14, 2018 |

| Top 10 ICOs* | 135 | |||

| Total funds collected from April 9-15, 2018 (21 ICOs)* | 155.7 | |||

| Average funds collected | 7.4 |

* When compiling the lists of top ICOs, information from the websites tokendata.io, icodrops.com, icodata.io, coinschedule.com and other specialized sources is used.

** The category was established based on expert opinions.

*** Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered. Information may be incomplete for some ICOs (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

The data for past periods (April 9-15, 2018) may be adjusted as information on the amounts of collected funds by completed ICOs is finalized.

The leader of the week was the MOOVER project. This is a protocol that allows mobile users to share (sell or buy) excess mobile data outside the confines of the contract-based communications operators. It represents a new exchange economy that will give value to surplus resources. MOOVER performs the exchange of mobile data in a P2P network, encrypted using blockchain technology. This makes it possible for the system to work autonomously without centralized control. It is an inexpensive platform where third parties who do not know one another (all participating users) can safely communicate with one another while maintaining their anonymity.

Figure 1.2 presents the ten largest ICOs completed during the past week.

Figure 1.2. Top 10 ICOs in terms of the amount of funds collected (April 9-15, 2018)

1.3. Top ICOs in their categories

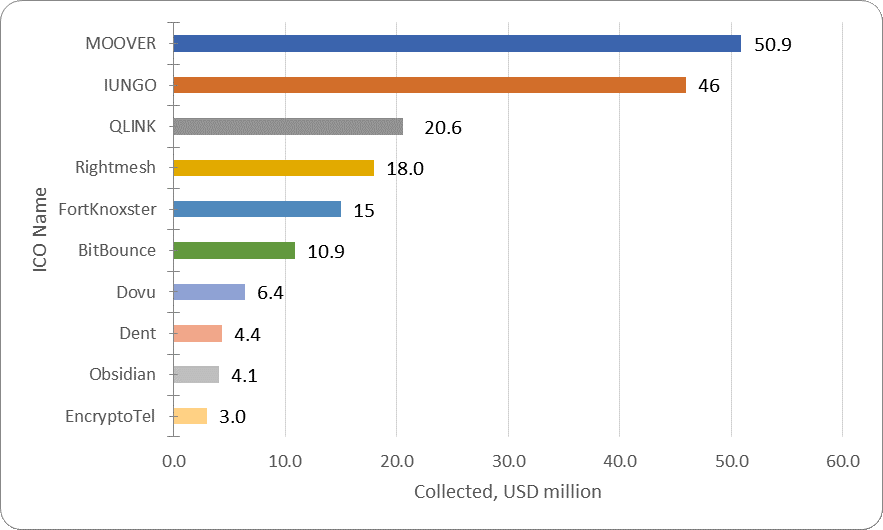

The list of top ICOs by category is compiled with due account of the categories of the leading ICOs for the week.

Table 1.5. Top 10 ICOs in terms of the amount of funds collected, Communications category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | MOOVER | Communications | 50.9 | April 15, 2018 | n/a |

| 2 | IUNGO | Communications | 46 | February 1, 2018 | 0.10x |

| 3 | QLINK | Communications | 20.6 | December 22, 2017 | 1.87x |

| 4 | Rightmesh | Communications | 18.0 | February 28, 2017 | n/a |

| 5 | FortKnoxster | Communications | 15 | March 18, 2018 | n/a |

| 6 | BitBounce | Communications | 10.9 | August 28, 2017 | n/a |

| 7 | Dovu | Communications | 6.4 | October 17, 2017 | 0.71x |

| 8 | Dent | Communications | 4.4 | July 27, 2017 | 22.50x |

| 9 | Obsidian | Communications | 4.1 | August 25, 2017 | 0.48x |

| 10 | EncryptoTel | Communications | 3.0 | May 10, 2017 | 0.40x |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in March and April 2018 are highlighted in red.

The MOOVER project was the leader of the week and the leader of the Communications category. At present, all projects from the top 10 in this category have a token performance indicator of 0.1x to 22.5x. The Dent project can be considered one of the most successful exchange listings, as this project has a current token price to token sale price ratio of 22.5x. When considering this indicator, it is important to remember that the Dent ICO was completed on July 27, 2017, i.e. the 22.5x growth took place over approximately eight months. The market capitalization of Dent currently exceeds $105 million.

Figure 1.3. Top 10 ICOs in terms of the amount of funds collected, Communications category

The Cedex, Midex, and Gizer ICO projects, which can be assigned to the Trading & Investing, Finance, and Gaming & VR categories, respectively, were also completed last week. These projects did not make it into the top 10 of the corresponding categories (Tables 1.6, 1.7).

