promised decentralized value transfer: be your own bank.

Yet more than a decade later, the vast majority of volume still transpires on centralized exchanges that have full control over your crypto.

, billions in lost funds, and shady banking partnerships have prompted a wave of new, “decentralized” exchanges.

But despite the promise of these DEXs, most are limited to only a single family of assets (e.g. only ETH and ERC-20 , or only , LTC and the like), necessitate undesirable trust assumptions, or are constrained by a slow, loathsome user experience.

Introducing Switch 💸

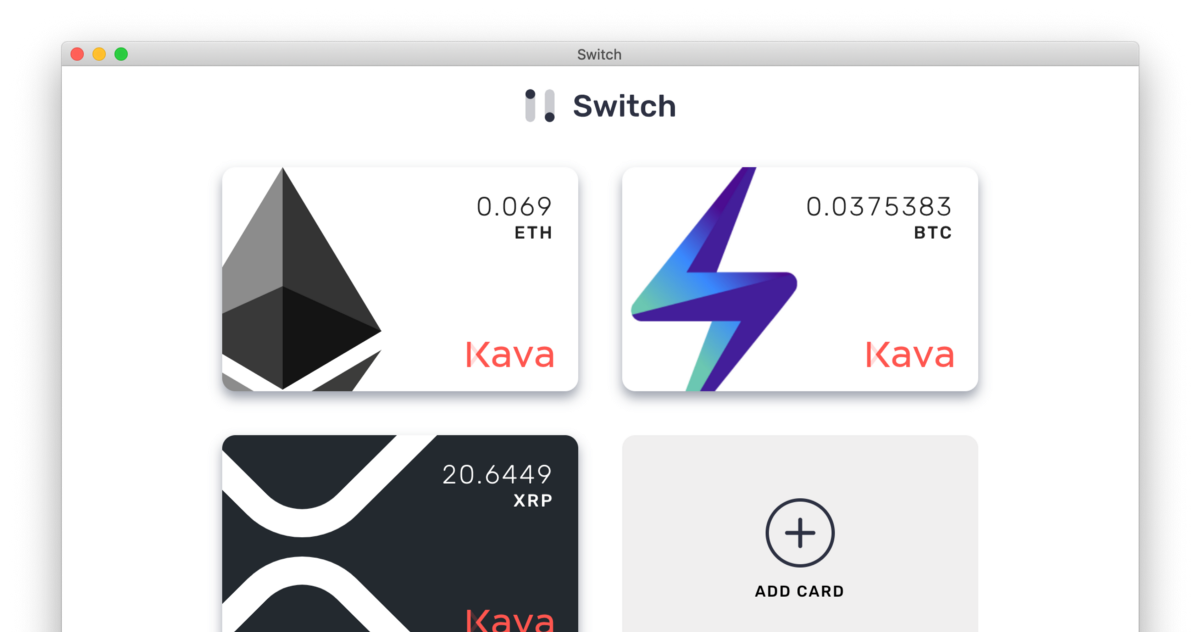

Today, we’re launching Switch, a new for non-custodial crypto .

Switch sidesteps the problems of traditional DEXs by employing a novel solution: streaming micropayments, which work by moving little bits of value piece-by-piece until an entire payment or trade is complete.

Streaming micropayments enable lightning-fast swaps, interoperability across blockchains, and complete self-custody of assets.

Load funds onto “cards,” swap between them, and withdraw at your leisure. Only you have access to these funds, even while !

bitcoin? Ethereum? You got it! 🌈

Today, Switch supports the three top crypto assets: , using LND and the Lightning Network; Ether, using Machinomy payment channels; and XRP, using its native payment channels.

Crucially, nearly any or layer 2 network that transfers value fast and cheaply can support non-custodial in Switch. No specialized required!

We’ve been building the foundation to support ERC-20 such as Dai, and hope to roll out support in the coming weeks. On top of that, many more asset integrations are in the pipeline.

Wait, it’s that fast? 🏎

Switch swaps are fast, and complete in seconds for small value transfers.

Since streaming micropayments leverage payment channels and layer 2 networks such as Lightning, each “packet” of value settles on the order of milliseconds.

No slow on-chain transactions, or outrageously long escrows. It’s just: Settled. Boom. Done.

Networked liquidity 🕸

Switch is underpinned by the to send packets over a decentralized network of “connectors,” or money routers, which provide liquidity.

Inspired by the internet, Interledger is an for interoperability across all payment networks.

Each card in Switch is linked to a connector, and provides an “uplink” to the Interledger network to perform swaps and send peer-to-peer payments.

For this beta release, Switch uses a connector operated by Kava. But coming soon, we’ll roll out support for user-defined connectors, and all the tools, infrastructure, and docs necessary to operate one yourself.

Safe and secure 🔐

Even if you use the Kava connector, don’t trust us!

When between , Switch will prefund a very small amount of the source asset — the equivalent of $0.10, by default — to the connector. Then, the connector sends back a small amount of the destination asset. If the exchange rate is reasonable, we repeat the process. And again. And again; many times per second.

If at any point the connector stops sending or sends us too little of the destination asset, we halt the exchange. This enables non-custodial , since the counterparty risk is merely a few cents, and comparable to that of atomic swaps.

But by contrast to atomic swaps, streaming micropayments also mitigate and — which is a win-win!

Try it today 🚀

Switch is available in beta for , and supports both testnet and mainnet, with trades up to $20.

Follow our to get up to speed and configure Switch on testnet in minutes.

While we hope it’s all smooth streaming, as this is beta-quality software, issues may arise. We’re rapidly iterating to make Switch more reliable, feature-complete, and secure. If you encounter any bugs or unexpected behavior, we’d encourage you to !

And for the latest updates from Kava, ~ we’d love to hear about your experience with Switch!

Published at Wed, 22 May 2019 20:59:48 +0000

![Bitcoin [btc]: andreas antonopoulos rejects the idea of china launching 51% attack on btc blockchain Bitcoin [btc]: andreas antonopoulos rejects the idea of china launching 51% attack on btc blockchain](https://ohiobitcoin.com/storage/2019/03/2699.png)