Tonight we talk with Bryson C Hill about the Daplie. The Daplie has a 20 TB physical cloud storage that you have control over with an integrated Dapps Store as well as bitcoin wallet capabilities.

‚Sponsored by: , and

Links

Social Media

Tip with Crypto

BTC: 139R6K7fxTYaFf2aXTid84Le1ayqMVvSCq

Dash: XoeHNrTMKcLWxZpKfUnDMpRbHFNgFmRrLF

LTC: LUTJtk4QqXLiDkK8pDKK3jM73VVwbp7oSr

BCH: qrf5qmpya8zetcefupdcaew9ch87egl6us7xvrfzh4

ETH: 0x10cfd6916832566e82b3ab38cc6741dfd7e6164fo

In what appears to be an attempt to test their ability to distribute bitcoin Gold (BTG), a Coinsecure weakness was apparently exposed, and over 3 million dollars worth of bitcoin were stolen as a result. The large crypto exchange based in India filed a First Information Report (FIR) with police, alleging their own Chief Scientific Officer to be responsible.

Also read:

Coinsecure Hacked for Over 438 bitcoin

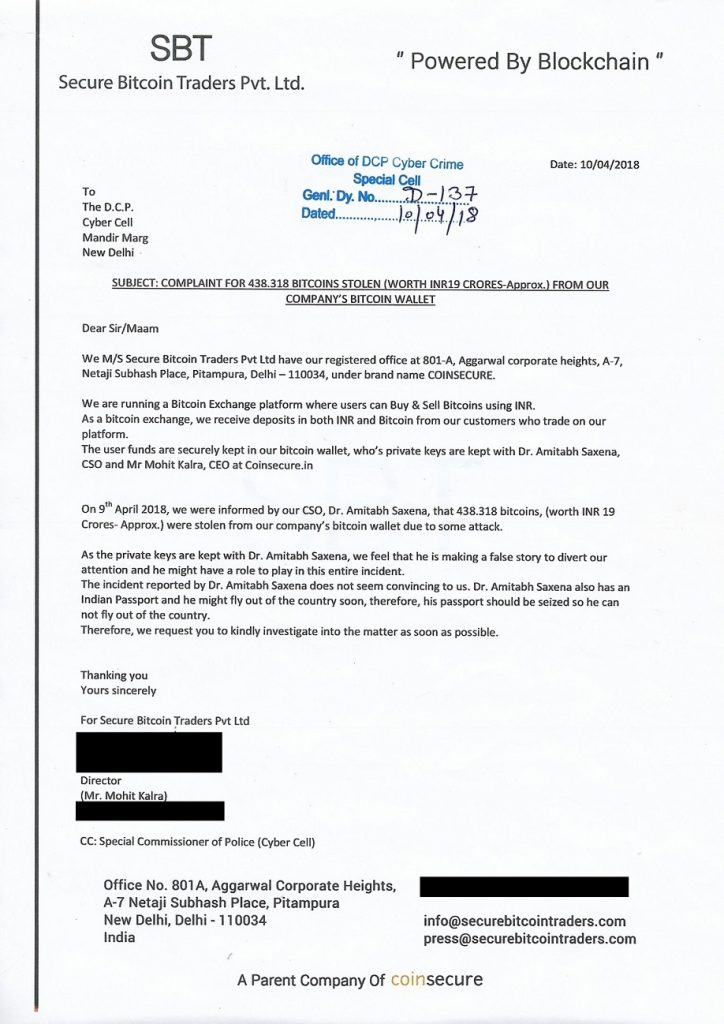

Secure bitcoin Traders Pvt Ltd, Coinsecure’s parent company, filed the FIR just days ago, explaining how “user funds are securely kepts in our bitcoin wallet, who’s private keys are kept with Dr. Amitabh Saxena, CSO and Mr. Mohit Kaira, CEO at Coinsecure.in.” Interestingly, it was Mr. Mohit Kaira who filed the FIR.

