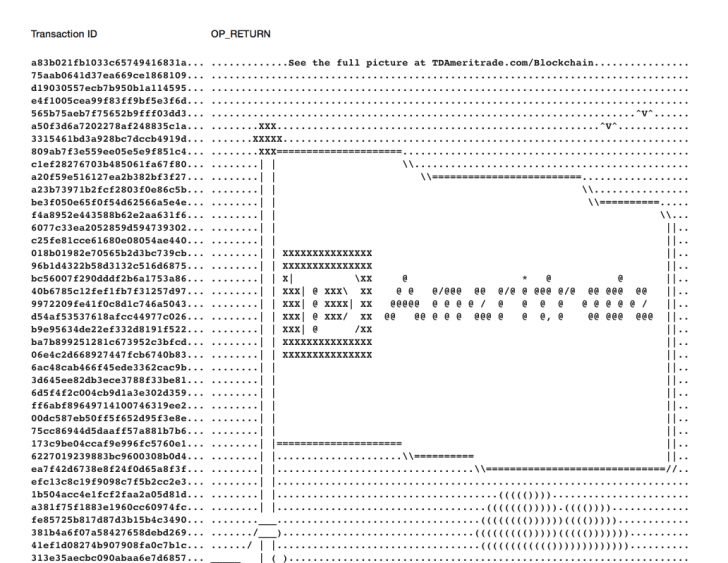

TD Ameritrade planted an ASCII flag – that is to say, imprinted an advertisement – on bitcoin’s blockchain earlier this month.

The online broker announced that it sent 68 bitcoin transactions to create a digital flag with its logo on the bitcoin blockchain, in a post published .

The company used the feature in bitcoin’s protocol to insert the characters, creating 68 invalid transactions as a result. Due to the nature of the blockchain, this flag is now forever preserved on the cryptocurrency’s ledger.

“We love finding new ways to use emerging technology. So we decided to have a little fun and plant our flag. Okay – technically, we embedded it,” the broker said, adding:

“With a part of the blockchain called OP_Return, which functions like the memo space on a check, simple messages and characters can be placed within transactions on the blockchain. By linking 68 individual transactions, with 80 characters per transaction, we were able to create the larger image.”

No bitcoins were actually transferred through these transactions, according to data from Blockchain.info.

OP_Return was first introduced in 2013 as a way for users to include some messages in the blockchain. However, the release notably stated that developers were not endorsing data storage in the blockchain, saying that “storing arbitrary data in the blockchain is still a bad idea; it is less costly and far more efficient to store non-currency data elsewhere.”

The official bitcoin wiki page notes that OP_Return can be used to convey information.

“We’re proud to be part of it. Forever,” the broker wrote.

image via Jonathan Weiss / Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a . CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Published at Tue, 24 Apr 2018 21:45:16 +0000

bitcoin[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]