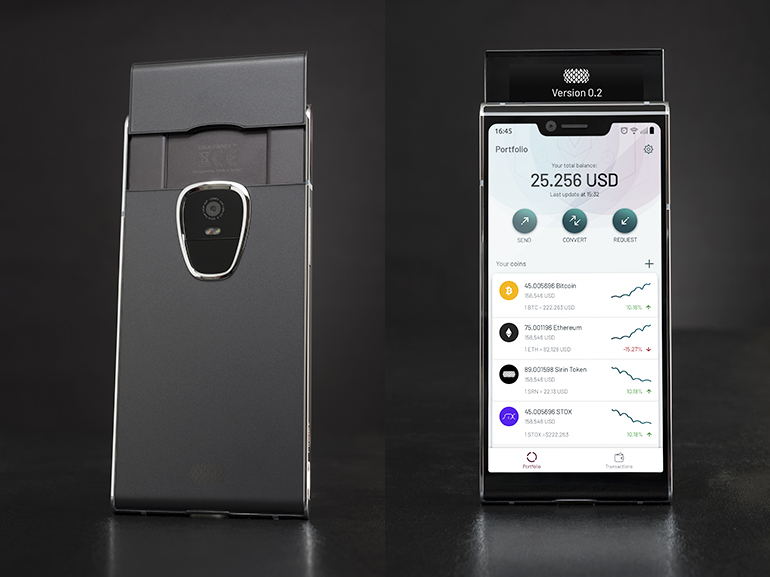

On Nov. 29, Sirin Labs announced the commercial launch of its new blockchain smartphone known as the Finney. According to the cellphone creators, the Finney offers “secure and state of the art mobile technology” alongside an embedded cold storage cryptocurrency wallet.

Also read:

People Can Now Preorder the Finney Smartphone

has launched its flagship product the Finney phone, a mobile device named after the late bitcoin developer . News.bitcoin.com originally on the Finney phone back in May when it was revealed that Foxconn, the company that manufactures iPhones, helped Sirin Labs produce the new blockchain mobile device. This week, Sirin Labs the phone can now be purchased on the company’s official website for $999 and the product will also join the Amazon Launchpad program in January.

According to the , the mobile device has a 6-inch touchscreen display and is powered by an octa-core processor with 6GB of RAM. Finney runs on an operating system called Sirin OS, which is a fork of the Oreo software Android 8.1. The cryptocurrency features within the phone can be seen by using a second touchscreen that’s attached to the phone’s body. Sirin has explained that this is how the Finney device’s extra layer of security works because when the pop-up screen is used, all actions performed by the Sirin OS are encrypted. The Finney creators state that the second touchscreen has a firewall between the main operating system and claims the process makes the phone much harder to compromise. The cryptocurrency side-software has a program known as token conversion service (TCS) so the mobile phone’s owners can swap coins like BTC and ETH.

Additionally, the phone has a 12-megapixel rear camera and a selfie camera with a design that’s very similar to the . The Solarin is another design created by Sirin Labs, but the Solarin carbon titanium 128GB version is a whopping $13,800 plus tax. The Finney model also comes with 128GB of storage and can be expanded upon with a micro-SD card. Lastly, the mobile device accepts a nano-SIM and can connect to traditional Bluetooth, NFC, and wifi networks. “Sirin Labs is also looking for strategic OEMs to implement Sirin OS in additional consumer devices,” the Barcelona-based company explained on Thursday.

The Finney Smartphone Has a Competitor

The new Finney cellphone is not the only mobile device specifically designed for blockchain security. Taiwanese consumer electronics manufacturer High Tech Computer Corporation (HTC) is also producing a cryptocurrency-centric phone. HTC has said the new “blockchain-powered” product will use a modified version of the Android operating system. The HTC Exodus 1 is also available for preorder on its by reserving the phone with either BTC or ETH funds. At the moment the HTC Exodus 1 is priced at around 0.15 BTC or roughly $600 at the time of publication.

With the new Finney phone launch, Sirin Labs has explained that the company is planning to open two flagship concept stores so the public can get an inside glimpse at the blockchain mobile device. According to the Finney manufacturer, the first concept store will open in London in December of this year and then another location in Tokyo in January of 2019. Sirin Labs emphasized during the announcement that the London store will also act as a blockchain academy for individuals in the community looking to learn about cryptocurrency solutions.

What do you think about the Sirin Labs produced Finney phone? Let us know what you think about blockchain-centric mobile devices in the comments section below.

Disclaimer: bitcoin.com does not endorse nor support this product/service.