“On April 9th,” Mr. Kaira continued, “we were informed by our CSO […] that 438.318 were stolen from our company’s bitcoin wallet due to some attack. As the private keys were kept with Dr. Amitabh Saxena, we feel that he is making a false story to divert our attention and he might have a role to play in this entire incident.”

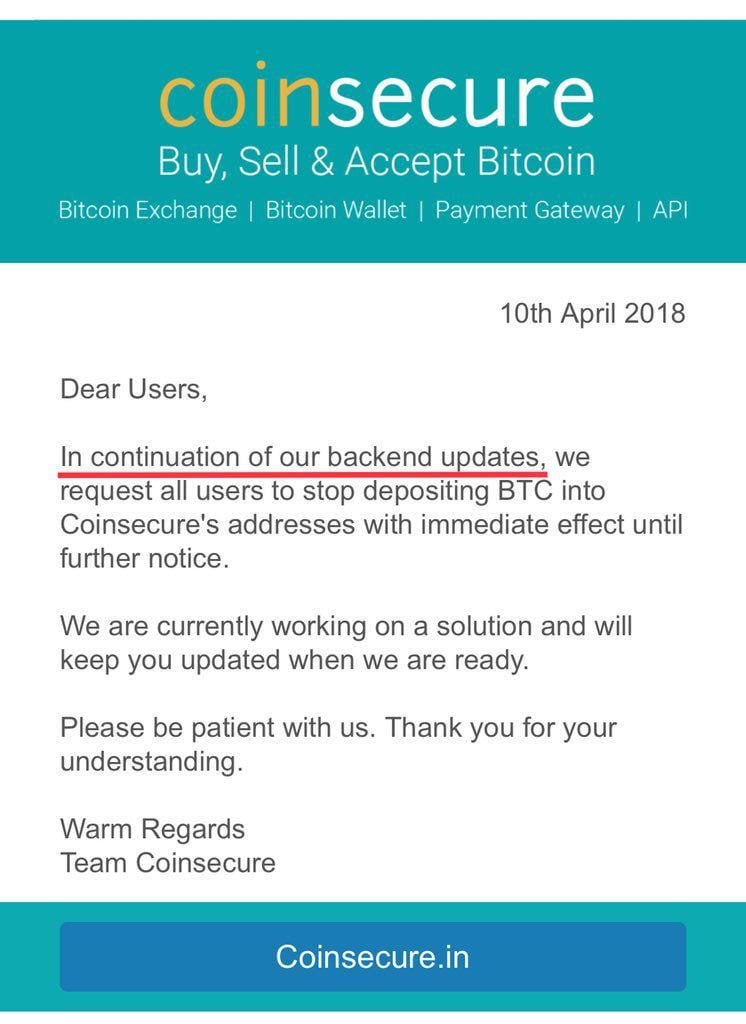

Just two days ago Coinsecure alerted users shortly after filing the FIR, “In continuation of our backend updates, we request all users to stop depositing [bitcoin core] into Coinsecure’s addresses with immediate effect until further notice. We are currently working on a solution and will keep you updated when we are ready,” its website read.

“The incident reported by Dr. Amitabh Saxena does not seem convincing to us,” the FIR goes on, reminding police, “Dr. Amitabh Saxena also has an Indian Passport and he might fly out of the country soon, therefore, his passport should be seized so he can not fly out of the country. Therefore, we request you to kindly investigate into the matter as soon as possible.”

Extremely Strong Understanding of the Crypto Space

Dr. Saxena was appointed to Coinsecure as Chief Scientific Officer back in late September of last year, to much . He has worked with Accenture and Hewlett Packard, and was professor of Computer Science in Australia. “Among the few early adopters in the cryptocurrency ecosystem, Dr. Saxena has also contributed scientific articles based on his research in the blockchain space. He comes with an extremely strong understanding of the crypto space and has a lot of ideas and implementations,” the company’s press release announced.