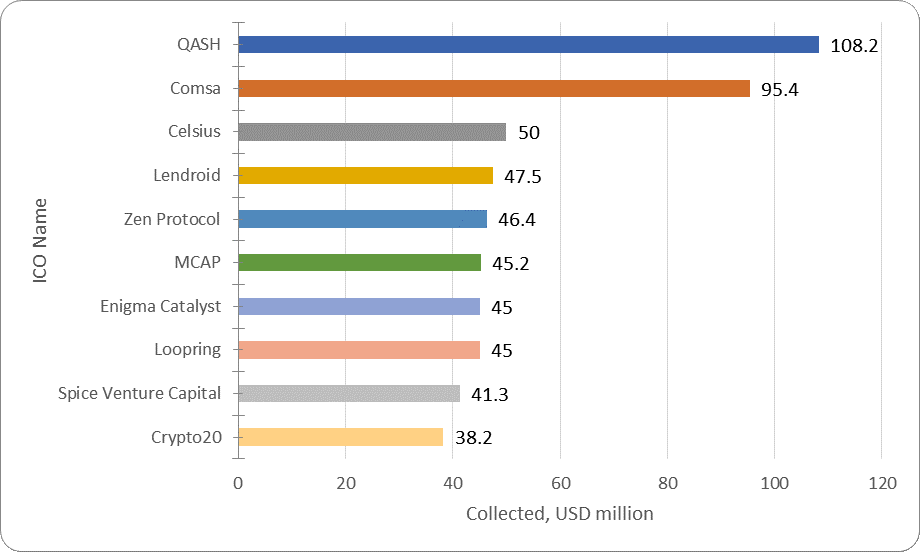

Table 1.6. Top 10 ICOs in terms of the amount of funds collected, Trading & Investing category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | QASH | Trading & Investing | 108.2 | November 11, 2017 | 2.02x |

| 2 | Comsa | Trading & Investing | 95.4 | November 6, 2017 | 0.55x |

| 3 | Celsius | Trading & Investing | 50 | March 23, 2018 | n/a |

| 4 | Lendroid | Trading & Investing | 47.5 | February 20, 2018 | 0.44x |

| 5 | Zen Protocol | Trading & Investing | 46.4 | December 30, 2017 | n/a |

| 6 | MCAP | Trading & Investing | 45.2 | May 7, 2017 | n/a |

| 7 | Enigma Catalyst | Trading & Investing | 45 | September 11, 2017 | 3.09x |

| 8 | Loopring | Trading & Investing | 45 | August 16, 2017 | n/a |

| 9 | Spice Venture Capital | Trading & Investing | 41.3 | March 3, 2018 | n/a |

| 10 | Crypto20 | Trading & Investing | 38.2 | November 30, 2017 | 1.27x |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in March 2018 are highlighted in red.

At present, the QASH project has the largest amount of funds collected in the Trading & Investing category. The Enigma Catalyst ICO has the best token performance indicator among the top 10 projects. Its market capitalization currently exceeds $135 million.

Figure 1.4. Top 10 ICOs in terms of the amount of funds collected, Trading & Investing category

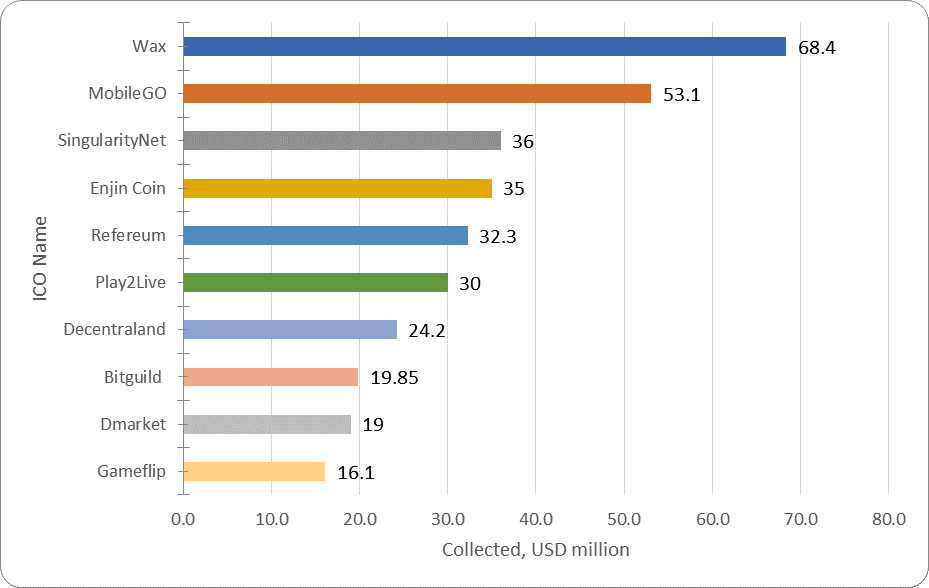

Table 1.7. Top 10 ICOs in terms of the amount of funds collected, Gaming & VR category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | Wax | Gaming & VR | 68.4 | November 29, 2017 | 2.36x |

