The creation of competing altcoins is likely to place downward pressure on the prices of all , including bitcoin BTC (). This conclusion was found by conducted by the Federal Reserve Bank of St. Louis and on Jan. 11.

The report cites two perspectives: bitcoin BTC bulls’ belief that the capped supply and increased demand will increase BTC’s price, and the bears’ belief that its price will fall to zero. The researchers state:

“We think the future price path is more likely to remain bounded between these two extremes.”

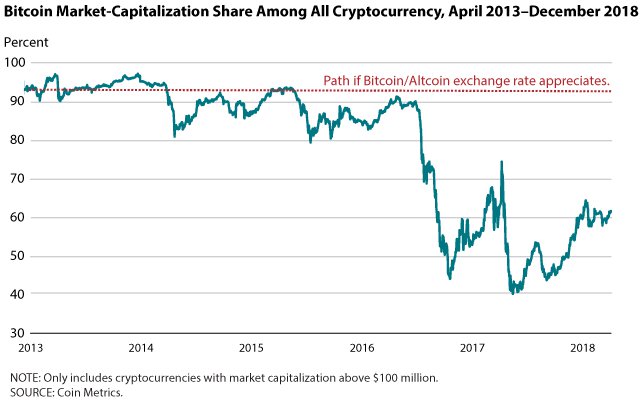

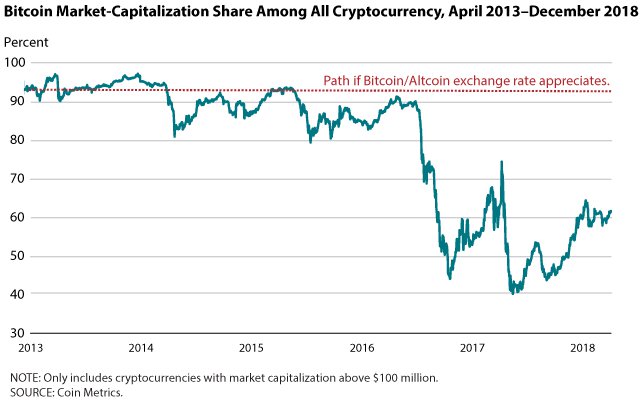

According to the research, the dollar price of BTC will also depend on its exchange rate relative to altcoins. The report explains that the bulls expect bitcoin BTC to appreciate relative to altcoins, or to keep its market capital relative to the global crypto market cap constant. Still, the researchers show that this hasn’t been the case so far.

bitcoin’s crypto market share April 2013-December 2018. Source:

According to the researchers, the chart suggests that the increasing supply of altcoins keeps bitcoin BTC’s price and market cap depressed. Still, according to the report, bitcoin BTC has a fundamental value that will prevent its price from falling to zero that derives from demand for its permissionless access and decentralized database. The report concludes:

“While bitcoin BTC’s price is not likely to fall to zero, the prospect of a flood of Altcoin competing with bitcoin BTC in the wealth portfolios of investors is likely to place significant downward pressure on the purchasing power of all cryptocurrencies, including bitcoin BTC.”

As Cointelegraph today, the number of active bitcoin BTC () wallets, many of which have long been dormant, has seen an uptick that could herald some major market movements.

Also recently, that , CEO of identity platform , has revised down his short-term bitcoin BTC price prediction, stating that the top coin could now fall below $3,000.

Published at Sat, 12 Jan 2019 12:02:00 +0000