Readers should do their own due diligence before taking any actions related to the mentioned company or any of its affiliates or services. bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images via Sirin Labs, the Finney phone, and HTC.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

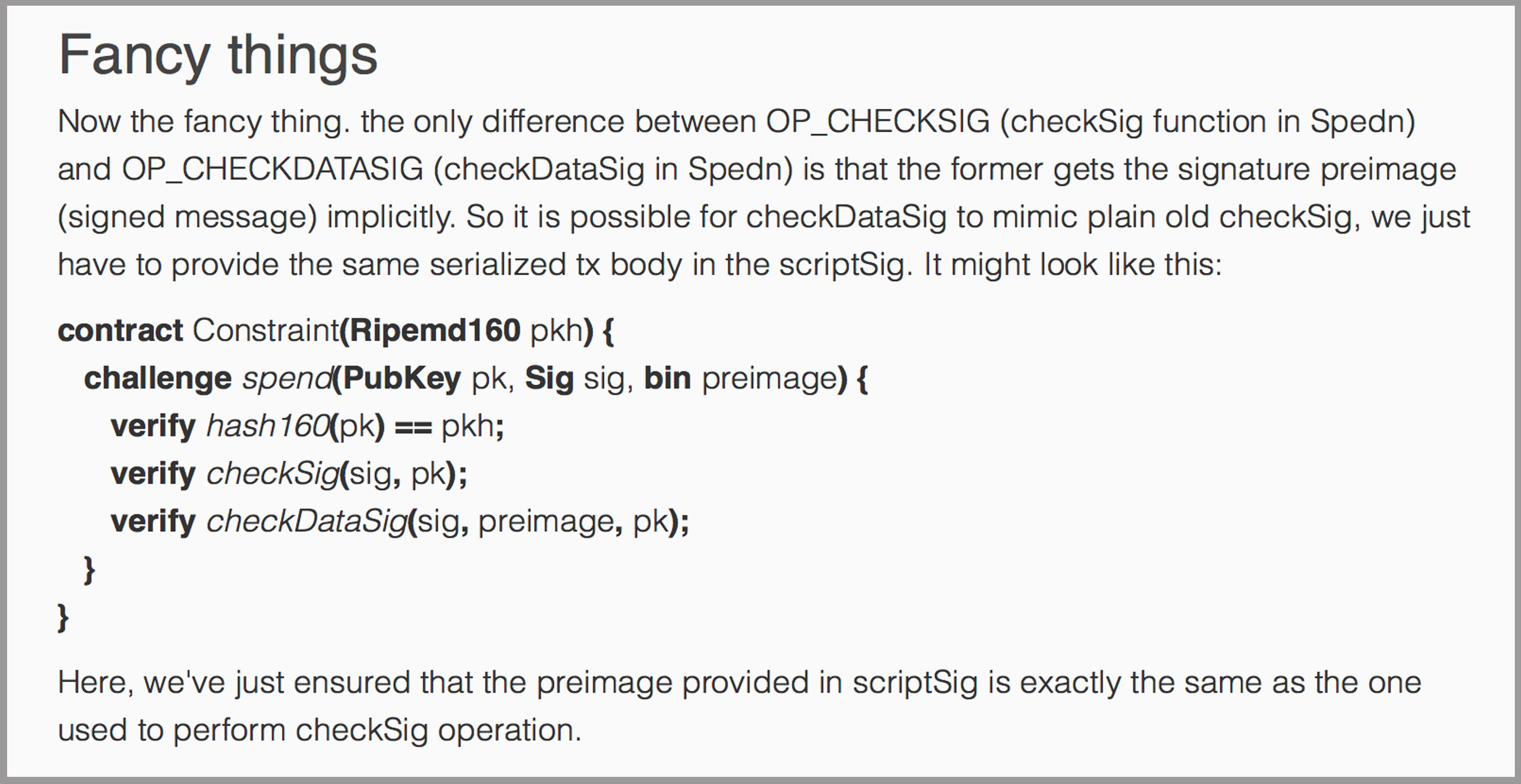

Since the recent bitcoin Cash (BCH) upgrade, the protocol now has some newly added features like the re-enabled opcode OP_Checkdatasig. After the implementation, a few developers have been experimenting with the opcode and have developed concepts such as “spending constraints.” Moreover, in another instance, a programmer recently used the opcode to create an onchain chess game on the BCH blockchain.

Also Read:

Spending Constraints

Over the last week, BCH supporters have been slowly trying to move away from the recent blockchain split and concentrate on building. One example of this is a recent written by a BCH developer called Pein Sama, which uses the opcode OP_Checkdatasig to explore new capabilities. Sama details that before the the BCH script was limited to someone specifying that one could spend a coin but at the time there was no way of adding constraints on how it could be spent. The developer then demonstrates how it is now possible to create spending constraints with the new BCH coding language called .

