Huobi, the new South Korean crypto exchange, has officially opened trading today according to the on March 30.

The new South Korean exchange will support 100 altcoins as well as trading on 208 market (77 ETH markets, 98 BTC markets, and 33 USDT markets).

Huobi is also offering investors a protection line where they will be compensated for losses incurred which are outside of the exchanges control.

The global exchange currently ranks second worldwide by trading volume according to CoinMarketCap at the time of this press release. Itsfaster than any other country since 2017.

Huobi is set to target overseas markets with a to be…..

Daniel, great article. Provides lots to think about. More, it provides some places to think from.

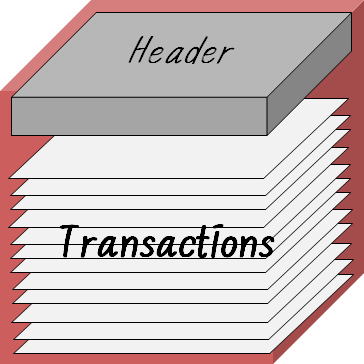

I’m sharing a double entry bookkeeping story — Or is it single entry or triple entry? — that is earlier than the reaction to the Italian Scandal (I think). This is “double entry” more like the entry of block chain

This ‘Blockchain’ of 1170AD (approx.) isn’t double entry bookkeeping in the traditional sense. I’m a CPA and so I can say this unequivocally. This one allows verification over time and space with a single entry. Here’s how it goes. I’m sharing this because I think it is a way of providing an ‘entry level’ understanding of blockchain. So let’s begin.

After the completion of the Domesday Book, which few realize was for purposes of accounting for ‘proper’ tax collection, the process went as follows. Twice per year, the propertied classes of England “came to the Exchequer to render their accounts” and to pay their various taxes. It has been said that the Domesday Book was the basis of the most effective tax system until our current one.

“Next the sheriff was given a tally — a hazel stick cut with notches to mark the amounts he had paid in. To provide each party with a record, accros the notches … the two tallies being known as the foil and counterfoil.”

“Finally, after satisfying the Chancellor of the Exchequer at the great table, the sheriff’s transactions would be recorded by the scribes.”

Each party to each transaction had proof of the tax settlement details which could not be tampered with by either party because, to be taken as evidence, the notches in the two sticks had to match.

Viola! The first block chain.

Technology has taken this to a new level — after only about a thousand years. Seems like we needed the time, the technology and, new thinking, to understand distributed ledgers which was what these two sticks were.

The point here is to emphasize the value provided, not the technology nor its challenges. You may know the saying, “To a man with a hammer, everything is a nail.” Well, think blockchain. Then the saying becomes, “To a person with a blockchain, everything can be recorded for all time.” Maybe this isn’t the way to approach it — but it seems a good start.

I’m sure, by now, you’ve heard that the blockchain is “just” distributed ledgers. But even most of my accounting friends don’t get it. Maybe they’ll be the last to get it because they only see the mechanical recording nature of what they do rather than existing and future possibility of their work.

My approach is driven by a problem looking for a solution. Certain problems are calling for this solution. Many others may find it useful someday. And many more may find it helpful as part of a solution but far from complete. And then there are those that simply don’t have an economic use case even though they may be interesting to some.

This is stage one of my article which will be followed two and three over the next couple of weeks.