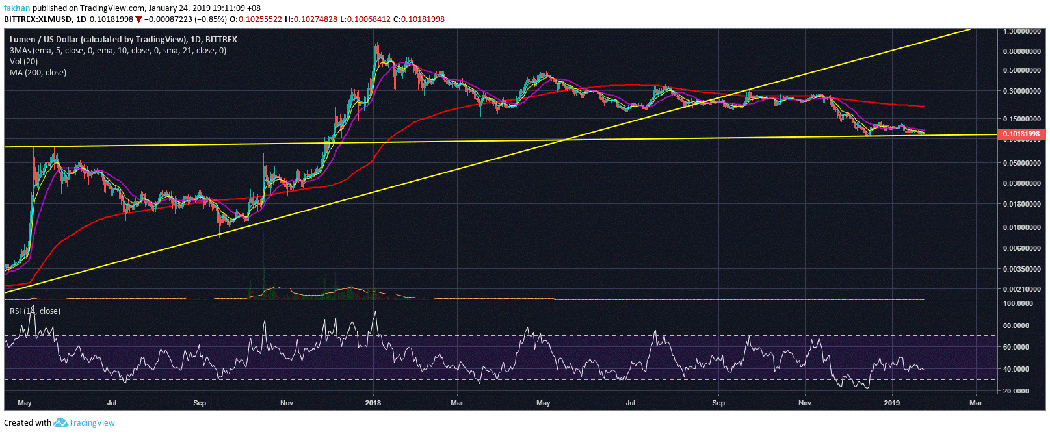

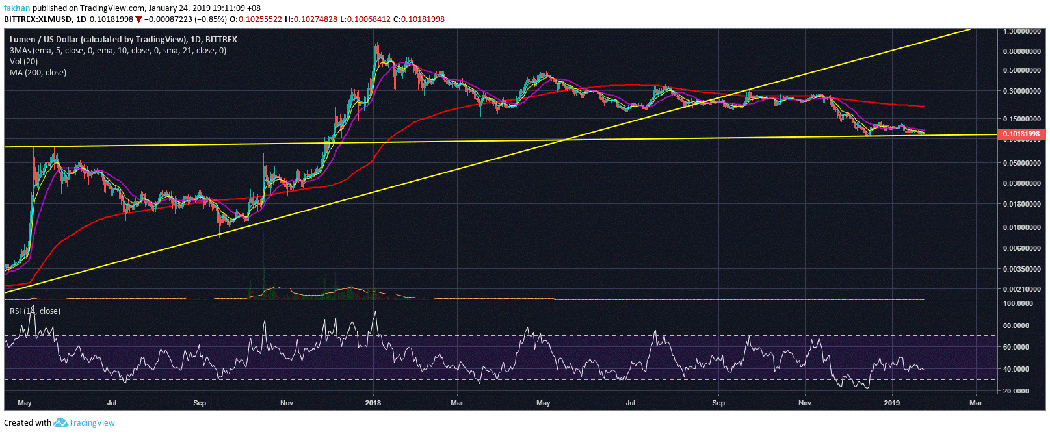

(XLM) has been through an extensive market correction just like most other but it has held its ground against (). In fact, the weekly chart for shows that the price just entered a consolidation phase during the bear market. When this prolonged accumulation comes to fruition, we could see the (XLM) rise astronomically in price against (). (XRP) went through a similar accumulation pattern before it broke out during the last few month of 2017. This consolidation also appears to be part of a giant bull flag that could shoot up towards a new all-time high somewhere around mid-2019. (XLM) is one of the few in the market with a solid use case and a working product which is why Grayscale Investments just recently announced their Lumens Trust.

RSI for the weekly chart for XLM/ shows that there is plenty of room for a series of rallies to the upside. If these rallies are anything like the ones we saw during the last bull market, (XLM) might be headed to a new all-time high a lot sooner than other large cap coins. Distributed technologies are starting to get a lot of attention and 2019 might very well be the year of distributed leger technologies. In the last bull market, we saw companies launch their ICOs on (ETH). This year, we may see a lot of new companies launch their ICOs on to launch cross border payments solutions. While its competitor, (XRP) is focused on large financial institutions for mainstream , (XLM) is focusing directly on peer to peer finance.

Lumens (XLM) has found support above its previous resistance which is now acting as a strong support. The daily chart for shows that the price has found a double bottom and is now likely to rise above the 21 Day EMA to stage a comeback towards the 200 Day MA. (XLM) has received a lot of bad press recently over its price being vulnerable to further downside short term, but the facts state otherwise. One of such statements that received a lot of undue hype was a tweet from renowned trader, Peter Brandt who called it “worthless”. In response to a tweet by one of his followers asking whether he was taking the coin’s fundamentals into account, he tweeted back saying, “Fundamentals. What are fundamentals?”

The market is still in its infancy and it is reasonable to see that a lot of these projects will not have the same fundamentals as a billion dollars company on the stock market. That being said, the speculation that has driven up the prices of like (XLM) stems from a strong belief in the technology and the problem it solves instead of wishful thinking to see a startup succeed. If (XLM) manages to capture even a fraction of the trillion dollars foreign exchange market, its current price of ten cents is going to look very cheap.

Published at Thu, 24 Jan 2019 23:18:07 +0000