After Sama published his idea, the BCH community discussed the concept of spending constraints and other ideas like as well. A few people specifically discussed the end of Sama’s documentation, which says the concept could produce things like OP_Return based tokens that are “miner enforceable.” The programmer explained that it could be argued that is a cleaner way of adding native tokens, but he didn’t have a strong opinion on the matter. “My article is just exploring the new land,” the developer on the Reddit forum r/btc.

A Game of Chess

“The good thing about chess is that its rules are deterministic, so no need to throw dice or do some cryptographically secure pseudo-random number generator magic,” Ruck explained in his recent blog post. The developer continued by describing the benefits of using OP_Checkdatasig as trusted oracle within a game of chess by stating:

If Kasparov were to challenge Anand for a round of chess, they might trust some third party (referee) or even each other to enforce/follow the rules, but if they are anonymous people on the internet playing for not insignificant amounts of money, it would be good if the rules of the games didn’t require a trusted third party.

In his blog post, Ruck further elaborated how chess can be played with the new opcode and implemented the concept into a Python environment. This is where Ruck adds the “juicy parts” of the code, like operations such as “apply_move,” “white_has_won,” “black_has_won” and “is_stalemate.” After messing around with the program some more, Ruck eventually runs into the situation where a stalemate occurs and the game ends as a draw. Ruck explains that if the game was being played for a 1,000 satoshi incentive “neither white nor black can get any of the 1,000 satoshis, except if they agree to a draw and split the money.”

The chess game creator also explains there are a few issues that could arise, like someone not making a move and the 1,000 satoshis getting locked into the blockchain forever. But Ruck says that a lock time could be added and the game will end after a certain amount of time has passed. Overall, Ruck’s chess concept is extremely raw and basic but shows how the opcode could be applied to all types of decision-based games. In conclusion, the developer’s blog post states that he hopes he was able to convey the idea of a chess game using OP_Checkdatasig as trusted and autonomous referee.

Building a Turing Machine on Top of the bitcoin Protocol

After publishing the onchain chess game and while experimenting with the new opcode, Ruck realized that it is possible to build a Turing machine on top of the bitcoin protocol. The researcher which shows how he simulated an old programming language using the BCH script.

“A simple way to show Turing completeness is by simulating a Turing machine,” Ruck details in his second blog post. “For that, we’ll pick a derivative of , an esoteric programming language, which has been shown to be Turing complete — If we can simulate that on bitcoin, we know it’s Turing complete,” the programmer adds.

After showing how it can be done using the new opcode OP_Checkdatasig, Ruck emphasized that the bitcoin protocol is Turing complete giving the technology a myriad of use cases. Ruck further adds that if developers optimized the code a “fully fledged and operational bitcoin virtual machine (VM)” could be built. Ruck also adds that people who claim Craig Wright’s propositions “were right about OP_Checkdatasig introducing loops in the bitcoin script are just wrong” and this is “false” information. “The idea that you could call another transaction by checking a signature is just ludicrous,” Ruck’s blog post states. In order to keep loops spinning, Ruck’s details that the program has to be fed with more satoshis per loop in a similar fashion to the Ethereum network’s gas limit.

What do you think about the chess game that uses the BCH opcode OP_Checkdatasig as an autonomous referee? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, Honest.cash, Pein Sama, Pixabay, and Tobias Ruck.

Express yourself freely at bitcoin.com’s user forums. We don’t censor on political grounds. Check .bitcoin.com.

The post appeared first on .

Ether falls to a 2018 low of $102.36 as bitcoin experiences its worst crash this year. Ethereum is down -3.23% in 24 hours, down -8.26% on the week and down -41.77% on the month on a last price of $114.68. The Ethereum marketcap is $11,871,817,867 with a circulating supply of 103,521,258 $ETH. $ETH/USDT is trading between a 24hr high of $120.26 and a 24hr low of $112.01 on a 24hr Binance volume of $51,170,520. This trading volume is moderate to heavy. The weekly price trend is mixed.

We are excited to host the Ethfinex Meet-up NO.5 in London on December 4th, and are lucky have the CEO and CTO of & travelling down to join us.

If you’re in the area make sure to stop by, grab a free drink and meet the team!

