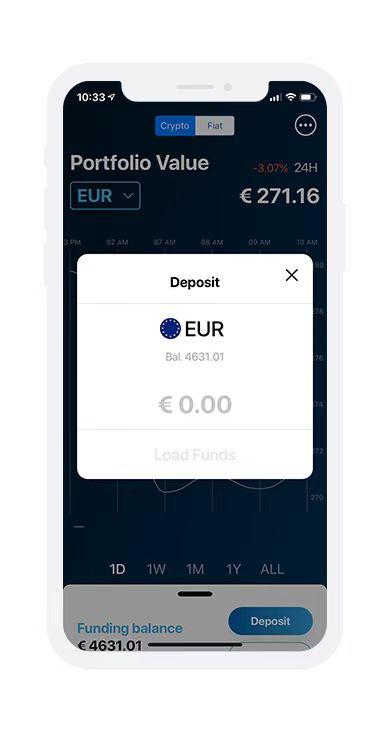

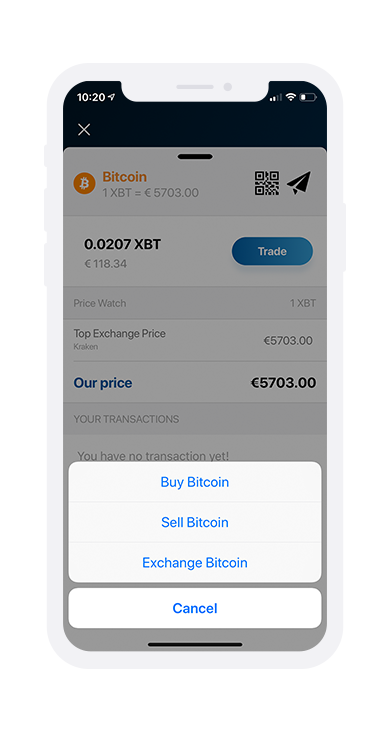

TAP will provide an app that is a one stop shop for anyone involved, or looking to get involved, in crypto currencies. With the easiest fiat onboarding process, multiple exchanges linked by one app (with only 1 KYC process), a powerful “middleware” engine adding convenience never seen in the crypto sector and a payment card attached, TAP represents a major leap forward in making crypto both more accessible to new investors and more convenient to current adopters.

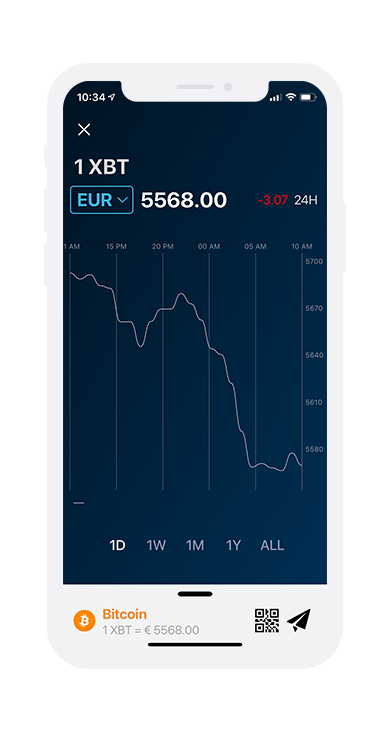

The main feature added to this latest update is the integration with the Binance exchange. TAP now supports two exchanges, Binance and Kraken, and will scan both these exchanges to find the customer the best price. The middleware reads both exchange order books as if they were one and can split a trade over both exchanges if that delivers the customer a better price.

With more exchanges to be added soon, will be able to guarantee the best price for the customer on any trade with instant fulfilment.

As well as a better price, linking multiple exchanges will deliver more benefits to TAP customers. In the app, a user will be able to exchange any supported crypto currency to any other supported crypto or fiat currency in one touch. This effectively creates alt to alt pairings across exchanges and eliminates the need to convert into BTC to move across exchanges.

The teams’ 8 permanent developers are working well under their CTO Mike and aim to release the beta version soon on a first come first served basis (to customers who have registered on their site).

The post appeared first on .

The battle for privacy is ramping up. Every day, in the cryptocurrency space, we learn of increased blockchain surveillance, countered by the efforts of privacy protocol developers. We’ve got stories from both sides of the divide in this episode of The Daily, plus a “bitcoin mansion” that’s up for sale.

Also read:

Flagging bitcoin Volume – But What Does It Mean?

Trading volume in the cryptocurrency markets has been low of late, with BTC, as the market leader, particularly exposed. One analyst, who’s been studying bitcoin’s trade volume all the way back to 2012, has observed that the intraday range for the past two months ranks in the bottom decile. “It’s now the fourth longest consecutive period where volume has been this low,” he . While low volume is generally a bearish sign, Fundstrat’s Thomas Lee has pointed out that, based on historical data, there may soon be some relief:

Hedge Fund Chief Offers Mansion for bitcoin

Roy Niederhoffer, founder of an eponymous hedge fund, has a big old mansion to sell in New York. The wealthy financier purchased the property in 2013 while renovating his Manhattan pad. Now he’s ready to put his temporary Riverside Drive mansion on the market, but there’s a twist – Niederhoffer wants BTC. The 10,720-square-foot property is on the market for $15.9 million. He will accept either cash or the equivalent in BTC.

“I’m a big believer in bitcoin. I really am so bullish on it, and I want to own more of it,” he told Bloomberg. “Whatever the obligations and brokers fees are, I would pay in cash and keep the bitcoin.”

The Battle for Privacy Heats Up

On Oct. 19, Monero upgraded its protocol to include Bulletproofs. The tech, developed by Benedict Bunz and Jonathan Bootle, reduces the size of confidential transactions, helping to minimize blockchain bloat. This is a particular problem with Monero, whose privacy tech grants anonymity at the expense of larger transaction sizes on account of Ring CT. Bulletproofs, while not technically a privacy feature, provide a more efficient means of verifying the information stored within confidential transactions. The technology is also of interest to bitcoin users, as it has the potential to be implemented on BTC and BCH in conjunction with a complementary privacy protocol.

Privacy is a key battleground in cryptocurrency, with many users resenting the trend towards blockchain surveillance. Binance is the to have gone down this route, teaming up with Chainalysis to scrutinize the source of customer funds. A Gemini customer, meanwhile, claims to have received a probing request for information or face having his account shut down:

Gemini request for information Today –

(Or my account is suspended in 10 days)

1. What equipment do you mine with?

2. Provide live link to mining statistics?

3. What coins do you mine?

Why do you need this information?

— Jason A. Williams

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock, and Bloomberg.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .