“50 transactions per day, per human, for 10 billion humans. This is, I believe, the end game for bitcoin Cash.” So says an energetic Joannes Vermorel, an engineer and founder of…

The post appeared first on .

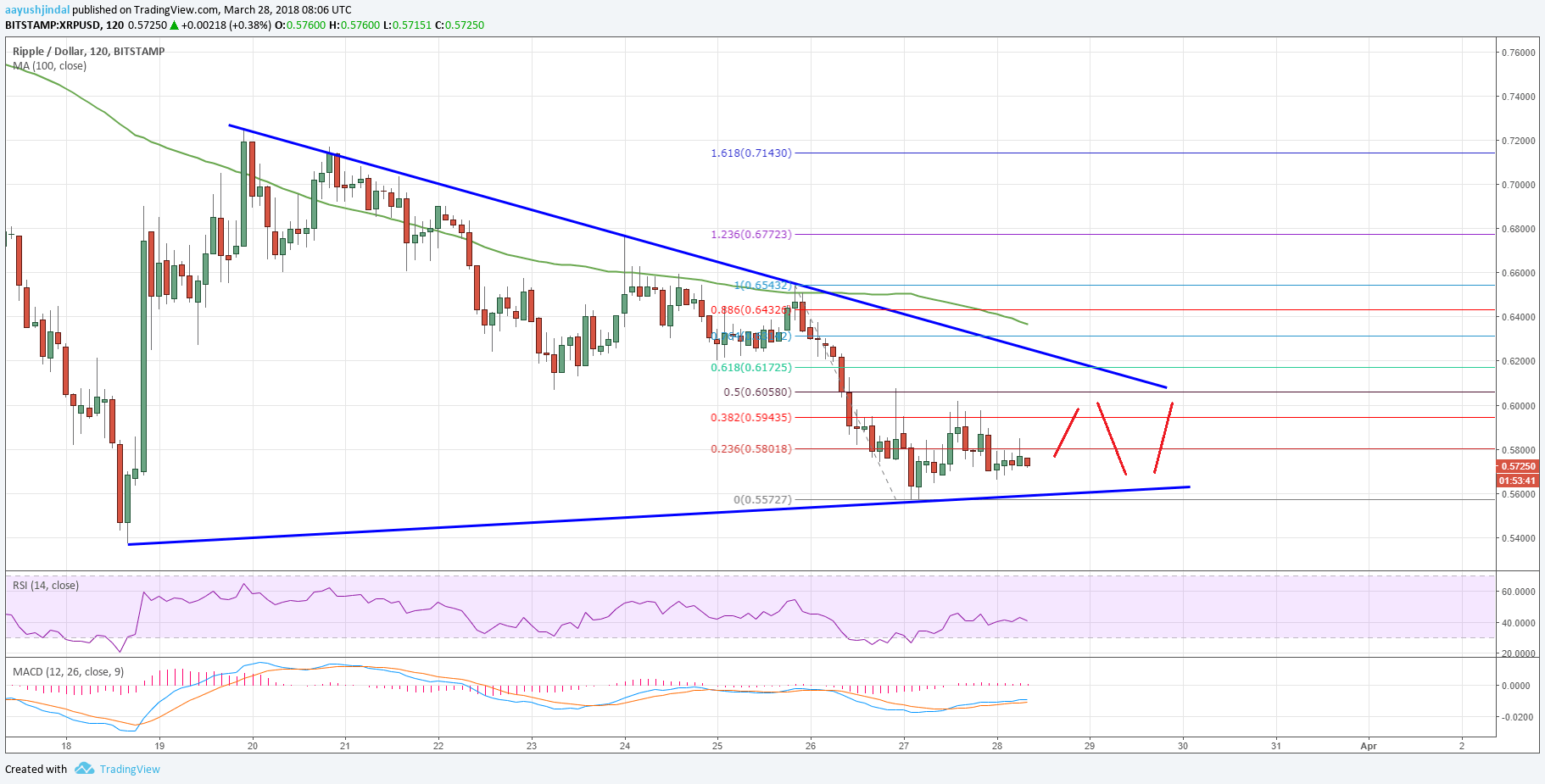

Ripple price declined sharply this week from the $0.6540 swing high against the US Dollar. XRP/USD is currently forming a bearish structure with resistance at $0.6100.

Key Talking Points

Ripple price declined heavily and traded below the $0.6800 and $0.6200 support levels against the US Dollar.

There is a key contracting triangle forming with resistance around $0.6100 on the 2-hours chart of the XRP/USD pair (Data feed via Bitstamp).

On the downside, the $0.0.5570 low is a short term support followed by $0.5200 and $0.5000.

Ripple Price Forecast

The past few days were simply bearish as Ripple price including $0.6800 against the US Dollar. The XRP/USD pair even settled below the $0.6200 and $0.6300 pivot levels to set the pace for more losses.

It traded as low as $0.5570 recently and is currently trading in a range. There was a short-term correction above the 23.6% Fib retracement level of the last downside move from the $0.6543 high to $0.5572 low.

However, buyers could not gain upside momentum above the $0.5900 level. Moreover, the 38.2% Fib retracement level of the last downside move from the $0.6543 high to $0.5572 low acted as a barrier for buyers.

At the moment, it seems like there is a key contracting triangle forming with resistance around $0.6100 on the 2-hours chart of the XRP/USD pair. The triangle resistance is near the 50% Fib retracement level of the last downside move from the $0.6543 high to $0.5572 low.

Lastly, the 100 simple moving average (2-hours) is positioned at $0.6350. Therefore, it seems like there is a crucial resistance region forming near the $0.6100 and $0.6350 resistance levels.

On the downside, the triangle support is around the $0.5600. A break below the stated $0.5600 level could push the price to a new low below the $0.5572 level.

The overall price structure remains bearish with resistances on the upside at $0.6100 and $0.6350. Supports are seen at $0.5600 and $0.5400.

Trade safe traders and do not overtrade!

The post appeared first on .