| 2 | MobileGO | Gaming & VR | 53.1 | May 25, 2017 | 0.55x |

| 3 | SingularityNet | Gaming & VR | 36 | December 22, 2017 | 1.93x |

| 4 | Enjin Coin | Gaming & VR | 35.0 | November 1, 2017 | 2.23x |

| 5 | Refereum | Gaming & VR | 32.3 | February 8, 2018 | 0.49x |

| 6 | Play2Live | Gaming & VR | 30.0 | March 14, 2018 | n/a |

| 7 | Decentraland | Gaming & VR | 24.2 | August 17, 2017 | 3.14x |

| 8 | BitGuild | Gaming & VR | 19.9 | April 6, 2018 | n/a |

| 9 | Dmarket | Gaming & VR | 19.03 | December 1, 2017 | 1.46x |

| 10 | Gameflip | Gaming & VR | 16.1 | January 5, 2018 | n/a |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in March-April 2018 are highlighted in red.

Most of the projects in this category have a token performance indicator of more than 1. The Decentraland project has the best token performance indicator. Its market capitalization currently exceeds $93 million, and its token performance indicator equals 3.14x.

Figure 1.5.Top 10 ICOs in terms of the amount of funds collected, Gaming & VR category

During the analyzed period (April 9-15, 2018) at least 21 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected exceeding $155 million. Last week’s leader was the MOOVER project, which collected $50.9 million. The total amount of funds collected by a number of ICOs failed to reach even $100,000 (the information for some projects is still being finalized).

Annex – Glossary

| Key terms | Definition |

| Initial coin offering, ICO | A form of collective support of innovative technological projects, a type of presale and attracting of new backers through initial coin offerings (token sales) to future holders in the form of blockchain-based cryptocurrencies and digital assets. |

| Token sale price

Current token price |

Token sale price during the ICO.

Current token price. |

| Token reward | Token performance (current token price ÷ token sale price during the ICO), i.e. the reward per $1 spent on buying tokens. |

| Token return | (see token reward) Performance of funds spent on buying tokens or the ratio of the current token price to the token sale price, i.e. performance of $1 spent on buying tokens during the token sale, if listed on an exchange for USD. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | Alternative performance indicator of funds spent on buying tokens during the ICO or the ratio of the current ETH price to its price at the start of the token sale, i.e. if instead of buying tokens $1 was spent on buying ETH at its rate at the start of the token sale and then it was sold at the current ETH price. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the above: Alternative performance indicator of funds spent on buying tokens during the token sale, i.e. if instead of buying tokens $1 was spent on buying BTC at its price at the start of the token sale and then it was sold at the current BTC price. |

| Token/ETH reward | This ratio describes a market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying ETH. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on ETH. |

| Token/BTC reward | This ratio describes the market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying BTC. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on BTC. |

The post appeared first on .

On Monday April 16, the Philippines opposition senator Leila M. de Lima asked her fellow bureaucrats to push the passage of the cryptocurrency bills she helped frame. The proposed bills aim to introduce a harsher penalty towards criminals who use cryptocurrencies during illegal activities.

Also read:

Philippines Lawmaker Wants to Speed Up Cryptocurrency Regulations

Opposition senator Leila M. de Lima thinks that the legislative chamber needs to prioritize Senate Bill 1694, a proposal she filed a month ago. The recent Ordonio Ponzi scheme has compelled her to call upon her colleagues.

“I hope that this occurrence will push my esteemed colleagues in the Senate to take my proposed bill seriously and help pass it into law soon,” the senator explains.

Knowing that virtual currency resembles money, and that the possibilities in using it are endless, higher penalty for its use on illegal activities is necessary.

The Opposition Senator Believes Cryptocurrency Criminals Deserve Harsher Penalties

SB1694 would re-define the Republic Act No. 3815 or the Revised Penal Code (RPC) in order to penalize cryptocurrency criminals one degree higher than the traditional RPC.

“No matter how small or big a group, a punishment must be given. It should never be easy to escape after stealing the hard earned money of other people,” de Lima said.

The older RPC also states that “syndicated estafa and other forms of swindling shall be punishable by life imprisonment to death” if the act involves five or more individuals. De Lima’s proposal wants to lessen the guidelines of the law to two or more people involved with a syndicated crime involving cryptocurrencies.

The opposition senator also details that citizens from the Philippines should be leery of cryptocurrency investments. It’s also worth noting that senator Leila M. de Lima is a controversial figure, and is currently facing trial for profiting from the illegal narcotics trade.

What do you think about the Philippines senator who wants harsher punishments for those who use cryptocurrencies in crimes? Let us know what you think in the comments below.

Images via Shutterstock, Pixabay, AP, and Wiki Commons.

Do you agree with us that bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything bitcoin. We have a. And a. And a, a and real-time .

The post appeared first on .