By : The U.S. Securities and Exchange Commission has decided once again to kick the can on its decision about a . In a ruling published today, the securities watchdog revealed that an answer on the as proposed by the Cboe would be postponed for another 90 days, pushing the . The crypto community wasn’t shocked by the announcement, but the price has retreated modestly from Sunday’s fresh 2019 highs. Despite the pullback in the price, the market has several major catalysts this year that will continue to fuel the bull market. And the can’t stick its head in the sand on forever.

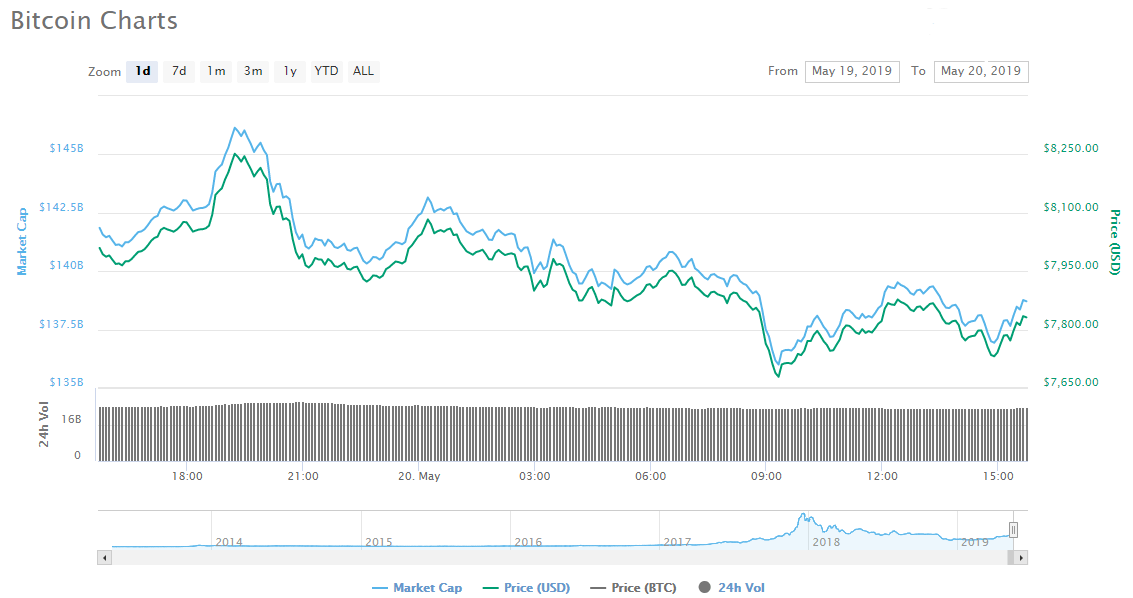

The price pulled back modestly from Sunday’s fresh highs. | Source: CoinMarketCap

Gabor Gurbacs, director of digital assets strategy at VanEck/MVIS, responded to the latest delay on Twitter, basically saying the firm will not give up and adding:

“ is too big to ignore. Vires in numeris!”

The VanEck SolidX decision has been postponed by the . We continue the hard work towards better-regulated, safer and more liquid digital assets markets. is too big to ignore. Vires in numeris! Public document and timelines:

— Gabor Gurbacs (@gaborgurbacs)

The SEC Delayed A Different bitcoin ETF Last Week

Last week, the decided to delay another issued by . Its decision to stay mum at the time about the VanEck product left many wondering what the fate of the most high-profile would be with the May 21 deadline right around the corner. According to attorney Jake Chervinsky on Twitter, the fact that the needed more time to issue its decision on the VanEck product was likely due to semantics.

15/ To be fair, the fact that the delayed Bitwise & stayed silent on VanEck could mean nothing at all.

Maybe staff just hasn’t had time to finish the VanEck delay order yet. These things take time & there’s no reason why the has to issue delays at once.

— Jake Chervinsky (@jchervinsky)

While they ultimately decided to punt on both ETFs, they didn’t issue a flat-out rejection. It seems as though they are just waiting as long as possible to drag this out until either there is a regulatory framework from which to work or the crypto community gives up, the latter of which isn’t going to happen.

Many Reasons to Remain Bullish on bitcoin

The attitude emanating from Crypto Twitter was basically one of annoyance. For example,

“The market will pump with or without the .”

Another said:

“Apparently no one cares about an . Just buy a .”

bitcoin’s Higher Highs and Higher Lows

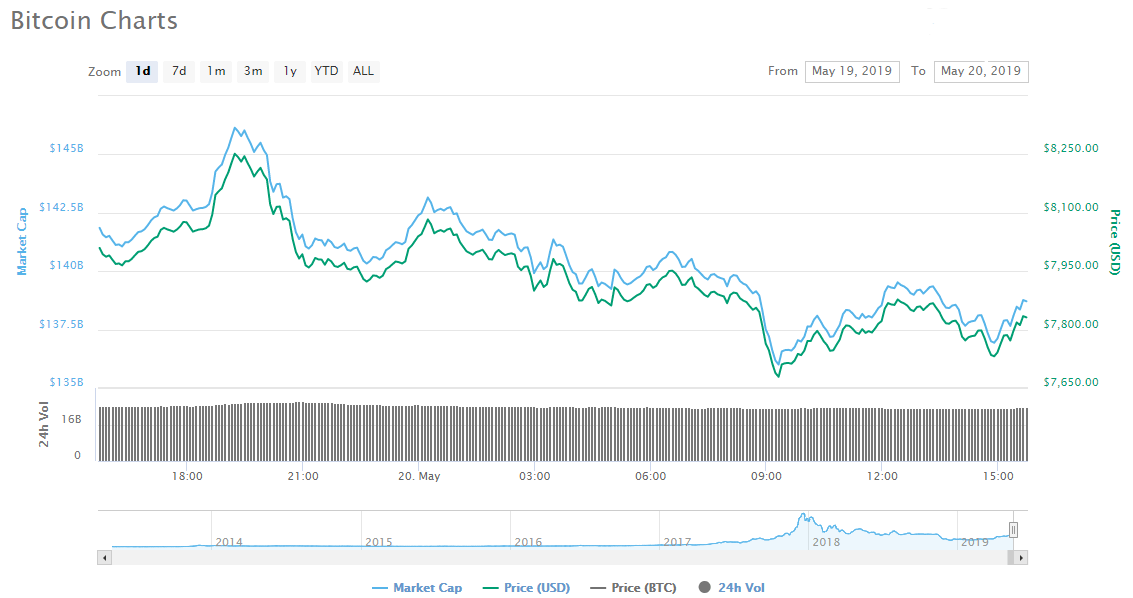

A would be nice but the crypto revolution is much bigger than one single product. Sure, it would incentivize big investors whose capital remains sidelined to jump in, and the knows this. It means that the average Joe will probably gain exposure to in their retirement fund. So they are being probably overly cautious. In the meantime, has proven its resilience in 2019. It has been on positive developments and taking setbacks such as the delay in stride, as evidenced by a market cap that remains close to Sunday’s $140 billion.

is back to $140 billion market cap.

This thing just refuses to die.

— Pomp 🌪 (@APompliano)

As industry leaders have been saying, the price lows are getting higher and the highs are getting higher. Over the weekend, CBS/60 Minutes shared with millions of American households. Fidelity is poised to roll out its service to institutional investors, and the launch of Bakkt is right around the corner. has plenty of catalysts until the finally realizes that it’s not in charge of deciding how much risk investors choose to inherit.

Published at Mon, 20 May 2019 20:39:40 +0000