Lumens (XLM) is caught between rock and a hard place. The is lagging behind even (ETH) while () is up more than 6%. ran into the 21 day EMA and faced a strong rejection. It rallied after find a strong support atop the 61.8% Fib extension level. The price was stopped on the way towards a retest of the 38.2% fib level. This has put (XLM) in a difficult situation and it is not clear yet which way the price will swing. Even if it breaks above the 21 day EMA, it is still likely to be stopped by the 50 day moving average as it has been in the past. This leaves (XLM) little choice but to trade sideways till /USD takes a definitive position. So far, () is just determined to test the $5,800-$6,000 resistance zone.

If /USD breaks the resistance zone which is unlikely any time soon, then we might see a rally in XLM/USD. However, so far the probability of a rally in (XLM) remains low in light of prevailing market conditions. (XLM) is a wonderful project and was recently added to but () does not seem to be out of the woods yet. Unlike (XRP), (XLM) is not known for its independent moves because it is not as “centralized” as (XRP) which recently released 1 billion XRP from escrow. The does have a strong edge over (XRP) and is very likely to replace it as the third largest coin by market cap if it gains in the same manner as (XRP) did. Jed McCaleb, the founder of (XLM) previously used to be CTO at (XRP).

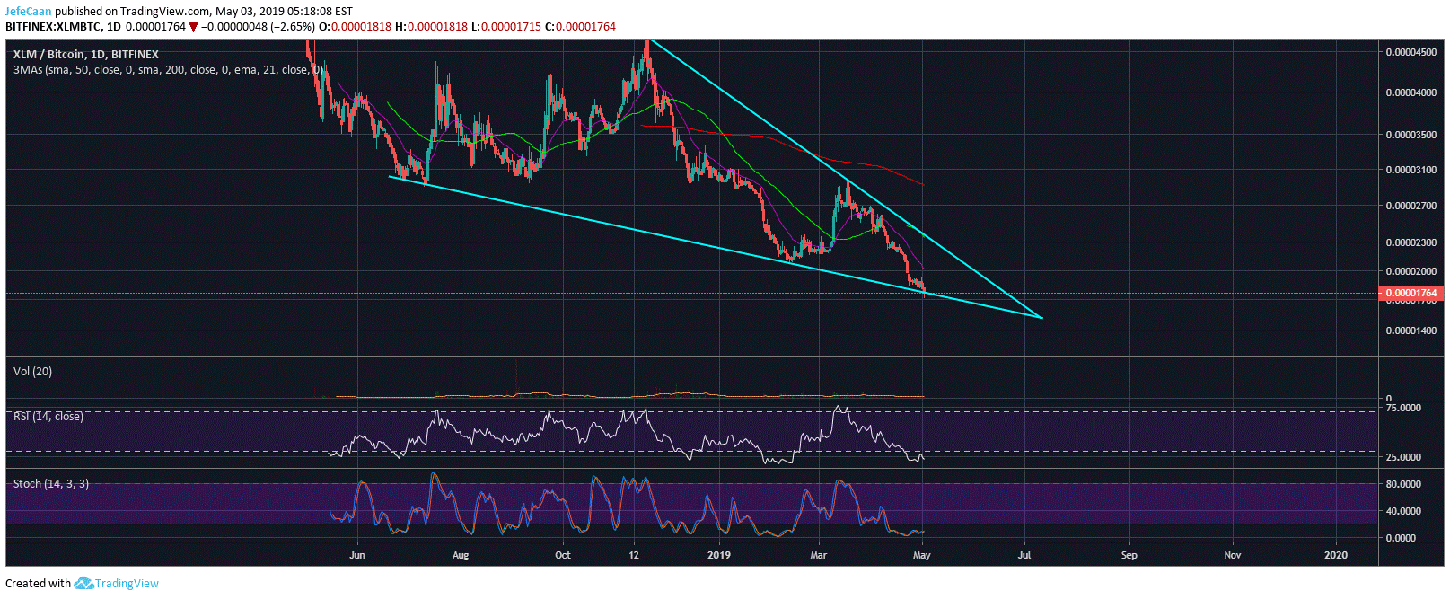

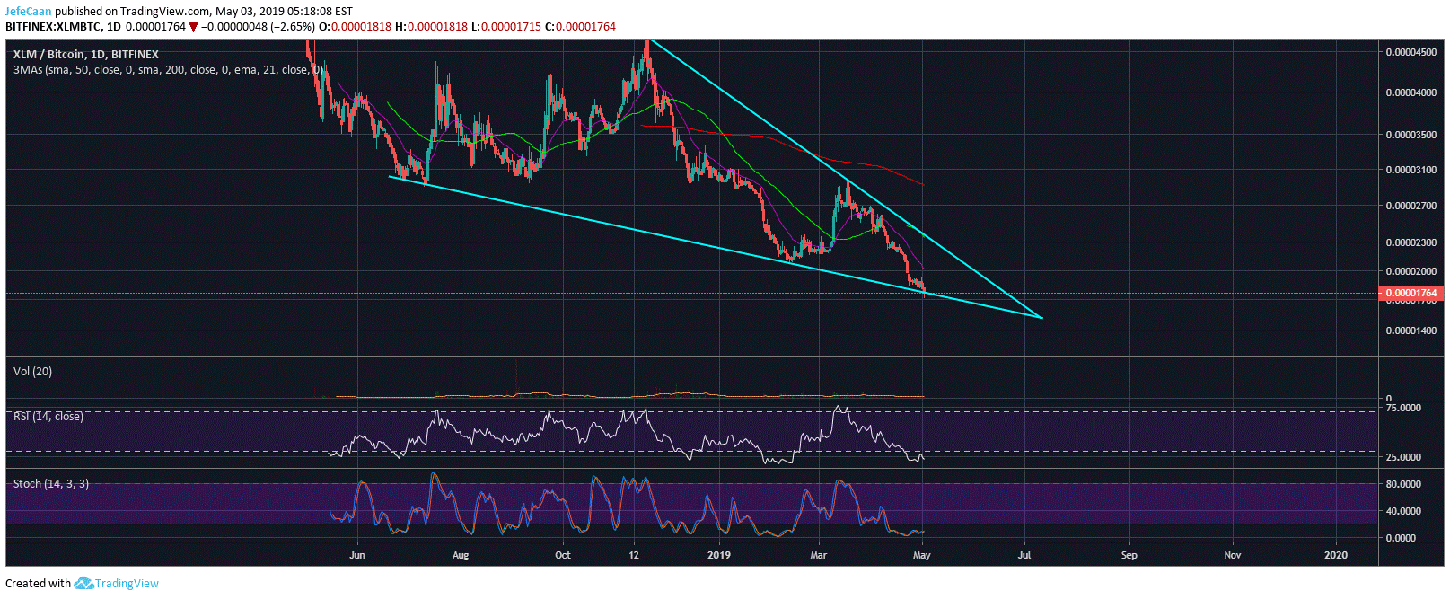

(XLM) is now in a very interesting position against () as the has come down to the bottom of a falling wedge. If the market outlook wasn’t this bearish mid-long term, this would be the best time to start accumulating. However, as we have seen in the past, most technical analysis patterns often get invalidated when () falls aggressively. This is because most excluding stable coins are still coupled to (). So, every move /USD makes has a major impact on . If the price of () goes up, like (XLM) usually go up a lot. If the price of () falls then like (XLM) fall hard.

The price of (XLM) could continue to decline in the days and weeks ahead if () faces a strong rejection at the $5,800-$6,000 zone. This decline is very likely to hit the market hard and like (XLM) will be hit even harder which is why it would be a good idea to move to () if not cash out completely when that happens. (XRP) faced a similar situation recently when the price kept on declining against () even though XRP/ had been massively oversold for weeks.

Published at Fri, 03 May 2019 22:13:31 +0000