— Ethfinex (@ethfinex)

Brief

Promoted

Rank

Last price

$USD

Price change

Volume

Market Share

Remarks

Bitcoin Background

Highlight Chart

Data sources

Market capitalization

Daily high low

Trend

Resistance

Support

Market sentiment

Summary

Cryptocurrency Storage Safety

Bitcoin & Ethereum Market Reports

Disclaimer

Printed

Ethereum is ranked #3 today by cryptocurrency market capitalization.

114.68 $ETH/USDT

| last price | $ 114.68 |

| one week ago | $ 125.00 |

Price change is the $ETH percentage change within the period:

| period | change |

| day | -3.23% |

| week | -8.26% |

| month | -41.77% |

| USDT | $51,170,520 |

| all $ETH currencies | $2,075,529,900 |

The 24 hour volume for $ETH/USDT on Binance is $51,170,520. This volume weight is moderate to heavy when compared with Binance daily trading levels for $ETH over the last month.

The total 24 hour volume for all reporting $ETH markets is $2,075,529,900.

Ether falls to a 2018 low of $102.36 as bitcoin experiences its worst crash this year. Ethereum is down -3.23% in 24 hours, down -8.26% on the week and down -41.77% on the month on a last price of $114.68. The Ethereum marketcap is $11,871,817,867 with a circulating supply of 103,521,258 $ETH. $ETH/USDT is trading between a 24hr high of $120.26 and a 24hr low of $112.01 on a 24hr Binance volume of $51,170,520. This trading volume is moderate to heavy. The weekly price trend is mixed.

$ETH Remains Third Rank

Two weeks ago we saw in market cap to $XRP (again), and this hasn’t changed. Ripple has widened the gap and today is printing more than $2.8 billion more in market capitalization. Coinmarketcap pegs $XRP at $14.6 billion with ether weighing in at $11.8 for a difference of $2.8 billion. The flip is not irreversible but the fundamentals for $XRP appear to be much healthier than those of $ETH.

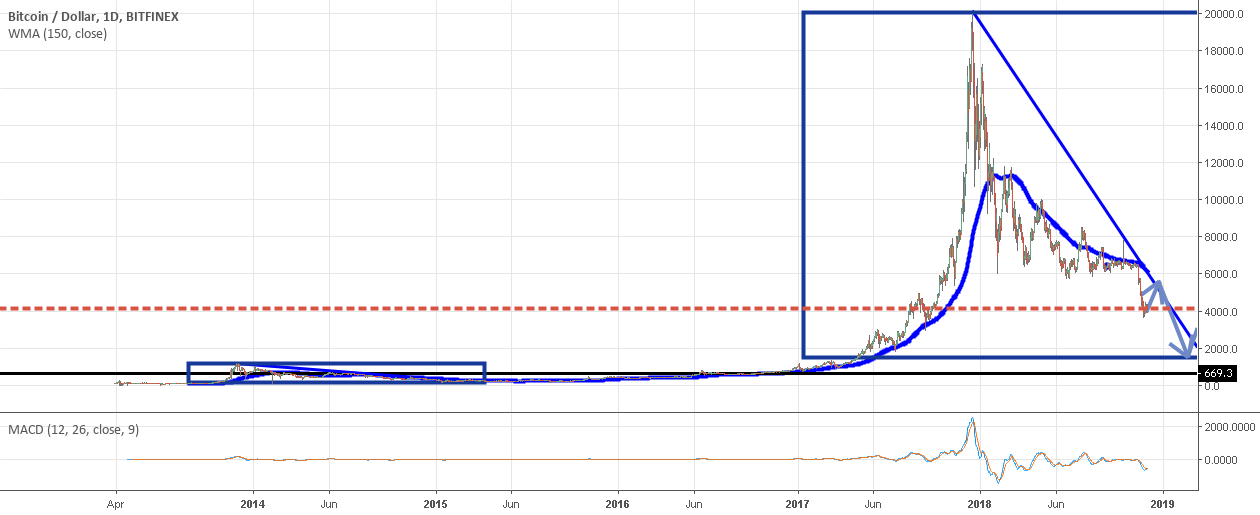

Lowest Price Since Spring 2017

The last time we saw ether at such a bargain it was May 19 of 2017, the price was $113.41, and ether was on its way up. That rally saw a peak of $410.75 (Coinmarketcap). However this time the market has been bearish since the week of May 06 2018. That’s half a year of bear market:

Bear Market Since Spring of 2018

What to Expect?

With half a year of bearish movement it might be easy to postulate more of the same. The six hour chart default MACD is showing strong buying pressure on an extended length of time:

Six Hour Chart MACD

The RSI on the one day chart is printing 41.61 which is well within the neutral zone (between 30 and 70).