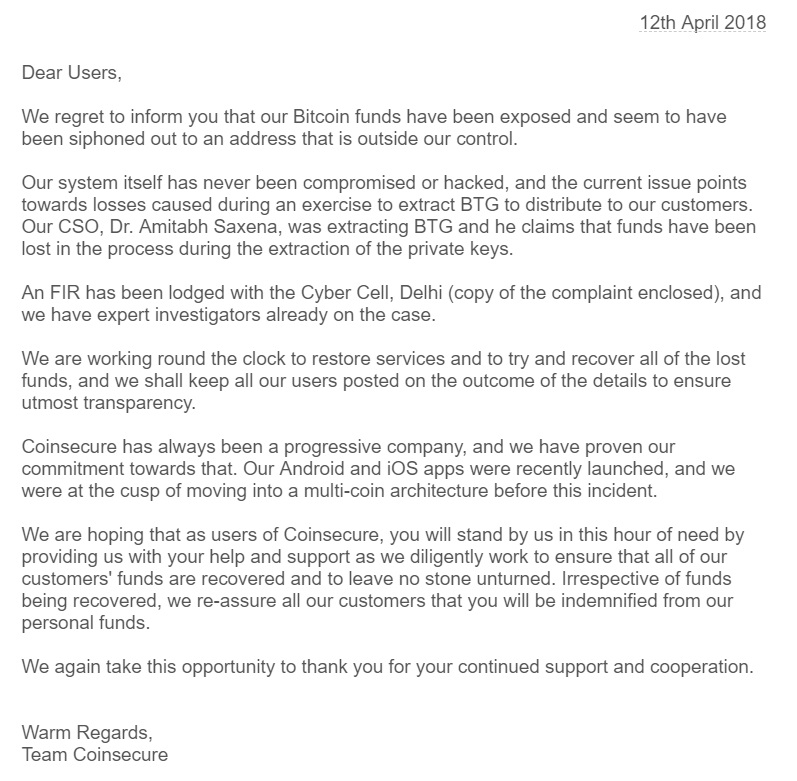

Obviously, Coinsecure believes this to be an inside job, one of embezzlement. Their first statement online, however, was somewhat less candid than the FIR. On 12 April 2018 the exchanged announced, “We regret to inform you that our bitcoin funds have been exposed and seem to have been siphoned out to an address that is outside our control. Our system itself has never been compromised or hacked, and the current issue points towards losses caused during an exercise to extract BTG to distribute to our customers.”

That could be anything really. But the statement begins to lay out a case, naming “CSO, Dr. Amitabh Saxena, was extracting BTG and he claims that funds have been lost in the process during the extraction of the private keys. An FIR has been lodged with the Cyber Cell, Delhi, and we have expert investigators already on the case.”

Attempts to receive comment from Dr. Saxena were at the time of writing fruitless. A profile of him late last year states approvingly, “, the popular India-based bitcoin exchange recently announced that after Dr. Amitabh Saxena spent over three years helping the company realize their vision for the Indian crypto ecosystem, he is now formally joining the team as its Chief Scientific Officer (C.S.O). Dr. Amitabh Saxena has kept a watchful eye on the progress of Coinsecure’s construction of complex and fast algorithms and a reliable exchange platform backbone.”

Was this an inside job, a hack, or just a beef between CEO and CSO? Let us know in the comments section below.

Images courtesy of Shutterstock. was the original source for this article.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

It’s amazing what a fat green wick can do. In just 30 minutes on Thursday, bitcoin rose by $1,000, sparking ear-to-ear smiles and mass euphoria throughout the crypto space. In today’s edition of bitcoin in Brief, we explore the ramifications of the BTC breakout plus a whole lot more.

Also read:

bitcoin Makes a Move

Altcoin Roundup

Cryptographic researchers vulnerabilities in a group of privacy coins that includes zerocoin and PIVX.

Coinsheets writer Dmitriy is 100 days of shitcoins in which he appraises a bunch of alts in a tweet apiece.

EOS has been one of this week’s big gainers, and is one of the few coins to be up in 2018. A number of reasons have for its sudden gains including an upcoming airdrop and imminent mainnet launch.

One critic who’s not feeling those EOS vibes is Jackson Palmer, who : “People don’t seem to realize that there is no actual EOS “network” that the ERC-20 tokens can be redeemed on. They’re just releasing the code and there will be *multiple* networks/blockchains you can then hopefully redeem some sort of other token on. It won’t be “EOS” though.”

Crypto Scammers Are Getting Smarter

How’s this for an ingenious way to load up on gas?

Bittrex Reopens Registrations

This week Bittrex reopened new user registrations. Then it closed them again after being swamped by demand. And now it’s again, this time for good hopefully.

Finally, crypto has a new word: fomonomics, the art of studying Google search trends to identify when the masses are about to FOMO into bitcoin again.

Do you think ‘fomonomics’ can be used to anticipate new money flooding the market? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

An often overlooked hurdle in the formulation of legislative apparatus for cryptocurrency is the challenge of adapting cryptocurrency to the classifications and language of financial regulations.

Also Read:

Language Barrier Between Regulators and Crypto Community

Juan Llanos, the fintech and regtech lead at Consensys, alluded to the gap in the perceptual understanding of key terms between members of cryptocurrency community and the regulators tasked with overseeing the virtual currency markets.

Mr. Llanos stated “At this point in time, all token distinctions and definitions come from the emerging crypto industry, not regulators. In the eyes of regulators, there are no clear-cut token definitions, only ‘activities’ and ‘products’ regulated under existing law. That is to say, several regulators are claiming jurisdiction over crypto assets inasmuch as these emerging assets fit their subject matter focus.”

As a consequence of unique ways in which cryptocurrency phenomena sit within the regulatory purview of individual regulatory agencies, fundamental definitions pertinent to cryptocurrency often differ greatly between different governing institutions. “Some regulatory agencies have defined ‘virtual currencies’ as ‘monetary equivalents’ for purposes of money transmission and anti-money laundering; others have defined them as digital goods tradable in markets for purposes of ‘commodities’ regulation, yet others have defined them as ‘property’ for taxation purposes,” said Mr. Llanos.

Conforming Crypto to Language of Securities Law

Mr. Llanos concluded that “There is today a global legal vacuum with respect to certain tokens that have a strong utility and consumptive value because they don’t fully fit the definition of ‘investment contract’ under Howie or its international equivalents,” adding that “the challenge for both regulators and entrepreneurs is that some of the digital cryptographically protected units of value known as tokens that are emerging have a dual nature: they’re both consumptive because they grant access to a technology service, for example, and at the same time provide an investment opportunity for purchasers.”

Swiss Regulators Excessively Focus on AML Considerations

The recently published regulatory guidelines pertaining to initial coin offerings in which tokens were classified as falling into one of three categories: payment tokens, utility tokens, and asset tokens.

Mr. Thomas describes the categories as reductive, stating that “Oftentimes projects fall into two or even all three categories,” in addition to alluding to “hybrid” tokens that do not fit neatly within the parameters of the three juridical classifications. Mr. Thomas also stated that “It seems like the regulatory authority is trying to stretch the law so that everyone is in the [anti-money laundering] bucket.”

Reports of bitcoin Bans Often Conflated

In January 2017, the (CBN) published a circular cautioning banks and financial institutions not to transact in bitcoin and other cryptocurrencies. Following widespread claims that the CBN had banned bitcoin, the deputy director of the CBN’s banking and payments system, Musa Itopa-Jimoh, later that the CBN was “just issuing caution to Nigerians.” The deputy director stated that “A lot of people misinterpreted it that we wanted to stop bitcoin. We can’t stop bitcoin […] Central bank cannot control or regulate bitcoin […] just the same way no one is going to control or regulate the internet.”

How do you feel that we can bridge the gap between the language of financial regulation and the language of the cryptocurrency community? Share your thoughts in the comments section below!

Images courtesy of Shutterstock

Want to create your own secure cold storage paper wallet? Check our section.

The post appeared first on .