The short term EMA on the four hour chart has dipped below the medium term EMA, signalling a weakening of the $ETH position.

Volume is down, although still moderate, and price is in the red over a two day period on the one day chart. There appears to be less contention over the current price, and not as much enthusiasm to send it higher or lower.

$ETH Weekly Price Trend

Tap/click to zoom:

The weekly trend is mixed. This is different from up or down. The weekly range is between $126.80 and $102.36. Within the week we’ve seen four daily candles of red, but three of green. Seven days of oscillation within a $24.44 scope is beginning to look like a sideways condition. The price is softening over the last two days, but staying within the weekly range.

The key ten day resistance line is $137. If ether can decisively break this resistance then good things could happen.

The yearly 2018 low of $102.36 was set three days ago on November 26 2018. This sits just below a critical support level at $104.53. If ether erodes below this key support then fresh price declines are likely.

View

If ether can decisively break $137 key resistance then a continuing upwards movement is possible.

If ether erodes below $104.53 key support then fresh price declines are forecast.

The technicals suggest a weakening $ETH price but within the existing narrow weekly range.

$ETH One Day Candles

One Year $ETH Chart

Browse Ethereum Collection

Learn about the unique characteristics of $ETH. Browse our collection of

Friday November 30 2018 bitcoin Background

Altcoins such as Ethereum ($ETH) may show a relationship with bitcoin ($BTC) which changes with the alt, bitcoin and market conditions:

24 Hours of bitcoin

24 Hours of #bitcoin

-4.86% price $4,019.63

vol $6,001,511,297

mktcap $69,944,755,952

17.40M #XBT 20:38

XBTLivePriceTM

Yesterday

Tap / click to enlarge:

Main Data Source

is the main data source for this report. The One Day Candles chart, highlight chart, and digital asset numeric trading data are from Binance.

Secondary

CoinMarketCap is the secondary data source for this report. The One Year Chart, cryptocurrency rank, token circulating supply, and daily market share are sourced from

Tertiary

XBTLivePriceTM and 24 Hours of bitcoin are fine data products from

Other sources are credited where used.

Market capitalization is the total $US dollar value of the Ethereum market calculated using the formula:

| Market cap | $ 11,871,817,867 |

| Circulating supply | 103,521,258 |

| Last price | $ 114.68 |

| 120.26 USDT |

| 112.01 USDT |

The weekly trend is mixed.

Trend is "mixed" when the week contains both green and red daily price candles, price movement up or down is significant, and there is no clear weekly price direction.

Resistance is the highest price within the period:

| day | 120.26 USDT |

| week | 126.80 USDT |

Support is the lowest price within the period:

| day | 112.01 USDT |

| week | 102.36 USDT |

$ETH market sentiment is neutral to bearish.

Ether falls to a 2018 low of $102.36 as bitcoin experiences its worst crash this year. Ethereum is down -3.23% in 24 hours, down -8.26% on the week and down -41.77% on the month on a last price of $114.68. The Ethereum marketcap is $11,871,817,867 with a circulating supply of 103,521,258 $ETH. $ETH/USDT saw weekly resistance at $126.80 USDT in a falling market, and weekly support at $102.36 USDT the year’s lowest price. Market sentiment is neutral to bearish. The weekly price trend is mixed in daily moderate to heavy volume trading.

Past history is NOT an indicator of future results. Read the legal disclaimer:

KittyBitcoin’s Market Reports bring you timely and detailed cryptocurrency market information. Covering many of the top 100 coins, the impartial and hyperlinked format enables you to quickly synthesize accurate trading data gleaned from top cryptocurrency exchanges. Over time the market reports also comprise an invaluable archival collection.

This report was generated on Friday November 30 2018 20:21 hours UTC.

This report was authored by KittyBitcoin and originally published on BlockDesk: . Contact to license or request reports. Share your thoughts with

Reprinting without written permission is expressly prohibited, theft of intellectual property, and copyright violation.

KittyBitcoin media is licensed not sold. Copyright©KittyBitcoin.com 2018. All rights reserved.

You might be interested in …

Mayo Madness 2: Can We Trust The Press To Get It Right? | ZDoggMD.com

Mayo Madness 2: Can We Trust The Press To Get It Right? | ZDoggMD.com Remember the old adage “There’s two sides to every story?” When it comes to healthcare reporting, it seems there’s often only […]

Bitcoin near to conclude correction

bitcoin near to conclude correction EN English (UK) EN English (IN) DE Deutsch FR Français ES Español IT Italiano PL Polski SV Svenska TR Türkçe RU Русский PT Português ID Bahasa Indonesia MS Bahasa Melayu […]